Zelle®

Zelle® App Info

-

App Name

Zelle®

-

Price

Free

-

Developer

Early Warning Services, LLC

-

Category

Finance -

Updated

2025-05-02

-

Version

9.3.2

Introduction to Zelle®: A Seamless Digital Payment Solution

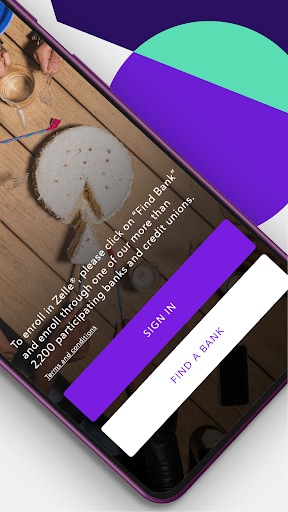

In an era where digital transactions have become ingrained in daily life, Zelle® stands out as a straightforward and reliable method to send and receive money instantly. Developed by a consortium of major U.S. banks, this app aims to simplify peer-to-peer payments, making splitting bills or sending gifts effortless. With its sleek design and focus on ease of use, Zelle® caters primarily to individuals seeking quick, secure, and hassle-free financial exchanges.

Developer and Core Highlights

Created by Early Warning Services, LLC, a consortium owned by some of the largest U.S. banks, Zelle® leverages banking-level security with an intuitive interface. Its main features include real-time transfers directly between bank accounts, minimal setup requirements, and integration with a wide network of banking institutions. The app's primary goal is to eliminate the need for cash or checks among friends, family, and trusted contacts, making it ideal for fast, small-value transactions.

Who Appears to Benefit Most?

Zelle® targets a broad user base, especially individuals who prioritize speed and security in their everyday transactions. Students, young professionals, and families often find it convenient for splitting rent, bills, or sharing expenses without the fuss of cash or third-party payment apps. Its transparent process and bank affiliation lend trust and familiarity to users wary of third-party platforms.

A Fresh Take on Digital Payments: A Friendly Review

Imagine effortlessly sharing a pizza bill with friends at a lively dinner, or sending a quick thank-you gift without fumbling for cash or opening multiple apps. Zelle® transforms this scene into a seamless experience—no more fumbling, no more waiting. Its promise is pretty much what you'd wish for in a modern financial sidekick: quick, safe, and surprisingly simple. But how well does it perform in the real world? Let's explore.

Core Functionality: Instant Transfers and Bank Safety as the Power Duo

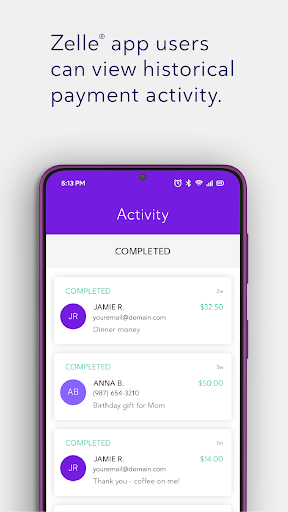

The standout feature of Zelle® is undoubtedly its ability to transfer money instantly between bank accounts. Unlike traditional wire transfers that can take days or require cumbersome procedures, Zelle® leverages the existing banking infrastructure to deliver near-instantaneous transactions. Once both sender and receiver are enrolled, the money moves swiftly from one account to another, often within minutes, making it ideal for urgent payments or last-minute splitting of costs.

Security is baked into the process—transactions are directly between bank accounts, bypassing third-party storage or handling of funds, which significantly reduces fraud risks. The app uses bank-level encryption and authentication, providing peace of mind that your money and personal data are protected. This emphasis on security elevates Zelle® above some competitors that may rely on third-party servers or less established security measures.

User Experience: Design, Ease of Use, and Learning Curve

The design of Zelle® is deliberately straightforward—think of it as a digital wallet with a clean, familiar banking app look. The interface is intuitive, with clear options to send, receive, and track transactions, making it beginner-friendly even for those less tech-savvy. The setup process is minimal: you link your bank account directly via your existing banking app or online banking credentials, which keeps the onboarding process frictionless.

Operation feels snappy and responsive. Navigating through transaction histories, managing contacts, or initiating payments is smooth and doesn't require a steep learning curve. Users report that even first-timers can master the app within minutes, and the consistent design across participating banks further reduces confusion.

Unique Selling Points: How Zelle® Outshines Competitors

What truly sets Zelle® apart from other financial apps like PayPal or Venmo is its direct bank linkage and focus on security. Its most remarkable feature is the ability to send money directly from one bank account to another without an intermediary holding of funds—this significantly minimizes risks associated with fund security. This is akin to passing a message directly from one trusted friend to another, rather than leaving it with a third person.

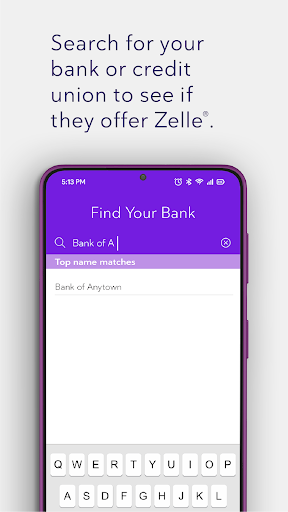

Additionally, the transaction experience is incredibly natural for existing bank users, as the interface mirrors familiar online banking layouts, removing the hurdle of learning something entirely new. Unlike some apps that rely on email or QR codes, Zelle®'s integration with a broad range of banks ensures most users are covered—no need to download yet another app or create a new account.

Final Thoughts: Should You Give It a Go?

All in all, Zelle® is a robust, secure, and user-friendly option for anyone looking to make quick peer-to-peer payments. Its biggest strength lies in its ability to transfer funds instantly and securely directly between bank accounts—no third-party wallets, no waiting days. This makes it particularly appealing for everyday transactions within familiar banking environments.

If you're a user already engaged with participating banks and need a straightforward way to send money rapidly—whether for splitting rent, sharing dinner bills, or emergency transfers—Zelle® is highly recommended. For those who prioritize security and simplicity over fancy features or social payment streams, Zelle® deserves a top spot in your financial toolkit.

However, it's worth noting that Zelle® isn't designed for international transfers or for handling business transactions at scale. For casual, domestic peer-to-peer exchanges, it remains one of the most practical options out there—reliable, straightforward, and irreproachable in security.

Pros

Easy instant transfers between users

Allows users to send money quickly within minutes, similar to SMS messaging.

No fees for peer-to-peer payments

Most transactions between Zelle users are free, saving costs for users.

Integrated directly with bank apps

Can be accessed seamlessly through participating bank mobile apps without separate login.

Supports large transfer amounts

Allows sending up to $2,500 per transaction, suitable for various payment needs.

No need to store account information

Transfers are made using email or phone number, reducing the risk of card details exposure.

Cons

Limited availability outside the U.S. (impact: medium)

Only supported in the United States, restricting international use.

No buyer protection for transactions (impact: high)

Unlike PayPal, Zelle does not offer refunds or dispute resolution for unauthorized transactions; users should verify recipient details carefully.

Requires recipient to have Zelle account (impact: medium)

Transfers fail if the recipient is not registered, which can cause delays.

Limited to participating banks and credit unions (impact: low)

Some smaller or non-partnered banks do not support Zelle integration, reducing accessibility.

Security concerns over fraud and scams (impact: high)

Users must stay vigilant as dishonest actors can exploit fast transfers; official updates aim to enhance security measures.

Zelle®

Version 9.3.2 Updated 2025-05-02