Venmo

Venmo App Info

-

App Name

Venmo

-

Price

Free

-

Developer

Venmo

-

Category

Finance -

Updated

2025-12-16

-

Version

10.78.2

Venmo: Seamless Social Payments at Your Fingertips

Venmo stands out as a user-friendly mobile payment app that integrates social features—a perfect choice for friends sprawling across different cities sharing bills, meals, or spontaneous gifts with just a tap. Developed by PayPal, Venmo's core mission is to make peer-to-peer transactions straightforward, fun, and social.

Who's Behind Venmo?

Venmo is developed by PayPal, a global leader in digital payments with decades of experience in secure financial transactions. This backing ensures a robust infrastructure backed by trusted security protocols and constant innovation in digital payments.

What Makes Venmo Shine?

- Social Payment Feed: Unlike traditional apps, Venmo transforms transactions into a social feed where users can see friends' payments and comments, fostering a sense of community.

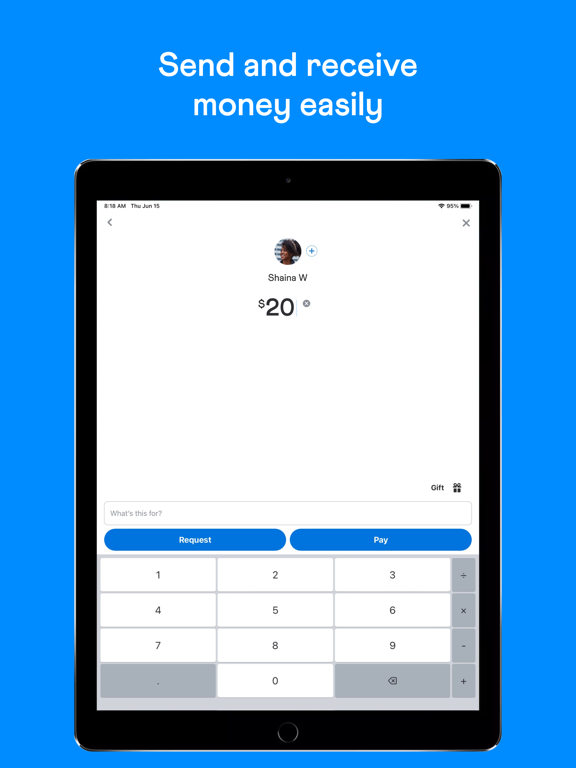

- Instant Transfers: Easily transfer funds from your Venmo account to your bank account within a few taps, often instantly, making money movement quick and hassle-free.

- Split Payments & Expense Management: Simplify group expenses by splitting bills directly within the app, ideal for roommates, coworkers, or friends on a night out.

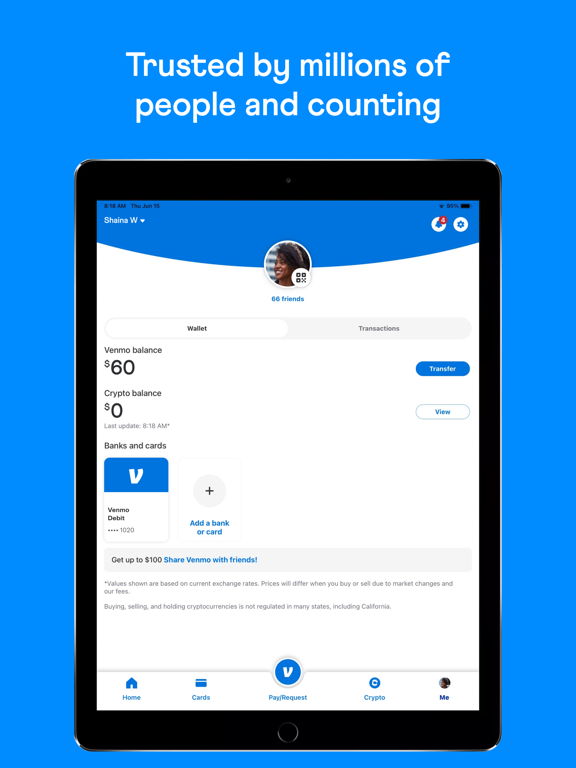

- Integrated Card Options: Link your Venmo balance to physical or virtual Visa debit cards, allowing for in-person purchases or online shopping effortlessly.

Discovering Venmo's User Experience: The Playful yet Practical Design

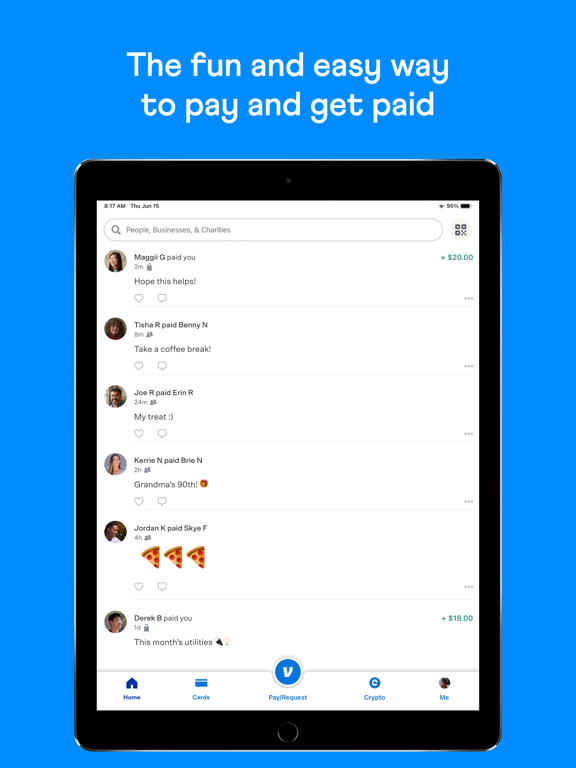

Imagine opening your wallet to a friendlier, more colorful version—Venmo's interface resembles a lively social media feed, complete with profile icons, personalized emojis, and a real-time stream of transactions. This approach makes paying someone or splitting a dinner feel less like a chore and more like sharing a moment. Navigating the app is smooth sailing; transitions between screens are seamless, and the setup process is straightforward, even for first-time users. Within minutes, you'll be sending and receiving money with confidence.

Core Features in Action

Social and Transactional Engagement

The standout feature that sets Venmo apart is its social payment feed. When you send money to a friend, you can add a note—like “Coffee fix” or “Weekend rent”—that appears on your friends' feeds (unless privacy settings say otherwise). This feature transforms a mundane money transfer into a social share, almost like a digital handshake. It's clever and makes money exchanges more personable, especially among close-knit groups.

Split Bills and Expense Sharing

Host a dinner party or plan a group trip? Venmo's built-in split payment feature acts like a digital IOU, allowing you to divide costs evenly or unequally, then pay or request with a few taps. The clarity and speed help reduce awkwardness when settling debts—no more arguments over who owes what. The interface guides you through each step, making group expenses manageable and transparent.

Security & Transaction Experience

In the realm of digital wallets, security is king, and Venmo doesn't fall short. It employs encryption, multi-factor authentication, and real-time fraud monitoring to keep your funds safe. Moreover, transactions are quick and reliable, with options for instant transfers and seamless linking to bank accounts. Compared to other finance apps, Venmo's social aspect adds a human layer, but behind the scenes, it maintains rigorous security standards, providing peace of mind for everyday users.

Final Thoughts: Should You Jump In?

Venmo is more than just a digital wallet—it's a social tool woven into everyday life. Its most notable feature, the social payment feed, makes peer-to-peer transactions engaging and less transactional, helping friends stay connected over shared expenses. The app's intuitive design, combined with reliable security, makes it suitable for casual users and small groups alike.

While Venmo excels in social engagement and simplicity, it may not yet be the best option for larger, business-scale transactions or international transfers. However, for routine peer-to-peer payments, splitting bills, or sending a quick gift, it's a solid choice. The app gets a strong recommendation for those who value convenience, transparency, and a dash of social fun in managing their finances.

Pros

User-Friendly Interface

Venmo offers an intuitive and easy-to-navigate design that simplifies money transfers for all users.

Social Payment Features

The social feed allows users to see and comment on friends' transactions, adding a fun social dimension.

Instant Transfers

Allows immediate transfer of funds to linked bank accounts for quick access to money.

Wide Acceptance

Venmo is widely accepted among merchants, especially for small businesses and peer-to-peer payments.

Free Transactions with Balance or Bank Account

Sending money from linked balance or bank account is generally free, saving users on fees.

Cons

Limited International Use (impact: high)

Venmo operates primarily within the US, so international transactions are not supported, which can be inconvenient for users with cross-border needs.

Privacy Concerns (impact: medium)

By default, transactions are public, which may expose personal payment details unless manually adjusted.

Recipient's Payment Pending Acceptance (impact: medium)

Funds are not immediately accessible until the recipient accepts the payment, which can delay access to money.

Customer Support Accessibility (impact: low)

Support channels can sometimes be slow or limited, leaving users to troubleshoot issues independently temporarily.

Transfer Limits (impact: medium)

There are daily and weekly transfer limits that may require verification for higher amounts, impacting frequent large transactions.

Venmo

Version 10.78.2 Updated 2025-12-16