Varo Bank: Online Banking

Varo Bank: Online Banking App Info

-

App Name

Varo Bank: Online Banking

-

Price

Free

-

Developer

Varo Bank, N.A.

-

Category

Finance -

Updated

2025-12-10

-

Version

4.21.2

Varo Bank: Redefining Online Banking with Simplicity and Security

Varo Bank's online platform stands out as a user-centric digital banking solution designed to make financial management effortless, secure, and accessible for everyone—from busy professionals to tech-savvy young adults. Developed by the innovative team at Varo Money, Inc., this app aims to bridge the gap between traditional banking and modern convenience through a sleek interface and powerful features.

Core Features That Make Varo Bank Shine

Seamless Money Management and Budgeting Tools

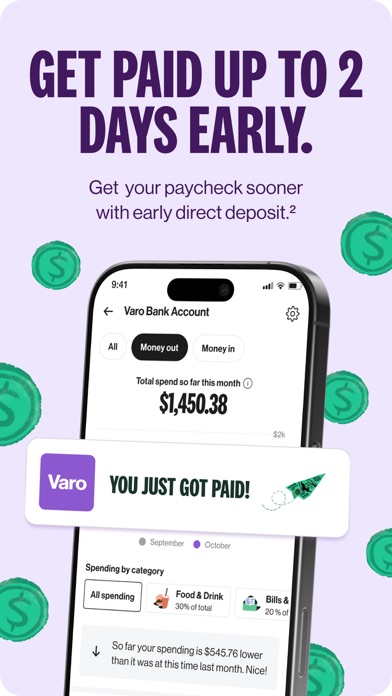

At its core, Varo offers robust financial tools that transform your smartphone into a personal finance assistant. The app provides real-time expense tracking, customizable budgeting categories, and instant alerts, empowering users to stay on top of their finances without switching between numerous platforms. Its intuitive interface visualizes spending habits clearly, turning complex data into understandable insights.

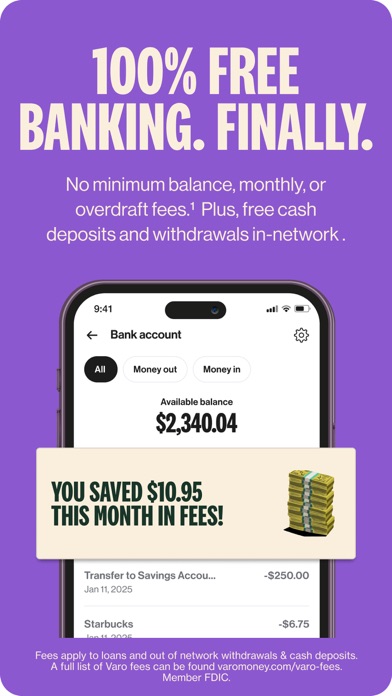

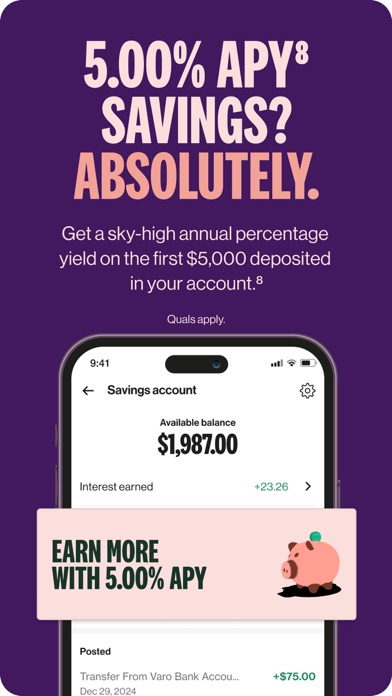

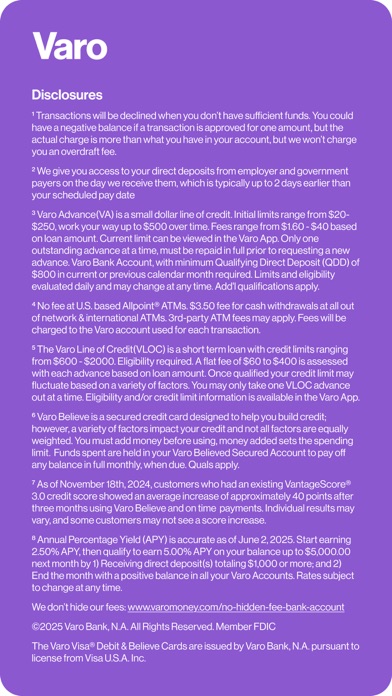

High-Yield Savings with No Hidden Fees

One of Varo's standout features is its high-yield savings account, which offers competitive interest rates that outpace many traditional banks. Coupled with no minimum balance requirements or monthly maintenance fees, this feature encourages saving effortlessly. The app automates rounding up purchase amounts to bolster savings and tracks progress visually, making the journey to financial goals engaging and motivating.

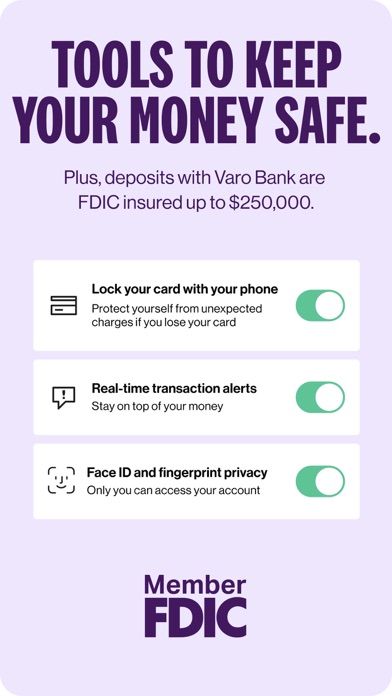

Enhanced Security and Fraud Prevention

Security is a top priority, and Varo doesn't disappoint. The app employs multiple layers of protection including biometric login options, real-time fraud monitoring, and instant block/unblock capabilities. Notably, the app's biometric authentication ensures that only you can access your financial data, giving peace of mind akin to having a digital vault. This focus on safeguarding user funds and data is a defining trait that sets it apart from many peer apps.

User Experience: Pleasant, Streamlined, and Friendly

From the moment you open Varo, it feels like stepping into a well-organized digital wallet—clean, inviting, and easy to navigate. The interface employs soft pastel colors with thoughtful iconography that guides users intuitively through various functions. Navigating between accounts, viewing transaction histories, and setting saving goals feels as smooth as gliding on an icy lake—fluid and effortless.

Learning curve-wise, Varo strikes a good balance: new users can quickly familiarize themselves thanks to clear labels and guided onboarding. Once accustomed, users will appreciate the app's logical flow and minimal clicks required to perform complex tasks. The app's responsiveness remains swift across devices, ensuring a hassle-free experience whether on a smartphone or tablet.

Differentiation in a Crowded Market

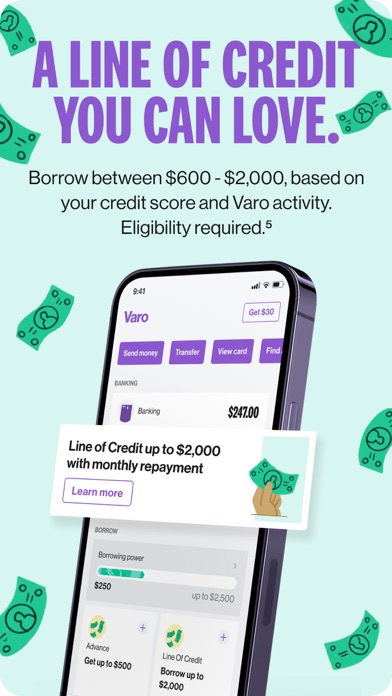

While countless digital banking apps flood the market, Varo's focus on security and user-centric features elevates it. Its unique ability to combine high-yield savings, real-time expense tracking, and top-tier security measures makes it feel like a digital fortress that also doubles as a financial coach. Its emphasis on transparent, no-fee banking with automated savings tools resonates well with users tired of hidden charges and complicated fee structures in traditional banks.

Compared to peers like Chime or Ally, Varo's holistic approach—integrating savings, spending, and security into one simple interface—provides a seamless experience that feels less like juggling multiple apps and more like managing your money from a single, trustworthy digital desk. Its emphasis on account and fund security is especially reassuring in today's climate, where digital threats are ever-present, yet Varo confidently walks the walk with advanced encryption and fraud detection.

Final Verdict: A Solid Choice for Modern Banking Needs

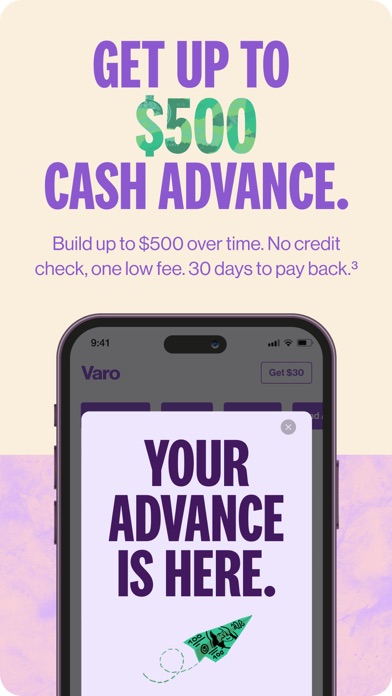

If you're searching for a bank app that combines straightforward usability with powerful features and top-tier security—think of it as having a personal finance expert in your pocket—Varo Bank is worth considering. Its most compelling standout is undoubtedly its comprehensive security suite coupled with intuitive savings tools, making everyday banking less of a chore and more of a smart, secure habit.

We recommend Varo for users seeking a transparent, fee-free alternative to traditional banks, especially those who value high-yield savings and robust fraud protection. Whether you're managing a tight budget or aiming to grow your savings without hassle, Varo offers a balanced blend of convenience and security designed for today's digital-savvy consumers.

Pros

User-Friendly Interface

The app features an intuitive design that makes managing accounts simple for users of all experience levels.

Robust Security Measures

Varo Bank employs advanced encryption and secure login options to protect user data and transactions.

Comprehensive Features

Includes functionalities like mobile check deposit, budgeting tools, and savings goals to enhance user financial management.

Zero Monthly Fees

Offers no maintenance fees, making it economical for customers seeking low-cost banking options.

Fast Customer Support

Provides quick assistance via chat and phone, resolving issues efficiently.

Cons

Limited ATM Network (impact: low)

The app's ATM locator shows limited options, which could pose challenges when withdrawing cash.

Occasional App Crashes (impact: medium)

Some users report occasional crashes or lag, especially during high traffic periods; updating the app may resolve this.

Limited International Support (impact: medium)

Currently, international transactions and support are minimal; users may need workarounds for such activities.

Delayed Deposit Processing (impact: low)

Mobile deposits may sometimes take longer than expected; Varo is working on optimizing this feature in future updates.

Limited Physical Branches (impact: low)

As an online-only bank, it lacks physical branches, which may inconvenience those who prefer in-person banking.

Varo Bank: Online Banking

Version 4.21.2 Updated 2025-12-10