Vanguard: Save, Invest, Retire — A Trustworthy Companion for Your Financial Journey

In the bustling world of personal finance apps, Vanguard's latest platform aims to be your reliable partner in saving, investing, and planning for retirement. Crafted by Vanguard Group, a titan in the investment management arena, this app promises a blend of solid expertise and user-centric features designed to demystify the complexities of finance and empower your wealth-building journey.

Key Features That Stand Out

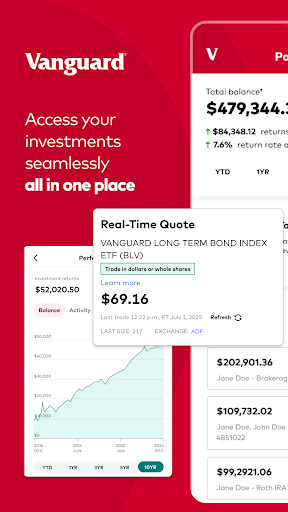

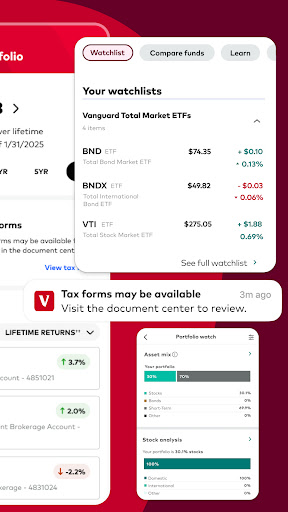

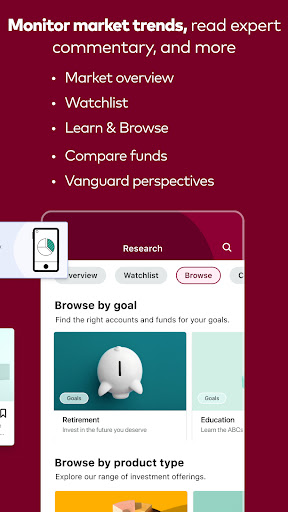

- Seamless Portfolio Management: Vanguard makes it effortless to create and monitor a diversified investment portfolio tailored to your goals, with real-time updates and personalized insights.

- Robust Security and Privacy: Recognizing the importance of trust, the app incorporates advanced security measures ensuring your account and fund safety, giving peace of mind in every transaction.

- Interactive Retirement Planning: The app guides users through retirement scenarios with intuitive calculators and strategic suggestions, making complex planning accessible to all.

- User-Centric Design & Experience: An intuitive interface paired with smooth navigation and minimal learning curve makes managing finances less daunting—like chatting with a knowledgeable friend.

A Gripping Introduction into Vanguard's World

Imagine waking up and, with a few taps, feeling confident that your financial future is being stewarded by a platform built on decades of expertise. Vanguard: Save, Invest, Retire offers that sense of reassurance—a bridge between your ambitions and real-world financial health. Whether you're just starting out or are a seasoned investor, this app molds itself to your needs, transforming the often intimidating world of finance into a friendly neighborhood where every button press feels purposeful.

Core Functionality Deep Dive

Investment Made Simple with Portfolio Management

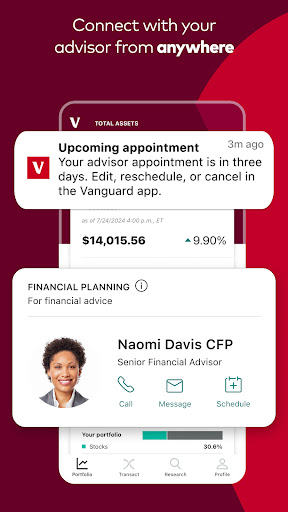

Vanguard's standout feature is its streamlined portfolio management. From the moment you set up your account, the app guides you through creating an investment plan aligned with your risk appetite, timelines, and goals. Its real-time tracking dashboard resembles a sleek control panel, offering clear visuals of your holdings, asset allocations, and performance metrics. Unlike some apps that present overwhelming data, Vanguard's presentation is akin to having a seasoned financial advisor at your fingertips—concise, insightful, and engaging.

Retirement Planning—Your Personal Financial GPS

Navigating toward retirement can feel like trying to plot a course through uncharted waters. Vanguard tackles this with its interactive retirement planning tools. Users input their current savings, expected income, and retirement goals, and the app runs simulations to forecast future fund requirements. The standout here is its adaptive suggestions, based on life changes or market fluctuations, like a vigilant GPS recalculating routes to keep you on track. This proactive approach helps demystify planning, transforming it from a bewildering chore into an empowering, manageable process.

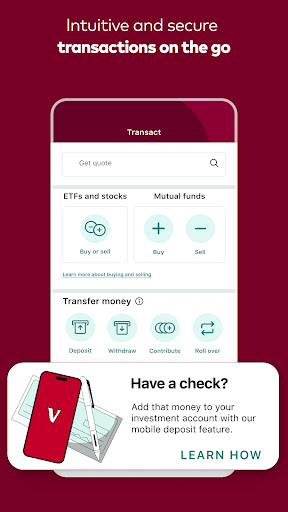

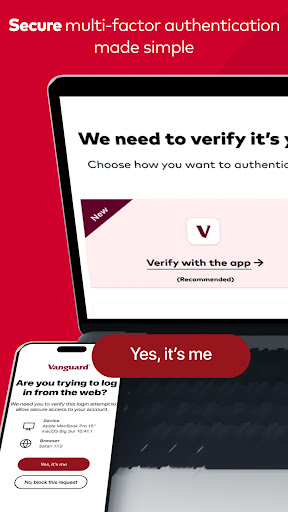

Security & Transaction Experience—Built on Trust

What sets Vanguard apart in the crowded finance app space is its unwavering focus on account and fund security. Utilizing multi-layer authentication, biometric access, and end-to-end encryption, the app ensures that your financial data and transactions are protected against threats. Transferring funds feels effortless—akin to passing a note in class—yet underpinned by military-grade safeguards. Additionally, the app provides transparent transaction histories and prompt notifications, making every financial movement traceable and reassuring—a vital factor in building user trust.

User Experience—Smooth, Intuitive, Friendly

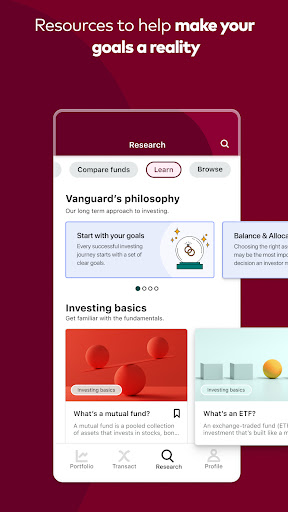

From interface design to functionality, Vanguard excels at delivering a user experience that feels both professional and welcoming. The interface employs a clean, modern aesthetic, with intuitive icons and minimal clutter—think of it as a well-organized toolbox, where every instrument is within reach. Navigation is swift and responsive, with transitions that feel natural, much like flipping through a well-loved magazine. Even newcomers to investing can navigate with ease, thanks to guided tutorials and contextual help.

Differentiation in the Finance App Realm

Compared to traditional finance apps, Vanguard's strength lies in its emphasis on security and personalized investment advice. Its account and fund security measures are top-tier, providing a level of confidence often reserved for institutional clients. The transaction experience is streamlined yet transparent, eliminating common frustrations found in other apps—like confusing fee disclosures or slow processing. Furthermore, with its focus on retirement planning and holistic wealth management, Vanguard distinguishes itself from apps that only handle specific aspects of personal finance, offering instead a one-stop solution rooted in decades of investment expertise.

Final Verdict and Recommendations

Vanguard: Save, Invest, Retire is highly recommended for users who value security, clarity, and a trustworthy interface. Its core features are robust enough for seasoned investors but remain approachable for novices. If you're seeking a platform that combines comprehensive planning tools with peace of mind—particularly for those with a long-term perspective—this app warrants a place on your device.

Use it if: You prioritize security, seek an all-in-one financial planning app, and appreciate a clean, user-friendly interface.

Consider alternatives if: You need quick day-to-day transactional apps or prefer more gamified features for engagement.

In essence, Vanguard's latest app is like having a seasoned financial advisor in your pocket—steady, dependable, and ready to assist at every step of your financial voyage.

Pros

User-friendly interface

The app is intuitive and easy to navigate, making it accessible for users of all experience levels.

Comprehensive financial planning tools

Offers detailed investment analysis and retirement planning features to help users set clear goals.

Educational resources included

Provides helpful articles and tips to improve financial literacy and investment knowledge.

Secure data encryption

Utilizes strong security measures to protect user information and investment data.

Customizable investment portfolios

Allows users to tailor their investment strategies based on risk tolerance and time horizon.

Cons

Limited international availability (impact: medium)

Currently optimized mainly for the US market, which limits access for users abroad.

Basic customer support options (impact: low)

Support primarily via email with limited live chat or phone assistance; future improvements may include expanded support channels.

Some features require premium subscription (impact: medium)

Advanced analysis tools are behind a paywall, which might deter some users; a free trial could enhance adoption.

Limited real-time market updates (impact: high)

Real-time data may be delayed, affecting timely investment decisions; official updates may improve this in future versions.

Occasional app stability issues (impact: low)

Users have reported minor crashes or slow responses; developers are expected to optimize performance in upcoming updates.