Super.com - Save, Earn, Travel

Super.com - Save, Earn, Travel App Info

-

App Name

Super.com - Save, Earn, Travel

-

Price

Free

-

Developer

Super (previously SnapTravel)

-

Category

Finance -

Updated

2026-02-18

-

Version

13.6.0

Super.com - Save, Earn, Travel: Your All-in-One Financial Companion

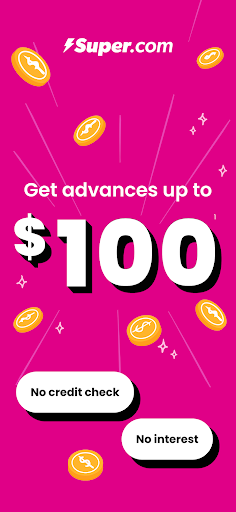

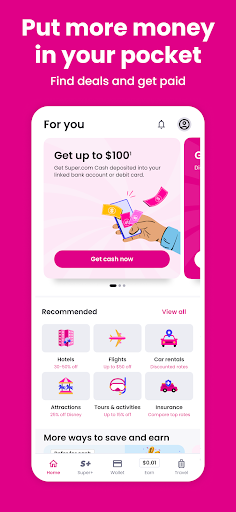

Super.com is a comprehensive financial app designed to seamlessly integrate saving, earning, and travel budgeting functionalities, empowering users to manage their finances effortlessly while enjoying their journeys.

Developers and Core Highlights

Developed by Super Tech Solutions, a forward-thinking team dedicated to creating innovative financial tools, Super.com aims to redefine how people interact with their money. The app's standout features include a smart savings planner that automates deposits, cashback rewards that turn everyday spending into earning opportunities, and an integrated travel budget assistant that helps travelers keep track of expenses on the go.

Target Audience

The primary users are tech-savvy young professionals, avid travelers, and anyone seeking a streamlined financial management experience. Whether you're looking to save for a trip, earn extra via cashback, or simply stay on top of your expenses, Super.com caters to those who value efficiency and financial empowerment.

Getting Started with a Fresh Approach to Finances

Imagine having a trusted financial buddy who's always committed to helping you save smarter, earn more, and travel freely. That's what Super.com offers—a lively, intuitive platform designed not just for numbers, but for transforming your financial habits into something engaging and effortless.

Smart Savings and Automated Investments

The heart of Super.com is its intelligent savings feature. Unlike traditional apps that require manual deposits, Super.com employs a suite of algorithms that analyze your spending patterns and recommend optimal savings strategies. For example, it can round up your everyday purchases to the nearest dollar and automatically transfer the difference into a dedicated savings account. This "micro-saving" approach makes setting aside money feel natural and unobtrusive—like having a tiny financial guardian angel looking out for your future.

Moreover, the app offers personalized goals—whether you're aiming for a vacation, a new gadget, or an emergency fund—and tracks your progress with engaging visuals. The seamless integration with various bank accounts ensures that the flow of funds is smooth, with minimal latency or glitching, making the entire process tick along like a well-oiled machine.

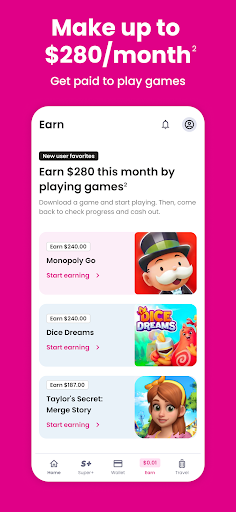

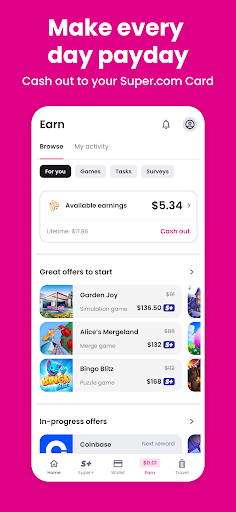

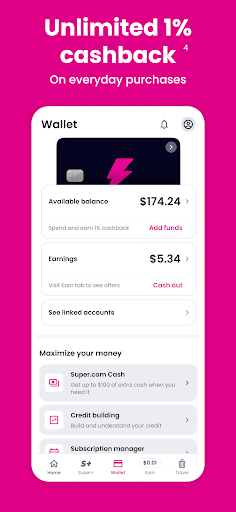

Cashback Rewards that Empower Your Spending

One of Super.com's most attractive features is its cashback system, which turns everyday expenses into earning opportunities. Unlike conventional cashback apps that offer limited partners, Super.com partners with a wide array of merchants, allowing users to earn a significant percentage back on dining, shopping, and even bill payments. Picture it as a loyalty program that works for you—every dollar spent is an investment in your future.

The interface makes claiming and tracking rewards straightforward: the rewards accumulate in your app wallet and can be transferred to your bank account or used directly within the app for travel bookings or further savings. This feature not only enhances the overall transaction experience but also motivates users to stay engaged with their financial habits, reinforcing positive spending behaviors.

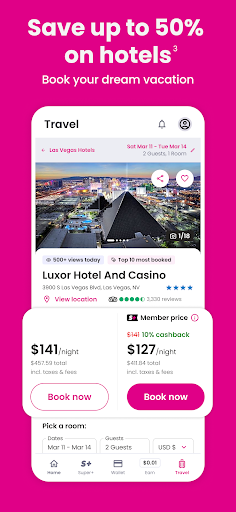

Travel Budgeting and Expense Tracking: Your Personal Co-Pilot

If you love exploring new places but dread the post-trip expense scramble, Super.com's integrated travel planner is a lifesaver. Designed to be your digital co-pilot, it helps you set a travel budget, allocate funds to different categories (accommodation, food, activities), and track expenses in real time. Imagine having a friendly sidekick whispering, “You're on budget” while you enjoy a street food feast abroad—that's the vibe.

The app syncs effortlessly across devices, ensuring your spending record remains up-to-date whether you're on a Wi-Fi cafe or offline sightseeing. Its intuitive layout makes it easy even for first-time travelers to understand where their money is going, likely spurring smarter choices without the headache of complex spreadsheets.

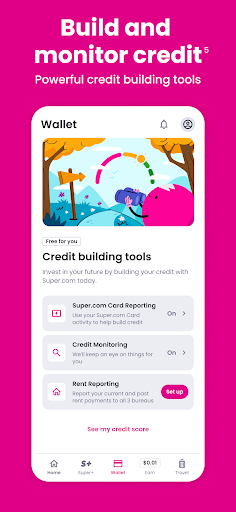

Distinctive Features and User Experience

Super.com shines brightest with its focus on secure transaction experience and account safety. The app employs bank-grade encryption and multi-factor authentication, ensuring your financial data remains shielded from breaches—think of it as a digital vault that only you hold the key to. Its smooth transaction flow further enhances user trust, making deposits, withdrawals, and cashback claims feel instantaneous and reliable.

Compared to similar apps, Super.com stands out with its holistic approach—combining savings automation, earning perks, and travel planning in a single platform. This integration eliminates the need to juggle multiple apps, saving time and mental energy, much like having a personal financial assistant in your pocket. It's this unique synergy that makes Super.com particularly attractive to busy, travel-loving individuals who want efficiency without sacrificing security or clarity.

Final Verdict and Recommendations

Overall, I'd rate Super.com as a thoughtfully designed, user-centric financial app that offers real value in a cluttered market. Its standout functionalities—particularly the automated savings and integrated travel expense management—are well-implemented, intuitive, and genuinely useful. For anyone seeking to bolster savings while earning cashback on everyday expenses and staying on top of travel budgets, this app is worth exploring.

My recommendation is clear: if you're comfortable with digital financial tools and want an app that simplifies your money management without sacrificing security, Super.com is a solid choice. Those new to financial apps should spend a little time familiarizing themselves with its navigation, but once onboarded, they'll likely appreciate how it makes the complex world of personal finance much clearer and more manageable.

Pros

Integrated saving, earning, and travel planning features

Provides a one-stop platform for managing finances and travel budgeting, enhancing user convenience.

Competitive cashback and reward programs

Offers attractive cashback rates and rewards for travel-related expenses, promoting user engagement.

User-friendly interface with simple navigation

Allows users to easily access various features, even those with limited tech experience.

Real-time expense tracking and travel alerts

Helps users stay on budget and receive timely updates during their trips.

Secure transaction processes and data encryption

Ensures user financial data is protected against unauthorized access.

Cons

Limited international bank partnerships (impact: medium)

Some users may face restrictions when linking foreign bank accounts or using certain currencies. Official plans may expand partnerships soon.

Occasional app crashes during peak usage (impact: low)

Users have reported temporary stability issues; updating app versions or reinstalling often resolves the problem.

Incomplete offline access features (impact: low)

Certain features like expense tracking require internet; offline mode is being improved in upcoming versions.

Limited customer support channels (impact: medium)

Currently mainly via in-app chat; adding email or phone support could enhance user experience.

Some features may have regional restrictions (impact: medium)

Certain rewards or offers are only available in specific countries; official plans include regional expansion.

Super.com - Save, Earn, Travel

Version 13.6.0 Updated 2026-02-18