SoLo Funds: Lend & Borrow

SoLo Funds: Lend & Borrow App Info

-

App Name

SoLo Funds: Lend & Borrow

-

Price

Free

-

Developer

Solo Funds

-

Category

Finance -

Updated

2026-01-28

-

Version

2.12.0

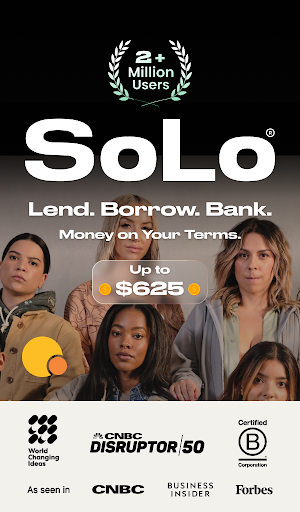

Introducing SoLo Funds: A Fresh Take on Crowdlending and Borrowing

SoLo Funds emerges as a pioneering platform designed to bridge the gap between trusted community lending and modern financial needs. By fostering direct peer-to-peer financial relationships, it aims to redefine how individuals access short-term loans and lend funds responsibly. Developed by a dedicated team with a focus on ethical lending, SoLo Funds stands out with its user-centric approach and secure transaction environment. The app's primary features include transparent lending processes, flexible repayment options, and an emphasis on community trust. Its target audience comprises young adults, gig workers, and anyone seeking alternative borrowing solutions outside traditional banks.

A Vibrant New Player in the Crowdlending Scene

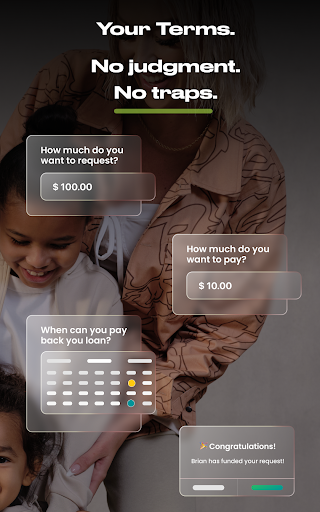

Imagine being able to tap into a social lending network that feels more like borrowing from a trusted friend than navigating a maze of banking institutions. That's the essence of SoLo Funds—an app that combines convenience with a community-driven spirit. Whether you're in a pinch, need quick cash, or want to lend to those you trust, the platform provides an engaging and straightforward journey. Tech meets trust in a way that makes borrowing and lending less intimidating and more human. This app isn't just about transactions; it's about creating responsible financial connections.

Core Features that Make a Difference

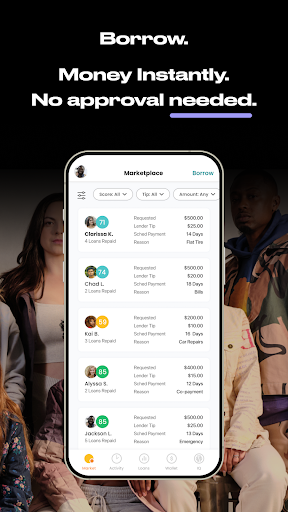

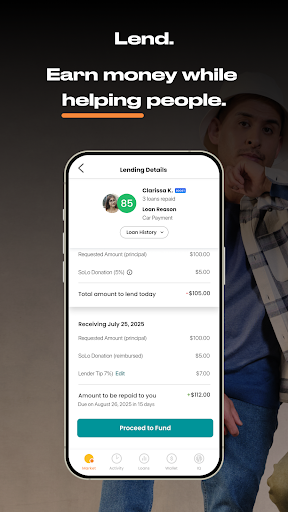

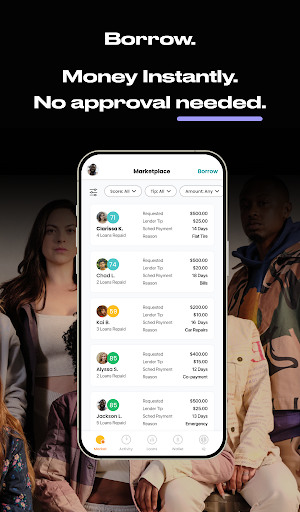

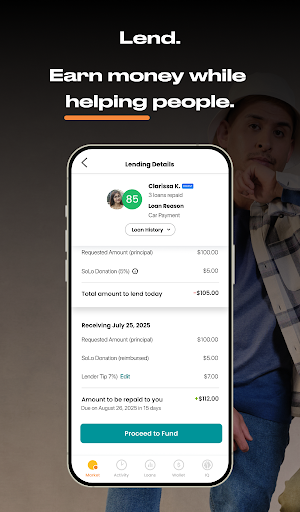

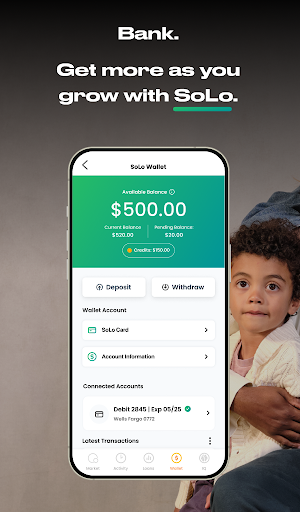

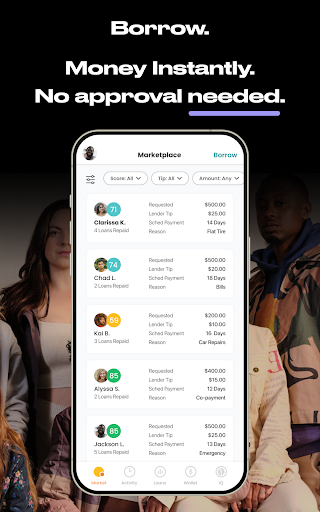

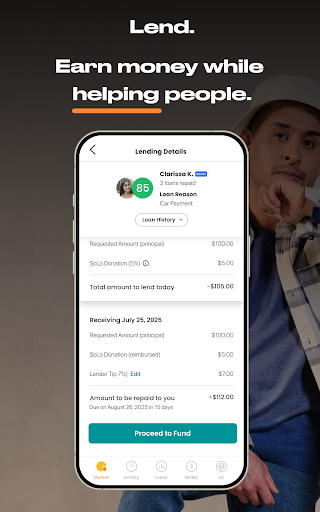

- Streamlined Lending and Borrowing Platform: SoLo Funds simplifies the entire process, allowing users to request or offer loans with just a few taps. Borrowers complete a quick profile, specify their needs, and receive tailored offers from lenders, making the process feel almost like browsing a marketplace of trusted options. The platform employs smart algorithms to match lenders with suitable borrowers based on credibility scores and repayment history, ensuring security and trustworthiness.

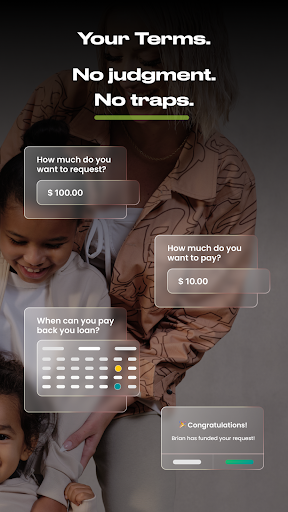

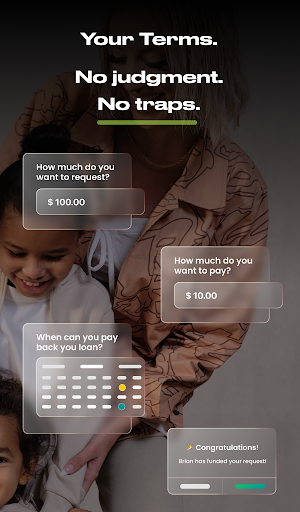

- Flexible Repayment Structures: Unlike traditional loans with rigid terms, SoLo Funds emphasizes flexible repayment schedules. Borrowers can agree on personalized repayment plans that suit their financial situation, which helps foster responsibility and reduces stress. The app also provides reminders and progress tracking, keeping everyone aligned and informed throughout the repayment journey.

- Emphasis on Community and Trustworthiness: One of SoLo Funds' standout features is its community reputation system. Lenders can see borrower profiles, reviews, and payment histories, cultivating trust and accountability. This community-driven model encourages responsible lending, where users are motivated by social reputation as much as financial return. It's akin to sitting in a cozy café and chatting with familiar faces rather than dealing with faceless institutions.

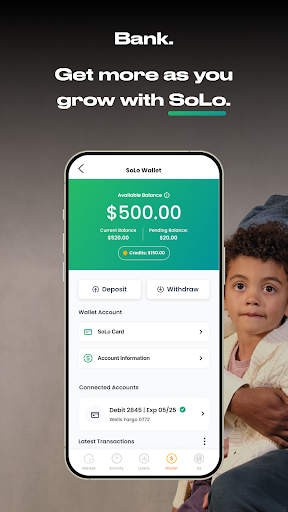

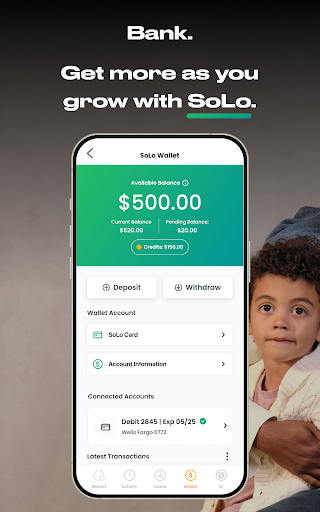

- Enhanced Security and Privacy Measures: Security is a top priority, with robust encryption, identity verification, and dispute resolution mechanisms. The platform's transparency and security features aim to make every transaction as safe as possible, giving users peace of mind whether they're lending or borrowing.

Design, Usability, and User Experience

Visually, SoLo Funds boasts a clean, intuitive interface that feels welcoming and approachable—no steep learning curves here. The home screen uses vibrant icons, guiding users effortlessly through requesting or lending funds. Navigation is smooth; pages load swiftly, and actions like signing up or updating profiles are seamless. For first-time users, onboarding is straightforward, with clear instructions and helpful tips. The app's layout is well-balanced, balancing flashy visuals with essential information, making it engaging without feeling overwhelming.

Operationally, SoLo Funds shines with fluidity—transitions are smooth, and interactions respond instantly, creating a sense of reliability. Its core functions are designed to minimize friction, whether setting up a loan request or confirming repayment. This user-centric design encourages ongoing engagement and builds user confidence with approachable language and helpful prompts throughout the process.

Learning the ropes is easy; the app provides contextual guidance, FAQs, and customer support options that make troubleshooting less intimidating. Overall, it offers a delightful user experience that balances simplicity with powerful features.

Unique Selling Points: Trust & Transaction Security

What truly sets SoLo Funds apart from traditional finance apps and other peer-to-peer lending platforms is its focus on community trust and transaction security. Unlike conventional apps that rely solely on credit scores or extensive underwriting, SoLo leverages a reputation system—think of it as a digital neighborhood watch—where users build credibility through consistent, responsible behavior. This social trust mechanism not only fosters safer lending but also creates a sense of accountability and mutual respect.

From a transaction perspective, SoLo Funds ensures every exchange is handled with industry-grade encryption, identity verification, and dispute resolution channels—making digital transactions as trustworthy as handing over cash in a secure, familiar setting. The platform's emphasis on transparency and security reassures users that their funds and personal data are well protected, which is especially critical in an era of increasing cyber threats.

Final Thoughts and Recommendations

All in all, SoLo Funds offers a responsible, community-oriented approach to short-term lending that feels approachable yet secure. Its standout features—the flexible repayment plans and reputation-based trust system—are It's like having a friendly neighborhood lender at your fingertips. Whether you're in need of quick cash or want to lend responsibly within a trusted network, the app provides a balanced, user-friendly platform.

For users comfortable with digital financial services and seeking alternatives beyond traditional banking or payday loans, SoLo Funds is a compelling option. Its emphasis on security, community trust, and transparency makes it worth considering for both borrowers and lenders who value responsible interactions over impersonal transactions. I'd recommend giving it a try, especially if you're looking for a platform that blends technological efficiency with human-centered values.

Pros

User-Friendly Interface

The app has an intuitive design that makes it easy for new users to navigate and understand the lending process.

Flexible Lending Options

Borrowers can choose from various loan amounts and repayment periods to suit their needs.

Quick Approval Process

Loans are often approved swiftly, providing fast financial assistance when needed.

Transparent Fee Structure

Clear information about fees and interest rates helps users make informed decisions.

Strong Community Focus

The platform fosters a community-driven environment which builds trust among users.

Cons

Limited Loan Availability (impact: medium)

The maximum loan amounts are relatively low, which may not meet larger financial needs; official enhancements are expected to increase limits.

Interest Rates Could Be Lower (impact: high)

Interest rates are higher compared to traditional banks, but future policy updates may offer better rates.

Limited Geographic Coverage (impact: high)

Currently available only in select regions, restricting access for some users; official expansion plans are underway.

Verification Process Can Delay Lending (impact: medium)

Identity checks sometimes slow down loan approval; improvements in automation may reduce delays.

Customer Support Responses Vary (impact: low)

Some users report delayed customer service responses, although improvements are expected with upcoming upgrades.

SoLo Funds: Lend & Borrow

Version 2.12.0 Updated 2026-01-28