SoFi - Banking & Investing

SoFi - Banking & Investing App Info

-

App Name

SoFi - Banking & Investing

-

Price

Free

-

Developer

Social Finance, LLC

-

Category

Finance -

Updated

2026-01-08

-

Version

3.75.4

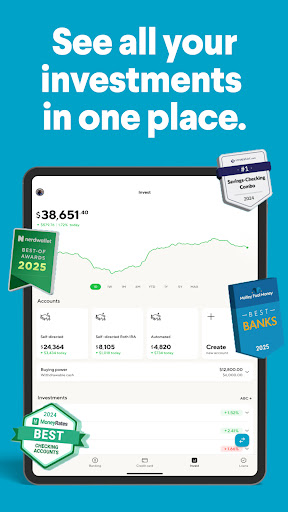

Introducing SoFi - Banking & Investing: A Fresh Approach to Financial Freedom

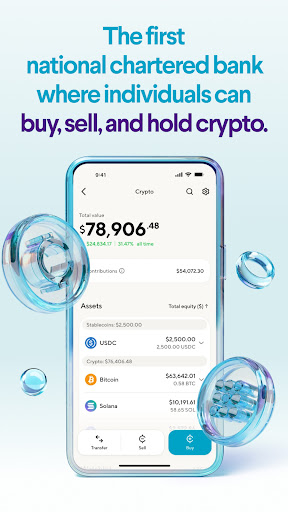

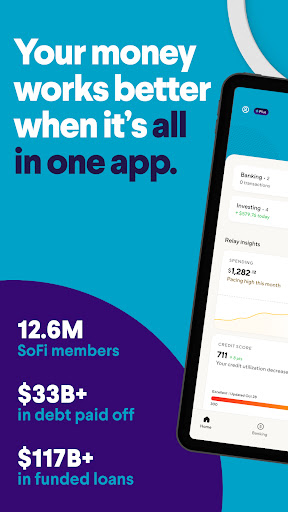

SoFi - Banking & Investing is a comprehensive financial app designed to streamline banking, investing, and money management into a single, user-friendly platform. Crafted by the innovative team at SoFi Technologies, this app aims to empower users to manage their financial lives with confidence and ease.

Spearheading Modern Finance: What Sets SoFi Apart

At its core, SoFi distinguishes itself through a blend of sleek design, robust security, and seamless user experience. Its main features include integrated banking services with no account fees, a variety of investment options, and personalized financial planning tools. The app caters primarily to young professionals, students, and anyone seeking a one-stop financial solution that's both accessible and efficient.

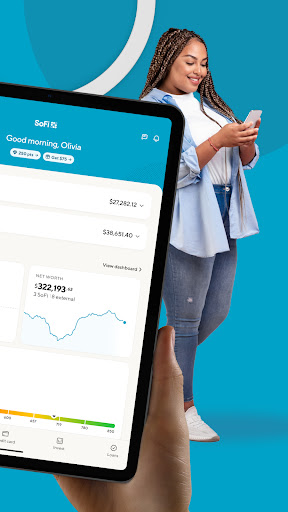

Engaging and Intuitive Design: Your Digital Wallet's Comfort Zone

Open the app, and you're greeted with a clean, modern interface that feels more like a friendly digital assistant than a complex financial tool. The interface employs a soothing palette, intuitive icons, and a layout that guides you naturally from one function to the next. Navigation is smooth, with quick loading times and logical flow, making onboarding and daily use both effortless and enjoyable. Whether you're checking your balance, transferring money, or exploring investment options, everything is just a tap away. For newcomers to finance apps, SoFi minimizes the learning curve through clear labels and straightforward processes, turning what could be intimidating into a manageable and even enjoyable routine.

Core Features That Make Your Money Work Smarter

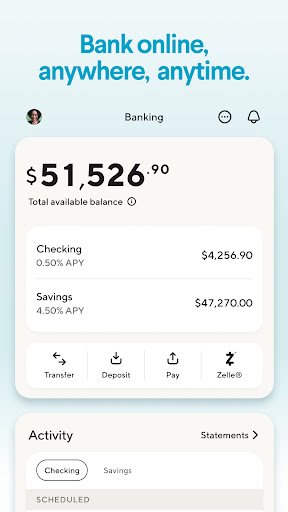

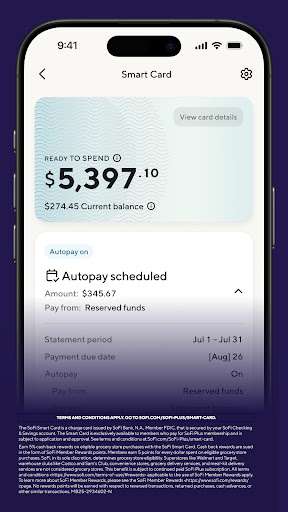

Seamless Banking with Zero Fees and Quick Transfers

The banking component offers savings and checking accounts with no monthly fees or minimum balances, which feels like a breath of fresh air compared to traditional banks—no surprise there, as SoFi aims to democratize financial access. Transfers are instant, whether you're moving money between your SoFi accounts or sending cash to friends, thanks to integrations with popular platforms and ACH transfer technology. Features like direct deposit enable faster paychecks, making everyday transactions as smooth as sliding a credit card at your favorite coffee shop.

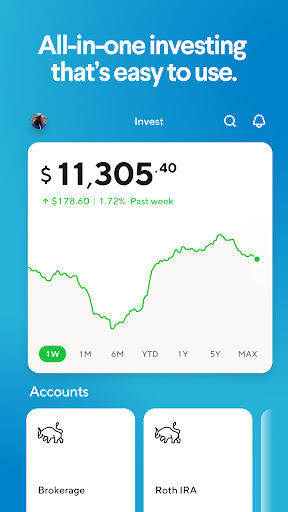

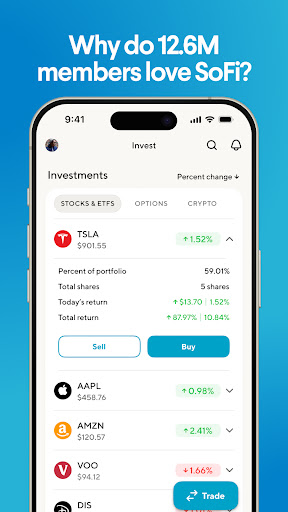

Investing Made Simple and Smart

The investment module is designed to appeal to both beginners and seasoned investors. With fractional shares, automatic investing options, and a range of mutual funds and ETFs, SoFi makes diversified investing approachable. The app offers personalized investment insights based on your goals, risk tolerance, and timeline—think of it as having a seasoned financial advisor in your pocket. The interface simplifies complex data into digestible visuals, encouraging users to grow their wealth actively without feeling overwhelmed.

Financial Planning and Security You Can Trust

Beyond transactions and investments, SoFi offers tools for budgeting, student loan refinancing, and credit monitoring, turning the app into a holistic financial companion. The standout feature here is its robust security measures—advanced encryption, multi-factor authentication, and real-time account monitoring—ensuring your assets and data stay protected. Compared to other finance apps, SoFi's focus on security feels less like a box to check and more like a core value; it builds trust quietly but confidently, reinforcing user confidence to explore financial opportunities risk-free.

Overall Experience and Final Verdict

For those looking for an all-in-one financial platform that combines ease of use with powerful features, SoFi - Banking & Investing holds significant appeal. Its blend of clean design, innovative security features, and holistic financial tools makes it stand out among peers like Robinhood, Chase, or Wealthfront. The app's unique strength lies in its integrated approach—making it possible to handle banking, investing, and financial planning without juggling multiple apps or platforms.

Considering its user-centric design and comprehensive feature set, I would recommend SoFi to young professionals, students, and anyone venturing into personal finance who values simplicity without sacrificing sophistication. Whether you're starting your financial journey or aiming to optimize your existing investments, SoFi offers a reliable and engaging platform to support your goals.

Pros

User-friendly interface

The app offers an intuitive layout that makes navigation seamless for users of all experience levels.

Comprehensive banking features

Provides a wide range of services such as checking accounts, savings, and debit cards in one platform.

Robust investment options

Offers easy access to ETFs, stocks, and automated investing, ideal for both beginners and experienced investors.

Competitive interest rates

Savings accounts and CDs offer higher-than-average APYs, helping users grow their funds faster.

Integrated financial planning tools

Includes budgeting and goal tracking features that assist users in managing their finances efficiently.

Cons

Limited international services (impact: medium)

The app currently supports only U.S. residents, which may be restrictive for global users.

In-app customer support delays (impact: medium)

Users have reported slow response times from customer service; official updates on improvements are expected soon.

Few advanced investment tools (impact: low)

Lacks some complex analysis features needed by professional traders, which might be a drawback for advanced investors.

Occasional app crashes (impact: low)

Some users experience app stability issues during peak usage times; a future update aims to improve stability.

Limited educational resources (impact: low)

The app offers basic financial tips but lacks comprehensive educational content for beginners; plans for added resources are underway.

SoFi - Banking & Investing

Version 3.75.4 Updated 2026-01-08