Sendwave—Send Money

Sendwave—Send Money App Info

-

App Name

Sendwave—Send Money

-

Price

Free

-

Developer

Sendwave

-

Category

Finance -

Updated

2026-01-12

-

Version

25.24.1

Introducing Sendwave—Send Money: A Streamlined Solution for Global Remittances

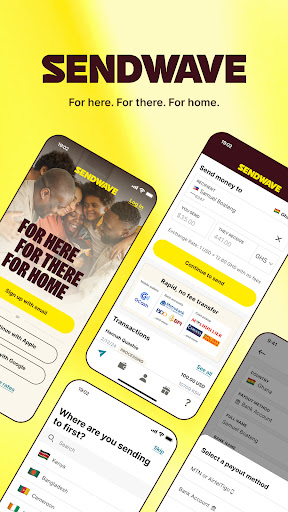

Sendwave is a user-friendly mobile application designed to facilitate quick and affordable international money transfers, primarily serving immigrants and expatriates seeking seamless remittance options. Developed by Sendwave Inc., this app aims to bridge the gap between traditional wiring services and modern, tech-driven solutions by emphasizing speed, security, and simplicity. Its standout features include low transaction fees, instant transfer capabilities, and broad recipient options—making it a practical choice for those wanting to send money across borders without the usual hassle.

Seeking Simplicity and Security in Cross-Border Transfers

Imagine sending the equivalent of a birthday gift or educational fund to a loved one abroad — but without the complexity or hidden costs that can turn a heartfelt gesture into a logistical nightmare. Sendwave steps into this scene as a reliable courier of your financial kindness, turning what used to be a lengthy, costly process into a swift, transparent experience. Whether you're transferring funds to family, supporting friends, or managing your international business payments, Sendwave aims to make this process as effortless as a tap on your phone.

Core Features That Make Sendwave Stand Out

1. Fast and Low-Cost Transactions

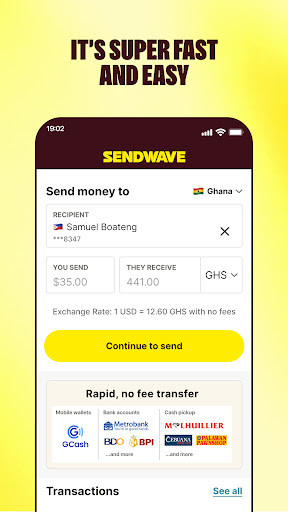

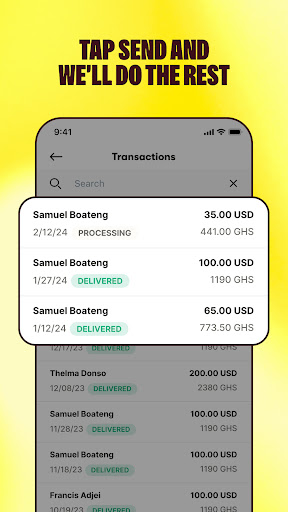

One of Sendwave's most notable offerings is its ability to provide instant money transfers at a fraction of the price charged by traditional banks or remittance services. It leverages local banking partnerships and mobile money integrations to ensure that recipients get their money almost immediately, often within minutes. The app's fee structure is straightforward and transparent, eliminating surprises that often come with currency exchange costs or hidden charges—saving users both time and money.

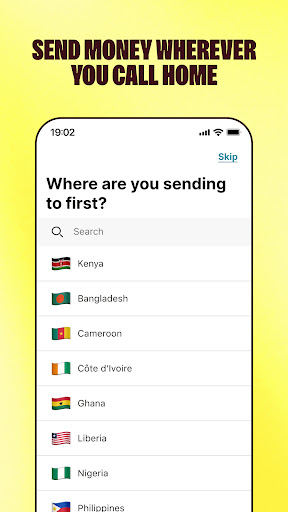

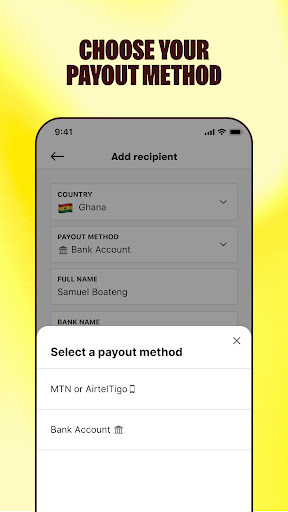

2. Broad Coverage and Recipient Flexibility

Sendwave isn't limited to just bank account transfers; it extends its reach to mobile money wallets and local agents in many countries, especially across Africa and Asia. This extensive network means recipients aren't locked into needing a bank account—they can pick up cash at local agent locations or receive money directly into their mobile money accounts. This flexibility greatly enhances accessibility, particularly for recipients in regions where banking infrastructure is limited.

3. Intuitive Interface and User Experience

From first launch, Sendwave's interface feels like a familiar app — clean, simple, and almost instinctive to navigate. Setting up an account takes less than a few minutes, with minimal learning curve. The transaction flow is smooth, with clear instructions and real-time updates. Whether on a smartphone or tablet, users find their way easily, making it suitable for all ages and tech proficiency levels. The app also prioritizes security through multi-layered encryption and biometric verification, ensuring your money and details are well protected.

Comparing Sendwave with Other Financial Apps: What Makes It Unique

While many apps promise convenient international transfers, Sendwave distinguishes itself through a heavy emphasis on security and transfer experience. Its security model goes beyond standard encryption by utilizing robust identity verification processes, making unauthorized access highly unlikely. Unlike some competitors that hide their fees or add hidden charges, Sendwave's transparent fee structure builds trust and simplifies budgeting for users.

Moreover, Sendwave's unique integration with local mobile money services offers a seamless experience that many similar apps lack. For instance, transferring money to a recipient's mobile wallet in Kenya or Ghana is straightforward, often with a few taps, contrasting sharply with more cumbersome processes in traditional remittance services. This focus on ease, speed, and safety ultimately provides a more reliable and user-friendly experience, especially for first-time senders who may be overwhelmed by complex procedures elsewhere.

My Take: Is Sendwave Worth a Try?

Overall, I'd recommend Sendwave to anyone looking for a practical, transparent, and secure way to send money internationally, especially if speed and cost are your top priorities. Its most impressive feature—the ability to transfer funds instantly with low fees—makes it stand out as a convenient alternative to traditional wire transfers. If you frequently send money in regions served by Sendwave's extensive agent network or mobile wallet partnerships, this app deserves a place on your device.

For those who value security, simplicity, and speed without sacrificing transparency, Sendwave offers a compelling solution. However, as always, users should remain cautious with sensitive financial data and confirm recipient details carefully. It's best suited for personal remittances rather than large-scale corporate transfers, but in its domain, it truly shines.

Pros

User-friendly interface

The app is intuitive and easy to navigate, making money transfers simple for all users.

Low transfer fees

Sendwave offers competitive rates with minimal charges, saving users money on each transaction.

Fast transaction processing

Transfers are completed quickly, often within minutes, ensuring timely support for recipients.

Wide coverage in multiple countries

Supports transfers across numerous countries, facilitating international remittances for users worldwide.

Strong security measures

Uses encryption and secure protocols to protect users' personal and financial information.

Cons

Limited deposit options (impact: medium)

Currently primarily supports mobile wallet transfers, which may exclude some users without compatible wallets.

Occasional app crashes (impact: medium)

Some users report app freezes or crashes during busy periods; updating the app regularly may temporarily mitigate this.

Restricted to certain countries (impact: high)

Does not yet support transfers to all countries, which might inconvenience users needing broader options; official expansion is expected.

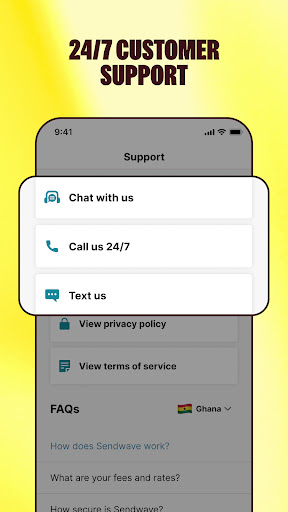

Limited customer support channels (impact: low)

Customer service primarily through in-app chat, which may be slow; users can try reaching out via email for more persistent issues.

Withdrawal delays in some regions (impact: medium)

Cash pickup or bank transfer delays can occur depending on local banking infrastructure; users are advised to plan accordingly.

Sendwave—Send Money

Version 25.24.1 Updated 2026-01-12