Self - Credit Builder

Self - Credit Builder App Info

-

App Name

Self - Credit Builder

-

Price

Free

-

Developer

Self Financial, Inc.

-

Category

Finance -

Updated

2026-01-07

-

Version

6.24.0

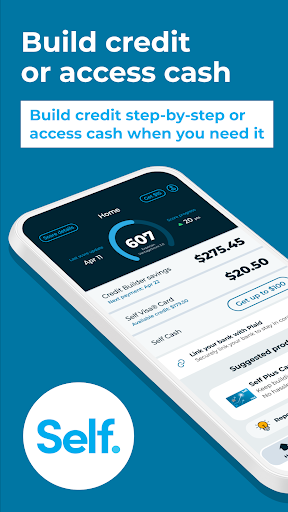

Self - Credit Builder: Empower Your Financial Future

Self - Credit Builder is a user-friendly financial app designed to help individuals establish or rebuild their credit scores by offering innovative tools and transparent management features, all while maintaining a friendly and approachable interface.

About the App: Building Credit with Confidence

Developed by Self Financial, Inc., a company dedicated to making financial independence accessible, Self - Credit Builder combines advanced algorithms with straightforward design to serve those aiming to improve their credit profiles. Its main highlights include seamless credit reporting to major bureaus, personalized savings plans, and real-time credit monitoring. This app is especially tailored for young adults, newcomers to credit, or anyone seeking a transparent, supportive platform to achieve better financial stability.

The Journey Begins: An Inviting and Intuitive Entry

Opening the Self - Credit Builder app feels like stepping into a cozy, well-organized workspace where every tool is just a tap away. The onboarding process is straightforward, guiding users through setting up their profile with minimal fuss, making it ideal for those new to digital financial management. Its friendly tone and clear visual cues demystify the often intimidating world of credit management, turning what might seem like a daunting task into an achievable, even encouraging, experience.

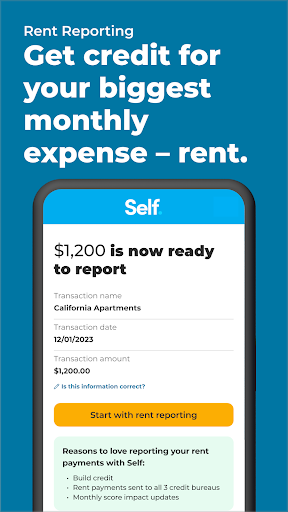

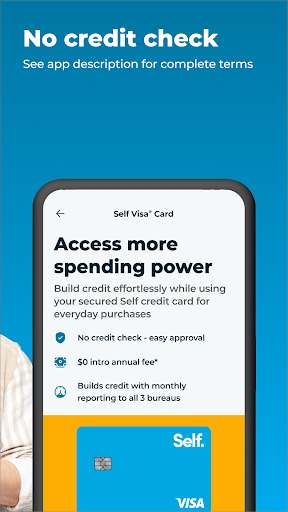

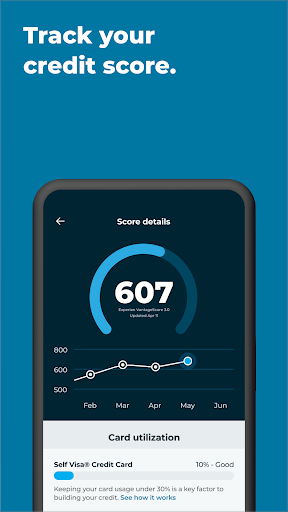

Core Feature 1: Transparent Credit Building & Reporting

One of the standout features of Self is its direct reporting to the three major credit bureaus—Equifax, Experian, and TransUnion. Unlike traditional approaches that leave consumers in the dark about their credit progress, Self provides real-time updates on your credit score, showcasing how your actions impact your profile. Imagine having a GPS for your credit journey, guiding you step by step, highlighting what actions boost your score and which ones might hold you back. The app applies a monthly installment-based saving plan, creating a built-in mechanism to demonstrate responsible borrowing behavior—essential for credit approval processes.

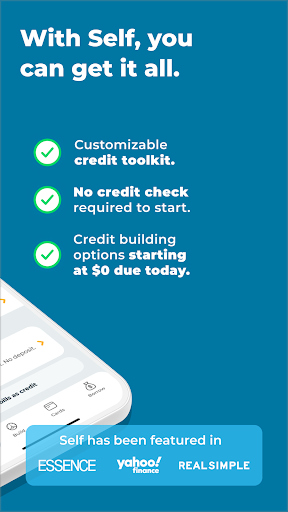

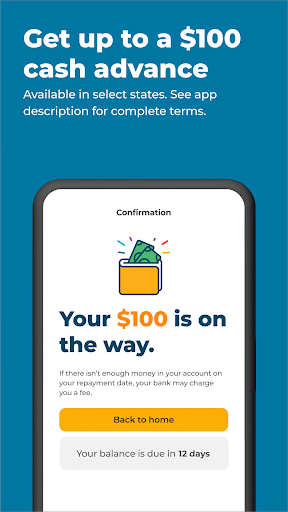

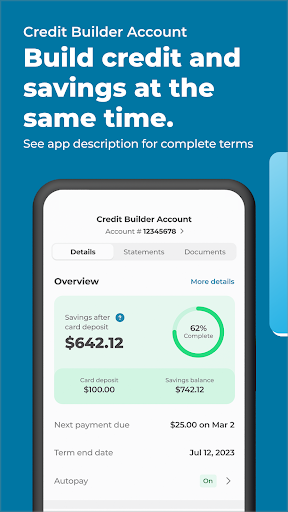

Core Feature 2: Customized Savings Plans & Responsible Borrowing

At the heart of Self's strategy lies a clever savings plan that acts as both a penalty and a proof of responsibility. Users deposit a small amount each month and borrow against their own savings, helping to establish positive credit history. This method feels like a disciplined workout for your credit muscles, gradually increasing your score without the risks associated with high-interest loans. The app tailors plans to individual needs, whether you're starting from scratch or rebuilding after setbacks, making credit growth feel realistic and manageable.

Core Feature 3: Security & User Experience: Trustworthy & Effortless

Security is a cornerstone of Self, with robust encryption protocols ensuring your data and financial information are well-guarded—much like having a safe vault for your financial life. Navigating the app is smooth; pages load swiftly, and the interface's minimalist design ensures clarity without clutter. The learning curve is gentle, with helpful tips and prompts that demystify terminology for beginners. The overall experience resembles having a trusted financial mentor at your side, guiding you through each step with clarity and patience.

What Sets Self Apart? A Focus on Security and Transaction Experience

While many finance apps promise to improve credit, Self's emphasis on transparent reporting and responsible, personalized savings offers a differentiated experience. It stands out for its proactive credit reporting, which empowers users with knowledge and control—akin to having a personal scoreboard for your credit journey. Additionally, its transaction process is designed to be frictionless; deposits and repayments are straightforward, with immediate feedback on how each action influences your score, fostering trust and confidence. This user-centric approach makes Self not just a tool, but a companion in your financial growth.

Final Verdict: A Friendly Hand for Your Credit Goals

All in all, Self - Credit Builder is a well-crafted app that balances simplicity with powerful features. Its unique focus on transparent credit reporting combined with responsible savings plans makes it a compelling choice for those seeking to build or rebuild their credit without surprises or hidden pitfalls. If you're someone who prefers a straightforward, supportive platform to take charge of your credit health, this app deserves a strong recommendation. Use it as a steady partner on your path to financial independence, and you may find yourself not just improving your score, but gaining confidence in your financial journey.

Pros

User-friendly interface

The app is easy to navigate, making credit building accessible for users of all tech skill levels.

Clear credit progress tracking

Provides users with transparent updates on their credit score improvements, encouraging continued use.

Educational resources included

Offers guidance and tips to help users understand credit management better.

Low fee structure

Affordable pricing makes it a cost-effective tool for building credit.

Flexible payment options

Users can customize contributions to fit their financial situations, increasing accessibility.

Cons

Limited credit reporting agencies (impact: medium)

Currently reports to only one credit bureau, which may limit the impact on credit scores.

Limited credit score improvement speed (impact: high)

Changes in credit scores might take longer compared to traditional methods; official plans suggest ongoing updates.

Basic educational content (impact: low)

Information provided may be insufficient for advanced users seeking in-depth credit management strategies.

Lack of financial counseling (impact: low)

No integrated financial advice; users may need external resources for comprehensive guidance.

App availability in select regions (impact: medium)

Currently limited to certain countries; expansion plans are underway to serve more users.

Self - Credit Builder

Version 6.24.0 Updated 2026-01-07