Rocket Money - Bills & Budgets

Rocket Money - Bills & Budgets App Info

-

App Name

Rocket Money - Bills & Budgets

-

Price

Free

-

Developer

Rocket Money - Bills & Budgets

-

Category

Finance -

Updated

2025-12-10

-

Version

12.7.0

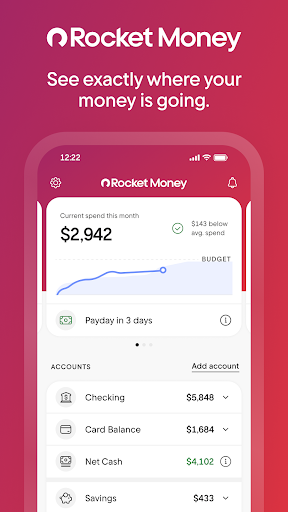

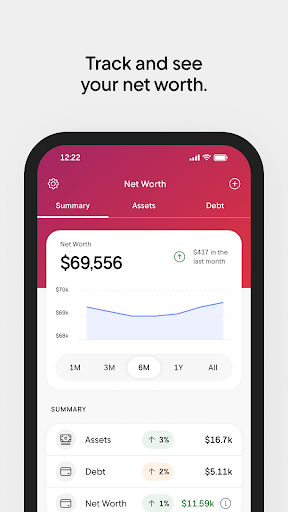

Rocket Money - Bills & Budgets: Your Personal Finance Sidekick

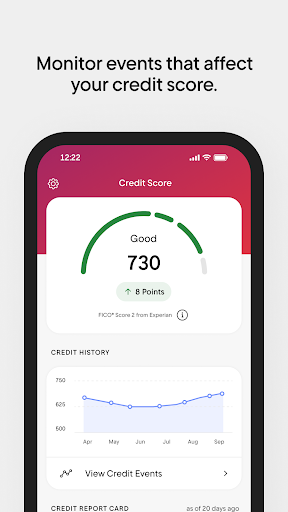

In a sea of finance apps, Rocket Money stands out as a streamlined, user-friendly tool designed to help you take control of your bills and budgets with confidence and clarity.

About the App

Rocket Money - Bills & Budgets is a personal finance management application developed by Rocket Money Inc., a team dedicated to simplifying financial oversight for everyday users. With a focus on ease of use and robust features, it aims to help you track expenses, manage subscriptions, and stay within your budgets effortlessly.

Key features that make Rocket Money shine include:

- Automatic subscription tracking and cancellation options

- Real-time bill reminders and due date alerts

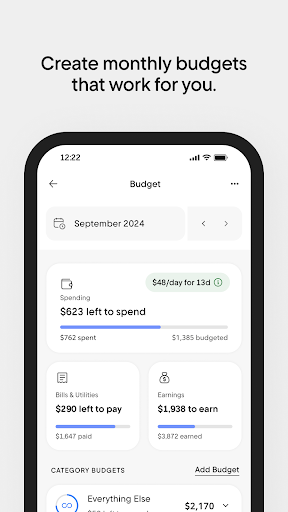

- Intuitive budget planning with visual breakdowns

- Secure account aggregation with bank-level encryption

Designed primarily for young working adults, busy professionals, and anyone looking to streamline their finances without the complexity of traditional apps, Rocket Money offers a balanced interface that caters to both beginners and seasoned budgeters.

A Fun and Friendly Introduction to Your Financial Assistant

Imagine having a personal financial assistant by your side, gently reminding you when a bill is due or alerting you to subscriptions draining your wallet. Rocket Money makes this a reality, transforming the often-daunting world of budget management into a straightforward, even enjoyable, experience. Its vibrant interface and clear visuals make navigation feel like flipping through a well-organized planner—nothing feels overwhelming, just a clear pathway to better financial habits.

Core Features That Pack a Punch

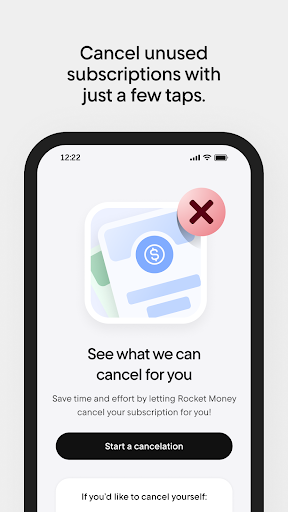

Subscription Management: The Night Watchman for Your Wallet

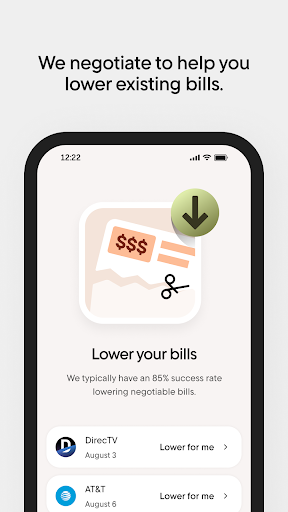

This feature sets Rocket Money apart from many peers. It automatically scans your bank accounts and credit cards for recurring payments, giving you a transparent view of all your subscriptions—from streaming services to gym memberships. Want to cancel that unused magazine subscription? Rocket Money makes it straightforward, allowing you to manage cancellations directly within the app. This function acts like a vigilant guardian, ensuring no sneaky subscription sneaks past without your knowledge, thereby shielding you from unnecessary expenses and helping you regain control over your financial commitments.

Bill Tracking and Reminders: Never Miss a Due Date

Our busy lives are filled with countless payment deadlines, and missing one can mean late fees or service interruptions. Rocket Money tackles this with a smart reminder system, alerting you ahead of time about upcoming bills. Think of it as your financial personal assistant who texts you: “Hey, your internet bill is due tomorrow!” Its real-time updates keep your cash flow steady and your financial stress low. Plus, the visual dashboard presents upcoming bills in an easy-to-understand timeline, making it simple to plan your month's expenses at a glance.

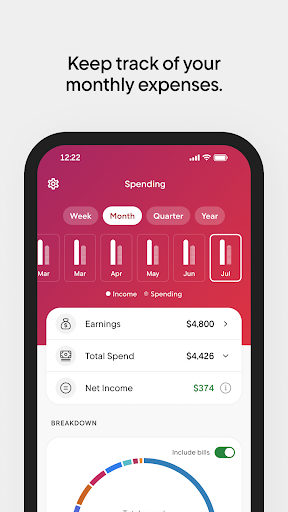

Budget Planning and Spending Insights

Creating a budget shouldn't feel like assembling a complex puzzle. Rocket Money offers an intuitive interface with colorful charts and clear categories that help you visualize where your money goes. It breaks down your expenses into segments—housing, food, entertainment—making it easier to identify savings opportunities. As you input your income and spending limits, the app dynamically updates your progress, acting as your financial GPS. This feature encourages smarter spending habits by providing actionable insights while avoiding overwhelming financial jargon.

User Experience: Smooth Sailing in the Financial Seas

Design-wise, Rocket Money employs a clean and modern aesthetic, with bright accents and straightforward layouts that feel inviting rather than intimidating. Navigation is a breeze—think of it as gliding effortlessly on a well-paved road. The app's responsiveness ensures that switching between features is seamless, with minimal loading times. For new users, the learning curve is gentle; onboarding tips are concise, guiding you gently into optimal usage. Experienced budgeters will appreciate the depth of data insights, but even without complex financial knowledge, users find the app approachable and easy to master.

What Sets Rocket Money Apart?

While many finance apps focus solely on expense tracking or investment management, Rocket Money's standout is its integrated approach—particularly its proactive subscription management. Unlike traditional apps that merely categorize expenses, Rocket Money actively helps users identify and cut unnecessary recurring costs, which can significantly boost savings. Its strong encryption and account aggregation features also ensure that your data remains secure, giving peace of mind in a digital world riddled with cyber threats.

Furthermore, the transaction experience is smooth, with automatic bank syncing that feels almost magical—like watching your financial life come to life with minimal effort. This combination of security, automation, and user-friendly design gives Rocket Money a notable edge in the personal finance domain.

Final Recommendation and Usage Tips

Overall, Rocket Money - Bills & Budgets earns a solid recommendation for anyone seeking a straightforward yet powerful tool to manage their financial health. Whether you're just starting your budgeting journey or are a seasoned pro, the app's features can adapt to your needs. For optimal benefit, I suggest regularly reviewing your subscription list and making mindful adjustments based on the insights provided. Also, set aside a few minutes weekly to update your budgets and check upcoming bills—consistency is key to turning financial management from a chore into a habit.

In essence, Rocket Money acts like a wise, friendly navigator steering you towards smarter financial choices—always guiding, never judging. It's a reliable companion in your journey to financial wellness, offering peace of mind in a busy digital age.

Pros

Intuitive Budget Tracking

Users can easily categorize and monitor their income and expenses with a user-friendly interface.

Automated Bill Reminders

Rocket Money sends timely notifications to help users avoid late payments, reducing fees.

Subscription Management

The app identifies and cancels unwanted subscriptions, saving users money effortlessly.

Secure Data Handling

Utilizes bank-level encryption to ensure user financial data remains safe and private.

Customizable Budget Goals

Allows users to set personalized financial targets and track progress over time.

Cons

Occasional Syncing Delays (impact: medium)

Bank account updates may be delayed, temporarily affecting real-time accuracy.

Limited Free Features (impact: medium)

Many advanced features require a subscription, which may be a barrier for some users.

Subscription Cancellation Response Time (impact: low)

Automated cancellation features may sometimes take a few days to process, causing delays.

Steep Learning Curve for New Users (impact: low)

Initial setup and understanding all features can be somewhat complex for beginners.

Limited Support for Certain Banks (impact: low)

Some less common financial institutions may not sync properly, but official updates are expected.

Rocket Money - Bills & Budgets

Version 12.7.0 Updated 2025-12-10