Robinhood - FinTech SuperApp

Robinhood - FinTech SuperApp App Info

-

App Name

Robinhood - FinTech SuperApp

-

Price

Free

-

Developer

Robinhood

-

Category

Finance -

Updated

2026-01-12

-

Version

2026.2.1

Robinhood - FinTech SuperApp: Revolutionizing Everyday Finance with Simplicity

Robinhood is a comprehensive financial platform designed to simplify investing and personal finance management for a broad audience, blending user-friendly interfaces with advanced security features.

Who's Behind Robinhood?

Developed by Robinhood Markets, Inc., a pioneer in democratizing finance through technology, this app aims to make investing accessible and transparent for everyone—from seasoned traders to first-time investors.

Key Highlights that Make Robinhood Stand Out

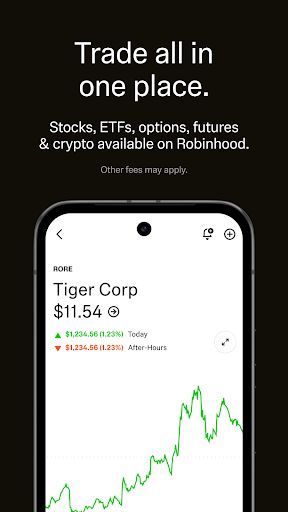

- All-in-One Financial Hub: Combines investing, banking, and cash management within a single app, reducing the need for multiple platforms.

- Fractional Shares & Commission-Free Trading: Enables users to buy partial shares of expensive stocks, all without trading fees, opening the markets to more people.

- Enhanced Security & Real-Time Monitoring: Implements biometric authentication, instant transaction alerts, and advanced encryption, ensuring user assets and data are well protected.

- Intuitive Design for All Ages: Features a clean, modern interface that caters to both beginners and experienced investors.

Drawing You Into the World of Robinhood

Imagine holding a sleek, digital toolbox where you can plant your financial dreams—and watch them grow—without sweating through complicated jargon or navigating clunky screens. Robinhood invites you to rethink personal finance, transforming what used to be a daunting task into a friendly, engaging experience. Whether you're looking to dip your toes into stock markets or manage your cash flows effortlessly, Robinhood makes it all feel like you're chatting with a knowledgeable friend over coffee.

Core Functionality: Investing Made Simple and Secure

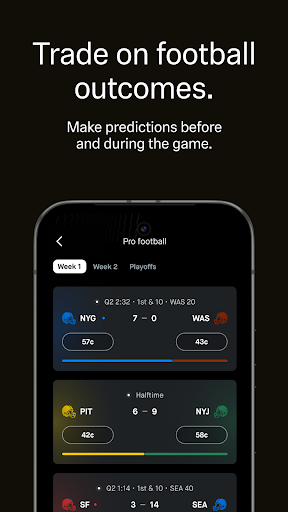

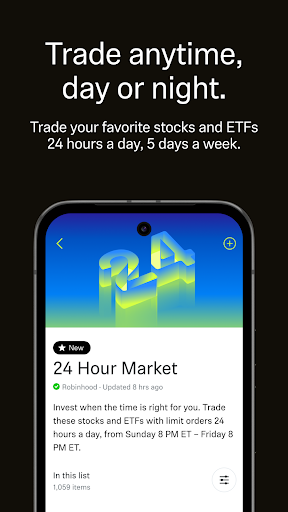

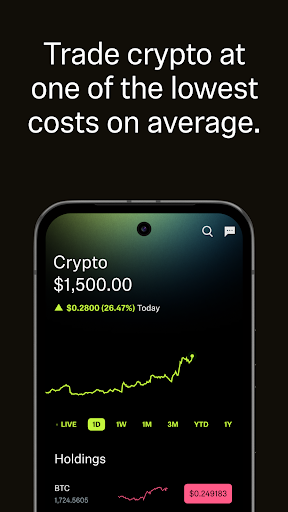

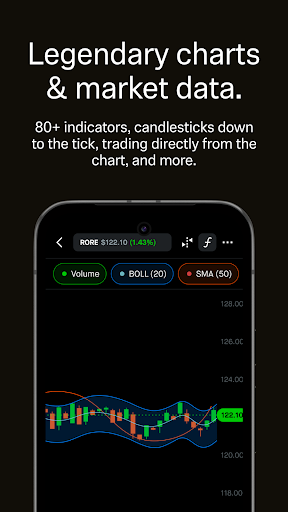

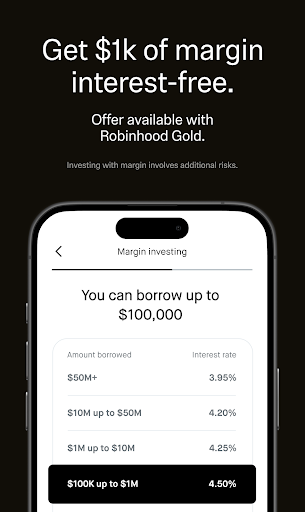

The heart of Robinhood lies in its investment platform, which is remarkably user-centric. The app offers seamless, commission-free trading of stocks, ETFs, options, and cryptocurrencies. Its intuitive order placement process feels akin to flipping through a well-organized catalog—clear, straightforward, and quick. Underlying this ease is a robust security infrastructure: biometric logins, real-time alerts, and encryption protocols create a digital vault that keeps your assets under lock and key, fostering confidence even in volatile markets.

Core Functionality: Banking Features that Fit Your Lifestyle

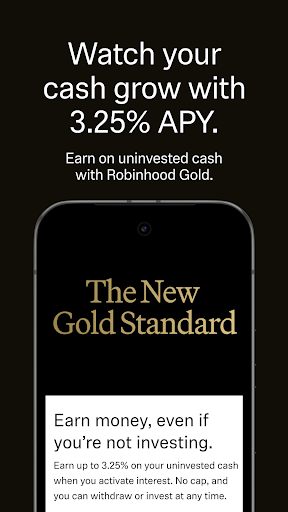

Robinhood's Cash Management service turns the app into a financial Swiss Army knife. You can earn interest on your cash, make fee-free ATM withdrawals worldwide, and even get a debit card that blends into your everyday life. What sets it apart from traditional banking apps is its integration with investing accounts, enabling swift transfers and a unified view of your finances—all without the hassle of multiple apps or long waits. The design here is minimalist but functional, with smooth transitions that make managing your money feel natural rather than a chore.

User Experience: Beautiful, Intuitive, and Easy to Learn

Robinhood's interface is like a well-lit, uncluttered workspace—every element has a purpose, and navigation feels instinctive. Beginners can learn the ropes quickly thanks to guided tutorials and simplified charts; experienced users appreciate the depth of data and customizable features. The app operates fluidly, with no lag or crashes when placing trades or checking balances. Its learning curve is gentle, making it accessible for tech-savvy teens and seasoned investors alike.

Differentiation: Security and Transaction Experience

Compared to many finance apps that prioritize flashy features, Robinhood's standout advantage is its dedication to security and transactional transparency. With biometric login options and instant transaction alerts, users are kept in the loop about every move—much like having a vigilant guard dog watching over your assets. Additionally, its seamless transaction experience—characterized by swift order execution and real-time updates—minimizes delays and uncertainties that often plague financial apps, giving users peace of mind whether they're executing a trade or transferring funds.

Should You Give Robinhood a Try?

If you're seeking an app that combines robust security, a unified financial dashboard, and an easy entry point into investing or banking, Robinhood is definitely worth considering. It's best suited for users who desire simplicity without sacrificing security or functionality. For seasoned investors, its advanced features and zero-commission structure make it a practical choice, while newcomers will appreciate its approachable interface and educational tools.

Final Verdict: A Friend in Your Financial Journey

Robinhood stands out not just as a tool but as a partner that gently guides you through the labyrinth of personal finance. Its most distinguishing feature—the integration of banking, investing, and security into one cohesive platform—makes it a unique player in the fintech space. While no app is perfect, Robinhood's commitment to simplicity, transparency, and security makes it a commendable choice for anyone ready to take control of their financial future. I'd recommend it to anyone who values convenience and clarity in managing money—think of it as your friendly neighborhood financial companion, always there when you need it.

Pros

Intuitive User Interface

Robinhood offers a clean, easy-to-navigate layout suitable for both beginners and experienced investors.

All-in-One Financial Platform

Handles investing, banking, and cash management seamlessly within a single app, enhancing user convenience.

Commission-Free Trading

Allows users to trade stocks, ETFs, and cryptocurrencies without additional fees, making investing more accessible.

Educational Resources

Provides tutorials and news updates to help users make informed financial decisions.

Real-Time Data and Alerts

Delivers instant market updates and notifications to keep users informed and responsive.

Cons

Limited Research Tools (impact: medium)

Compared to other platforms, Robinhood offers fewer in-depth analysis tools, which may impact experienced traders.

Customer Service Challenges (impact: medium)

Users may experience longer wait times when seeking support; official improvements aim to enhance response efficiency.

No Retirement Accounts Yet (impact: low)

Currently lacks options like IRAs, which might limit long-term planning; some updates are expected soon.

Limited International Access (impact: low)

Primarily serves US users, restricting global expansion; future plans may include broader offerings.

In-App Security Features (impact: low)

While security measures are in place, users should remain vigilant; Robinhood is working on more advanced authentication tools.

Robinhood - FinTech SuperApp

Version 2026.2.1 Updated 2026-01-12