Revolut: Spend, Save, Trade

Revolut: Spend, Save, Trade App Info

-

App Name

Revolut: Spend, Save, Trade

-

Price

Free

-

Developer

Revolut Ltd

-

Category

Finance -

Updated

2025-12-12

-

Version

10.109

Revolut: Spend, Save, Trade — A Modern All-in-One Financial Companion

Revolut's latest app iteration positions itself as a comprehensive financial tool designed for the tech-savvy, globally minded user who demands flexibility, security, and simplicity in managing their money—all within a sleek digital environment.

Developed by Revolut Ltd., a fintech company headquartered in London with a focus on innovation and user-centric financial solutions, the app integrates banking, saving, investing, and currency exchange functionalities into a unified platform.

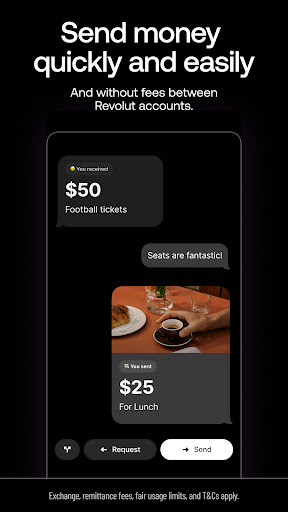

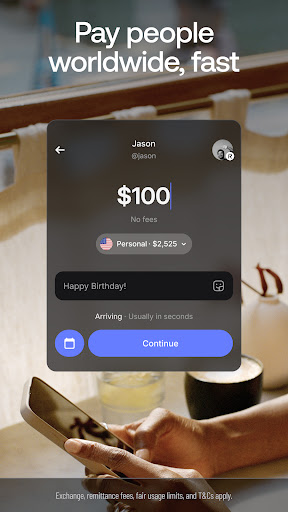

Its standout features include multi-currency accounts, instant peer-to-peer transfers, seamless spending controls, and a beginner-friendly trading interface, combined to serve a generation that values agility and control over their finances. The app primarily targets young professionals, frequent travelers, and digital-savvy investors seeking more streamlined money management without the need for multiple separate apps.

Introducing a Financial App That Fits Your Lifestyle

Imagine having a financial toolkit in your pocket that responds as swiftly as your latest Instagram story or your quick reply to a message. Revolut's app is that reliable assistant you never knew you needed—an intuitive, responsive platform that makes handling money feel less like chores and more like a daily habit. Whether you're paying for a cup of coffee abroad or exploring investments, the app promises to be your trusted partner, making every transaction smooth as butter and almost effortless.

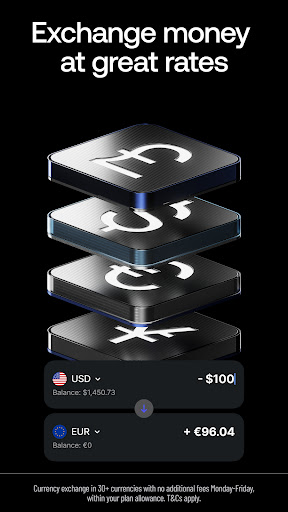

Multi-Currency Spending and Exchange

One of Revolut's most compelling features is its ability to handle multiple currencies seamlessly. Imagine strolling through Paris, paying in euros, then hopping to Tokyo and switching effortlessly to yen—without any hefty exchange fees or long waits. The app offers real-time currency exchange, typically at interbank rates, saving users from the rip-off rates banks or traditional forex agents often impose. This feature is particularly attractive to frequent travelers and remote workers juggling different currencies.

The interface for currency management is straightforward: users can hold and manage multiple currencies within the same account, convert instantly with a single tap, and even set alerts for favorable exchange rates. The transaction experience is swift: payments are processed almost instantaneously, with transparent fee structures that eliminate surprises at checkout. This clarity and speed create a sense of trust and control that's often missing in conventional banking apps.

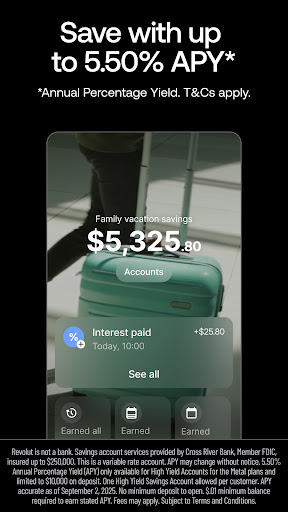

Integrated Saving and Budgeting Tools

Revolut's saving features go beyond simple account balances. Users can create smart savings pots—visualized as virtual jars—to set aside money for specific goals like trips, emergency funds, or big purchases. The app allows recurring transfers, round-up transactions, and interest-earning savings, making the act of saving both visual and rewarding.

With an engaging and user-friendly interface, these features make budgeting feel less like a spreadsheet chore and more like a game—where every small amount saved brings you closer to your financial goals. The app's real-time insights help users stay aware of their spending habits, providing a comprehensive picture that encourages smarter financial decisions.

Secure Transactions and Advanced Trading Features

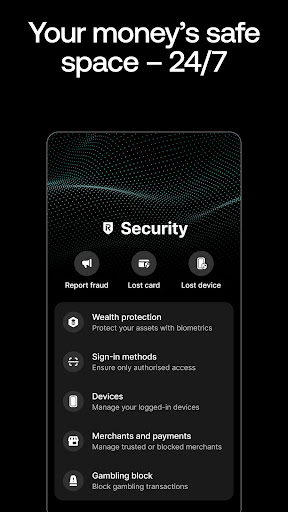

Security is a cornerstone of Revolut's appeal. The app employs multiple layers of protection—including real-time fraud monitoring, biometric authentication, and the ability to freeze or unfreeze cards instantly. Users can rest assured that their funds are safeguarded, even in a digital, borderless environment.

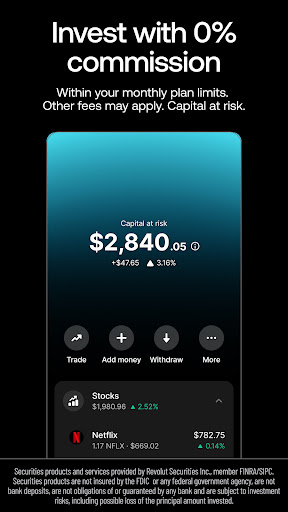

Most notably, the trading feature stands out: designed for beginners and casual investors, it offers an approachable interface to buy and sell stocks, cryptocurrencies, and commodities. Unlike many traditional trading platforms that intimidate with complex charts and endless options, Revolut simplifies the experience, highlighting key data and enabling quick trades—much like swiping your favorite dating app, but for your investments. This level of integrated investing within the same app as your daily banking is a unique selling point, offering versatility without sacrificing security or ease of use.

Design, Usability, and the User Experience

Revolut's interface resembles a well-crafted dashboard—clean, modern, and intuitive. Navigating between accounts, currencies, savings, and trading features feels natural, with minimal learning curve. The design employs a vibrant color palette and minimal text, making information digestible at a glance. Transitions are smooth, thanks to well-optimized animations and rapid response times, giving the impression of surfing on a digital wave rather than wading through a swamp of menus.

For users accustomed to traditional banking apps, initial onboarding might require a bit of time to familiarize with all the features, but the app's logical structure minimizes frustration. The app also provides guided tutorials and helpful prompts, easing newcomers into more advanced functionalities such as trading or setting up new savings pots.

Compared with typical banking or finance apps, Revolut's standout advantage is its unified platform—no need to juggle multiple apps or services. Its security layers and transaction performance foster confidence, even when handling sensitive operations across borders, currencies, and asset classes.

Final Verdict: A Versatile Financial Ally Worth Trying

Revolut: Spend, Save, Trade successfully bridges the gap between everyday banking and investing, delivering a comprehensive, secure, and user-centered experience. Its most remarkable features—multi-currency management and integrated trading—offer real-world advantages for a digital audience eager for simplicity, speed, and versatility.

For those looking to streamline their financial life without sacrificing security or control, this app comes highly recommended, especially for travelers, small investors, and anyone seeking to unify their financial footprint in one sleek platform. As with all financial tools, users should evaluate their own needs and risk profile, but Revolut provides a compelling, modern solution that's hard to overlook.

Overall, I'd rate it as a strong 'thumbs up'—an efficient, innovative app that truly adapts to today's fast-paced, borderless lifestyle. Whether you're just starting or looking to upgrade your financial toolkit, Revolut's blend of features makes it an excellent choice worth exploring.

Pros

User-friendly interface

The app has an intuitive layout that makes managing finances simple for users of all levels.

Comprehensive financial tools

Offers features like budgeting, savings, trading, and international spending within one platform.

Competitive exchange rates and low fees

Revolut provides favorable rates for currency exchange and transactions, saving users money.

Instant notifications and real-time balance updates

Keeps users informed immediately about transactions, enhancing money management.

Innovative features like crypto trading and stock investment

Allows users to diversify their portfolio directly through the app, appealing to modern investors.

Cons

Limited offline access (impact: medium)

Some features require active internet connection, which may limit usability in low connectivity areas.

Customer support response times vary (impact: medium)

Users have reported slow responses to inquiries; official improvements are expected to streamline support.

Restricted availability of certain banking services in some regions (impact: high)

Not all features are accessible worldwide, potentially limiting international users.

Complex fee structure for certain transactions (impact: low)

Some fees are not immediately transparent, which can cause confusion; detailed fee breakdowns are being enhanced.

Security concerns regarding crypto investments

Some users worry about the security of crypto trading; Revolut continuously updates security protocols to address this.

Revolut: Spend, Save, Trade

Version 10.109 Updated 2025-12-12