Remitly: Send Money & Transfer

Remitly: Send Money & Transfer App Info

-

App Name

Remitly: Send Money & Transfer

-

Price

Free

-

Developer

Remitly

-

Category

Finance -

Updated

2026-02-18

-

Version

6.60

Remitly: Send Money & Transfer — A Trusted Companion for Global Remittances

Remitly is a dedicated mobile application designed to simplify and secure international money transfers, catering to individuals who need a reliable way to send funds across borders with ease.

About the App: Connecting Families and Friends Worldwide

Developed by Remitly Inc., a well-established fintech company specializing in remittance services, this app leverages cutting-edge technology to enhance the speed and security of global money transfers. Its primary strength lies in offering tailored solutions for migrant workers, expatriates, and anyone needing to send money internationally without the hefty fees often associated with traditional banks.

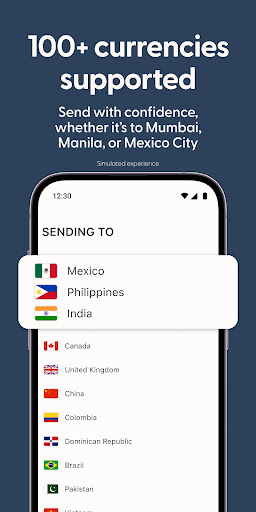

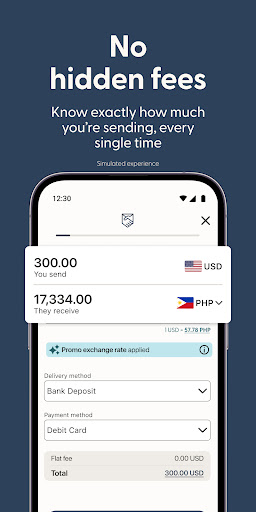

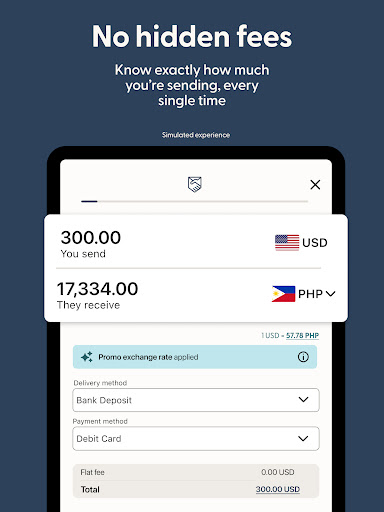

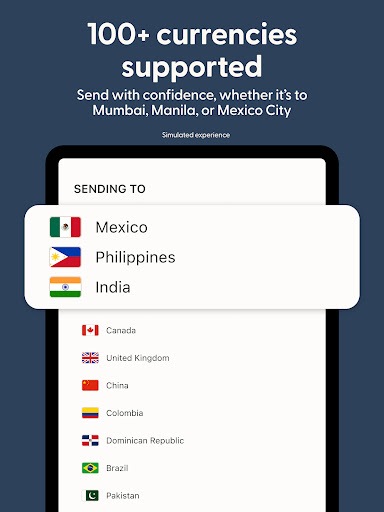

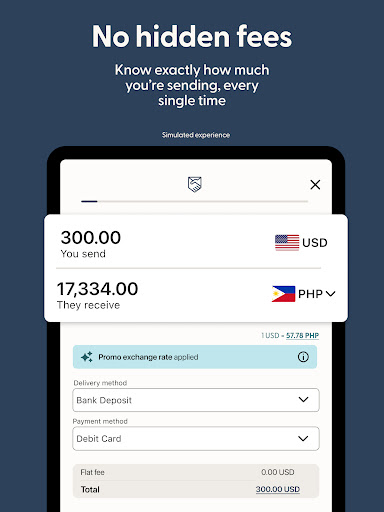

Key features that stand out include competitive exchange rates, fast transfer options, and transparent fee structures. Another highlight is its emphasis on security, ensuring users' funds and personal data are protected through robust encryption and verification measures. The app also offers multi-language support, making it accessible to a diverse user base traveling from different countries.

Targeted primarily at immigrants, overseas workers, and their families, Remitly aims to bridge financial gaps and provide a seamless transfer experience, regardless of the recipient's location.

Vivid First Impressions: Navigating Remitly's User-Friendly World

Imagine trying to send a gift across borders—nervous anticipation mixed with hope that it arrives safe and sound. That's the experience Remitly strives to deliver for each transfer. From the moment you open the app, a warm, intuitive interface greets you, making what could be a complex process feel like a friendly chat. The app's design is straightforward yet modern, with vibrant icons guiding you effortlessly through the transfer journey. It's akin to having a trusted travel companion who knows all the shortcuts and speaks your language.

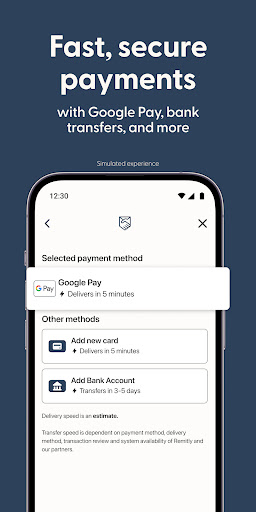

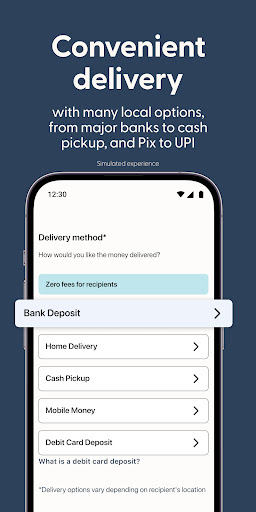

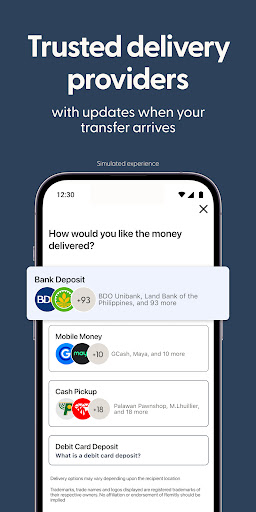

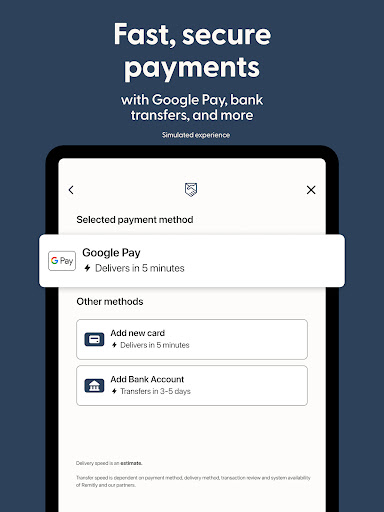

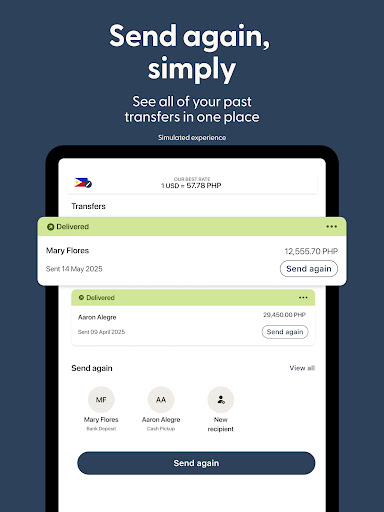

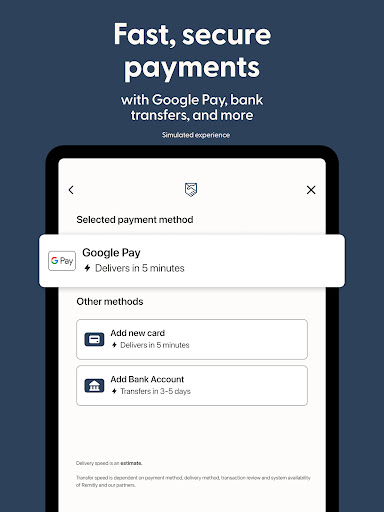

Core Functionality: Fast, Secure, and Transparent Transfers

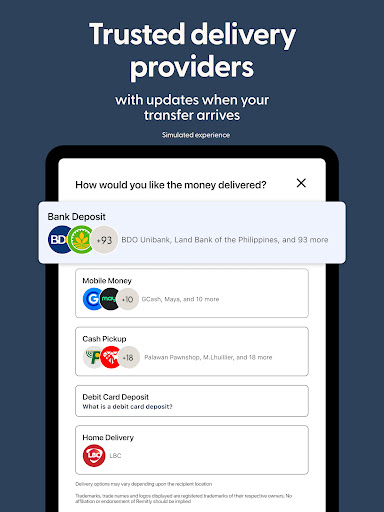

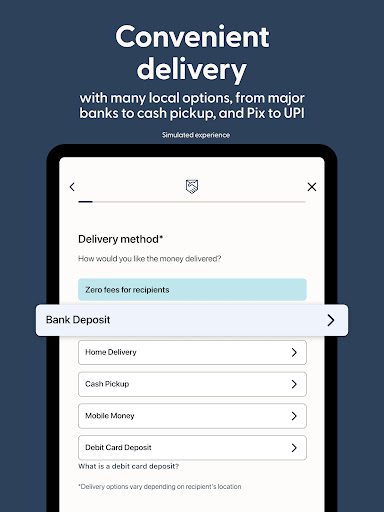

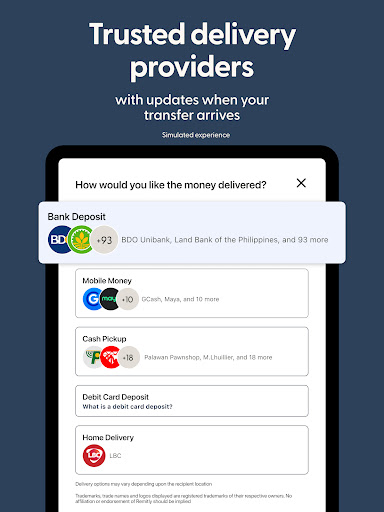

The heartbeat of Remitly lies in its core functions: swift money transfers, competitive exchange rates, and a transparent fee system. Users can choose between different delivery options—such as instant transfers or economical plans—tailoring their experience based on urgency and cost considerations. For example, if someone urgently needs funds for an emergency, the 'Express' service promises to deliver within minutes, utilizing a network of reliable local agents and digital channels. Conversely, the 'Economy' option might take a few days but offers significantly lower fees, making it ideal for planned remittances.

Security is a centerpiece, with advanced encryption, multi-factor authentication, and real-time transaction monitoring providing peace of mind. Compared to traditional banking, Remitly's approach combines efficiency with robust safeguards, ensuring your money and data are well protected throughout the process.

Engaging User Experience: Smooth, Learning Curve-Friendly, and Accessible

From a user experience perspective, Remitly shines in its simplicity and responsiveness. The interface is designed for both tech-savvy users and those less familiar with digital banking. Onboarding is quick, with clear instructions and helpful prompts guiding first-time users. Navigation feels fluid, and actions like selecting a recipient, entering amounts, and choosing delivery options become as intuitive as flipping open a brand-new book—familiar yet engaging.

Compared with similar apps like Wise or MoneyGram, Remitly's focus on clarity and ease of use sets it apart. It minimizes jargon and presents information—such as fees and exchange rates—in a transparent, digestible manner. Additionally, its multi-language support ensures that users worldwide can comfortably operate the app without language barriers, broadening its accessibility significantly.

Unique Selling Points: Security and Transfer Experience

What makes Remitly truly stand out are its dual commitments to security and an exceptional transaction experience. Particularly notable is its focus on account and fund security: it employs multi-layer protection, including device fingerprinting and behavioral analytics, to combat fraud proactively. Funds are held temporarily in secure, insured accounts, and the app adheres to strict compliance standards, giving users confidence that their money is safe.

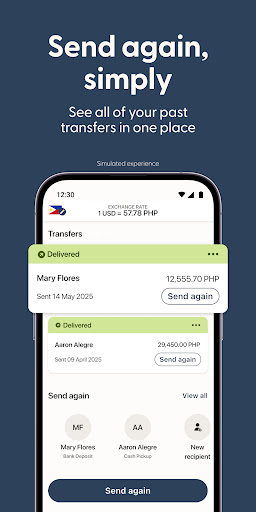

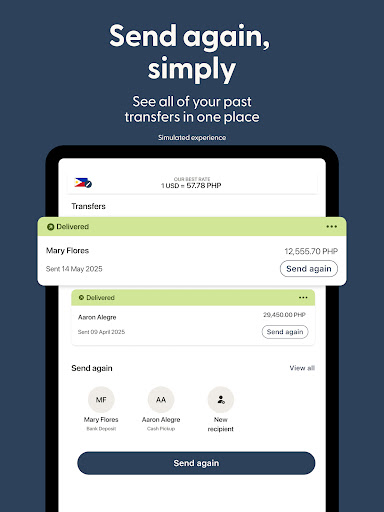

In terms of transaction experience, Remitly's speed and transparency are game changers. Unlike traditional remittance channels that can be opaque and slow, this app offers real-time updates and clear notifications at each step. Its user-centric design ensures that even those sending money for the first time won't feel overwhelmed, transforming a normally stressful process into a straightforward, worry-free activity.

Final Verdict: A Reliable Choice for Global Money Transfers

In sum, Remitly is a thoughtfully crafted app that balances security, usability, and cost-effectiveness. Its key features—particularly its multiple transfer options with varying speeds and transparent fee structures—make it a compelling choice for anyone who needs to send money abroad regularly or occasionally. While it might not replace all traditional banking features, it excels in its core promise: providing a safe, swift, and user-friendly remittance experience.

For those seeking a dependable tool to connect across borders without complications, I'd recommend giving Remitly a try. Its focus on security and dedicated customer support make it suitable for users who value peace of mind and efficiency in their financial transactions.

Pros

User-Friendly Interface

The app features an intuitive design that makes sending money simple for users of all experience levels.

Fast Transfer Speeds

Most transactions are processed quickly, often within minutes, ensuring timely remittances.

Competitive Exchange Rates

Remitly offers favorable rates compared to many competitors, saving users money on conversions.

Multiple Payment Options

Supports various methods like bank transfers, debit/credit cards, and e-wallets for convenience.

Excellent Customer Support

Provides accessible support through chat, email, and phone, helping resolve issues efficiently.

Cons

Limited Availability in Some Countries (impact: medium)

Remitly is not accessible in all regions, which can restrict users in less-supported areas.

Higher Fees for Certain Transfers (impact: medium)

Some transfer options incur higher fees compared to competitors, especially for instant transfers.

App Occasionally Experiences Glitches (impact: low)

Users may face occasional app crashes or slowdowns; restarting the app or updating can often resolve this temporarily.

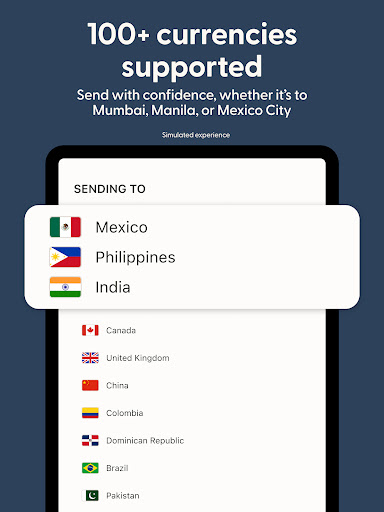

Limited Currency Support (impact: low)

Supports fewer currencies than some other apps, limiting options for certain users.

Verification Process Can Be Lengthy (impact: medium)

KYC procedures might take some time, delaying initial transfers but expected to improve with ongoing updates.

Remitly: Send Money & Transfer

Version 6.60 Updated 2026-02-18