Rain Instant Pay

Rain Instant Pay App Info

-

App Name

Rain Instant Pay

-

Price

Free

-

Developer

Rain Technologies Inc

-

Category

Business -

Updated

2026-02-23

-

Version

2.0.0

Rain Instant Pay: A Swift and Seamless Financial Companion

Rain Instant Pay is a cutting-edge financial app designed to provide immediate access to earned wages, streamlining the way employees manage their cash flow with speed and security. Developed by RainTech Solutions, this app aims to bridge the gap between work and financial flexibility, empowering users to access their earnings instantly rather than waiting for traditional pay periods.

Core Features That Stand Out

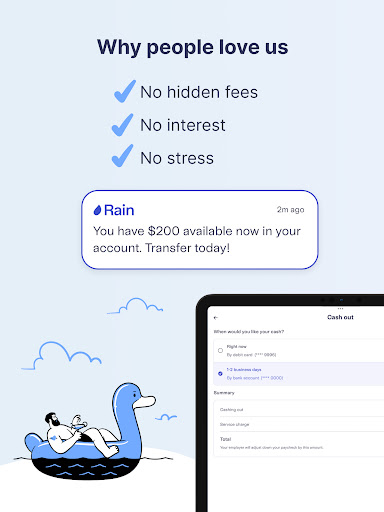

Rain Instant Pay's primary appeal lies in its three innovative features: rapid wage access, secure fund transfers, and integrated expense management. These functionalities work harmoniously to offer a comprehensive financial tool that fits into the busy routines of modern workers. The app's focus on speed and security makes it a go-to for those seeking financial agility with minimal fuss.

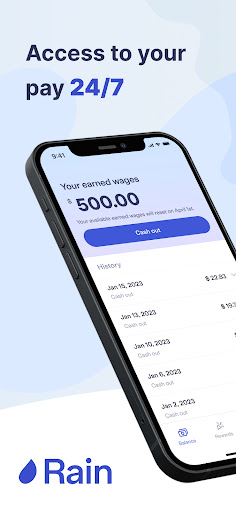

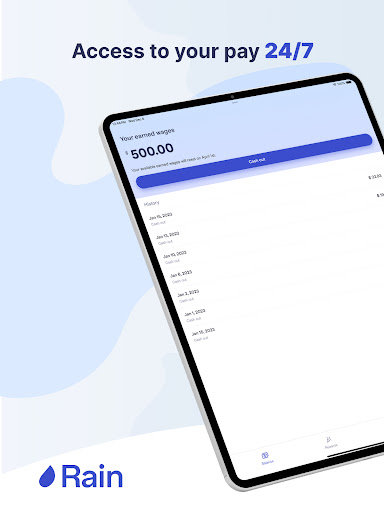

Lightning-Fast Wage Access

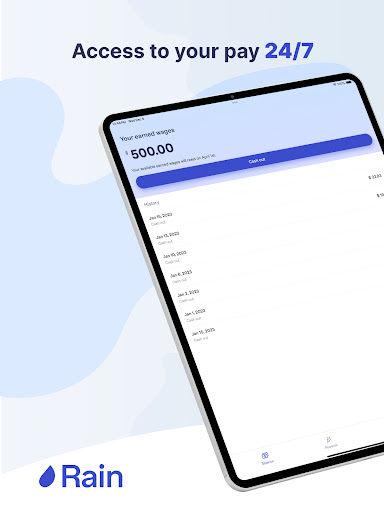

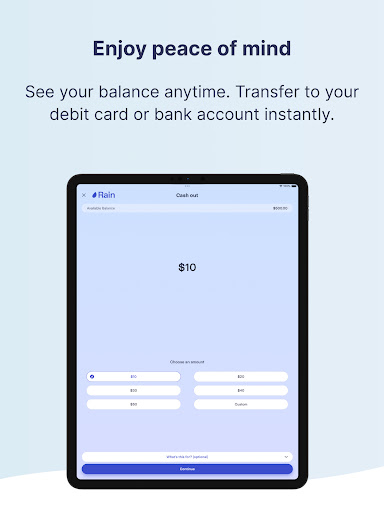

The essence of Rain Instant Pay is its ability to let users access a portion of their earned wages instantly, anytime they need. Unlike conventional salary cycles that can feel like waiting for a bus, this feature acts like a quick tap on a tap, delivering funds directly into the user's bank account within minutes. Whether it's for an unexpected bill or a last-minute splurge, this instant accessibility offers peace of mind and financial comfort. The app's seamless integration with payroll systems ensures that users can keep track of their earnings in real-time, removing the anxiety associated with limited pay periods.

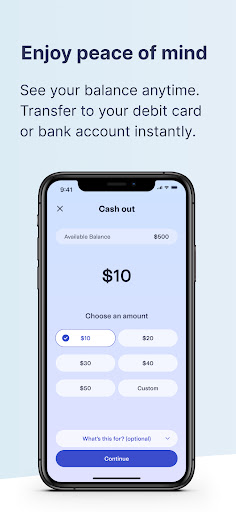

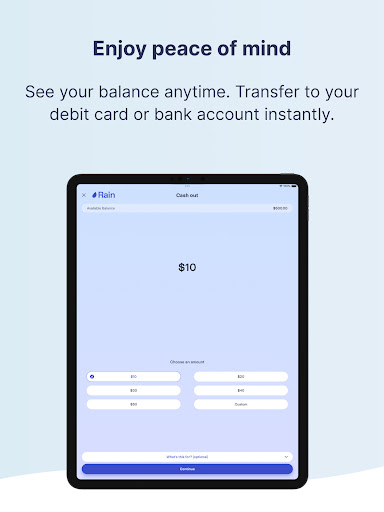

Secure and Trustworthy Transfers

Security is paramount when dealing with personal finances, and Rain Instant Pay delivers with robust encryption protocols and compliance standards. Transferring funds through the app feels like passing a message through a secure courier—swift but guarded. The intuitive transfer process is user-friendly; just a few taps and the money is on its way, no complicated steps or confusing verification processes. This reliability boosts user confidence, making it easy to recommend for everyday financial management.

Smart Expense and Budget Management

Beyond instant wage access, Rain Instant Pay offers integrated tools for expense tracking and budget planning. Think of it as having a financial advisor at your fingertips—a dashboard that visualizes your spending habits, upcoming bills, and savings goals. This feature helps users make informed financial decisions, encouraging responsible spending and saving behaviors. It's particularly useful for gig workers, freelancers, or anyone juggling multiple income streams, as it consolidates various financial data in one accessible place.

User Experience and Design: Simple, Fluent, Friendly

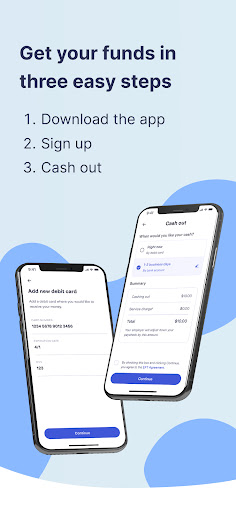

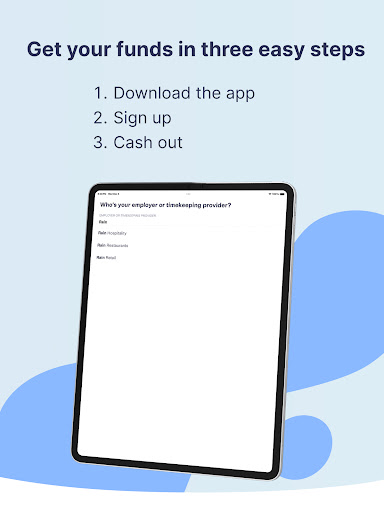

The user interface of Rain Instant Pay is as clean and inviting as a well-organized workspace. Bright, uncluttered screens combined with intuitive icons make navigation feel like a breeze, even for first-time users. The app's flow from sign-up to executing a bank transfer is smooth—callbacks that remind you of your favorite app's familiarity but with a specialized purpose. Loading times are minimal, and the transition animations are gentle, promoting a sense of calm and control. The learning curve is shallow; users can quickly become proficient after a brief exploration, making it accessible to a broad demographic, from tech-savvy millennials to older users seeking simplicity.

Unique Differentiators in a Crowded Market

While many apps might offer portions of what Rain Instant Pay does, what sets it apart is its emphasis on collaborative work features integrated with task management. Unlike traditional payroll apps, Rain creates a community-like environment where employees and employers can communicate regarding wage advances, schedules, or financial tips. Its task management tools also enable users to set financial goals, receive personalized alerts, and coordinate with team members, turning everyday financial activities into part of a broader collaborative effort. This dual focus on individual financial control and team-based coordination makes Rain not just a payment app, but a comprehensive financial partner.

Should You Give It a Try?

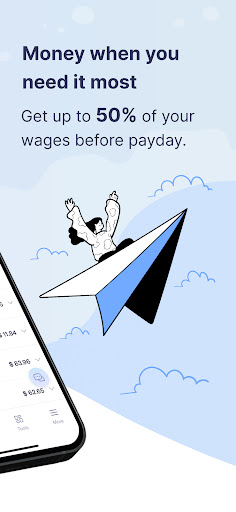

Based on its features, design, and user-centric approach, I'd recommend Rain Instant Pay to anyone who values flexibility and control over their earnings—whether you're a gig worker, part-time employee, or someone managing fluctuating income streams. Its core strength—the instant wage access—is especially relevant in today's fast-paced world where waiting for payday can feel like a lifetime. For those already using traditional payroll apps, Rain provides meaningful enhancements through its collaborative and task management integrations.

While it may not replace your primary banking app, it's a powerful supplement that offers peace of mind during financial emergencies or everyday expenses. As with any financial tool, it's vital to stay attentive to security updates and keep an eye on transfer limits. Overall, Rain Instant Pay earns a solid recommendation for its innovative approach to making wages more accessible and manageable in today's dynamic work environment.

Pros

Instant access to earned wages

Users can quickly withdraw their earnings anytime, improving cash flow flexibility.

No additional fees for basic transactions

The app offers free instant payouts, saving users money compared to traditional methods.

User-friendly interface

The app features an intuitive design, making it easy for users to navigate and manage their funds.

Secure transaction process

Rain Instant Pay employs encryption and security measures to protect user data and transactions.

Integration with multiple employers

Supports a wide range of partner employers, expanding its usability across industries.

Cons

Limited availability of instant payouts for some users (impact: medium)

Certain accounts or regions may have restrictions, requiring users to wait for regular pay cycles.

Potential withdrawal fees after free limits (impact: low)

Beyond a certain number of free transactions, users may incur small fees, which can add up.

Reliance on internet connectivity (impact: high)

As an app-based service, poor internet access can hinder transactions or app functionality.

Limited financial planning tools (impact: low)

Currently, the app focuses on payouts and lacks features like budgeting or savings advice.

Pending updates for enhanced security features (impact: low)

The developers plan to roll out additional security measures soon, which may temporarily affect usability.

Rain Instant Pay

Version 2.0.0 Updated 2026-02-23