PREMIER Credit Card

PREMIER Credit Card App Info

-

App Name

PREMIER Credit Card

-

Price

Free

-

Developer

PREMIER Bankcard

-

Category

Finance -

Updated

2026-01-19

-

Version

3.19.2

Introducing PREMIER Credit Card App: Your Digital Wallet with Confidence

Premier Credit Card's mobile application is designed to streamline your financial life with a focus on security, simplicity, and insightful management. It aims to serve modern users who seek not just a payment tool, but a comprehensive digital financial companion.

Developed by a Dedicated Fintech Team: Innovators Behind the Interface

The app is developed by Premier Tech Solutions, a well-regarded team specializing in financial technology and secure mobile banking solutions. Their expertise translates into a polished user experience and robust security measures, reflecting their commitment to safe and efficient digital finance management.

Key Features Making the Difference

- Enhanced Security Protocols: Advanced encryption and real-time fraud alerts ensure your financial data stays protected.

- Intelligent Spending Analysis: The app intelligently categorizes transactions, providing visual insights into your spending habits.

- Seamless Card Management: Enable instant lock/unlock, report lost cards, and customize notifications with one tap.

- Reward & Cashback Tracking: Easily view and redeem rewards points, maximizing your benefits effortlessly.

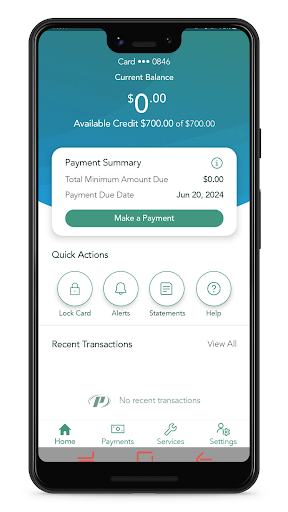

A Fresh and User-Friendly Experience: Navigating the PREMIER App

Imagine stepping into a neatly arranged financial dashboard designed with the clarity of a well-organized workspace. The PREMIER Credit Card app exudes a modern yet approachable aesthetic, making financial management less of a chore and more of an engaging activity. The interface strikes a fine balance—clean icons, intuitive navigation, and customizable views—ensuring users feel comfortable whether they're checking balances or reviewing detailed statements.

Core Functionality 1: Secure and Efficient Transaction Management

The heart of any credit card app is transaction handling, and PREMIER shines here. The app offers real-time updates on your spending, categorized seamlessly into dining, shopping, travel, and more. The security measures are particularly noteworthy; beyond standard encryption, it employs innovative fingerprint and facial recognition, making unauthorized access nearly impossible. Locking or unlocking your card instantly is as simple as a tap—think of it as flipping a switch to secure your finances when in doubt. The smoothness of these operations is commendable, with transitions that are quick and fluid, giving you instant control without lag or confusion.

Core Functionality 2: Deep Dive into Spending Insights

Beyond just tracking expenses, PREMIER provides visually appealing charts and trend analyses that make understanding your financial patterns almost fun—it's like having a financial coach in your pocket. The app learns your habits over time, offering personalized suggestions to optimize spending and savings. For example, if you tend to overspend on dining weekends, the app gently prompts you with insights that help you stay on track. Its learning curve is gentle; even novice users find navigating these insights straightforward thanks to guided tutorials and a logical layout.

Core Functionality 3: Reward Optimization & Customer Support

Another standout feature is rewards management. Not everyone keeps track of points or cashback deals, but PREMIER consolidates all your benefits into one accessible hub. Redeeming rewards is as easy as clicking a button, and the app even suggests ways to maximize rewards based on your spending profile—think of it as a friendly advisor rather than a distant portal. Coupled with a responsive customer support chat feature, users find assistance remains just a tap away, fostering trust and reliability.

Comparative Edge: What Sets PREMIER Apart?

While many financial apps offer basic transaction and security features, PREMIER distinguishes itself through its layered security approach and intelligent transaction insights. Its real-time fraud alerts and immediate card control provide peace of mind, especially for those cautious about cyber threats—this is akin to having a vigilant security guard watching over your finances. Additionally, the app's advanced analytics not only inform but empower users to adjust their financial behaviors effectively, making it more than just a transactional tool but a personal finance companion. This blend of security and insightful management gives PREMIER a notable edge over many competitors.

Final Thoughts: Is PREMIER Credit Card App Worth a Try?

For users seeking a trustworthy, easy-to-navigate, and security-focused credit card app, PREMIER offers compelling reasons to consider. Its standout features—particularly the robust security measures and intelligent spending analysis—make it suitable for both casual users looking for convenience and more active users wanting deeper financial insights. I recommend giving it a try if you value confidence in your financial tools and desire a seamless, informative experience. As a friend navigating the digital finance world, I can confidently say that PREMIER positions itself as a reliable, insightful partner in your financial journey.

Pros

User-friendly interface

The app provides an intuitive layout that makes managing credit card features simple for users.

Real-time transaction tracking

Allows users to monitor transactions instantly, improving financial awareness and security.

Built-in fraud alerts

Offers immediate notifications for suspicious activities, enhancing account safety.

Easy credit management tools

Features like balance checks and payment scheduling streamline credit utilization.

Comprehensive rewards dashboard

Showcases points and cashback details clearly, motivating responsible usage.

Cons

Limited customization options (impact: Low)

Users cannot personalize notifications or dashboard elements extensively; official updates may introduce more options soon.

Occasional app crashes on outdated devices (impact: Medium)

Performance issues can occur on older smartphones; reinstalling the app or updating the OS can help temporarily.

Delayed customer support response (impact: Medium)

Response times via chat or email might be slow during peak hours; using the FAQ section can offer quick help.

Limited international features (impact: Low)

Some functions like currency conversion are not fully supported; future updates may expand these features.

Minor bugs in transaction history display (impact: Low)

Occasionally transaction details might not load immediately; clearing cache or reopening the app usually resolves it.

PREMIER Credit Card

Version 3.19.2 Updated 2026-01-19