Possible: Fast Cash & Credit

Possible: Fast Cash & Credit App Info

-

App Name

Possible: Fast Cash & Credit

-

Price

Free

-

Developer

Possible Finance - A Public Benefit Corporation

-

Category

Finance -

Updated

2026-01-23

-

Version

2.4.0

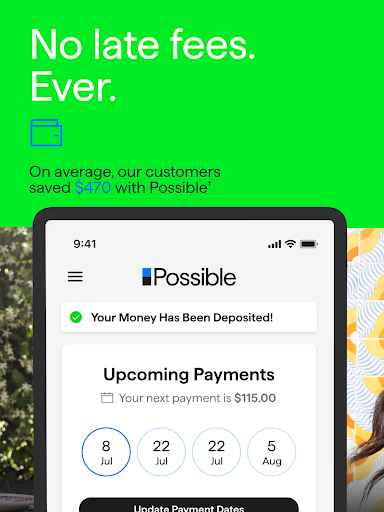

Introducing Possible: Fast Cash & Credit — Your Quick Gateway to Financial Flexibility

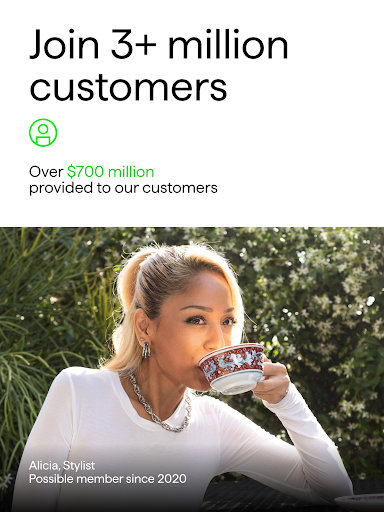

Possible: Fast Cash & Credit is an innovative financial app designed to provide users with rapid access to credit and cash flow management, making short-term financial needs more manageable and straightforward.

Who's Behind This? A Glimpse at the Developers

Developed by a tech-savvy team dedicated to changing the landscape of personal finance, Possible is the product of a well-regarded financial technology company committed to user-centric, secure, and efficient digital financial solutions. The team emphasizes transparency, security, and seamless user experiences, aiming to bridge the gap between traditional banking and modern mobile financial needs.

Core Features That Make It Stand Out

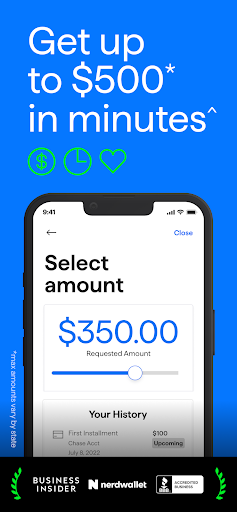

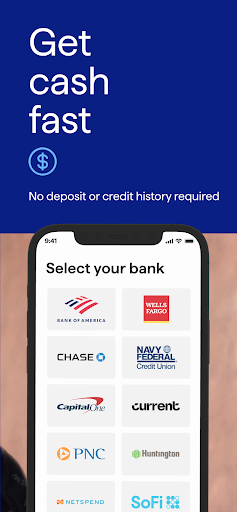

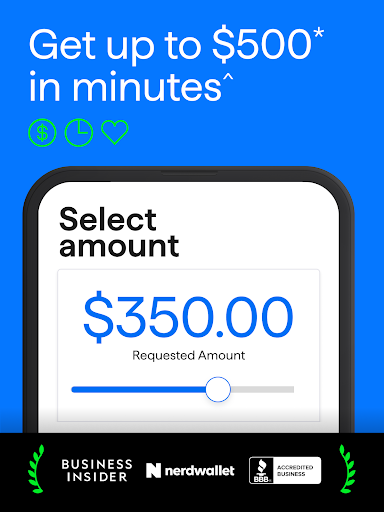

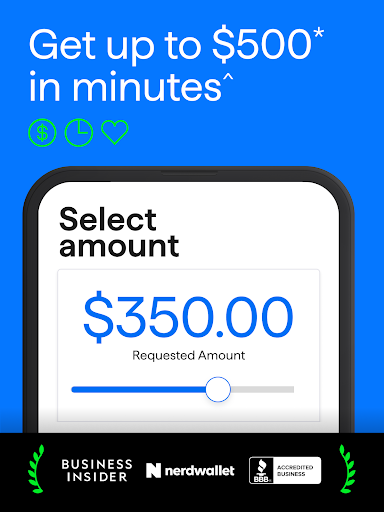

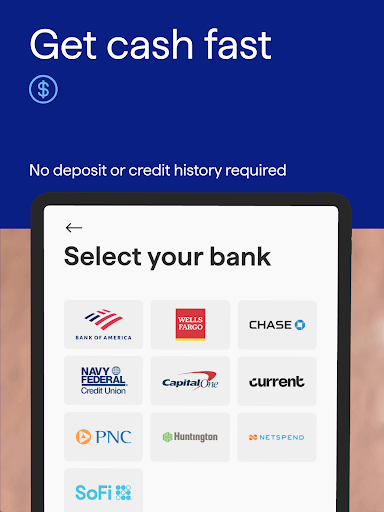

- Instant Cash Advance: Obtain short-term loans within minutes, ideal for urgent expenses without lengthy approval processes.

- Credit Building Tools: Supports users in establishing or improving their credit scores through responsible borrowing and repayment tracking.

- Secure Transaction Environment: Employs cutting-edge security measures to protect user data and financial transactions, ensuring peace of mind.

- Personalized Financial Insights: Provides tailored recommendations based on user spending patterns, aiding smarter financial decisions.

Charting a New Course in Mobile Finance: An In-Depth Review

Stepping into the world of Possible feels like entering a well-organized financial cockpit, where every feature is intuitively designed to keep you in control. Its sleek interface offers vibrant colors and straightforward navigation — it's like talking to a knowledgeable friend rather than wrestling with a confusing maze. Let's dive into the core aspects that make this app worth your attention.

Streamlined Cash Access and Loan Management

The crown jewel of Possible lies in its ability to deliver instant cash advances. Imagine encountering an unexpected car repair or medical bill — instead of waiting days for bank approvals or jumping through hoops, Possible empowers you to secure funds swiftly, often within 5-10 minutes. The loan application process within the app is straightforward: minimal documentation, real-time eligibility checks, and quick approval. This feature is particularly beneficial for gig workers, students, or anyone facing sudden financial strains.

Compared to traditional financial apps, Possible's emphasis on speed and simplicity distinguishes it. Its smart algorithms assess your financial behavior in real-time, making approval both faster and more personalized, reducing the hassle often associated with micro-lending.

Empowering Credit Building with Responsibility

One of the more innovative aspects of Possible is its focus on helping users establish and improve credit scores. Unlike many apps that simply provide loans, it offers tools and insights on responsible borrowing. Users can view their credit impact in real-time, set repayment reminders, and access tips on maintaining healthy credit habits. This educational component turns financial responsibility into an engaging journey rather than a boring chore.

This feature sets Possible apart from many competitors by blending practical utility with educational content, making it suitable for young adults just starting to navigate credit or those rebuilding after financial setbacks.

User Experience and Security — A Friendship Built on Trust

The app boasts a clean, friendly interface—think of it as a well-lit pathway where every step feels natural. Operations are smooth, with quick-loading pages and intuitive menus, making the learning curve gentle for first-time users. Navigation feels more like a conversation than a technological maze, which is vital for users unfamiliar with financial apps.

Security is a top priority. Possible employs advanced encryption, biometric authentication, and real-time fraud monitoring, ensuring that your data and transactions are protected. Unlike some apps that gamble with security, Possible emphasizes transparency and safety, reassuring users that their money and personal information are in safe hands.

Unique Strengths and Final Verdict

The app's most distinctive feature is its focus on speed paired with security—delivering cash swiftly without compromising safety. Its real-time credit insights and educational tools foster responsible financial habits, making it more than just a quick-credit app—it's a comprehensive financial buddy.

Compared to other finance apps, Possible stands out by combining rapid lending capabilities with responsible credit management and an emphasis on user security. Whether you're in a pinch or looking to build credit, this app offers a reliable, user-friendly solution.

Overall, I would recommend Possible: Fast Cash & Credit to individuals who value quick access to funds, trustworthiness, and a friendly user experience. It works best for those with occasional urgent needs or new credit builders seeking a safe, supportive platform. However, users should always ensure they understand the repayment terms to avoid unnecessary debt.

In conclusion, if you're seeking an app that combines speed, security, and practical credit tools into a seamless experience, Possible might just become your new financial best friend—ready to support you whenever immediate cash is needed, with a smile and a professional touch.

Pros

Fast approval process

The app provides quick approval decisions, often within minutes, enabling fast access to cash.

User-friendly interface

The app has a simple and intuitive design, making it easy for new users to navigate.

Wide accessibility

Available across multiple devices and platforms, increasing user reach.

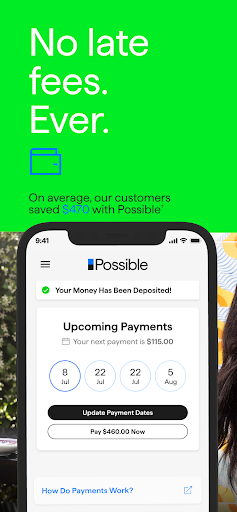

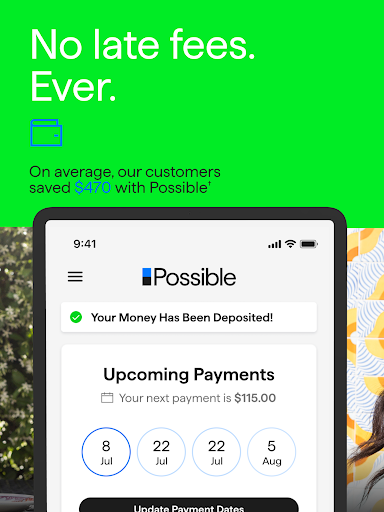

Clear fee structure

Transparent about fees and repayment terms, reducing hidden costs.

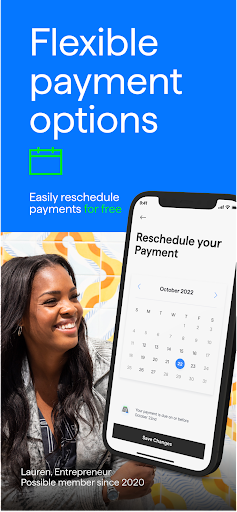

Flexible repayment options

Offers various repayment plans to suit different financial situations.

Cons

Limited loan amounts (impact: Low)

The maximum borrowing limit is relatively low, which may not meet larger financial needs.

High interest rates (impact: Medium)

Interest rates can be significantly higher compared to traditional lenders, increasing overall repayment.

Lack of offline support (impact: Medium)

Customer support is primarily online, which may delay assistance during urgent issues. Users can try reaching support via app chat or email for faster responses.

Security concerns (impact: High)

Some users might worry about data privacy; the app is expected to enhance encryption methods in future updates.

Limited repayment flexibility for some users (impact: Low)

Repayment options might not cater to all financial situations; future updates may include more tailored plans.

Possible: Fast Cash & Credit

Version 2.4.0 Updated 2026-01-23