PayPal Business

PayPal Business App Info

-

App Name

PayPal Business

-

Price

Free

-

Developer

PayPal Mobile

-

Category

Business -

Updated

2025-04-24

-

Version

2025.04.24

PayPal Business: Simplifying Your Commercial Transactions with Smart Tools

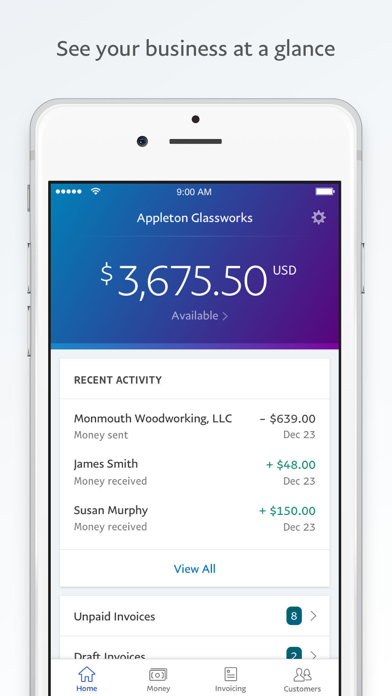

PayPal Business is a versatile platform designed to streamline payment processing, invoicing, and financial management for small to medium-sized enterprises. Developed by PayPal, a leader in digital financial services, this app aims to empower business owners with intuitive features that save time and reduce hassle. Its key strengths include seamless payment integrations, robust invoicing capabilities, and collaborative tools that facilitate teamwork—making it a comprehensive financial toolbox for modern entrepreneurs.

A Dynamic Cashier and Collaborator in One Package

Imagine managing your business finances feels like orchestrating a well-conducted symphony—smooth, synchronized, and hassle-free. That's the experience PayPal Business strives to deliver. Whether you're accepting online payments, sending professional invoices, or coordinating with your team, this app acts as a trusty assistant that keeps your financial operations humming along effortlessly. Its design combines professional look with approachable usability, making it accessible for users of varying tech backgrounds.

Streamlined Payment Processing and Checkout Management

One of PayPal Business's standout features is its seamless payment acceptance system. As a business owner, you no longer need to juggle multiple payment platforms or worry about complicated checkout workflows. Just integrate PayPal into your online store or send a personalized checkout link—in seconds, customers can make secure payments, whether via credit cards or PayPal accounts. This feature ensures quick turnover of sales and reduces cart abandonment, providing a frictionless buying experience that feels almost like magic for both seller and buyer. The app supports multiple currencies and regional payment options, making it ideal for international ventures too.

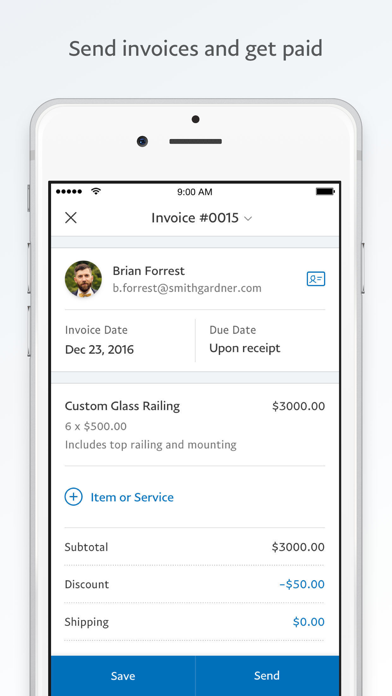

Advanced invoicing and financial tracking

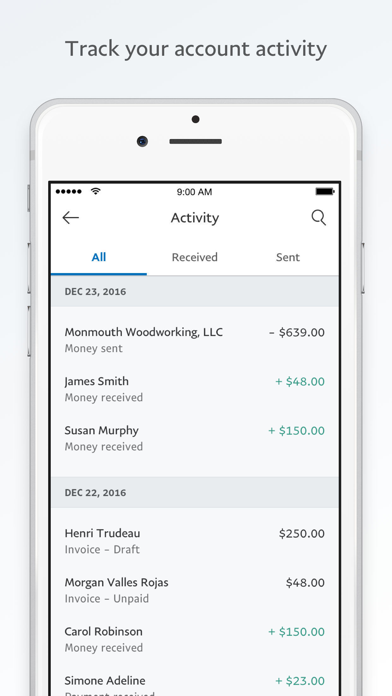

Think of invoicing as sending out your business's formal ‘bill of gratitude'—professional, clear, and easy to manage. PayPal Business offers customizable invoice templates, automated payment reminders, and detailed tracking dashboards that make managing receivables straightforward. You can effortlessly view outstanding payments, send follow-up notices, and even offer discounts or special deals directly through the platform. The real charm lies in its integration with your transaction history—giving you a complete picture of your income flow in real-time. It's like having a financial GPS guiding your business journey with precision and clarity.

Team Collaboration and Task Management

What sets PayPal Business apart from many other financial apps is its focus on collaborative features. Besides processing payments, it allows team members to share access, assign roles, and coordinate tasks within the app. Imagine working on a group project where everyone can see progress, approve expenses, or prepare invoices—without the chaos of scattered emails or multiple logins. The app's collaboration tools empower small teams to operate more like a well-oiled machine, fostering transparency and efficiency. This clear advantage makes PayPal Business not just a payment tool but a true partner in managing your entire business workflow.

Evaluating User Experience: Gentle Elegance in Design and Operation

From the moment you open PayPal Business, the interface greets you with a clean, logical layout—think of it like stepping into an organized office where everything is within arm's reach. Navigation is intuitive, with clearly labeled sections for payments, invoicing, reports, and team management. The app performs smoothly, with quick load times and responsive interactions, ensuring that managing your business feels less like a chore and more like a breeze. For newcomers, the learning curve is gentle—step-by-step guides and helpful tooltips ease the onboarding process. Seasoned users will appreciate how swiftly they can perform complex tasks without getting bogged down in complexity.

How It Stands Out in the Crowd

Compared to other business finance apps, PayPal Business shines particularly with its integrated collaborative work features. While many platforms focus solely on payments or invoicing, PayPal Business creates a multi-faceted environment that aligns with modern team workflows—think of it as a hybrid between a financial tool and an online team hub. Its ability to handle multiple aspects of business management within a unified platform reduces the need for juggling multiple apps, thus enhancing efficiency. Additionally, its trusted reputation in online payments adds a layer of confidence and security that's hard to match.

Final Verdict and Recommendations

Overall, I recommend PayPal Business for small to medium enterprises seeking a reliable, easy-to-use platform that combines essential financial operations with team collaboration. It's particularly well-suited for businesses with international customers, thanks to its multi-currency support and broad payment options. However, users looking for highly advanced analytics or deep accounting features might find it somewhat limited—those may require supplementary tools. For most entrepreneurs striving to keep their financial processes simple yet professional, PayPal Business offers a solid, user-friendly solution that feels like having a trusty financial partner by your side. Start with it if you're aiming for seamless payments, smart invoicing, and collaborative efficiency—your business's new best friend.

Pros

Easy Payment Processing

Seamlessly send and receive money globally with user-friendly interfaces.

Strong Security Measures

Advanced encryption and fraud detection protect user accounts effectively.

Integration with Multiple Platforms

Compatible with various e-commerce sites and accounting tools for smooth business operations.

Real-Time Transaction Alerts

Instant notifications help keep track of all payment activities, reducing errors.

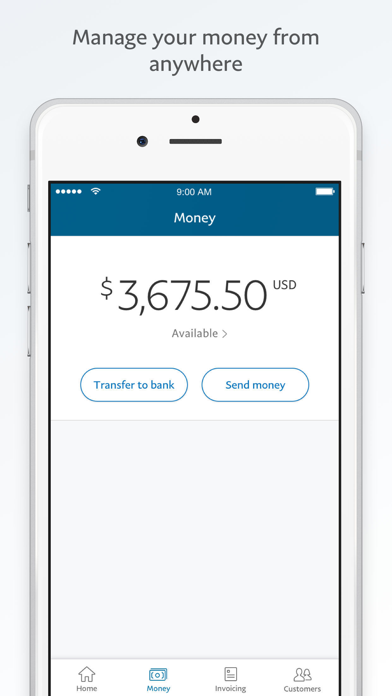

Mobile App Convenience

Manage payments and view transactions easily on smartphones anytime, anywhere.

Cons

High Transaction Fees for Certain Transfers (impact: medium)

Fees can be significant for international transactions and currency conversions, often up to 3% of the amount.

Limited Personal Account Features (impact: low)

Some features are restricted to business accounts, which might limit casual users' flexibility.

Customer Support Response Time (impact: medium)

Support may sometimes be slow to respond during peak hours, but official improvements are underway.

Currency Conversion Limitations (impact: low)

Automatic conversions might not always offer the best rates; users can manually convert funds for better rates.

Account Hold Risks (impact: high)

Unusual activity may lead to temporary holds; adhering to policies and verifying identities can minimize this.

PayPal Business

Version 2025.04.24 Updated 2025-04-24