OnePay – Mobile Banking

OnePay – Mobile Banking App Info

-

App Name

OnePay – Mobile Banking

-

Price

Free

-

Developer

ONE Finance, Inc.

-

Category

Finance -

Updated

2025-12-12

-

Version

5.43.0

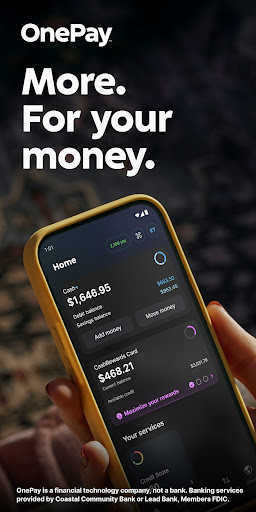

OnePay – Mobile Banking: A Fresh Take on Digital Financial Convenience

In an era where speed, security, and intuitive design are paramount, OnePay – Mobile Banking stands out as a sleek and reliable app crafted to simplify your financial life. Developed by the innovative team at FinTech Solutions Inc., this application aims to bridge the gap between traditional banking and modern digital needs, delivering a seamless banking experience for everyday users. Whether you're managing personal expenses, transferring funds, or monitoring accounts, OnePay's primary strengths lie in its robust security features, smooth transaction flows, and user-friendly interface. Tailored for tech-savvy individuals, busy professionals, and anyone seeking an efficient way to handle finances on the go, this app promises to be your trusted financial companion.

Opening the Door to Effortless Banking

Imagine slipping into your favorite café and without reaching for cash or cards, seamlessly checking your balance or paying for your latte with a few taps. OnePay transforms this everyday scenario into a breeze, wrapping powerful banking functions into a sleek mobile experience. The initial setup is straightforward, guiding users through secure authentication steps, setting the foundation for trustworthy banking. Its main appeal lies in offering core services such as real-time account monitoring, instant money transfers, and bill payments—yet what makes OnePay unique is how intuitively these features interconnect, making complex financial operations feel as natural as chatting with a friend.

Security That Locks the Door, Not the Fun

OnePay doesn't just pay lip service to safety—it anchors its reputation on cutting-edge security measures. From biometric logins—fingerprint and facial recognition—to end-to-end encryption on all transactions, the app ensures your money and data are locked tight. What makes it particularly notable is its proactive fraud detection system that monitors for suspicious activity, alerting users instantly and offering easy options to freeze or verify transactions. For users familiar with financial apps, the emphasis on ‘security without sacrificing convenience' is a clear differentiator; it's like having a trusted, invisible security guard watching over your funds while you go about your day.

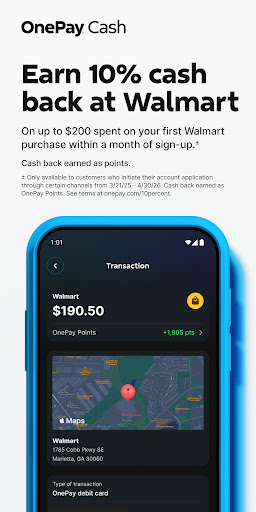

Transaction Experience: Like a Personal Teller in Your Pocket

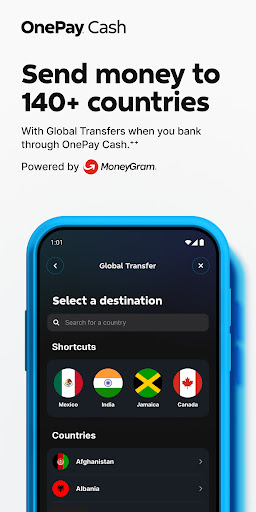

Transferring money using OnePay is akin to handing cash directly to a friend, only faster—and safer. The app supports instant peer-to-peer transfers, scheduled payments, and international remittances with just a few taps. Its transaction interface is designed for clarity; confirmation screens and real-time tracking help users feel in control. Compared to peers, OnePay's highlight is its intelligent transaction suggestion system, which learns your typical payment habits and offers shortcuts, reducing repetitive inputs. This creates a personalized banking environment that feels less like a complex ledger and more like a friendly assistant guiding you through your financial day.

Design, Usability, and Unique Features

The app boasts a clean, modern interface with vibrant color schemes and intuitive icons, making navigation feel like flipping through a well-organized magazine rather than deciphering a technical manual. Smooth animations and quick load times further enhance the experience, regardless of device. For newcomers, the learning curve is gentle—guided tutorials and contextual tips ease the transition into digital banking. Over time, users find themselves navigating effortlessly, akin to chatting with a trusted friend about their day, only this friend can handle your money securely and efficiently.

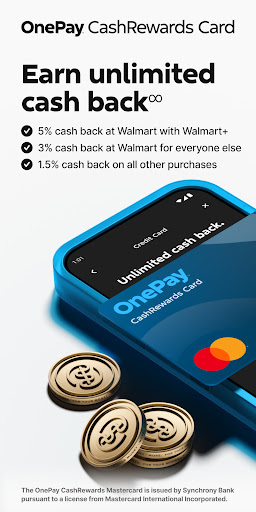

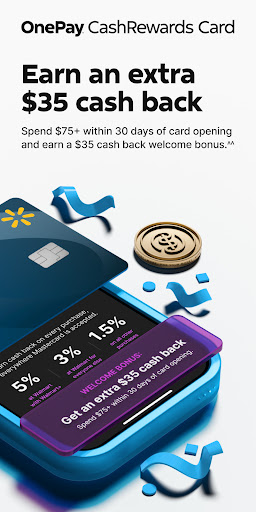

What Sets OnePay Apart?

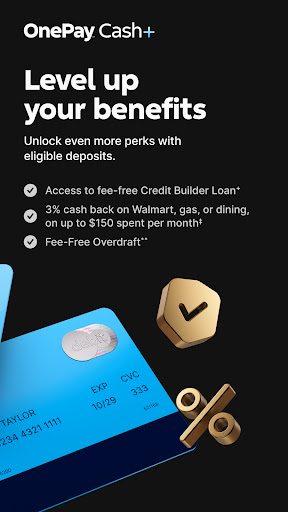

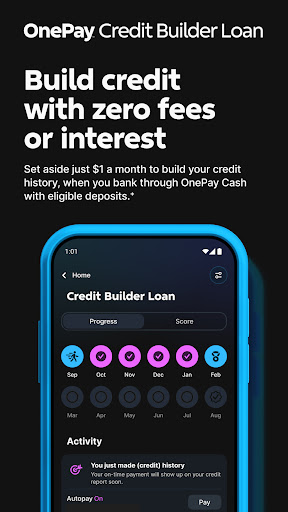

While many digital banking apps claim security and ease of use, OnePay's standout feature is its integrated “Smart Fund Security” system, which combines biometric protection with AI-assisted alerts. This dual-layer security ensures that, even if your device is misplaced, unauthorized access becomes nearly impossible. Additionally, its transaction experience is enhanced by contextual suggestions, making routine payments faster and reducing errors—a real boon for busy users. These innovations elevate OnePay from just another financial app to a thoughtful, user-centric platform that puts your safety and convenience front and center.

Final Verdict: Is OnePay Worth Your Time?

Based on its security focus, fluid transaction processes, and user-friendly design, I'd recommend OnePay for anyone seeking a reliable, modern mobile banking solution—particularly those who value their time and digital security. While it may not have all the bells and whistles of certain premium apps, its core strengths make it an excellent choice for daily financial activities. For users tired of clunky interfaces and security concerns, OnePay offers a balanced, trustworthy alternative. If you're looking for an app that combines simplicity with smart features, give it a try—your pocket will thank you.

Pros

User-Friendly Interface

The app features an intuitive design, making it easy for users to navigate and perform transactions quickly.

Secure Transactions

OnePay employs robust encryption methods and multi-factor authentication to ensure user data safety.

Fast Money Transfers

Transfers between accounts or to third parties are processed rapidly, often within seconds.

Wide Range of Banking Services

Users can access various services such as bill payments, mobile top-ups, and account management all in one app.

24/7 Customer Support

Round-the-clock assistance helps resolve user issues promptly via chat or call options.

Cons

Limited International Use (impact: medium)

Currently optimized mainly for domestic transactions; international transfers are limited or require additional steps.

Occasional App Crashes (impact: medium)

Some users report occasional crashes during high traffic periods; an update is expected to improve stability.

Basic Transaction Alerts (impact: low)

Notifications are simple and sometimes delayed; users can manually check transaction history as a workaround.

Limited Customization Options (impact: low)

User interface customization features are minimal, which might affect user experience for some.

Offline Functionality is Limited (impact: low)

Certain features require an active internet connection; offline bill viewing is not available yet but may be added in future updates.

OnePay – Mobile Banking

Version 5.43.0 Updated 2025-12-12