OneMain Financial

OneMain Financial App Info

-

App Name

OneMain Financial

-

Price

Free

-

Developer

OneMain Financial

-

Category

Finance -

Updated

2026-02-12

-

Version

10.19.3

Introducing OneMain Financial: Your Trusted Partner for Personal Loans and Financial Solutions

OneMain Financial is a comprehensive mobile application designed to streamline personal lending, debt management, and financial planning, making it easier for users to access and manage credit services on the go. Developed by the reputable team at OneMain Financial—a leading provider in consumer finance—the app aims to bring transparency, security, and user-friendly experiences to everyday financial tasks.

Key Highlights of the App

- Seamless Loan Application Process with Instant Pre-approvals

- Secure Account and Fund Management with Advanced Encryption

- Personalized Financial Insights and Repayment Tracking

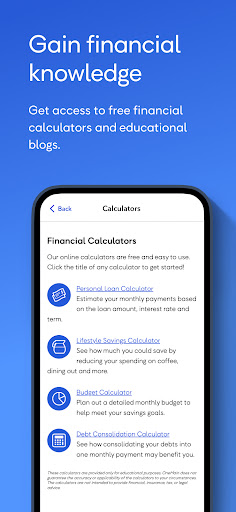

- Dedicated Customer Support and Educational Resources

The target users are individuals seeking flexible personal loan options, those wanting to improve credit, or anyone interested in simple, secure financial tools accessible from their devices.

Vivid Beginnings: A Friendly Guide to Better Money Management

Imagine having a seasoned financial advisor right in your pocket—ready to assist with your borrowing needs while ensuring your information stays locked tight behind a digital vault. That's exactly what OneMain Financial aims to be: your friendly yet professional companion in navigating the sometimes cloudy waters of personal finance. Whether you're consolidating debt, planning a big purchase, or just want control over your financial future, this app has features crafted to turn complex processes into straightforward actions, all wrapped in an intuitive interface.

Streamlining Loan Applications: Fast, Transparent, and Tailored

OneMain Financial stands out with its streamlined loan application feature, a core pillar that makes borrowing less of a chore and more of a confidence-boosting experience. Unlike traditional lenders requiring visit after visit, this app allows users to begin pre-approval in minutes—think of it as a virtual handshake confirming you're in the right neighborhood for borrowing. The app employs intelligent algorithms that analyze user input to provide personalized loan offers, which means you're not bombarded with irrelevant options but instead see what truly fits your needs. This not only accelerates decision-making but also enhances transparency, as clarity about loan terms is provided upfront, reducing the usual "fine print" anxiety.

High Security, Low Worry: Protecting Your Money and Data

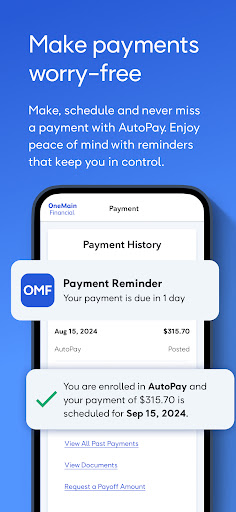

Security is the backbone of any financial app, and OneMain Financial doesn't fall short here. Its advanced encryption protocols act like an impregnable safe, ensuring personal information and fund transfers are shielded from malicious attacks. The app also incorporates multi-factor authentication, fingerprint, and facial recognition options, adding layers of protection that work like a vigilant security guard on duty 24/7. Furthermore, the app's transaction experience is smooth yet meticulous—fund transfers and repayments are executed seamlessly with real-time status updates, giving you peace of mind that your money is in safe hands.

Personalized Insights and Ease of Use: Making Financial Skills Second Nature

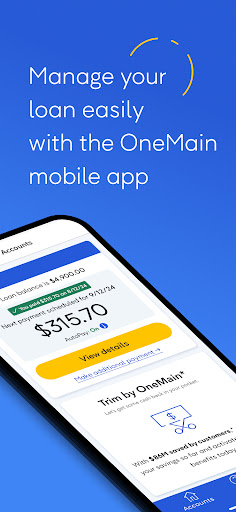

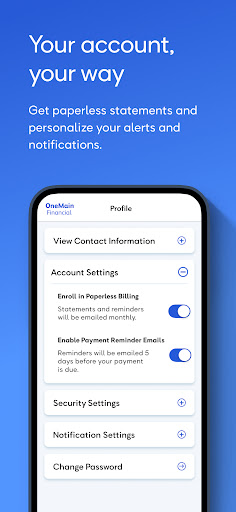

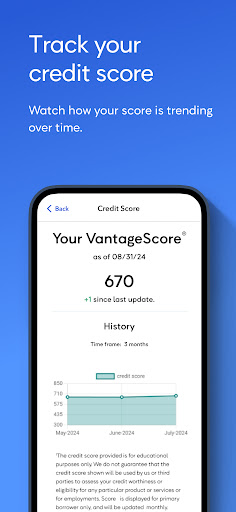

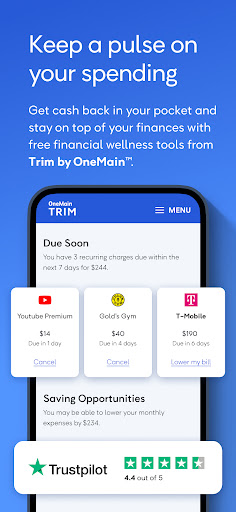

Beyond just facilitating transactions, OneMain Financial offers insightful financial analysis tailored to your profile. Visual dashboards display your repayment progress, upcoming due dates, and suggested strategies for debt reduction—think of it as having a friendly financial coach who encourages good habits. The interface itself is thoughtfully designed: clean, simple, and colorful, akin to a well-organized workspace that invites users to explore without feeling overwhelmed. Navigating between loan details, payments, and customer support is fluid, with intuitive menus and helpful prompts, reducing the typical learning curve. Whether you're tech-savvy or a novice, this app welcomes all users with open, easy-to-understand pathways.

Unique Selling Points: What Sets OneMain Financial Apart

When compared to similar financial apps, OneMain Financial's standout features are its superior account security coupled with a user-centric transaction experience. Its encryption technologies and multifaceted authentication tools make digital borrowing feel almost as secure as face-to-face meetings with a trusted advisor. Meanwhile, the app's personalized dashboards and adaptive loan offers differentiate it from cookie-cutter solutions—transforming financial management from a chore into an engaging, manageable journey.

Should You Try It? Final Recommendations

For those seeking a reliable, secure, and user-friendly platform to manage personal loans and overall financial health, OneMain Financial earns a solid recommendation. Its most compelling features—particularly the secure transaction environment and personalized financial insights—make it an excellent choice for individuals who value both security and tailored guidance. It's especially well-suited for users new to digital lending or those wanting a trustworthy app to guide their financial steps without feeling overwhelmed. However, users should still compare terms carefully, as with any financial product, to ensure it aligns with their specific needs.

Pros

User-friendly interface

The app offers an intuitive design that makes navigation simple for users.

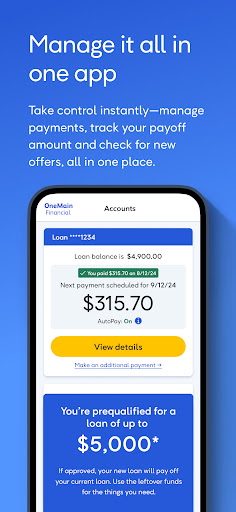

Comprehensive loan management features

Users can easily apply for loans, view balances, and make payments all within the app.

Secure login and data protection

Advanced encryption ensures that user data and financial information are well protected.

Quick approval process

The app facilitates faster loan approval times compared to traditional methods.

Dedicated customer support

In-app support options provide timely assistance for user inquiries.

Cons

Limited borrowing options (impact: low)

Currently, the app only offers specific loan types, which may not suit all users' needs.

Occasional app crashes during peak hours (impact: medium)

Some users experience app crashes, especially during high traffic, but updates are expected to fix these issues.

Slow load times on older devices (impact: low)

Older smartphones may experience lag due to high-resolution graphics, but lower-quality mode could alleviate this.

Restricted features for new users (impact: low)

New accounts have limited access to certain features until verification is complete, which can be inconvenient.

Notification personalization options are limited (impact: low)

Users cannot customize notifications extensively, though future updates may include more options.

OneMain Financial

Version 10.19.3 Updated 2026-02-12