myFICO: FICO Credit Check

myFICO: FICO Credit Check App Info

-

App Name

myFICO: FICO Credit Check

-

Price

Free

-

Developer

FICO

-

Category

Finance -

Updated

2026-02-16

-

Version

4.0.17.1

MyFICO: FICO Credit Check — Your Trusted Financial Snapshot in a Pocket

Imagine having a financial guardian that offers a clear lens into your credit health anytime, anywhere—that's what myFICO delivers. Designed to empower consumers with accurate and comprehensive credit insights, this app acts as your personal credit dashboard, helping you stay on top of your financial standing with ease.

Meet the Minds Behind the App

Developed by FICO, the pioneer behind the FICO score formulas, myFICO is crafted by a team with decades of experience in credit scoring and data analytics. Their goal is simple: provide consumers with reliable access to their credit information, fostering transparency and financial literacy in an increasingly digital world.

Key Features That Make a Difference

- Real-time Credit Score Monitoring: Constantly updated scores from all three major credit bureaus, providing you with an up-to-date picture of your credit health.

- Detailed Credit Reports: In-depth reports that break down factors influencing your scores—identifying debts, payment history, and credit utilization—so you can spot opportunities for improvement.

- Identity Theft Alerts and Security Tools: Proactive alerts notify you of suspicious activities, helping safeguard your financial identity with confidence.

- Personalized Recommendations: Insights tailored to your credit profile, guiding you on steps to boost your scores or handle debts more effectively.

Delving Deeper: Core Functionalities Explored

Unlocking Your Credit Score Universe

This app turns your credit score experience into an engaging journey. Unlike many financial apps that treat credit scores as mere numbers, myFICO presents them as a vital sign—like a fitness tracker for your financial health. The real-time updates mean you're always in the know; it's akin to having a personal financial coach checking your pulse daily. The interface for viewing your FICO scores is straightforward: large, clear numerals complemented by colorful trend indicators that show whether your score is improving or needs attention. This clarity makes it easy for users to understand their current standing without sifting through overwhelming data.

Spotting and Correcting Credit Report Details

The detailed credit report section is the heart of transparency. Here, each factor influencing your score—payment history, credit mix, new credit applications—is illustrated with visual aids and concise explanations. It's as if you're receiving a financial health report from a friendly analyst—instructive yet approachable. Navigating reports is seamless; swipe through sections or jump directly to items needing action. The design emphasizes simplicity, making complex credit terminologies accessible even to newcomers. The ability to dispute inaccuracies within the app streamlines the often cumbersome process, turning it into a manageable task rather than a chore.

Prioritizing Security and User Trust

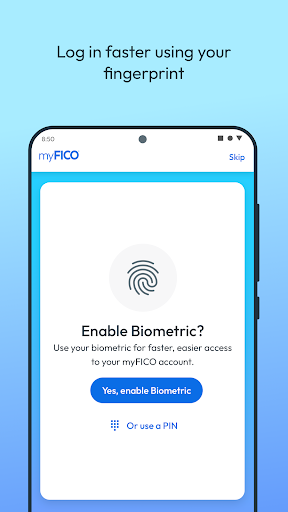

Security isn't just an afterthought here; it's woven into the fabric of the app. Unlike some competitors who merely display scores, myFICO emphasizes your account and fund security with advanced encryption and two-factor authentication. Moreover, the app proactively sends you alerts about unusual activities—think of it as a vigilant financial sentinel—giving peace of mind that your credit information remains protected. This security focus makes it stand out in the crowded market, especially considering the sensitive nature of credit data.

Experience and Differentiation: Why This App Excels

In the landscape of financial management apps, many fall into the trap of generic interfaces or lack of security features. myFICO breaks this mold by centering user experience around clarity and safety. The app excels in its dedicated focus on credit score accuracy—using FICO's own data rather than third-party estimations—and in providing detailed reports that are both comprehensive and digestible. Its transaction experience is streamlined; switching between monitoring, reports, and security features is swift, almost like flipping through pages of a well-organized financial diary. This smoothness ensures users don't feel bogged down by technicalities but are instead guided gently through their credit journey.

Recommendations and Final Thoughts

Given its robust features, trustworthy data, and user-centric design, myFICO stands out as a top-tier choice for anyone serious about understanding and managing their credit. I would recommend it primarily for individuals actively working to improve their credit scores or those concerned about identity security. The app's clear insights and strong security measures make it suitable even for financial novices, turning complex credit concepts into manageable, actionable steps. However, users should be aware that the subscription costs can be higher than free alternatives, so it's best suited for those who want detailed, reliable credit monitoring rather than casual check-ins.

In essence, myFICO isn't just another finance app; it's your personal credit ally—trusted, precise, and designed to keep you securely informed. If you're aiming to demystify your credit profile with confidence, this app deserves a spot on your digital device.

Pros

Comprehensive FICO Score Tracking

Provides detailed insights into your credit score with weekly updates, helping users monitor their credit health effectively.

User-Friendly Interface

The app features an intuitive design that makes navigation and understanding credit data simple for all users.

FICO Score Simulation Tool

Allows users to see potential score changes based on different financial actions, aiding informed decision-making.

Free Credit Monitoring

Offers free access to credit score updates and alerts without requiring a paid subscription.

Identity Theft Protection Alerts

Provides alerts for suspicious account activities, enhancing security awareness.

Cons

Limited Credit Report Details (impact: medium)

The app displays FICO scores but does not provide full credit reports; users needing detailed reports may need separate services.

Premium Features Cost (impact: low)

Certain advanced features or detailed insights require a paid subscription, which might deter some users.

Data Update Frequency (impact: low)

Credit scores are updated weekly, but real-time updates are not available; users seeking instant changes may be disappointed.

Limited Credit Agency Coverage (impact: medium)

Primarily focuses on FICO scores; users looking for VantageScore or other metrics might find the app insufficient.

Customer Support Response Time (impact: low)

Support options are limited, and response times can be slow during peak periods; official improvements are planned.

myFICO: FICO Credit Check

Version 4.0.17.1 Updated 2026-02-16