MyCard - Contactless Payment

MyCard - Contactless Payment App Info

-

App Name

MyCard - Contactless Payment

-

Price

17.99

-

Developer

Road Dogs

-

Category

Finance -

Updated

2024-07-09

-

Version

1.21

Introducing MyCard - Contactless Payment

MyCard is a modern contactless payment application designed to simplify everyday transactions while prioritizing security and user convenience.

Developed by a dedicated fintech team

The app is crafted by a team of experienced developers at InnovativePay, a company specializing in digital payment solutions with a focus on security and ease of use.

Key Features That Stand Out

- Seamless Tap-and-Go Payments: Effortlessly make transactions by simply tapping your device or card at payment terminals.

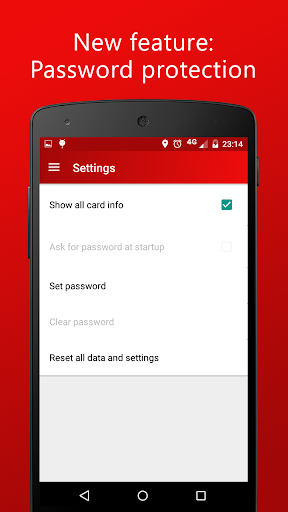

- Robust Security Measures: Multi-layered security including biometric authentication and card tokenization.

- Smart Wallet Management: Organize multiple cards, monitor transactions, and budget within a single app.

- Offline Payment Capability: Enables transactions even without internet connectivity through encrypted local token storage.

A Fun and Functional First Impression

Imagine walking into your favorite café — you reach into your pocket, tap your phone just like flicking a magic wand, and voilà— your bill is paid without fumbling with cash or cards. MyCard brings this kind of effortless interaction to your everyday life, blending technology with simplicity. It's not just about paying; it's about transforming routine payments into a swift, secure, and even enjoyable experience.

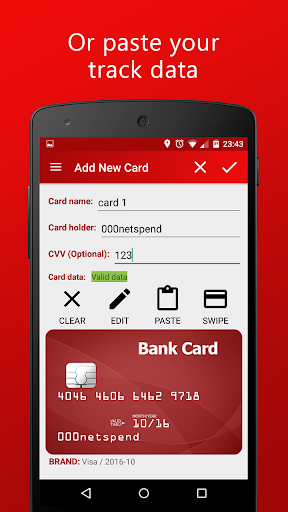

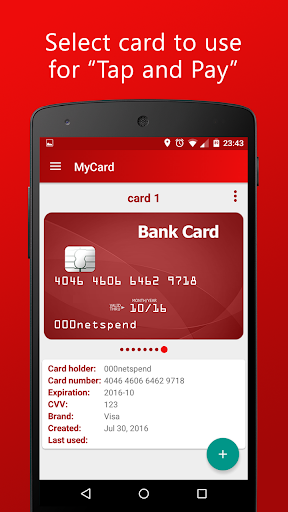

Core Functionality 1: Tap-and-Pay Made Effortless

MyCard's signature feature is its smooth contactless payment technology. The app utilizes NFC (Near-Field Communication) to enable quick transactions, mimicking the ease of contactless credit/debit cards but with added flexibility—your smartphone becomes a universal payment hub. The setup process is wizard-like; pairing your bank cards or adding new ones is straightforward through secure authentication steps. During purchases, the transaction process is lightning-fast, with confirmatory vibrations and visual cues reassuring you of successful payments. The experience resembles a friendly handshake—quick, reliable, and hassle-free.

Core Functionality 2: Unbreakable Security & Privacy

One of MyCard's standout aspects is its security architecture. Unlike some apps that store sensitive data in the cloud, MyCard emphasizes local encryption—your card details are replaced with tokens stored securely on your device. Using biometric verification (fingerprint or facial recognition) before any transaction ensures that only you can authorize payments. Additionally, multi-factor authentication and dynamic transaction encryption add extra layers of safety. This robust security framework offers peace of mind comparable to locking your valuables in a safe—your money is protected against theft, fraud, and unauthorized use.

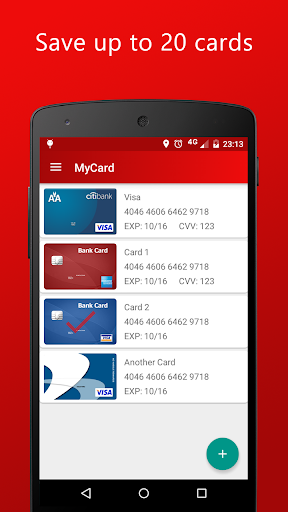

Core Functionality 3: Smart Wallet & Transaction Management

Beyond simple payments, MyCard acts as a personal financial assistant. You can add multiple cards, categorize your expenses, and set budgets—all within an intuitive interface. The app provides detailed transaction histories, helping you track spending habits effortlessly. Notifications about suspicious activities or balance limits keep you informed, fostering a sense of control. Its dashboard highlights your most used cards, recent transactions, and upcoming bills, making money management feel less like a chore and more like chatting with a knowledgeable friend who knows your financial tendencies.

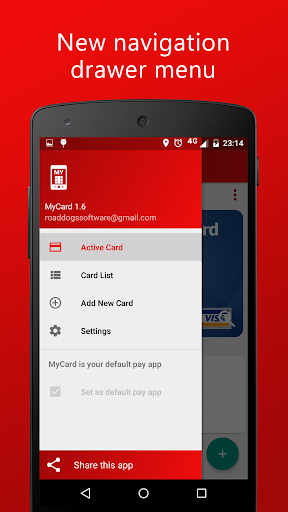

Design, Usability, and User Experience

The interface design of MyCard strikes a pleasing balance between minimalism and functionality. Clear icons, soft color schemes, and intuitive navigation make the app approachable, even for those new to digital wallets. The onboarding process is smooth; it takes only a few minutes to tie in your cards and familiarize yourself with features. Once set up, operations flow seamlessly, with swift responses and logical menu flows. The learning curve is gentle—users gradually discover all features without feeling overwhelmed. The app's responsiveness ensures that even on older devices, the experience remains reliable, akin to chatting with a well-trained assistant who's always on the ball.

Unique Selling Points & Differentiation

Compared to other finance apps, MyCard's standout feature is its offline payment capability combined with its security-centric design. Many apps depend heavily on internet connectivity and store sensitive data in the cloud, which can raise privacy concerns. MyCard's approach—storing tokens locally and encrypting transactions—sets it apart as a safer choice, particularly for users wary of data breaches. Its seamless transaction experience, echoing the familiarity of swiping a card but with modern digital flair, makes it especially appealing. The AI-driven expense categorization further enhances its role as a personal finance companion, making money management less of a headache.

Final Recommendation & Usage Suggestions

If you're looking for a reliable, secure, and user-friendly contactless payment app, MyCard deserves your attention. It's particularly well-suited for busy professionals, tech-savvy individuals, and anyone seeking to minimize physical contact during transactions. For users concerned about security, the app's robust measures make it a smarter choice over simpler mobile wallet options. While it functions seamlessly in most environments, ensuring your device supports NFC and biometric authentication will optimize your experience.

In summary, I'd confidently recommend MyCard for everyday transactions, especially if you value privacy and simplicity. It's like having a secure, smart wallet in your pocket—ready to serve at a moment's notice with an intuitive, friendly interface that transforms routine payments into a smooth, refreshing experience.

Pros

Seamless Contactless Payments

Allows quick and easy transactions with just a tap, reducing checkout time.

Wide Compatibility

Supports multiple devices and major card providers, enhancing usability.

Enhanced Security Features

Utilizes tokenization and encryption to protect user data during transactions.

User-Friendly Interface

Simple navigation and clear instructions make onboarding easy for new users.

Transaction History Tracking

Provides detailed logs for expense management and fraud prevention.

Cons

Limited Offline Functionality (impact: medium)

Currently requires internet connection for certain features, which can be inconvenient in areas with poor reception.

Compatibility Constraints (impact: medium)

May not work seamlessly with older smartphones lacking NFC technology; users should check device specs beforehand.

Dependence on App Updates (impact: low)

Occasional bugs or feature delays may occur until official updates are released; keeping app updated mitigates this.

Limited International Support (impact: low)

Primarily designed for domestic use; international transactions and currency conversions may need additional apps or services.

Battery Consumption (impact: low)

Tapping NFC frequently can drain device battery faster; users should monitor usage during long transactions.

MyCard - Contactless Payment

Version 1.21 Updated 2024-07-09