MoneyLion: Bank & Earn Rewards

MoneyLion: Bank & Earn Rewards App Info

-

App Name

MoneyLion: Bank & Earn Rewards

-

Price

Free

-

Developer

MoneyLion Inc.

-

Category

Finance -

Updated

2026-01-08

-

Version

7.142.0

Unlocking Financial Growth with Simplicity: An In-Depth Look at MoneyLion: Bank & Earn Rewards

In an era where financial management is increasingly about convenience and rewards, MoneyLion stands out as a comprehensive platform that aims to merge banking, investing, and earning opportunities into one seamless experience. With a sleek interface and innovative features, it's tailored for those who want their money to work smarter, not harder.

A Brief Overview: Who's Behind MoneyLion?

Developed by MoneyLion Inc., a well-known fintech company dedicated to democratizing financial wellness, this app embodies their mission to empower users through accessible banking solutions and earning rewards. Founded in 2013, MoneyLion has steadily grown into a holistic financial ecosystem that combines banking, investment management, and rewards programs, all wrapped into a user-friendly app.

Main Features & Highlights include:

- Integrated banking with checking and savings accounts

- Reward-based earning system linked to financial activities

- Personalized financial insights and goal tracking

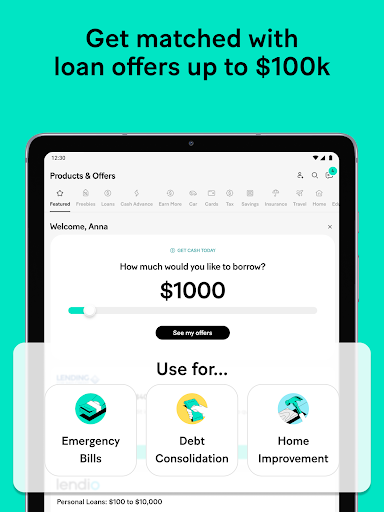

- Access to investment opportunities with minimal barriers

The target audience primarily comprises young professionals, tech-savvy individuals, and anyone seeking a streamlined approach to managing finances and earning rewards without the hassle of multiple separate apps.

Engaging and User-Friendly Interface: Making Money Management Feel Natural

Upon launching the app, you're greeted with a clean, modern interface—think of it as walking into a well-organized, friendly bank branch where everything is exactly where it should be. The bright yet calming color scheme coupled with intuitive icons makes navigation feel almost instinctive. Setting up your account is straightforward, and the dashboard provides a snapshot of your financial health at a glance—like checking the dashboard of a sleek car that tells you everything happening under the hood.

The user experience is smooth, with minimal lag or clutter. Animations are subtle, aiding transitions between features without distraction. The learning curve is gentle; for first-time users, onboarding tips guide you through key functionalities seamlessly, making the journey from novice to proficient user effortless.

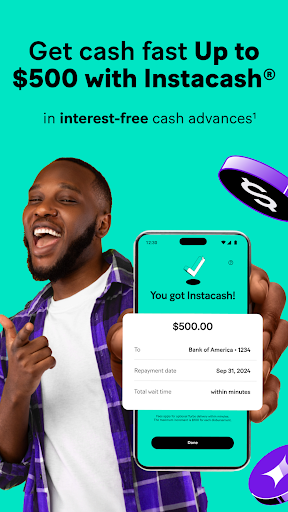

Core Functionality: Banking and Rewards – Your Financial Co-Pilots

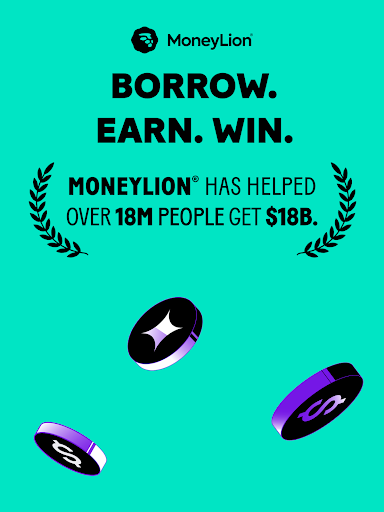

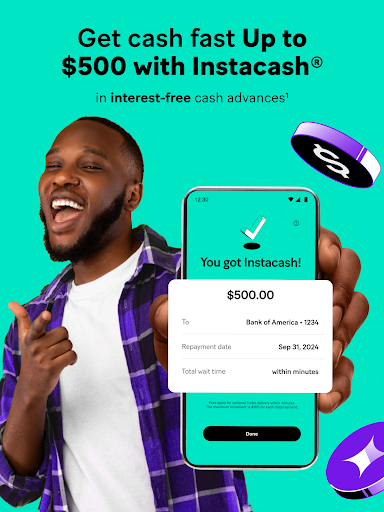

Banking Made Simple: Checking, Saving, and Managing Funds

MoneyLion's banking features are akin to having a bank branch in your pocket. It offers checking accounts with no monthly fees, competitive interest rates on savings, and a straightforward process for deposits and withdrawals. The app's security measures, including multi-factor authentication and end-to-end encryption, ensure your money and data are guarded as tightly as a treasure chest. The transaction experience is fluid—fund transfers happen swiftly, with instant notifications keeping you updated. This setup makes managing your cash feel less like a chore and more like checking off tasks on a well-organized to-do list.

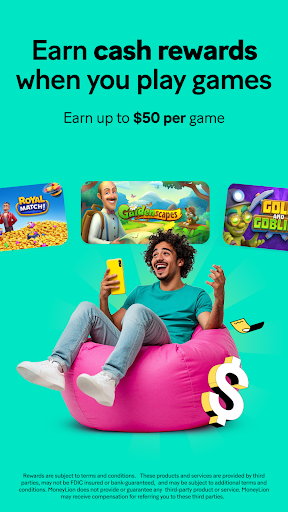

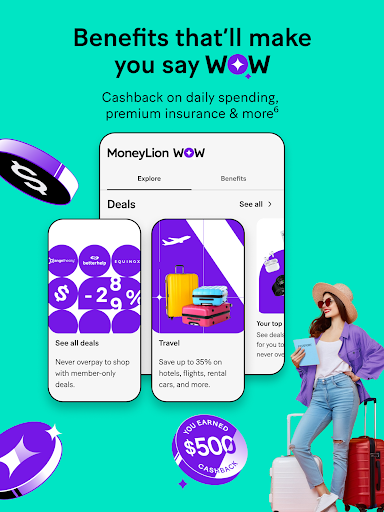

Earn Rewards Through Engaging Activities

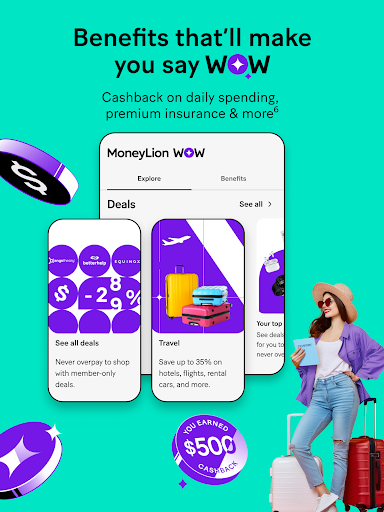

The standout feature of MoneyLion is its rewards system that incentivizes users to stay active with their finances. Whether it's paying bills, saving money, or even increasing your credit score, the app rewards these behaviors through cash-back offers, bonus points, or lower interest rates. Think of it as turning your financial habits into a game—motivation that feels both natural and rewarding. This gamification, unique among many finance apps, helps cultivate healthy financial behaviors effortlessly, fostering a sense of accomplishment and ongoing engagement.

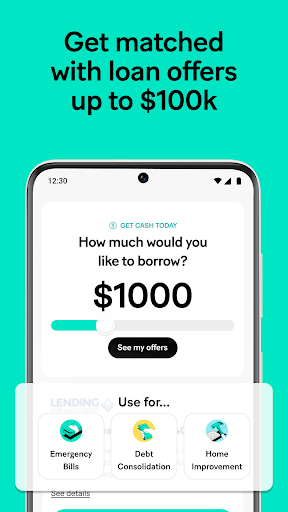

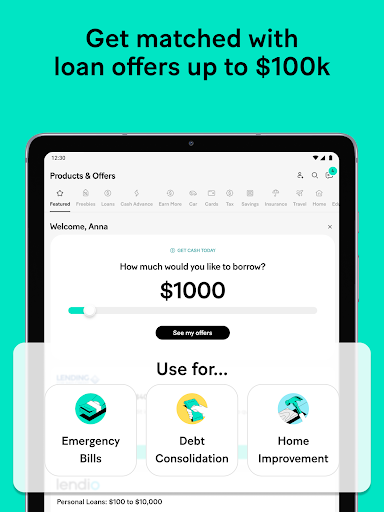

Investments and Financial Insights: Building Wealth Smartly

Beyond daily banking, MoneyLion offers accessible investment options, allowing users to start investing with as little as a few dollars. Its robo-advisor delivers personalized portfolio recommendations based on your goals and risk appetite—akin to having a financial advisor in your pocket, ready to steer your money in the right direction. Additionally, the app provides tailored insights and alerts, alerting you to opportunities or potential issues before they escalate—like having a wise old mentor constantly watching over your shoulder keeping you informed.

Assessing the User Experience and Unique Selling Points

The app's design prioritizes ease of use without sacrificing depth. Its interface is polished yet practical, making complex financial concepts approachable for newcomers while still offering advanced tools for seasoned users. Transitioning between functions is fluid, with responsive controls that contribute to a feeling of confidence when managing your money.

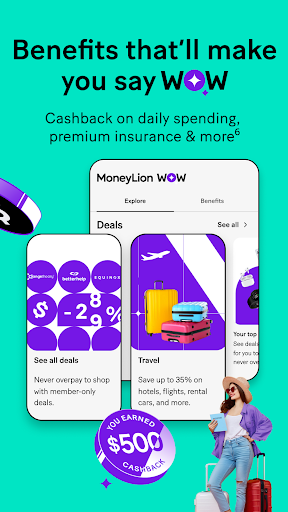

Compared to traditional banking apps or more basic financial tools, MoneyLion's key differentiator lies in its combined approach—merging banking, rewards, and investments under one roof, all linked via a single, secure account. The most unique aspect is its reward system tied directly to your financial behaviors, which fosters a proactive, engaging experience rather than passive account monitoring. Furthermore, its emphasis on account and fund security is matched with an intuitive transaction experience, making the complex world of finance approachable and safe.

Final Verdict: Is MoneyLion Worth a Try?

Overall, MoneyLion strikes a commendable balance between functionality, security, and user engagement. For users seeking an all-in-one financial platform that simplifies money management while offering tangible rewards, this app is a solid choice. Its standout features—particularly the rewards linked to financial activities and its integrated investment suggestions—set it apart from many competitors in the fintech space.

If you're someone who enjoys earning benefits for everyday financial habits and wants a streamlined app that handles banking, investing, and rewards without the clutter, MoneyLion comes highly recommended. Beginners will appreciate its accessible interface and guiding features, while experienced users will find enough depth to keep things interesting. Just remember, like any financial tool, it's best used as a complement to your broader financial strategy, not a standalone solution.

Pros

User-friendly interface

The app offers an intuitive and easy-to-navigate layout, making it accessible for all users.

Earn rewards on everyday banking

Users can earn cashback and rewards on routine transactions like direct deposits and bill payments.

Integrated financial tools

Includes budgeting and savings features to help users manage their finances more effectively.

No traditional bank fees

Offers fee-free checking accounts, reducing costs for users compared to conventional banks.

Early access to paychecks

Allows users to access their paycheck up to two days early, promoting financial flexibility.

Cons

Limited ATM network (impact: Medium)

ATM access may be restricted, potentially leading to fees when withdrawing cash at non-network machines.

Rewards redemption options are somewhat limited (impact: Low)

Currently, rewards can mainly be redeemed for cashback or gift cards, which may not suit all users.

Customer support availability (impact: Medium)

Support channels might have limited hours or response times, but improvements are planned.

Certain features may require a minimum account balance (impact: Low)

Some rewards or advanced features might need maintaining a minimum balance, which could be inconvenient.

Privacy features could be enhanced (impact: Low)

While generally secure, additional privacy controls are expected in future updates to increase user trust.

MoneyLion: Bank & Earn Rewards

Version 7.142.0 Updated 2026-01-08