Mission Lane

Mission Lane App Info

-

App Name

Mission Lane

-

Price

Free

-

Developer

Mission Lane, LLC

-

Category

Finance -

Updated

2026-02-18

-

Version

11.0.0

Mission Lane: A Fresh Take on Personal Finance Management

Mission Lane is a thoughtfully designed financial app that aims to empower individuals with transparent and accessible credit management tools, seamlessly blending user-friendly interfaces with robust security features.

Who's Behind the Curtain?

Developed by Berkeley-based Mission Lane, Inc., this innovative fintech team focuses on democratizing credit access while ensuring user privacy and security are front and center. Their mission is to provide consumers with clearer financial pathways through technology-driven solutions.

Highlights That Make Mission Lane Shine

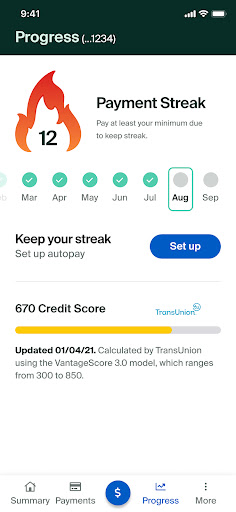

- Transparent Credit Reporting: Users can view real-time updates to their credit scores and understand the factors influencing them.

- Secure Account and Fund Management: Advanced security protocols ensure that user data and transactions are protected at every step.

- Intuitive User Experience: Designed with simplicity in mind, making financial management accessible even for first-time users.

- Personalized Financial Insights: The app offers tailored advice and insights to help users improve their credit health.

A Little Launchpad for Your Financial Journey

Imagine standing at a crossroads of your financial life—Mission Lane offers a friendly guide, illuminating the path with clear, actionable information. Its sleek and approachable interface turns potentially overwhelming credit details into digestible stories. Whether you're checking your credit score, managing your credit line, or exploring new financial opportunities, this app makes the process feel more like an engaging conversation than a daunting task.

Core Functionalities: Deep Dive

1. Real-Time Credit Monitoring and Insights

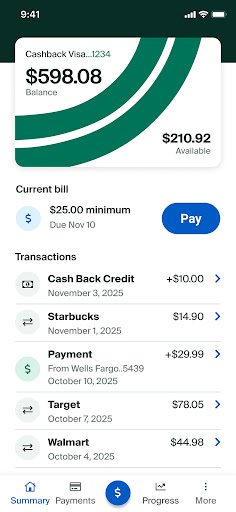

At the heart of Mission Lane is its real-time credit monitoring feature. Upon logging in, users are greeted with a vivid dashboard displaying their current credit score, recent activity, and key drivers affecting their rating. The app doesn't just show numbers—it offers explanations in plain language, helping users understand why their score changed and what actions can help improve it. This transparency fosters trust and motivates users to stay engaged with their financial health.

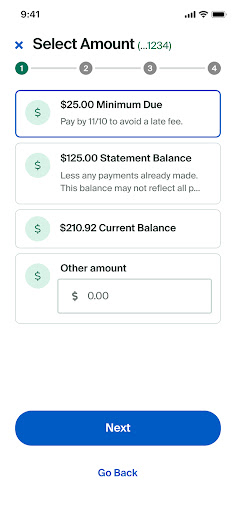

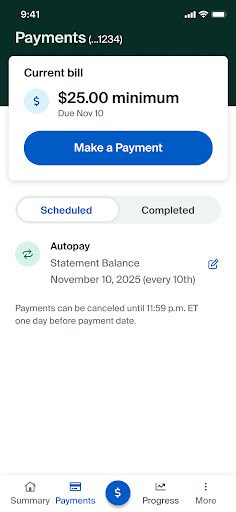

2. Secure Transactions with Peace of Mind

Security is the backbone of any financial app, and Mission Lane emphasizes this with advanced encryption, biometric login options, and fraud detection mechanisms. The app's interface guides users through transactions smoothly—be it paying bills, transferring funds, or setting up automatic payments—without sacrificing security. Its focus on account and fund security makes users feel confident that their sensitive information remains protected, which is a crucial differentiator in today's digital finance world.

3. Personalized Financial Planning & Recommendations

Another standout feature is the app's personalized advice engine. Based on your credit behavior and financial data, Mission Lane suggests tailored strategies—whether it's paying down a specific debt, diversifying your credit mix, or other actions to boost your score. It feels a bit like having a friendly financial coach by your side, charting a course towards better credit health with clear milestones along the way.

Design, Ease of Use, and Overall Experience

The interface design resembles a calm, well-organized workspace—clean lines, intuitive icons, and straightforward navigation make managing finances less like decoding hieroglyphics. Transitioning from one feature to another is smooth, thanks to thoughtful UI choices that prioritize user flow. Even for someone new to credit management, the learning curve is gentle; the app's guidance prompts and clear language make onboarding feel like catching up with an old friend rather than mastering a complex system.

What Sets Mission Lane Apart?

Compared to other finance apps, Mission Lane stands out notably in its emphasis on account and fund security, combined with a transparent approach to credit information. While many apps offer credit monitoring, few provide this level of real-time insight coupled with security features that placate privacy concerns. Furthermore, its personalized recommendations—rooted in data-driven analysis—offer a nuanced approach to credit improvement that feels more tailored than generic advice commonly found elsewhere.

Recommendation and Usage Suggestions

Overall, I consider Mission Lane a solid choice for individuals looking for a reliable, user-friendly platform to oversee their credit health. For those new to credit management or wary of security breaches, this app's transparency and security measures make it particularly appealing. If your goal is to get a clearer picture of your credit standing, actively manage your credit line, and receive personalized recommendations without feeling overwhelmed, Mission Lane deserves a spot on your smartphone.

However, for advanced users seeking sophisticated investment tools or extensive financial planning features, this app may feel limited. I suggest it as an excellent starting point or a complementary tool for everyday credit monitoring and basic fund security.

Pros

User-friendly interface

The app is intuitive and easy to navigate, making financial management accessible for all users.

Transparent fee structure

Clear information about fees helps users understand costs upfront, fostering trust.

Fast approval process

Loan approvals are often quick, providing immediate assistance when needed.

Accessible credit options for underserved populations

Mission Lane caters to those with limited credit history, expanding financial inclusion.

Educational resources available

The app offers tips and guidance to help users improve their credit health.

Cons

Limited credit product diversity (impact: low)

Currently, the app mainly offers loans, lacking options like savings or investment products.

Interest rates can be relatively high (impact: medium)

Some users may face higher APRs compared to traditional banks, which could increase repayment cost.

Requires a stable internet connection (impact: low)

Users in areas with poor connectivity might face difficulties in accessing account information or completing transactions.

Customer support response times vary (impact: medium)

Support may sometimes take longer during peak hours, but official improvements are expected.

Limited availability of financial tools (impact: low)

Advanced features such as budgeting or savings tracking are not currently integrated but are planned for future updates.

Mission Lane

Version 11.0.0 Updated 2026-02-18