Klover - Instant Cash Advance

Klover - Instant Cash Advance App Info

-

App Name

Klover - Instant Cash Advance

-

Price

Free

-

Developer

Klover Holdings

-

Category

Finance -

Updated

2025-12-08

-

Version

2025.12.8

Introducing Klover - Instant Cash Advance: A New Player in Financial Flexibility

Klover is a financial app designed to provide quick cash advances with a user-centric approach, aiming to bridge the gap between immediate needs and financial planning. Developed by Klover Inc., this app emphasizes transparency, security, and ease of use, positioning itself as a trusted partner for individuals seeking short-term financial relief without the complexities of traditional loans. Its standout features include instant access to advances, personalized financial insights, and robust security measures tailored to safeguard user data. Geared towards working individuals, especially those living paycheck to paycheck, Klover strives to make financial management more accessible and less stressful.

Vivid Beginnings: Why Klover Stands Out in Your Financial Journey

Imagine you're caught in a sudden money pinch—your car breaks down, or a medical bill arrives unexpectedly. Instead of scrambling to borrow from friends or explore complicated loan options, Klover appears like a friendly financial companion just a tap away. Its intuitive design and quick processes make it feel less like an app and more like a trusted buddy who understands your urgent needs. The app isn't just about borrowing—it's about creating a safety net that's accessible without the traditional hurdles, giving you peace of mind when life throws curveballs.

Core Functionality that Empowers Your Wallet

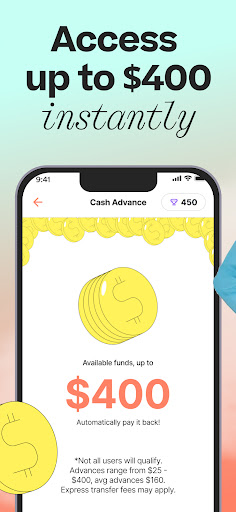

Instant Cash Advances: Fast and Convenient

The hallmark of Klover is its ability to provide instant cash advances — often within minutes. Users link their bank accounts securely and can request small sums to cover immediate expenses. Unlike traditional payday loans or bank overdrafts that require lengthy approval processes, Klover's system assesses your financial patterns and offers a personalized limit. This dynamic approach ensures borrowers aren't overwhelmed and can plan their repayment comfortably. The interface presents clear information about the borrowed amount, repayment schedule, and remaining balance, which simplifies complex financial decisions into straightforward choices.

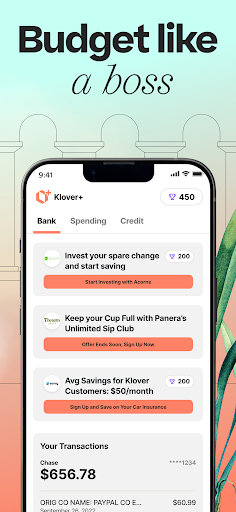

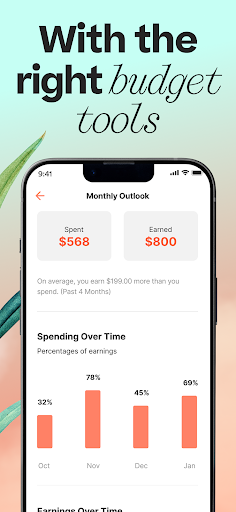

Personalized Financial Insights

Beyond just offering advances, Klover shines in providing tailored financial education and guidance. It analyzes your income, spending, and saving patterns to generate personalized tips aimed at improving your financial health. Think of it as having a miniature financial advisor in your pocket—suggesting smarter spending habits, alerting you about upcoming bills, or recommending the optimal time to take a cash advance. This feature transforms the app from a simple borrowing tool to an empowering platform fostering better money management.

Robust Security and User Trust

Security is the backbone of Klover's appeal. Unlike many competitors that merely implement basic encryption, Klover employs multilayered security protocols including bank-grade encryption, real-time fraud detection, and regular audits. Users' account details, transaction history, and personal data are protected with the highest standards, ensuring peace of mind at every step. Additionally, Klover's transparency about fees and repayment terms helps build user trust, making it a compelling choice for users wary of hidden charges or security loopholes.

User Experience: Seamless, Intuitive, and User-Friendly

The app's design resembles a sleek financial dashboard—clean, minimalistic, yet packed with intuitive features. Navigation feels fluid, with clear icons and logical flow, making even first-time users feel at home quickly. The onboarding process is straightforward: connect your bank account, review your available advance limit, and request funds with just a few taps. The entire experience runs smoothly, with no lag or confusing steps, akin to chatting with a knowledgeable friend rather than deciphering a complex software. Learning curve is gentle, thanks to helpful tips and transparent instructions integrated into the interface, making financial management accessible to all skill levels.

What Sets Klover Apart? The Unique Edge in Financial Apps

While many financial apps focus solely on either borrowing or saving, Klover integrates both with a special emphasis on security and transparency. Its standout feature is the combination of instant cash access with personalized financial insights—like having both a trusted banker and a financial coach rolled into one app. Particularly, its advanced security measures for transaction and data protection surpass many competitors, offering peace of mind that your sensitive information remains just that—sensitive and safe.

Furthermore, the app's approach to continually analyze your financial habits helps it to recommend borrowing amounts and repayment strategies that align with your unique situation, rather than offering one-size-fits-all solutions. This personalized, security-first methodology significantly enhances user confidence and satisfaction, especially in a market flooded with similar services.

Final Verdict and Recommendations

In essence, Klover stands out as a reliable, user-friendly, and secure platform for those needing quick cash solutions coupled with financial insights. Its core strengths—fast, personalized cash advances and top-tier security—make it a compelling choice for everyday users who want more control over their short-term finances without sacrificing safety. While it's not designed to replace long-term financial planning tools, it excels as an accessible safety net for unexpected expenses.

If you're someone who appreciates transparency, ease, and a bit of financial guidance along the way, Klover deserves a solid recommendation. It's best suited for individuals who value quick access, trustworthy security, and ongoing financial empowerment, making it a helpful addition to your financial toolkit when urgent situations arise.

Pros

User-friendly interface

The app offers an intuitive design that makes it easy for users to navigate and request cash advances quickly.

Instant approval process

Funds are often approved and transferred within minutes, providing quick relief for urgent financial needs.

No credit check required

Klover allows users to access cash advances without impacting their credit score, ideal for those with poor credit.

Flexible repayment options

Users can choose repayment dates that align with their pay schedule, reducing financial stress.

Additional financial tools

The app offers features like financial insights and tips, helping users manage their money better.

Cons

Limited cash advance amount (impact: medium)

The maximum advance is often around $100-$500, which may not suffice for larger expenses.

Potential fees for exceeding limits (impact: medium)

Additional charges may apply if users request multiple advances in a short period, impacting overall cost.

Requires linking bank account (impact: low)

Users need to securely connect their bank account, which might raise privacy concerns for some.

Limited availability in some regions (impact: low)

The app's services may not be accessible in all states or countries, restricting potential users.

No detailed credit reporting (impact: low)

Since it doesn't conduct credit checks, there's limited impact on credit score, but it also offers no credit building benefits.

Klover - Instant Cash Advance

Version 2025.12.8 Updated 2025-12-08