Kikoff - Build Credit Quickly

Kikoff - Build Credit Quickly App Info

-

App Name

Kikoff - Build Credit Quickly

-

Price

Free

-

Developer

Kikoff Inc.

-

Category

Finance -

Updated

2025-12-14

-

Version

1.147.2453

Getting to Know Kikoff - Build Credit Quickly

If you're on the quest to boost your credit score without the hassle of traditional banks and paperwork, Kikoff offers an innovative approach designed to make credit building accessible, transparent, and user-friendly.

Who's Behind Kikoff?

Developed by Kikoff LLC, a financial technology firm dedicated to helping consumers establish and improve their credit profiles, the app stands out as a fresh alternative to conventional credit-building tools. Their mission centers on providing affordable, straightforward solutions tailored for young adults and newcomers to credit.

Key Features That Shine

- Credit Builder Loans with No Hidden Fees: Offering small, manageable loans that help establish a positive credit history without hefty costs or complex requirements.

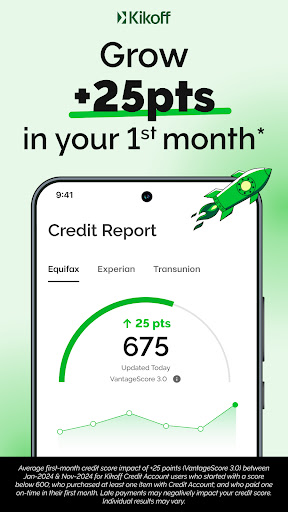

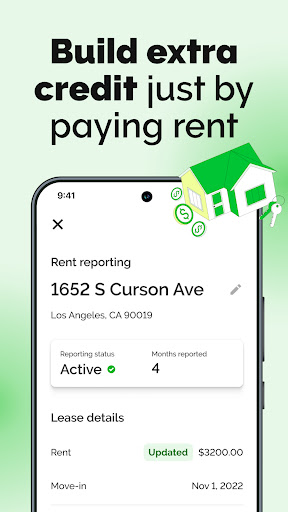

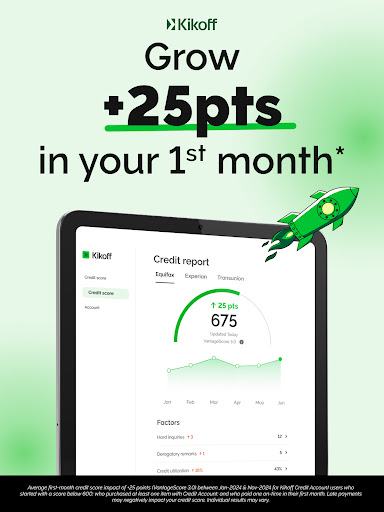

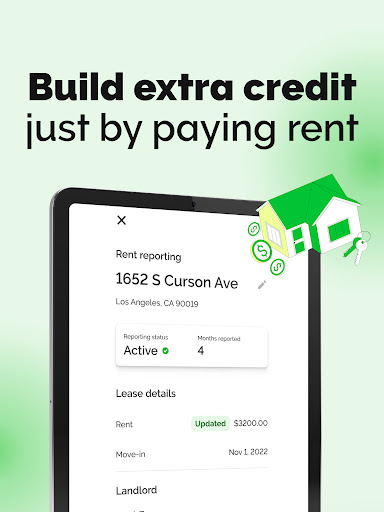

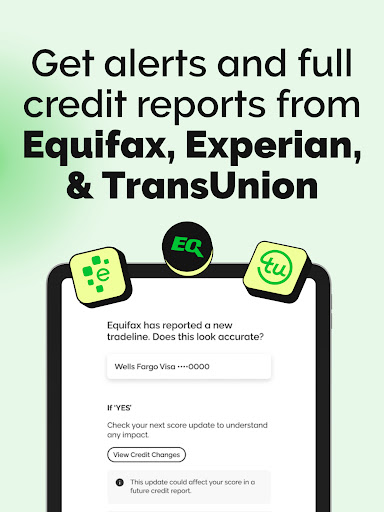

- Automatic Payment Reporting: Ensuring that on-time payments are seamlessly reported to major credit bureaus, thereby accelerating credit score growth.

- Educational Insights: Providing users with personalized tips and educational resources to understand credit concepts and make informed financial decisions.

- Simple Credit Monitoring: Easy-to-understand dashboards that track credit progress over time, giving users motivation and clarity on their financial journey.

Let's Dive Deeper: How Does It Work?

An Engaging Entry Point into Credit Building

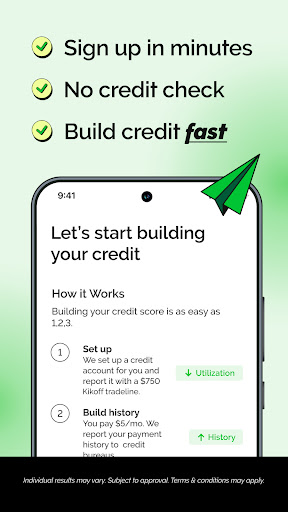

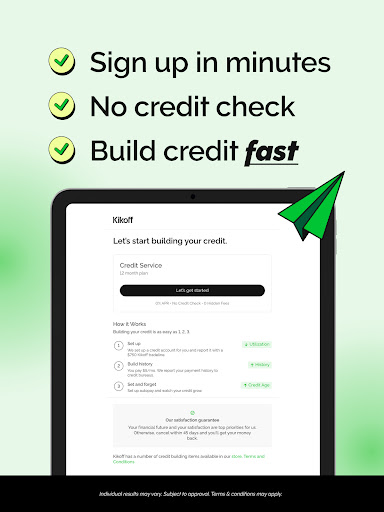

Imagine stepping into a well-lit, friendly storefront where every detail is designed to ease your credit journey. Kikoff opens with a smooth onboarding process—minimal paperwork, quick verification, and a straightforward approach that makes even credit novices feel welcomed. The colorful, intuitive interface turns often complicated credit-building activities into a series of simple, achievable steps, much like following a friendly guide through a new city.

Core Function 1: Credit Builder Loans Made Easy

At the heart of Kikoff are its credit builder loans—tiny yet powerful tools designed to kickstart your credit history. Unlike traditional banks that might require extensive documentation, Kikoff's process is transparent and accessible. Once enrolled, users receive a modest credit line—think of it as a small deposit on a big future—then make monthly payments that are automatically reported to credit bureaus. This setup not only helps build credit but also inculcates disciplined payment habits, all while avoiding exorbitant interest or hidden charges.

Core Function 2: Transparent and Supportive Learning Experience

Building credit isn't just about numbers; it's about understanding the game. Kikoff excels by integrating educational content directly into the app—short, digestible tips, progress trackers, and personalized insights that demystify credit scores. It's like having a financial buddy whispering advice in your ear, guiding you through the nuances of credit history, utilization, and future planning. This approach helps users develop financial literacy simultaneously with their score improvement.

Experience and Unique Value Proposition

In terms of user experience, Kikoff manages to strike a balance between simplicity and functionality. The interface design resembles a clean, welcoming dashboard—colors are soft, navigation is intuitive, and actions like making payments or viewing progress feel fluid, akin to gliding on smooth ice. The learning curve is gentle; even tech novices can pick it up within minutes, thanks to clear prompts and minimal steps.

Comparing Kikoff to other credit-focused financial apps, its standout feature lies in its focus on security and trust. The app ensures that your data is protected with bank-level security measures, making the process of reporting payments and tracking progress secure and reliable. Additionally, its transaction experience is crafted to feel seamless—automated payments mean less manual entry, reducing errors and stress. Unlike some tools that simply display data, Kikoff emphasizes transparency and education, empowering users to understand where their credit stands and how to improve it.

Final Verdict: A Gentle Nudge in the Right Direction

Overall, Kikoff is highly recommended for those just starting their credit journey or looking for a straightforward, educational approach to building credit. Its most compelling feature—the seamless, automatically reported credit builder loan—makes it unique and effective. For users seeking a safe, user-friendly platform that combines practical credit-building with educational support, Kikoff is definitely worth trying out. Just remember, patience and consistency are key; this isn't a rocket-powered booster but a steady guide that helps you walk the path to better credit step by step.

Pros

Effective credit-building tools

Kikoff provides tailored financial products that help users establish and improve credit scores quickly.

No traditional credit checks

The app uses alternative data, making it accessible for users with limited or no credit history.

User-friendly interface

The app features an intuitive design that simplifies managing credit-building activities for new users.

Educational resources included

Kikoff offers tips and guidance on credit management, enhancing user financial literacy.

Quick approval process

Many users report instant or rapid approval, helping them build credit sooner.

Cons

Limited credit reporting options (impact: medium)

Currently, Kikoff reports to only a few credit bureaus, which might slow credit score improvements for some users.

Limited financial products (impact: low to medium)

The app mainly offers credit builder accounts and lacks broader financial services like loans or savings features, which could limit growth opportunities.

Monthly fee structure (impact: medium)

Some users find the subscription fees somewhat high relative to the credit benefits, but discounts or promotions may reduce this concern.

Limited customer support options (impact: low)

Support channels primarily include FAQs and email, which may delay issue resolution; official responses are expected to improve support accessibility.

Educational content could be expanded (impact: low)

While useful, the app's financial education sections are somewhat basic and could benefit from more comprehensive advice; upcoming updates may address this.

Kikoff - Build Credit Quickly

Version 1.147.2453 Updated 2025-12-14