Intuit Credit Karma

Intuit Credit Karma App Info

-

App Name

Intuit Credit Karma

-

Price

Free

-

Developer

Credit Karma, LLC

-

Category

Finance -

Updated

2025-12-16

-

Version

25.50.1

An Inside Look at Intuit Credit Karma: Your Friendly Guide to Smarter Financial Management

Imagine having a trustworthy financial sidekick that not only keeps tabs on your credit health but also helps you navigate the maze of personal finance—all for free. That's exactly what Credit Karma offers. Developed by Intuit Inc., this app is designed to empower everyday users with easy-to-understand credit insights, personalized financial recommendations, and tools to improve their financial standing. Whether you're looking to monitor your credit score, explore pre-approved loan offers, or manage your financial journey with confidence, Credit Karma aims to be your go-to digital navigator.

Major Features That Make Credit Karma Stand Out

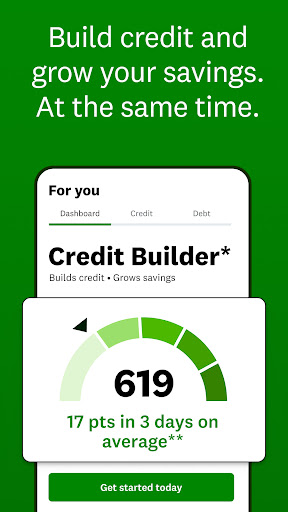

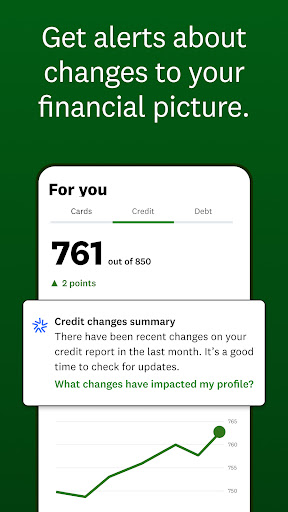

- Free Access to Credit Scores & Reports: Instant, no-cost updates on your credit health, updated weekly to keep you informed.

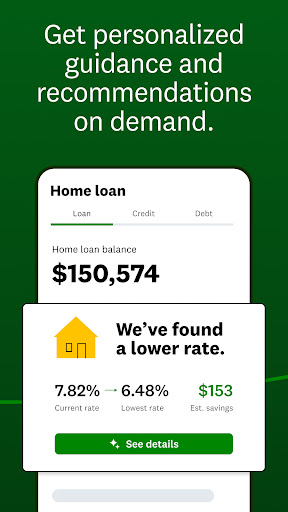

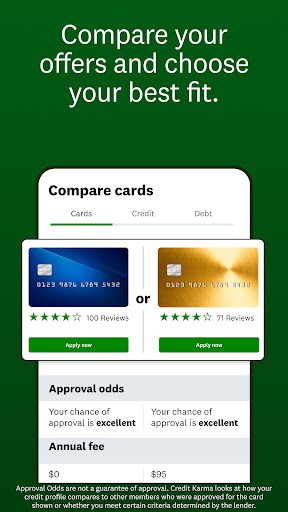

- Personalized Financial Recommendations: Tailored suggestions on credit cards, loans, and savings plans based on your unique profile.

- Credit Monitoring & Alert System: Continuous tracking of credit changes with real-time alerts, helping you spot and address potential issues promptly.

- Tax Filing and Identity Theft Protection: Additional services like free tax filing support and monitoring for identity theft threats.

Engaging and Intuitive User Experience

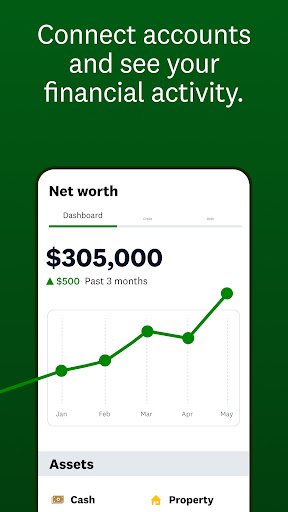

From the moment you open Credit Karma, it's like stepping into a well-organized financial workshop—clean, colorful, and welcoming. The interface strikes a fine balance between simplicity and functionality, much like a friendly navigator guiding you through a complex cityscape. Whether you're a tech novice or a seasoned user, the app's design makes understanding your financial picture straightforward and even enjoyable. The app's responsiveness is impressive, with smooth transitions between sections and quick data refreshes, ensuring you're always up-to-date without frustrating delays.

Core Functionalities in Detail

Credit Score & Report Monitoring

At the heart of Credit Karma lies its ability to provide real-time insights into your credit health. Think of it like a dashboard in your car—instantly showing your current speed, fuel level, and engine health. The app pulls data from major credit bureaus and displays your credit score in an easy-to-understand graph, complete with explanations of what factors are affecting it. This transparency helps users grasp the nuances of credit scoring, making it much less like magic and more like a science they can understand and influence.

Personalized Recommendations & Financial Tools

Imagine having a financial coach who learns your habits and suggests tailored moves—whether it's applying for a credit card with top rewards, consolidating debt, or saving for a big purchase. Credit Karma shines here, analyzing your profile history and proactively offering suitable options. The app's calculators and educational content further demystify complex topics like interest rates or loan terms, turning what was once intimidating into manageable, actionable steps.

Security & Identity Protection

In an age where cyber threats are lurking like shadows, Credit Karma offers a reassuring layer of security. The app provides regular monitoring of your credit report, alerting you to any suspicious activity or significant changes—much like a vigilant guarddog. It also gives tips on safeguarding your personal information and offers identity theft insurance service options, standing out from many peers by emphasizing proactive protection measures.

How Credit Karma Differs from Other Financial Apps

While many financial apps boast about their features, Credit Karma's real differentiator lies in its comprehensive, yet approachable, approach to credit health and security. Its focus on transparent, regularly updated credit scores feels akin to having a continuous, gentle schooling on your financial well-being—no hidden fees or confusing jargon. More importantly, its emphasis on security and proactive alerts ensures users aren't just passively viewing data but actively safeguarding their financial identity. Compared to other apps that might focus solely on budgeting or investment tracking, Credit Karma's specific niche in credit monitoring combined with personalized recommendations makes it a rare gem for those who want holistic yet approachable financial oversight.

Recommendation & Practical Usage Suggestions

Overall, I'd recommend Credit Karma to anyone looking for a trustworthy, user-friendly platform to keep an eye on their credit and improve their financial literacy. It's particularly suitable for recent graduates, first-time borrowers, or anyone wishing to better understand their creditstanding without hefty fees or complicated jargon.

For best results, set regular check-ins—think of it as visiting your digital financial coach monthly. Take time to explore its educational content, make use of the personalized recommendations, and keep an eye on alerts. Remember, the app's most distinctive feature is its commitment to empowering users with transparency and security—treat it as your financial safety net and learning partner rather than just another app on your device.

Pros

Comprehensive credit monitoring

Intuit Credit Karma offers free weekly updates on your credit score and report, helping users stay informed about their financial health.

User-friendly interface

The app's intuitive design makes it easy for users to navigate and access essential credit information quickly.

Personalized financial insights

Credit Karma provides tailored recommendations for credit cards and loans based on your credit profile, enhancing decision-making.

No hidden fees

The service is completely free with no subscription costs, making it accessible to a wide range of users.

Additional features like identity theft protection

Credit Karma integrates services such as fraud monitoring, adding extra security for users' financial data.

Cons

Limited credit reporting agencies (impact: Medium)

The app primarily pulls data from TransUnion and Equifax, which may omit some lenders reporting to Experian, possibly affecting credit insights.

Advertising within the app (impact: Low)

Credit Karma displays targeted ads and promotional offers, which can sometimes clutter the interface and distract users.

Delayed data updates for some accounts (impact: Medium)

Credit data may not be real-time, leading to slight discrepancies if recent activity hasn't been reflected yet—users can refresh regularly.

Limited loan and credit card options (impact: Low)

Recommendations are based on available partnerships, which may not include all preferred or local financial products; official updates may expand options in future.

Basic free security features (impact: Low)

While offering fraud alerts, advanced features like real-time transaction alerts are available only through premium services; users can upgrade or monitor regularly for updates.

Intuit Credit Karma

Version 25.50.1 Updated 2025-12-16