Greenlight Kids & Teen Banking

Greenlight Kids & Teen Banking App Info

-

App Name

Greenlight Kids & Teen Banking

-

Price

Free

-

Developer

Greenlight Financial Technology, Inc.

-

Category

Finance -

Updated

2026-02-19

-

Version

7.24.0

Introducing Greenlight Kids & Teen Banking: A Safe and Educational Financial Companion for Young Learners

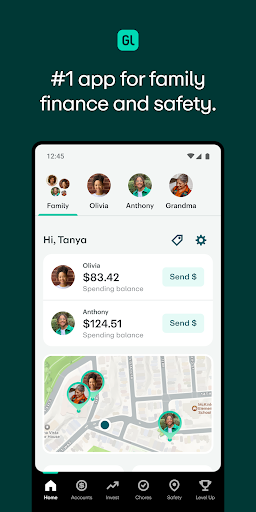

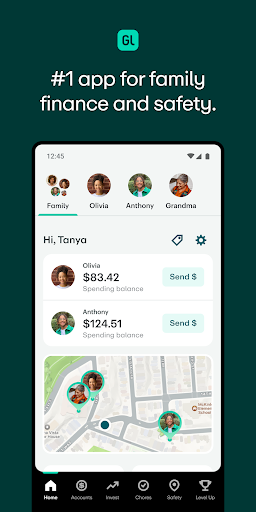

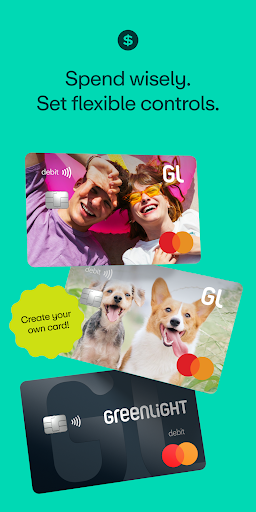

Greenlight Kids & Teen Banking is a thoughtfully designed financial app that aims to empower children and teenagers with essential money management skills through a secure and user-friendly digital platform. Developed by Greenlight Financial Technology, Inc., this app combines banking features with educational tools, making it a reliable partner for parents eager to foster financial literacy in their young ones.

Key Features That Make Greenlight Stand Out

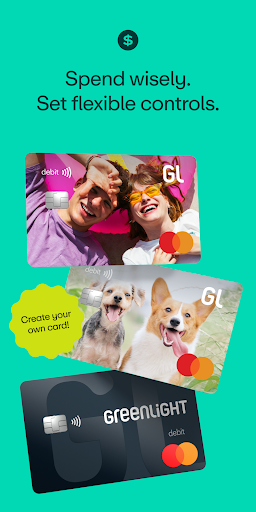

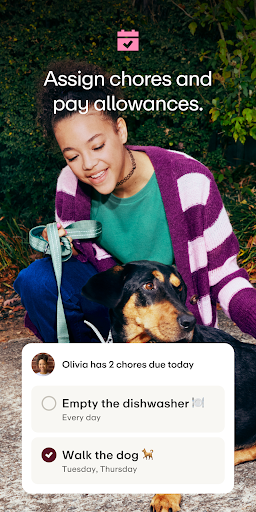

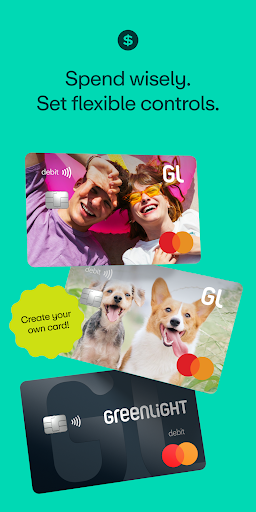

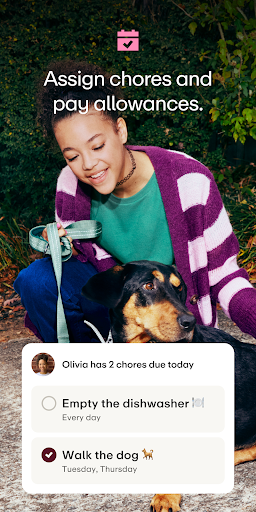

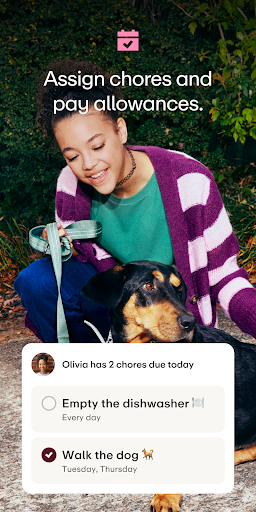

Greenlight offers a suite of features tailored for young users, including customizable chore-based allowances, real-time spending notifications, and parental controls that ensure a safe environment. Its intuitive interface and engaging financial literacy resources turn everyday banking into interactive learning sessions. The platform also emphasizes security, encrypting transactions and safeguarding personal data, which reassures parents and builds trust with users.

A Fun and Educational Journey into Money Management

Imagine handing your child a piggy bank that not only stores their savings but also teaches them how to handle money responsibly—Greenlight is that digital piggy bank, but smarter. From the moment you open the app, it feels like stepping into a friendly, approachable financial universe where kids become curious explorers of their own finances. Whether it's earning a weekly allowance or making their first purchase, Greenlight aims to make every interaction educational and engaging.

Streamlined and Secure Accounts for Young Savers

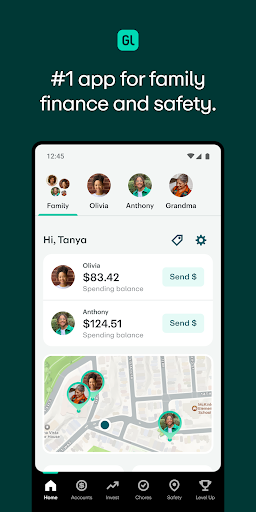

At the heart of Greenlight lies its core banking feature: creating a secure account for kids that parents can oversee. The app uses bank-grade encryption, ensuring that all transactions—from allowance deposits to spending—are protected against fraud. Parents have the authority to set spending limits, approve purchases, and monitor activity in real-time, transforming financial oversight from a hassle into a smooth experience. The account structure mimics real banking, helping children understand concepts like saving, budgeting, and responsible spending from an early age.

Interactive Learning and Goal-Setting Tools

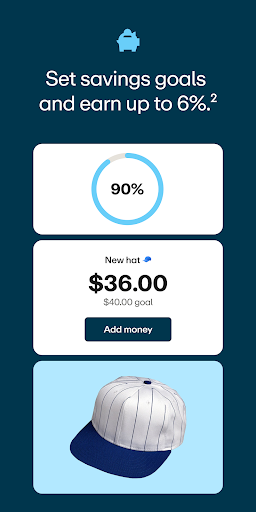

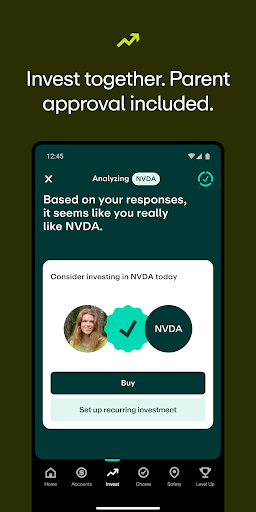

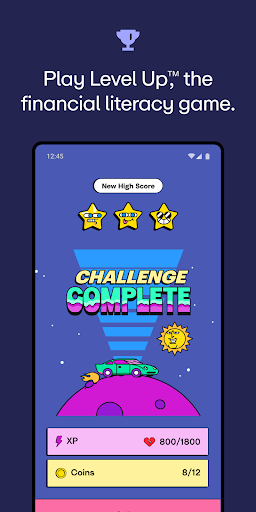

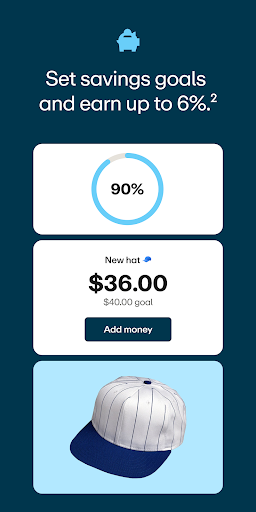

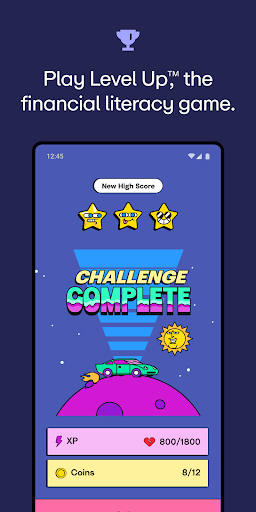

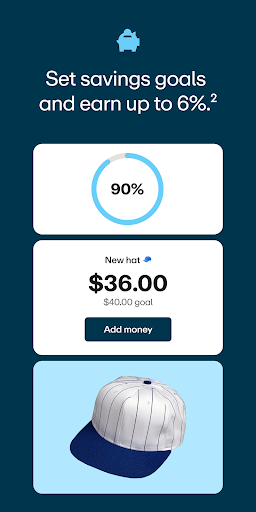

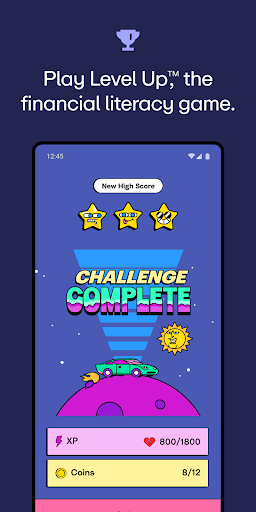

The app shines brightest as an educational tool. Children can set savings goals—like saving for a new gadget or a trip—and visualize their progress through colorful charts. Greenlight also offers mini-lessons on basic financial concepts, delivered through engaging videos and quizzes. This approach turns money management into a series of small, achievable milestones, cultivating financial habits that can last a lifetime. Parents can participate by assigning chores linked to allowance rewards, turning household responsibilities into lessons on earning and reward systems.

Effortless User Experience and Differentiators

The interface design of Greenlight is both inviting and straightforward, akin to flipping through a well-illustrated storybook. The app's buttons are intuitive, and navigation is smooth, even on older devices—a true win for busy parents and tech-savvy teens alike. Unlike many financial apps that prioritize adult users, Greenlight optimizes the experience for children, with playful graphics but serious attention to security and usability.

One of its standout features is its focus on account and fund security. While others may offer basic parental controls, Greenlight integrates advanced encryption and real-time monitoring, giving parents peace of mind. Furthermore, its transaction experience emphasizes transparency; kids receive instant notifications for every purchase, encouraging mindful spending and immediate discussion with their parents.

Who Should Consider Greenlight?

Greenlight is highly recommended for families eager to introduce their children to the realities of personal finance in a safe, educational environment. It's especially suitable for children aged 6 and up, who are becoming more independent but still need guidance and limits. The app works well for parents who want an all-in-one platform to teach, monitor, and guide their kids' financial habits without sacrificing ease of use or security.

Final Verdict: A Wise Choice for Young Financial Learners

If you're looking for an app that balances robust security, engaging education, and practical banking features, Greenlight Kids & Teen Banking deserves serious consideration. Its most remarkable strengths lie in its secure account management system and its ability to gamify financial literacy, making money management approachable and fun for young minds. Whether you're just starting to teach your children about money or seeking a digital tool that grows with them, Greenlight offers a trustworthy and educational experience that's worth exploring.

Pros

User-friendly interface

The app is easy for kids and teens to navigate, promoting independent financial management.

Parental controls

Provides robust tools for parents to monitor and approve transactions, ensuring safety.

Educational features

Includes financial literacy resources that help kids learn about saving and budgeting.

Real-time notifications

Keeps parents and teens informed of account activities through instant alerts.

Multiple savings goals

Allows users to set and track various savings targets, encouraging goal-oriented habits.

Cons

Limited international accessibility (impact: Medium)

Currently available only in select regions, restricting users in other countries. (Solution: Expanding server support globally is planned.)

Basic investment options (impact: Low)

Investment features are still under development, limiting opportunities for older teens to grow funds. (Official updates expected soon.)

Transaction fees (impact: Low)

Some transactions, like ATM withdrawals, may incur fees, which might deter usage. (Temporary workaround: Using bank partners' ATMs.)

Limited customer support channels (impact: Medium)

Support primarily available via in-app chat, which may delay issue resolution. (Official plan to add phone support in future releases.)

Basic parental dashboard (impact: Low)

Parental controls could benefit from more detailed analytics and customization options. (Expect improvements in upcoming updates.)

Greenlight Kids & Teen Banking

Version 7.24.0 Updated 2026-02-19