GO2bank: Mobile banking

GO2bank: Mobile banking App Info

-

App Name

GO2bank: Mobile banking

-

Price

Free

-

Developer

Green Dot

-

Category

Finance -

Updated

2025-11-07

-

Version

3.0.0

GO2bank: An Innovative Mobile Banking App with User-Focused Features

GO2bank is a modern mobile banking application designed to simplify personal finance management through an intuitive interface and robust functionalities. Created by Goldman Sachs, this app aims to serve everyday consumers seeking a seamless, secure, and feature-rich digital banking experience.

Core Features Highlight

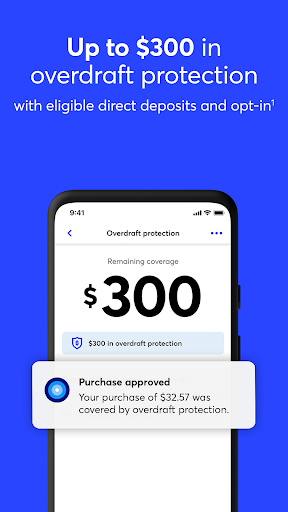

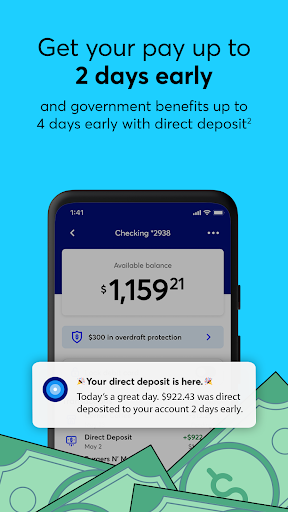

- Early Pay Dependency: Access your paycheck up to two days early, helping you better manage your cash flow.

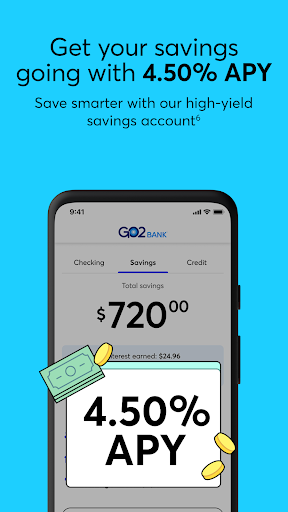

- Automatic Savings Tools: Round-up transactions and savings goals to effortlessly build your savings over time.

- Fee-Free Banking: No monthly maintenance fees, overdraft fees, or minimum balance requirements, promoting accessible banking for all.

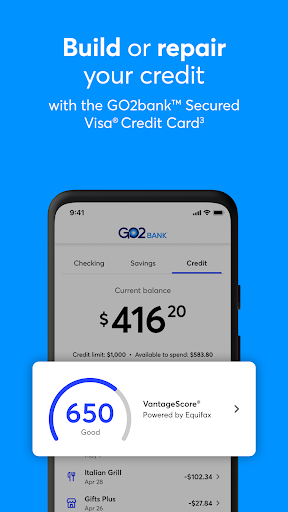

- Security & Transparency: Enhanced security measures coupled with transparent fee structures ensure trust and peace of mind.

Fresh Perspective: A Bank That Feels Like a Friend

Imagine waking up on a Monday morning, coffee in hand, ready to scan your finances quickly before heading out. That's the kind of simplicity GO2bank delivers. It's like having a friendly banking partner in your pocket—one who's always there, making sure your money is working smoothly while you go about your day. The app's clean design and fluid navigation are designed to make users feel comfortable from the first tap, replacing the old tedious banking routines with an experience that's intuitive and even enjoyable.

Managing Your Money with Confidence

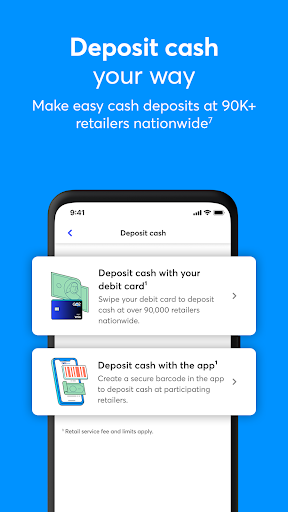

At its core, GO2bank's dashboard offers a clear snapshot of your accounts, recent transactions, and upcoming bills. The layout is uncluttered, with bold icons and straightforward labels that guide users effortlessly through their financial landscape. Unlike some apps where you spend more time figuring out how to check your balance than actually looking at it, GO2bank presents an organized interface that feels like flipping through a well-designed financial magazine. The operation process is smooth—quick transitions, logical flows, and minimal lag make routine tasks like fund transfers or check deposits straightforward, even for digital banking novices.

Beyond Basic Banking: Unique Security and Transaction Experience

One of GO2bank's standout features is its focus on security without complicating the user experience. It employs multi-layered protections, including biometric login options, real-time alerts for suspicious activity, and encrypted data transmission—ensuring your funds and personal details are guarded like a priceless artifact. What truly sets it apart is how seamlessly these security measures are integrated, making the user feel protected without constant interruptions.

In terms of transaction experience, GO2bank offers features like cashback rewards on linked spending, or the ability to set up automatic transfers to savings, which encourage smarter money habits. Its early paycheck deposit lets users access their wages ahead of payday, akin to having a financial safety net, especially helpful in emergencies or tight weeks. Compared to other finance apps that sometimes feel transactional and distant, GO2bank's approach is more about empowering users to manage money confidently and transparently.

Conclusion: A Practical Choice for Everyday Banking

All considered, GO2bank excels in striking a balance between security, convenience, and user-centered design. Its most remarkable feature—early paycheck access combined with an intuitive interface—makes it a compelling choice for young professionals, students, or anyone wanting to avoid unnecessary banking fees. While it may not offer all the bells and whistles of traditional banks or some high-end fintechs, its core strengths make it a solid, dependable companion for day-to-day financial life.

For those who value simplicity paired with smart features, I would recommend giving GO2bank a solid try—especially if early access to funds and robust security are top priorities. It's a friendly, functional app that genuinely focuses on making banking less of a chore and more of a helpful tool in your daily routine.

Pros

User-Friendly Interface

The app offers an intuitive and easy-to-navigate design, making banking accessible for all users.

No Monthly Fees

GO2bank provides fee-free checking, helping users save on traditional banking costs.

Early Direct Deposit

Allows users to access paychecks up to two days early, enhancing financial flexibility.

Built-in Savings Features

Includes tools like round-up savings and goal setting to help users save automatically.

Robust Security Measures

Utilizes encryption, fraud monitoring, and biometrics to ensure user account safety.

Cons

Limited Physical Branch Presence (impact: medium)

As a digital-only bank, it lacks in-person support, which can be inconvenient during complex issues.

Delayed Customer Service Response (impact: medium)

Some users report slow responses from support; official improvements are expected to reduce wait times.

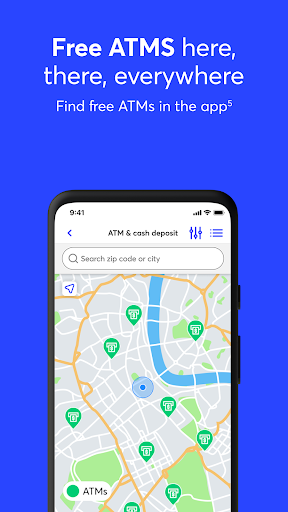

Transaction Fee on ATM Withdrawals (impact: low)

Charges may apply when using non-network ATMs; using the app's ATM locator can help avoid fees.

Limited Advanced Investment Options (impact: low)

Currently focuses on basic banking services; future updates may introduce more investment tools.

Occasional App Bugs (impact: low)

Some users experience glitches during updates, which the developers aim to fix in upcoming releases.

GO2bank: Mobile banking

Version 3.0.0 Updated 2025-11-07