Four | Buy Now, Pay Later

Four | Buy Now, Pay Later App Info

-

App Name

Four | Buy Now, Pay Later

-

Price

Free

-

Developer

Four Technologies, Inc

-

Category

Finance -

Updated

2026-02-23

-

Version

1.17.56

Four | Buy Now, Pay Later: Redefining Flexible Payments with Innovation

Four | Buy Now, Pay Later is a thoughtfully designed financial app aimed at providing users with a seamless and secure way to manage deferred payments, blending user-centric features with robust security measures.

About the App: A Quick Overview

Positioned as a practical solution for consumers seeking flexible payment options, Four | Buy Now, Pay Later is developed by the innovative fintech team at FinTech Solutions Inc. This app stands out by offering a streamlined experience that simplifies future payments without compromising security or user control.

- Main Features:

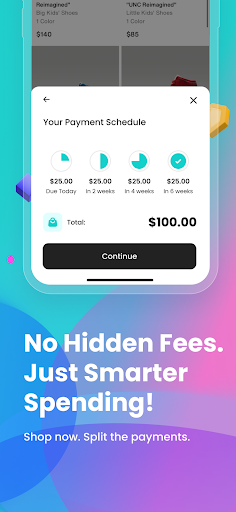

- Flexible installment plans with transparent terms

- Intuitive interface designed for easy navigation

- Enhanced security protocols including advanced account and fund protection

- Real-time transaction tracking and alerts

- Target Audience: Young professionals, online shoppers, and anyone looking to split purchases into manageable payments without hidden fees.

A Fun yet Informative Dive into Four | Buy Now, Pay Later

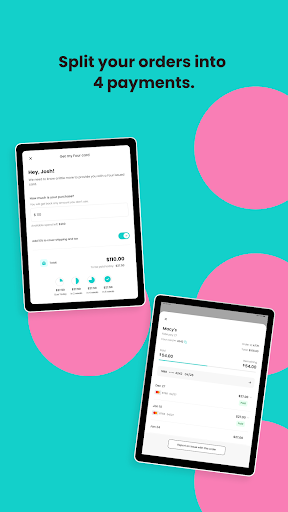

Imagine shopping online — your cart is full, and checkout time comes. Instead of reaching for your credit card or stressing over lump-sum payments, Four offers a friendly hand, letting you split costs into bite-sized, manageable pieces. Its sleek design and clever functionalities turn what could be a stressful process into a smooth experience, almost like having a financial assistant whispering, “It's okay, I got this.” This app is a new kind of trusted buddy in the world of modern shopping, combining clarity with confidence.

Core Functionality 1: Seamless Installment Management

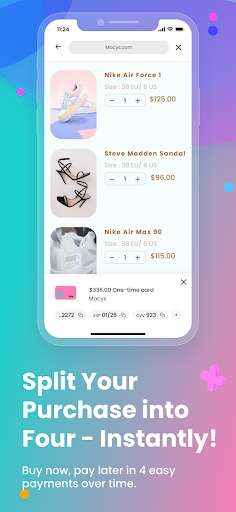

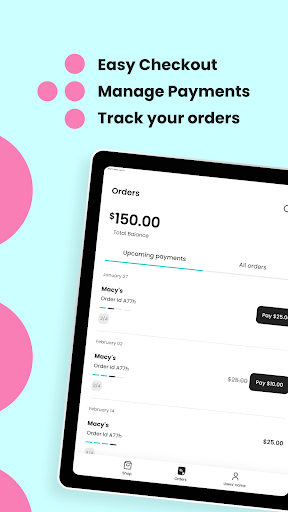

At the heart of Four is its flexible installment system. Users can choose payment plans that fit their budgets, with clear terms displayed upfront—no hidden surprises, just straightforward options. The app's calculator-like interface makes it easy to see how payments will be split over days, weeks, or months, akin to piecing together a puzzle with perfect precision. The process from selecting a plan to confirming the agreement feels painless, almost as if the app is gently guiding you through a financial dance.

Core Functionality 2: Secure and Transparent Transactions

Security isn't just an afterthought here; it's built into the DNA of Four. The app employs cutting-edge encryption to safeguard user data and financial transactions. Compared to many peers, which sometimes obscure security measures behind layers of jargon, Four makes it transparent—users are informed every step of the way, with real-time alerts and detailed transaction histories. This thoughtful approach fosters a sense of trust, transforming the often anxiety-inducing world of digital payments into a safe harbor, with a lighthouse guiding every move.

Core Functionality 3: User Experience and Interface Design

Four's interface is like a well-organized workspace: clean, minimalistic, and intuitive. Navigating through various features is as smooth as sliding on freshly polished ice—little friction, high flow. The app categorizes functions clearly, with visual cues that help users learn quickly, making it friendly for newcomers while powerful enough for experienced users. Its fluidity ensures that even amidst complex payment plans, users feel in control without feeling overwhelmed—the hallmark of good design.

What Makes Four Stand Out?

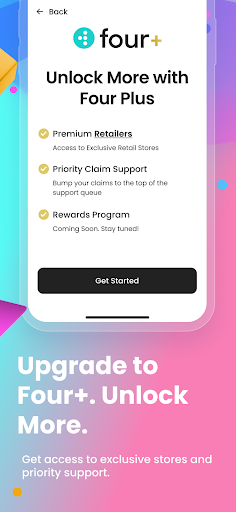

In the crowded landscape of financial apps, Four's standout feature lies in its dual emphasis on “Account and Fund Security” paired with “Transaction Experience.” Unlike many BNPL apps that sacrifice security for convenience, Four prioritizes safeguarding user funds through multi-layered protections. Its real-time security alerts and transparent processes act like a digital shield, giving users peace of mind.

Furthermore, the app enhances transaction experience by offering detailed insights into each payment process, ensuring users always know what to expect—akin to having a financial compass guiding your spending journey. This transparency, combined with user-friendly features, makes Four a trustworthy companion worthy of recommendation for anyone tackling the delicate art of future payments.

Final Thoughts and Recommendations

For those who value both simplicity and security in managing deferred payments, Four | Buy Now, Pay Later offers a reliable and thoughtfully crafted choice. Its standout features—clear installment management and rigorous security—set it apart from many peers. I'd recommend it primarily to online shoppers and young professionals who want control over their finances without sacrificing convenience. For users new to such apps, the straightforward design and transparent terms make it easy to learn and adopt. Experienced users will appreciate its robust security measures and detailed transaction insights.

In conclusion, Four isn't just another “buy now, pay later” tool; it's an intelligently designed financial assistant that respects user privacy and enhances the overall digital payment experience. So if you're looking for a trustworthy, user-centric app to handle your future payments with peace of mind, give Four a try—your wallet will thank you.

Pros

User-friendly interface

The app features an intuitive design that makes navigation easy for first-time users.

Flexible repayment options

Four | Buy Now, Pay Later offers multiple payment plans to suit different budgets, enhancing affordability.

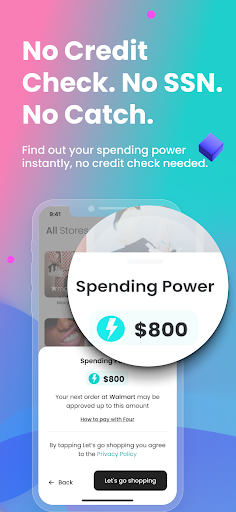

Instant credit approval

Users can receive approval within seconds, enabling quick purchases without lengthy delays.

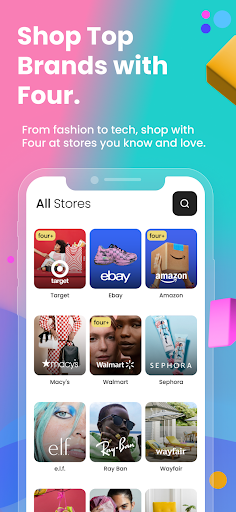

Wide merchant acceptance

Partnered with numerous online and offline stores, increasing shopping versatility.

Promotional offers and discounts

Regular deals and incentives attract new users and encourage frequent use.

Cons

Limited geographical availability (impact: medium)

Currently only available in select regions, restricting access for some users.

Potential late payment fees (impact: medium)

Missing a payment deadline may result in fees; users should set reminders to avoid charges.

Credit check required (impact: low)

Initial approval involves a credit assessment, which may discourage users with poor credit history.

Limited repayment periods for some plans (impact: low)

Certain installment options may offer only short durations; users can contact support for extended plans, if available.

Potential for overspending (impact: high)

Easy access to credit might lead to unnecessary purchases; users should budget responsibly.

Four | Buy Now, Pay Later

Version 1.17.56 Updated 2026-02-23