FloatMe: Budget & Cash Advance

FloatMe: Budget & Cash Advance App Info

-

App Name

FloatMe: Budget & Cash Advance

-

Price

Free

-

Developer

FloatMe

-

Category

Finance -

Updated

2025-12-18

-

Version

8.4.2

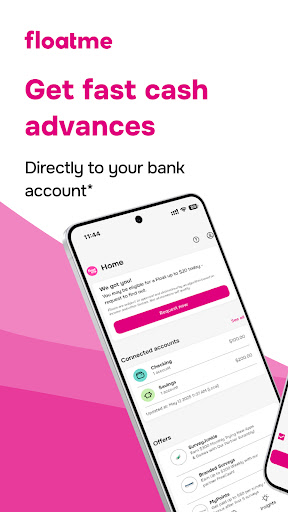

Introducing FloatMe: Budget & Cash Advance

FloatMe aims to serve as a friendly financial companion, helping users manage their everyday expenses with quick cash advances and budget tools, all wrapped into a user-friendly app.

Who Develops This App and What Are Its Main Features?

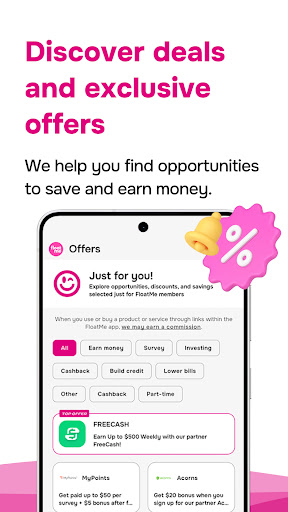

Developed by FloatMe Inc., a team dedicated to improving accessible financial services, this app offers a range of features designed to bolster your financial flexibility:

- Instant Cash Advances: Get small, hassle-free cash advances without the typical bank delays.

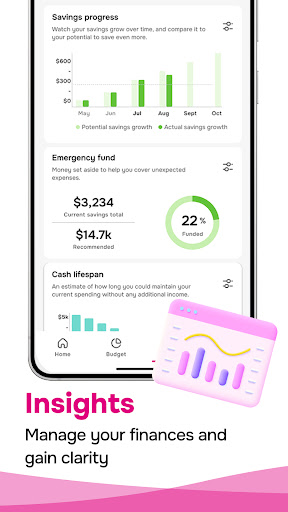

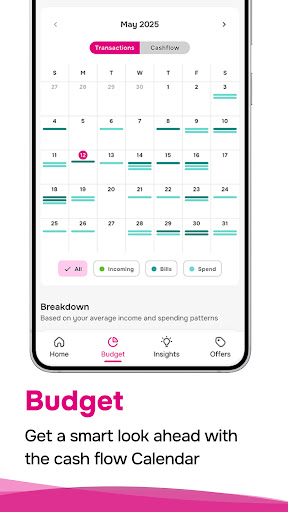

- Budget Management: Track your income and expenses seamlessly to stay on top of your finances.

- Automatic Repayment Reminders: Ensure your advances are paid back smoothly to avoid penalties.

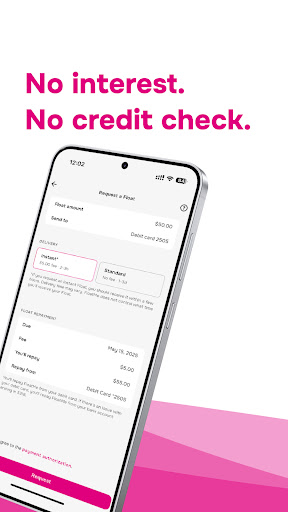

- Fee Transparency and Security: Clear fee structures alongside robust security measures.

The app primarily targets young professionals, gig economy workers, and anyone seeking a simple way to cover short-term financial gaps without incurring high-interest debts or complicated bank procedures.

A Spark of Freshness in Financial Apps — An Engaging Introduction

Imagine you're caught in an unexpected rainstorm—your wallet's empty, and the nearest store is miles away. FloatMe becomes your friendly umbrella, offering quick cash to keep you dry and moving. But unlike a bulky umbrella, this app is sleek, portable, and ready at your fingertips anytime you need that small financial boost. It's like having an empathetic financial buddy who's always there to lighten the load—no fuss, no complicated paperwork, just straightforward support when it matters most.

Core Feature Breakdowns: How Does FloatMe Shine?

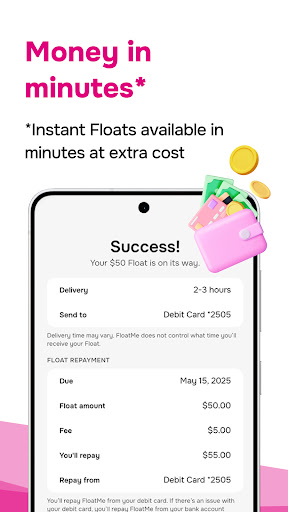

Lightning-Fast Cash Advances with Clear Terms

One of FloatMe's flagship features is its ability to provide instant cash advances—think of it as a financial pit stop before your next paycheck. The process is remarkably straightforward; users can request an advance directly from the app in just a couple of taps. The app's design minimizes confusion, presenting clear information about the amount, fees, and repayment date upfront—no hidden surprises. The transparency here is akin to a dependable GPS guiding you through financial decisions, ensuring you know where your money is headed at every step.

Intuitive Budget Tracking that Feels Like a Personal Finance Coach

Managing your money often feels like navigating a labyrinth, but FloatMe offers a smarter, simpler map. Its budgeting module categorizes expenses automatically and provides visual charts that make understanding spending patterns as easy as reading a weather forecast. Whether you're tracking daily coffee runs or larger bill payments, this feature makes budget management less of a chore and more of a discovery—like uncovering secret short-cuts in a familiar city.

Seamless User Experience and Enhanced Security

The app design emphasizes ease of use with a clean, modern interface that feels welcoming, not intimidating. Animations are smooth, and menus are logically arranged, reducing the learning curve to mere minutes. For security, FloatMe employs bank-grade encryption and multi-factor authentication, ensuring your data and funds remain protected—your financial safety net, as reliable as a trusted friend. Transactions are quick, with minimal lag, making the entire experience feel swift and frustration-free.

What Sets FloatMe Apart? Unique Strengths in a Crowded Market

While many financial apps focus solely on either budgeting or cash advances, FloatMe's strength lies in integrating these features while emphasizing transaction security and account safety. Its standout feature is the automatic repayment and alerts system, which acts like a gentle reminder from a caring friend—helping users avoid late fees and maintain healthy financial habits. Unlike some competitors, FloatMe avoids overly complicated processes or hidden fees; transparency becomes its guiding principle. This focus on straightforwardness and security makes it a trustworthy choice for those wary of high-interest loans or privacy breaches.

Final Verdict: Is It Worth Trying? Recommendations for Users

Overall, I'd recommend FloatMe to anyone looking for a no-fuss financial assistant that balances convenience with security. If you often find yourself needing small advances or want a simple tool to keep your spending in check without jumping through hoops, this app is worth exploring. It's especially suitable for users new to financial apps who value transparency and simplicity.

However, remember that this app is designed for short-term financial support, not long-term lending solutions. Responsible use in conjunction with personal budgeting habits will maximize its benefits. So, if you're after an approachable, trustworthy, and user-friendly financial companion, FloatMe could be a helpful addition to your digital toolkit.

Pros

User-friendly interface

The app features an intuitive design that makes it easy for users to navigate and access cash advances quickly.

No credit check requirement

Allows users to request cash advances without impacting their credit scores, which is ideal for those with limited credit history.

Transparent fee structure

Clear information about fees and repayment terms helps users make informed financial decisions.

Automatic savings features

The app offers tools to help users save automatically, promoting better budgeting habits.

Fast approval process

Cash advances are typically approved within minutes, providing quick financial relief in urgent situations.

Cons

Limited loan amounts (impact: medium)

The maximum cash advance limit is relatively low, which may not meet all users' larger financial needs.

Potential fees for certain transactions (impact: low)

Some users may encounter fees for express service options; checking fee details beforehand can help avoid surprises.

Temporarily restricts some features for certain accounts (impact: medium)

Certain advanced features may be unavailable until users verify their account or meet specific criteria; official updates are expected to expand access.

Limited financial planning tools (impact: low)

The app primarily focuses on cash advances and lacks comprehensive budgeting tools, which might limit its usefulness for long-term financial planning.

Higher interest rates compared to traditional banks (impact: high)

Fees and interest charges can be relatively high for small advances; users should review repayment terms carefully and consider alternatives for larger needs.

FloatMe: Budget & Cash Advance

Version 8.4.2 Updated 2025-12-18