Experian®

Experian® App Info

-

App Name

Experian®

-

Price

Free

-

Developer

Experian

-

Category

Finance -

Updated

2025-12-16

-

Version

4.2.6

Experian: Your Personal Financial Guardian in a Digital World

In today's fast-paced digital economy, managing personal finances effectively and securely is more crucial than ever. Experian positions itself as a comprehensive financial application designed to empower users with insightful credit information, seamless financial tracking, and robust security features. Developed by Experian, a global leader in credit reporting and data services, this app aims to bridge the gap between complex financial data and everyday users who seek clarity, control, and peace of mind in their financial lives. Its key highlights include real-time credit monitoring, personalized credit insights, secure transaction management, and an intuitive user interface tailored for both novices and financial enthusiasts alike. The target audience primarily comprises individuals eager to understand and improve their credit health, from young adults starting their financial journey to seasoned users aiming for better financial planning.

A Fresh Spin on Financial Monitoring—Engaging and User-Friendly

Imagine having a wise financial companion right in your pocket—one who not only understands your credit landscape but also guides you through it with clarity and confidence. That's the experience Experian aims to deliver. Unlike traditional credit bureaus or static financial apps, this platform transforms raw data into easily digestible insights, making financial literacy approachable and engaging, much like having a friendly consultant by your side.

Real-Time Credit Monitoring—Your Financial Radar

At the heart of Experian's charm lies its real-time credit monitoring feature. It's comparable to having a vigilant security guard who constantly scans for any unusual activity in your credit profile. The app provides instant alerts whenever there's a significant change—be it a new account opening, a credit inquiry, or a sudden dip in score—allowing users to react swiftly and safeguard their financial reputation. This feature is particularly valuable in an age of pervasive digital fraud, giving you peace of mind without the need to manually check credit reports periodically.

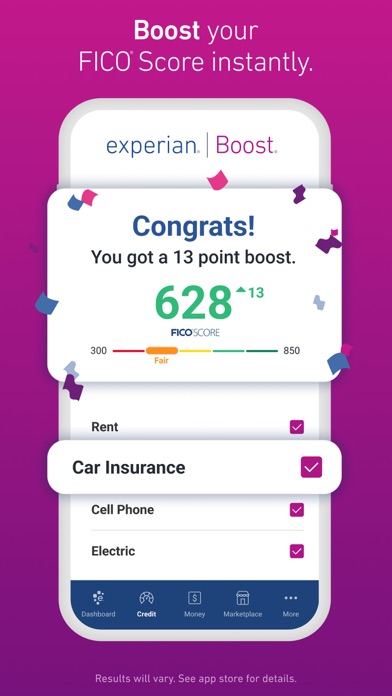

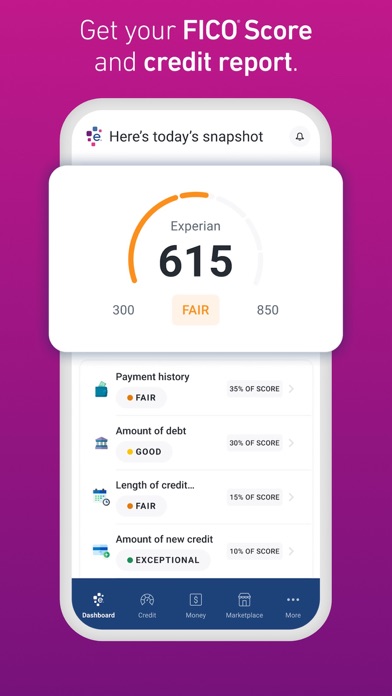

Personalized Credit Insights—Turning Data into Action

Beyond simple monitoring, Experian excels in turning complex credit data into actionable advice. Suppose you're planning to buy a house or car; the app offers tailored recommendations on how to improve your credit score, suggesting specific actions like paying down certain accounts or avoiding new inquiries. Its in-depth analysis demystifies credit scores, making it easier for users to understand what influences their numbers and how to enhance them. This personalized approach transforms credit management from a daunting task into a strategic game—much like having a financial coach whispering tips in your ear.

Secure Transaction and Identity Protection—The App's Hidden Shield

What truly sets Experian apart from many other finance apps is its focus on security. The app doesn't just display your credit data; it actively works to protect it. Features like identity theft monitoring, dark web scan, and fraud alerts act as an invisible shield, safeguarding users from potential threats. For example, if your information appears on a compromised data breach list, the app warns you promptly, allowing immediate action. These security measures are particularly vital in today's landscape where digital identity theft is rampant, positioning Experian as a trusted guardian rather than just a tracking tool.

User Experience: A Smooth Ride in a Financial Wonderland

From the moment you open Experian, it's evident that much thought has gone into crafting an intuitive interface. The design is sleek, with a colorful yet calming palette that echoes trustworthiness and professionalism. Navigating through different sections feels like strolling along a well-paved path—everything is where you expect it to be, without unnecessary clutter. Loading times are minimal, and animations are smooth, making the experience feel fluid rather than sluggish. Even users new to financial apps will find the learning curve gentle, thanks to clear labels, straightforward explanations, and helpful tips integrated seamlessly into the interface.

Compared to other financial apps, Experian's emphasis on simplicity doesn't sacrifice depth. The layout encourages exploration without overwhelming, making it accessible for a broad audience. Additionally, the app's alerts and notifications are timely but unobtrusive, respecting user attention while keeping them informed—a thoughtful design choice that enhances user trust and satisfaction.

Standing Out in the Crowd—What Makes Experian Unique

While many finance apps focus solely on tracking or reporting, Experian's standout feature is its dual emphasis on security and personalized insights. Its proactive fraud monitoring functions extend beyond basic reporting, actively helping users defend against identity theft before damage occurs. On the other hand, the tailored credit improvement suggestions are delivered in plain language with practical steps, empowering users to take control of their financial destiny. This combination positions Experian as not just a data provider but a true financial partner, especially appealing for those who prioritize security and actionable guidance over raw data dumps.

Final Verdict and Recommendations

Overall, I'd confidently recommend Experian to anyone looking to gain a clearer understanding of their credit health while enjoying a secure digital environment. Its most impactful features—real-time credit alerts and personalized credit improvements—are particularly compelling, acting like a dedicated financial assistant in your pocket. Casual users who want straightforward insights and security will find it user-friendly and reassuring, whereas more experienced users can leverage the depth of information for advanced financial planning.

For those new to financial management or wary of digital security threats, Experian offers a balanced blend of ease of use and robust protection, making it a valuable addition to your financial toolkit. Given its thoughtful design, proactive security measures, and focus on user empowerment, it earns a solid recommendation as a trustworthy, insightful, and secure financial application for the modern age.

Pros

Comprehensive credit monitoring

Provides users with detailed credit reports and real-time alerts to track changes.

User-friendly interface

Easy-to-navigate layout that makes understanding credit scores straightforward.

Free basic membership

Offers essential credit information without any cost, accessible to all users.

Customizable alerts

Allows users to set specific notifications for credit changes and suspicious activities.

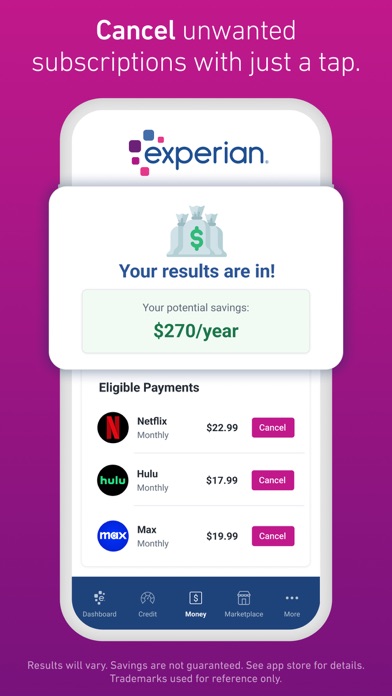

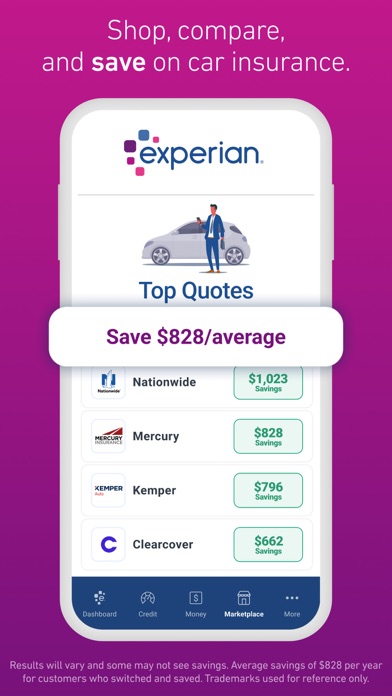

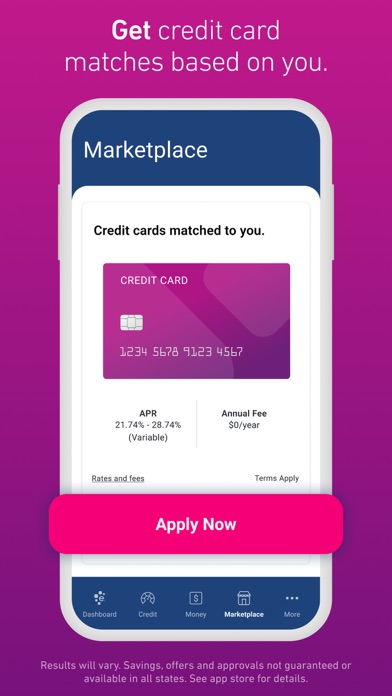

Additional financial tools

Includes resources like debt analysis and credit score improvement tips.

Cons

Limited credit bureau coverage (impact: Medium)

Currently only reports credit data from Experian, limiting a full credit picture; users can consider checking reports from other bureaus for a comprehensive view.

Ads in free version (impact: Low)

Displays advertisements which may disrupt user experience; upgrading to paid plans removes ads, which can be considered for a smoother experience.

Inconsistent update frequency (impact: Medium)

Credit data updates may lag behind actual changes, potentially causing delays in alerts; official updates are expected to improve this shortly.

Limited credit score factors explanation (impact: Low)

Provides overall scores but lacks detailed insights into the specific factors affecting scores; users can access more detail via educational resources or credit counseling.

Basic features restricted without subscription (impact: Low)

Advanced insights and tools are locked behind subscription plans; users can evaluate the value of premium features based on their needs.

Experian®

Version 4.2.6 Updated 2025-12-16