EveryDollar: Budget Planning

EveryDollar: Budget Planning App Info

-

App Name

EveryDollar: Budget Planning

-

Price

Free

-

Developer

Ramsey Solutions

-

Category

Finance -

Updated

2026-01-09

-

Version

2026.1.51

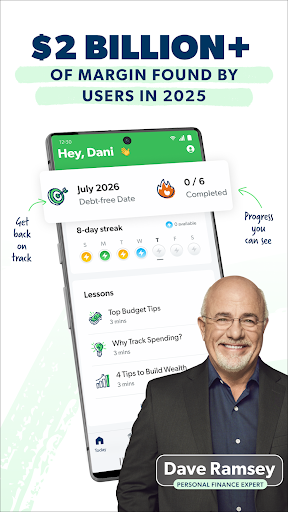

EveryDollar: Budget Planning — A Clean, Intuitive Approach to Managing Your Finances

EveryDollar is a thoughtfully designed budgeting app that aims to simplify personal finance management by providing a user-friendly platform for tracking expenses, setting financial goals, and maintaining control over your money. Developed by the Ramsey Solutions team, it stands out with its focus on zero-based budgeting methodology, making it ideal for those seeking clarity and discipline in their financial lives.

Core Features That Make EveryDollar Shine

1. Zero-Based Budgeting Made Simple

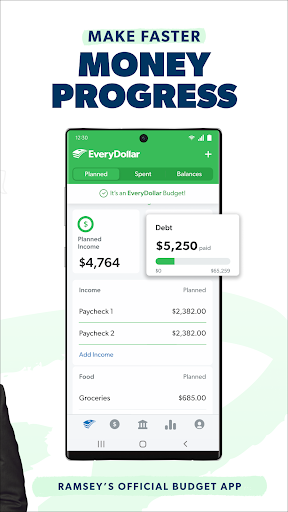

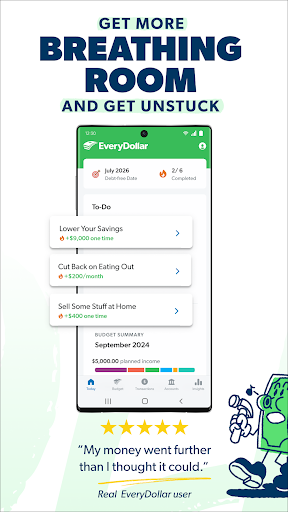

At the heart of EveryDollar is its core feature: zero-based budgeting. This approach assigns every dollar a specific purpose, whether for bills, savings, or leisure, ensuring that income minus expenses equals zero. Unlike traditional budgets that merely track spending, this method encourages proactive planning, helping users allocate funds with precision and confidence. The app offers guided workflows and preset categories, making it easy even for newcomers to adopt this disciplined approach.

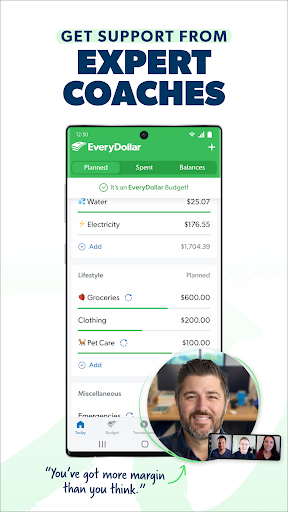

2. Seamless Expense Tracking & Real-Time Financial Overview

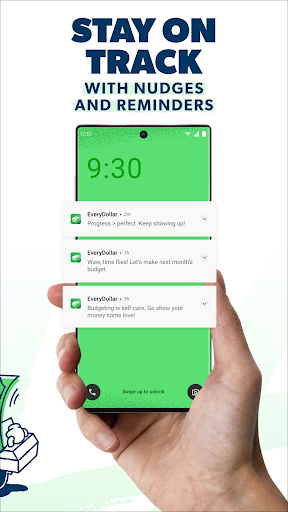

Keeping tabs on your spending becomes effortless with EveryDollar's real-time expense tracking. Users can manually log transactions or connect their bank accounts for automatic updates, depending on the version. The app visualizes budget performance through clean, easy-to-understand charts and summaries, empowering users to see at a glance whether they're on track or need to adjust. This immediate feedback loop encourages more mindful spending habits and enhances overall financial awareness.

3. Goal Setting & Financial Milestones

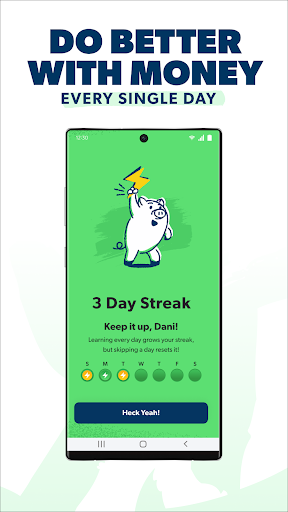

Beyond daily expense management, EveryDollar emphasizes long-term financial aspirations. Users can set personalized goals—such as building an emergency fund, saving for a vacation, or paying off debt—and monitor progress directly within the app. This feature fosters motivation and accountability, turning abstract goals into tangible milestones. The intuitive interface turns goal tracking into an engaging, gamified experience rather than a tedious chore.

User Experience and Design: Smooth Sailing in Financial Waters

The app's interface resembles a well-organized digital ledger—clean, uncluttered, and inviting. Its visual design employs calming colors and straightforward navigation, reminiscent of a friendly financial coach guiding you through your money story. Transitioning between sections feels seamless, with minimal lag or confusion. For those new to budgeting, the app offers walkthroughs and tutorials that flatten the learning curve, making it accessible without overwhelming users. Seasoned budgeters will appreciate the clarity and depth of control without excessive complexity.

Standing Out: What Sets EveryDollar Apart?

While many personal finance apps focus on investment or broad financial tracking, EveryDollar's standout feature lies in its unwavering dedication to zero-based budgeting combined with its emphasis on simplicity and user engagement. Its integration of the “Envelope Method” digitally—allocating funds into virtual envelopes—mimics traditional cash stuffing but adds the convenience of digital access. Moreover, the app prioritizes security of user data and transaction information with strong encryption, giving peace of mind in an era where digital trust is paramount.

Compared to competitors like Mint or YNAB, EveryDollar's unique appeal is its straightforward approach tailored for users who want a disciplined spending plan without the bells and whistles of advanced investment features. Its clear visualization of budget versus actual expenditure, alongside goal tracking, makes for a transparent and empowering experience. This focus on security and simplicity makes it a reliable companion for those serious about controlling their finances without becoming overwhelmed.

Final Verdict & Recommendations

All things considered, I would recommend EveryDollar to anyone looking for a disciplined, easy-to-use budgeting tool—particularly if you're drawn to the zero-based budgeting methodology or want a straightforward approach to managing your household finances. Its intuitive design, real-time expense tracking, and motivational goal-setting features make it a solid choice for beginners and seasoned budgeters alike.

If you value simplicity, transparency, and security in your financial tools, EveryDollar strikes a refreshing balance. However, those seeking more advanced investment tracking or multi-currency support might find it less comprehensive. Overall, it's a friendly financial partner designed to turn budgeting from a chore into a manageable, even somewhat enjoyable, part of your routine.

Pros

Intuitive Interface

User-friendly design makes budget tracking easy for both beginners and experienced users.

Comprehensive Budget Planning Tools

Offers detailed categories and customizable budgets to suit various financial goals.

Automatic Transaction Tracking

Syncs with bank accounts to automatically update transactions, saving time.

Real-Time Spending Insights

Provides instant updates and visual spending summaries for better financial awareness.

Goal Setting and Progress Monitoring

Allows users to set savings goals and track progress to motivate saving habits.

Cons

Limited Free Features (impact: Medium)

Most advanced features require a paid subscription, which might deter casual users.

Mobile App Stability Issues (impact: Medium)

Occasional crashes or slow response times reported on some devices; updating the app can often resolve this.

Lack of Multi-User Support (impact: Low)

Currently does not support shared budgets for couples or families, but this may be added in future updates.

Limited Export Options (impact: Low)

Exporting budget data is available but with fewer formats; users can request more via support channels.

No Investment Tracking (impact: Low)

Primarily focused on expense and income management; integrating investments could enhance functionality, which might be introduced later.

EveryDollar: Budget Planning

Version 2026.1.51 Updated 2026-01-09