EarnIn: Why Wait for Payday?

EarnIn: Why Wait for Payday? App Info

-

App Name

EarnIn: Why Wait for Payday?

-

Price

Free

-

Developer

Activehours Inc.

-

Category

Finance -

Updated

2026-03-01

-

Version

16.32

EarnIn: Why Wait for Payday? An In-Depth Look at a Budding Financial Assistant

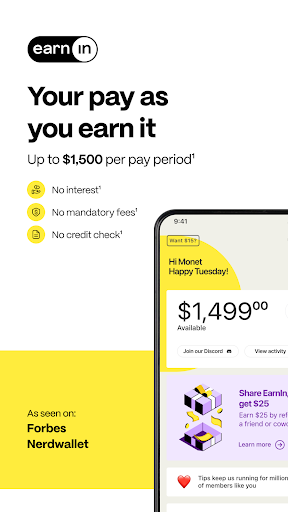

In our fast-paced world, waiting for payday can feel like watching paint dry. EarnIn emerges as a solution — a financial app designed to offer quick access to earnings without the need for traditional loans or credit checks. With its user-centric approach and innovative features, it aims to bridge the gap between work and financial flexibility.

What Is EarnIn and Who's Behind It?

EarnIn is a personal finance application developed by a dedicated team committed to providing on-demand earnings access. Its primary mission? To empower users with greater control over their cash flow, eliminating the stress of waiting for their scheduled paycheck.

Founded by a team of fintech enthusiasts and seasoned developers, EarnIn leverages modern technology to craft a seamless experience centered around transparency and security. It's designed for everyday consumers—particularly gig workers, freelancers, and employees living paycheck-to-paycheck—who seek an easy way to access their earned wages without incurring hefty fees or complicated procedures.

Key Features That Set EarnIn Apart

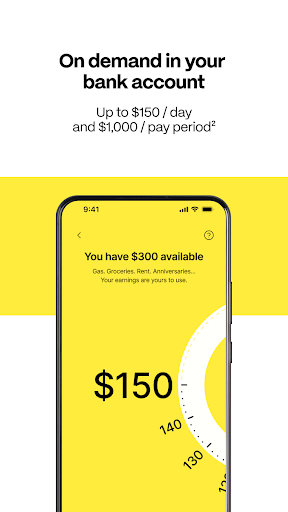

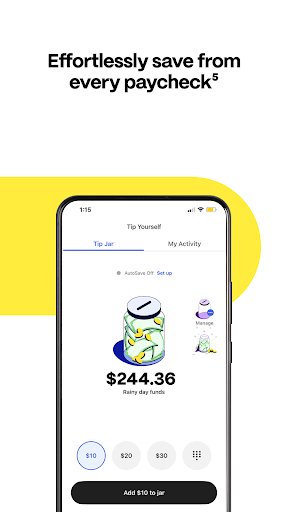

- On-Demand Wage Access: Instead of waiting for payday, users can access a portion of their earned wages immediately, reducing financial stress and avoiding overdraft fees.

- Fee Transparency and No Interest: Unlike payday loans, EarnIn operates with a tip-based model or optional fee structure, promoting fairness and clarity.

- Automatic Earning Tracking: The app intelligently monitors working hours via integrations or user input, ensuring the funds reflect actual work done.

- Security & Privacy: Employing bank-level encryption, it prioritizes transaction and data safety, reassuring users about their personal information.

The app's core appeal lies in providing “earned” money immediately, with minimal fuss and added security—an attractive proposition for modern workers juggling multiple financial needs.

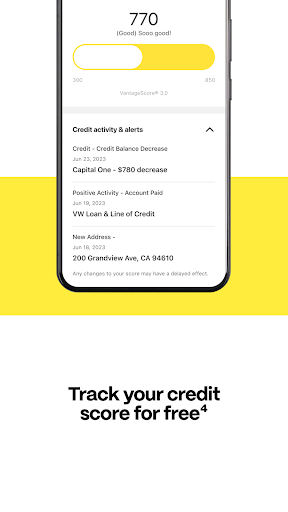

Design and User Experience: Smooth Sailing or Choppy Waters?

From the moment you open EarnIn, it feels like stepping into a well-organized, calming workspace—clean interfaces, intuitive navigation, and straightforward instructions make onboarding a breeze. The design strikes a balance between functionality and friendliness, akin to chatting with a knowledgeable friend who just happens to be a tech wizard.

Functionality-wise, the app is responsive. Whether checking your available funds, requesting an advance, or reviewing transaction history, each action flows naturally with minimal lag. This fluidity means users can manage their finances quickly, whether on a busy commute or during a quick coffee break.

The learning curve is gentle—most features are self-explanatory, supported by tooltips and clear prompts. For new users, the transition from traditional banking to earning-advance concepts might take a moment, but overall, the interface reduces barriers to quick comprehension.

Unique Selling Points: What Makes EarnIn Shine?

Compared with similar financial apps, EarnIn's standout differentiation lies in its commitment to security and transaction transparency. Unlike apps that might obscure fee structures or rely on credit checks, EarnIn clearly communicates how it operates, allowing users to make informed choices. Its security measures—bank-level encryption and secure servers—are on par with traditional financial institutions, fostering trust.

Another notable feature is the app's focus on ease of use. The process to request funds is streamlined, often completed within a few taps. Transacting feels akin to a smooth ride on a well-paved road—no rough patches, no confusing detours.

While some competitors rely heavily on interest or fees, EarnIn's tipping model and clear policy promote fairness. This transparency strengthens user confidence and makes it a responsible choice for everyday financial management.

Final Verdict: Should You Give EarnIn a Try?

In summary, EarnIn offers a practical, user-friendly solution to the common plight of waiting for payday, especially suited for those who value transparency and security. Its most compelling feature—immediate access to earned wages—is a game-changer for financial flexibility. The app's design ensures that even first-time users will find it approachable, making it accessible for a broad audience.

We recommend EarnIn especially for gig workers, shift-based employees, or anyone who wishes to avoid overdraft fees and manage cash flow more effectively. While it may not replace traditional savings or credit options, it fills an important niche—delivering peace of mind with a few simple taps. Overall, EarnIn earns a solid recommendation for those seeking a trustworthy way to bridge the gap between work and pay.

Pros

Immediate access to earned wages

Users can withdraw their accrued earnings before payday, helping manage urgent expenses.

No traditional interest charges

EarnIn operates without late fees or interest, making it a budget-friendly alternative to payday loans.

User-friendly interface

The app offers a simple and intuitive design, making it easy for users of all ages to navigate.

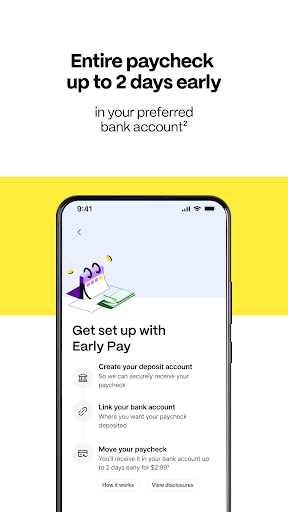

Integration with bank accounts

Seamless linking with your bank accounts allows for real-time earnings tracking and withdrawals.

Financial wellness features

Includes tips and resources to help improve budgeting and savings habits.

Cons

Limited fee transparency for some transactions (impact: low)

While most withdrawals are free, occasional fees or tipping options may cause confusion.

Requires linkage to qualifying bank accounts (impact: mid)

Not all banks are supported, which may restrict some users from using all features.

Withdrawal limits per pay period (impact: mid)

There are caps on how much can be accessed early, potentially limiting larger urgent needs.

Potential for overspending (impact: low)

Easy access might encourage some users to overspend before their actual paycheck.

Dependence on consistent income patterns (impact: mid)

The app's functionality assumes regular earnings, which may not suit gig or irregular workers.

EarnIn: Why Wait for Payday?

Version 16.32 Updated 2026-03-01