Dovly: Grow your Credit Score

Dovly: Grow your Credit Score App Info

-

App Name

Dovly: Grow your Credit Score

-

Price

Free

-

Developer

Dovly.com

-

Category

Finance -

Updated

2025-11-25

-

Version

7.0.13

Introducing Dovly: Grow Your Credit Score

In today's financial landscape, building and maintaining a good credit score is akin to laying a sturdy foundation for your financial future. Dovly aims to be your smart, personalized guide along this journey, helping you understand and improve your credit health effectively. Developed by a dedicated team of financial technology experts, this app combines innovative features with user-friendly design, making credit management less daunting and more empowering. Whether you're just starting out or looking to improve an existing score, Dovly positions itself as a reliable partner for your financial growth.

Key Functional Highlights That Set Dovly Apart

- Personalized Credit Growth Plans: Dovly analyzes your credit reports to craft tailored strategies, directing your efforts where they matter most.

- Real-Time Credit Monitoring & Alerts: Stay ahead with timely notifications about changes, potential errors, or suspicious activities on your credit report.

- Comprehensive Education and Actionable Tips: Beyond just tracking, Dovly educates users with easy-to-understand insights and clear steps to improve credit health.

- Robust Security & Privacy Measures: Emphasizing data security, Dovly ensures your sensitive information remains protected with bank-grade encryption and transparent data policies.

A Fresh Perspective on Credit Management

Picture this: your credit journey resembles navigating a labyrinth—full of twists, turns, and dead ends. Dovly acts like a reliable GPS, guiding you with precision and clarity. From the moment you open the app, you're greeted with a clean, intuitive interface that feels more like a friendly dashboard than a daunting financial tool. The onboarding process is straightforward; even newcomers can get their bearings with just a few taps. The app's design is sleek and minimalist, with color schemes that soothe and visuals that clarify rather than complicate.

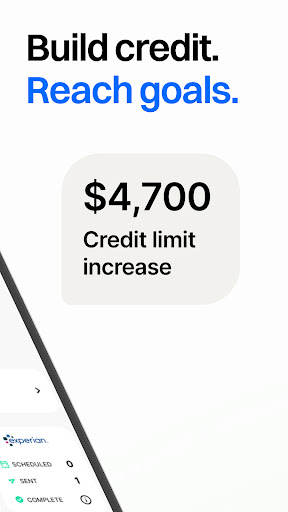

Core Functionality 1: Personalized Credit Growth Plans

One of Dovly's standout features is its ability to analyze your unique credit profile and generate customized action plans. Unlike generic advice that applies to everyone, Dovly digs into your specific credit report data—things like payment history, credit utilization, and recent inquiries—to identify the most impactful strategies. The app presents these steps in digestible chunks, complete with explanations and timelines, transforming the credit building process into an achievable, strategic game. It's like having a financial coach whispering tailored tips directly into your ear, helping you focus your efforts where they will yield the best results.

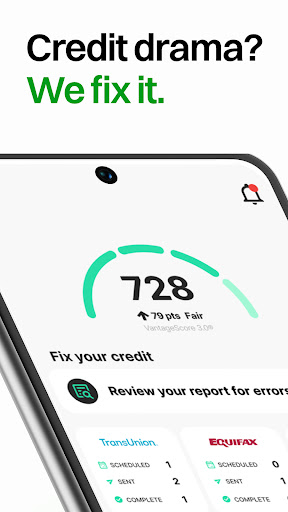

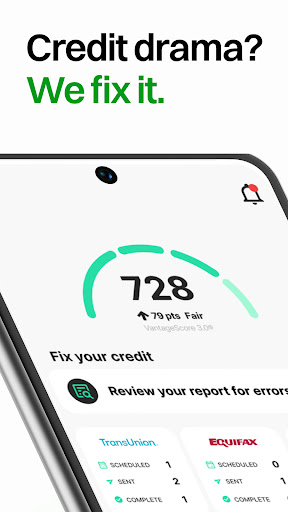

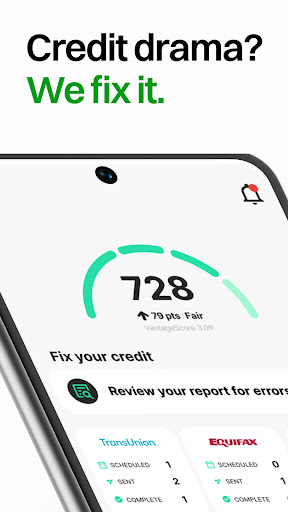

Core Functionality 2: Real-Time Monitoring & Alerts

Monitoring your credit shouldn't be a one-and-done task; it requires vigilance. Dovly excels here, offering real-time updates that keep you in the loop about any changes or potential red flags. The notifications are timely and unobtrusive, alerting you if a new credit inquiry appears or if your credit score dips unexpectedly. This proactive approach acts like a security alarm for your financial health, helping you catch errors or fraudulent activities early. Users have praised how this feature reduces anxiety—knowing that your credit profile is under constant watch feels like having a vigilant guardian on your side.

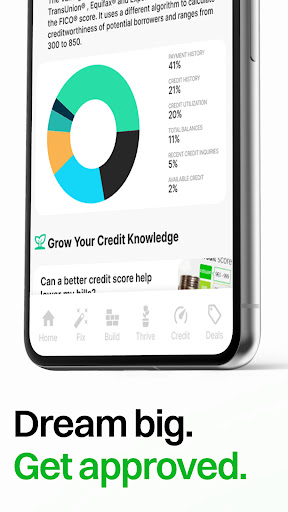

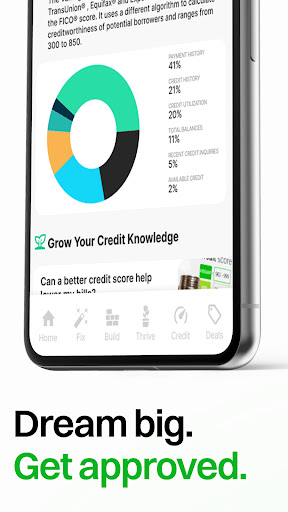

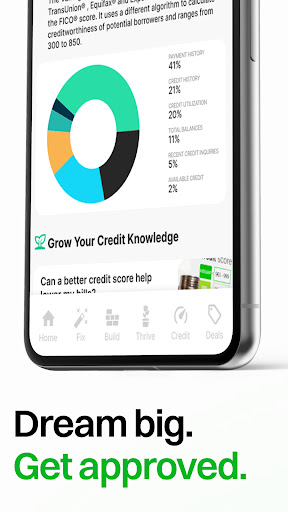

Core Functionality 3: Education and Actionable Tips

Understanding the nuances of credit can be as confusing as deciphering a foreign language. Dovly simplifies this by providing clear, digestible educational content alongside actionable advice. Whether it's understanding the impact of paying down balances or the importance of diverse credit types, the app makes learning engaging and practical. Daily tips, explanations, and step-by-step instructions turn financial education from a chore into an empowering experience. It's like having a friendly financial mentor walking you through the journey, building your confidence with each interaction.

User Experience and Differentiation

Navigation within Dovly feels smooth, akin to gliding down a well-paved road—clicks respond swiftly, and the interface maintains clarity even in complex sections. The learning curve is gentle, making it accessible for users with little prior financial knowledge, yet comprehensive enough for those wanting detailed insight. The app's visual hierarchy and straightforward layouts contribute significantly to its ease of use.

In terms of security, Dovly stands out by emphasizing data privacy. It employs bank-level security protocols and transparent privacy policies, assuring users that their sensitive information remains protected. Like a secure vault, your credit data is safeguarded against breaches, which is especially critical in an age of rising cyber threats.

Compared to other financial apps that focus mainly on tracking or basic advice, Dovly's unique strength lies in its personalized, actionable plans combined with continuous, real-time monitoring. This dual approach ensures users don't just see their credit score fluctuate—they understand why and learn how to influence it proactively. Its educational focus paired with robust security makes it more than just a tool—it's a trustworthy companion on your credit-building journey.

Final Recommendation and Usage Tips

I would recommend Dovly to anyone eager to understand and improve their credit score without feeling overwhelmed. It suits beginners looking for guidance and experienced users seeking a comprehensive overview of their credit health. For best results, consider integrating Dovly into your monthly financial routine—review your personalized plan, stay alert to notifications, and utilize the educational resources regularly. This consistent engagement will help you build a solid credit foundation while keeping your financial confidence buoyant.

In conclusion, Dovly combines personalization, security, and educational empowerment into a seamless experience. Its standout features—especially the tailored growth plans and real-time alerts—are like having a financial coach and security guard rolled into one, making your path to a better credit score clearer and safer. As a trusted friend in the digital age of finance, Dovly is worth exploring for anyone serious about growing their financial strength.

Pros

User-Friendly Interface

The app offers an intuitive and clean layout, making it easy for users to navigate and understand their credit report.

Effective Credit Monitoring

Provides real-time updates on credit score changes, helping users stay informed about their financial health.

Personalized Credit Tips

Offers tailored advice based on your credit profile to help you improve your score more efficiently.

Educational Resources

Includes helpful articles and explanations about credit scoring and financial management, beneficial for beginners.

Free Basic Service

Allows users to access core features without any subscription fee, making it accessible for many users.

Cons

Limited Credit Report Details (impact: Low)

The app provides simplified credit reports which may omit some comprehensive data available elsewhere.

Delayed Credit Score Updates (impact: Medium)

Credit scores might not update instantly after major financial changes; users may need to wait for refresh cycles.

Premium Features Require Subscription (impact: Medium)

Advanced insights and tools are locked behind a paywall, which could be a barrier for some users.

Limited Customer Support (impact: Low)

Support options are mainly automated or email-based, leading to potential delays in assistance.

Occasional App Glitches (impact: Low)

Some users have reported minor bugs or crashes, though updates are regularly released to address these issues.

Dovly: Grow your Credit Score

Version 7.0.13 Updated 2025-11-25