DailyPay On-Demand Pay

DailyPay On-Demand Pay App Info

-

App Name

DailyPay On-Demand Pay

-

Price

Free

-

Developer

DailyPay Inc

-

Category

Finance -

Updated

2025-11-04

-

Version

37.0.0

Introducing DailyPay On-Demand Pay: Your Flexible Pay Solution

DailyPay On-Demand Pay is a financial app designed to give employees instant access to their earned wages, helping to reduce financial stress and improve overall financial wellbeing.

Developer & Core Highlights

Developed by DailyPay Inc., a company known for innovative payroll solutions, this app boasts features such as real-time wage access, seamless integration with employer payroll systems, and robust security measures. Its main strengths include immediate wage withdrawal options, simple and clear user interface, and enhanced security protocols that protect user funds and data.

Target Audience

The app primarily targets employed individuals across various sectors who want more control over their paychecks, especially those living paycheck to paycheck or facing sudden financial needs. It appeals to companies aiming to support employee financial wellness through added benefit solutions.

A Fresh Take on Pay Flexibility: Why DailyPay Stands Out

Imagine being able to access your earned wages instantly after a long week rather than waiting until traditional paydays—DailyPay On-Demand Pay offers exactly that. Its user-friendly approach transforms a typical payroll experience into an empowering financial tool, turning the once static act of paycheck collection into a dynamic, on-demand service. Whether you're managing unexpected expenses or simply prefer better cash flow management, this app aims to be your financial lifeline—quietly reliable, straightforward, and secure.

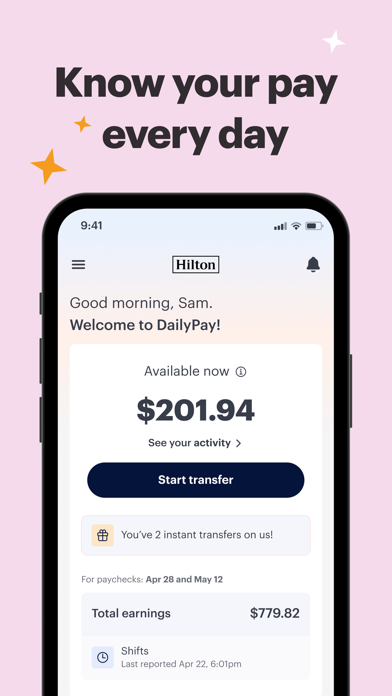

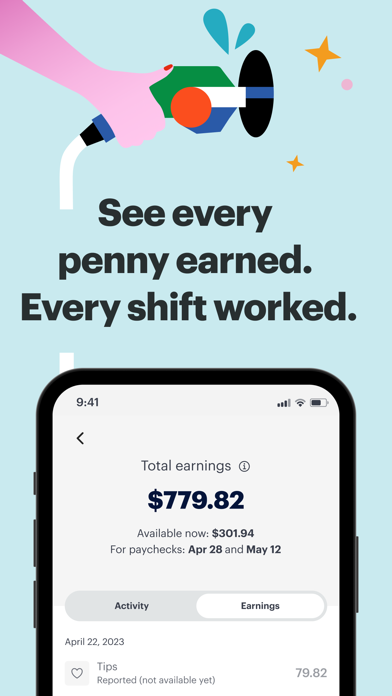

Core Functionality 1: Real-Time Wage Access

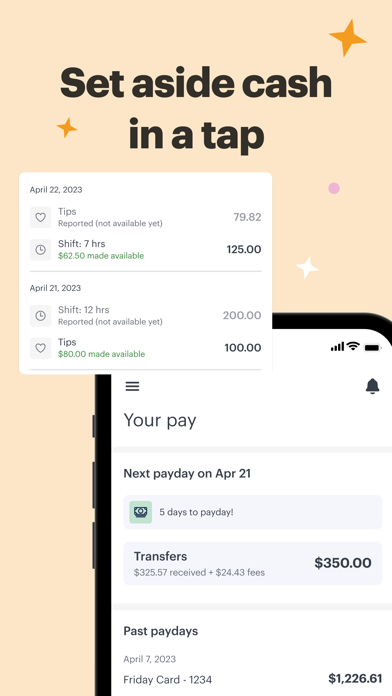

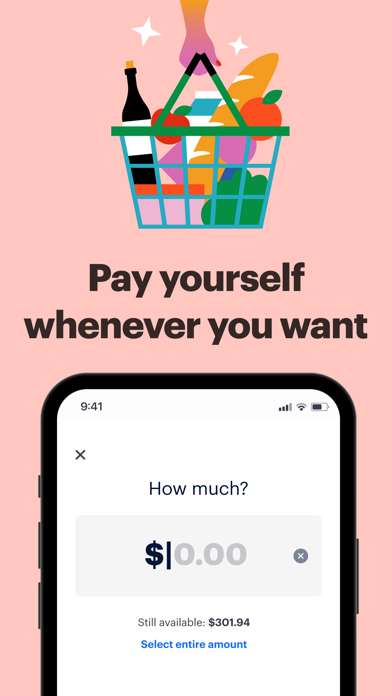

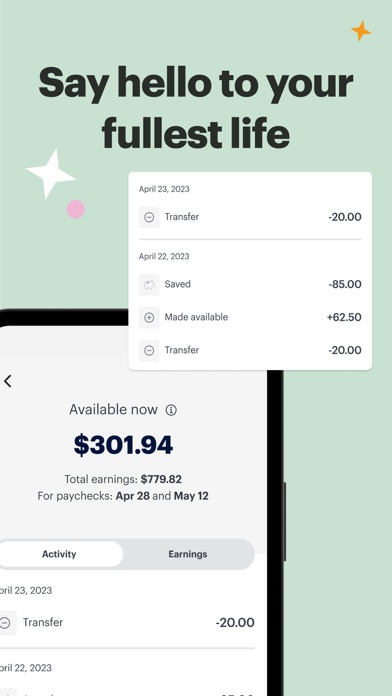

The standout feature of DailyPay is its ability to provide employees with immediate access to their earned wages. Unlike traditional pay systems, which only release funds biweekly or monthly, this app offers a flexible solution—think of it like having a financial safety net that can be pulled out in moments of need. Users can view their available earnings in real-time and transfer a portion or all of it directly to their bank accounts or digital wallets within minutes.

This feature is especially helpful for those facing urgent bills or unexpected expenses, effectively reducing reliance on costly payday loans or overdraft fees. The process is straightforward: after logging into the app, users review their accrued wages, select the amount they wish to withdraw, and confirm the transfer. The entire process feels seamless, almost like popping a quick cash button—prompt, simple, and hassle-free.

Core Functionality 2: Seamless Payroll Integration & Employer Support

One of DailyPay's key highlights is its smooth integration with existing payroll systems of partner companies. For employers, this means they can offer on-demand pay benefits without overhauling their current payroll infrastructure. The app syncs securely with payroll data, ensuring that wage information is accurate and immediately reflected on the employee interface.

Employees benefit from transparent visibility into their accrued earnings, providing them with greater financial awareness. For HR teams and payroll administrators, the backend system offers easy management, reporting, and compliance tools. This ecosystem simplifies the administrative process and encourages broader adoption among organizations seeking to improve employee satisfaction and retention through financial wellness initiatives.

User Experience & Differentiators: Designed with Simplicity & Security

From a user experience standpoint, DailyPay exemplifies clarity and ease of use. Its interface features intuitive navigation, clear digital labels, and minimal clutter, turning the app into a conversational companion rather than a confusing toolbox. The onboarding process is quick, with helpful prompts guiding new users through their first transfers, reducing the typical learning curve associated with financial apps.

In terms of security, DailyPay prioritizes funds and data safety. Its robust encryption protocols and multi-factor authentication ensure that users' personal and financial information, along with their earnings, are well protected. Compared to other finance apps that may treat funds as just another digital asset, DailyPay emphasizes account and fund security as a core feature—providing peace of mind alongside flexible pay options.

Another unique aspect is the transaction experience: transfers are fast, predictable, and reliable. Whether a user transfers funds at noon or midnight, the system handles their requests efficiently, making the app feel like a trusted financial partner. This reliability makes it stand out amidst a crowded field of on-demand pay platforms that sometimes struggle with delays or inconsistencies.

Final Verdict & Recommendations

Overall, DailyPay On-Demand Pay is a thoughtfully designed, reliable solution for employees seeking greater control over their financial lives. Its most compelling features—instant wage access coupled with seamless, secure integration—offer tangible benefits that can make a real difference during financial emergencies or cash flow management.

For employers, integrating DailyPay can enhance employee satisfaction and loyalty, positioning their workplace as caring and progressive. For individual users, particularly those facing financial strain, it's a convenient and safe tool worth trying—especially if you value quick access to your earned income without the pitfalls of traditional payday loans or overdrafts.

While the app may require some initial setup and understanding of its features, its user-centric design and robust security measures make it a trustworthy choice in the on-demand pay space. I recommend it for anyone looking to make their paycheck a more flexible and reliable resource—think of it as turning your payroll from a static paycheck into a living, breathing part of your financial toolkit.

Pros

Immediate access to earned wages

Users can withdraw their pay instantly after earning, helping manage cash flow more effectively.

User-friendly interface

The app features an intuitive design that makes navigation and fund management straightforward.

Low or no fees for basic transactions

Most withdrawals are fee-free, making it cost-effective for users frequently accessing their pay.

Integration with multiple payroll systems

Supports various employers, broadening its usability for a diverse user base.

Budgeting and financial planning tools

Includes features that help users track expenses and plan their finances better.

Cons

Limited availability outside the US (impact: Medium)

The app is primarily designed for US users, which restricts international users from benefiting.

Potential fees for rapid withdrawals beyond free limits (impact: High)

Excessive use of instant cashouts may incur charges; official plans to introduce more free options are underway.

Dependence on employer payroll integration (impact: Medium)

Requires employer onboarding to access on-demand pay, which might delay set-up for some users.

Limited customer support channels (impact: Low)

Support is mainly through chat or email, which could be slow during busy periods; improvements are planned for real-time support.

Some users may experience delays in fund transfer (impact: Medium)

Despite instant withdrawal features, occasional processing delays can occur, but official updates expect to improve reliability.

DailyPay On-Demand Pay

Version 37.0.0 Updated 2025-11-04