Credit Sesame: Grow your score

Credit Sesame: Grow your score App Info

-

App Name

Credit Sesame: Grow your score

-

Price

Free

-

Developer

Credit Sesame, Inc.

-

Category

Finance -

Updated

2026-02-12

-

Version

7.24.1

Introduction to Credit Sesame: Grow Your Score

In today's credit-driven world, maintaining a healthy credit score is akin to having a reliable compass guiding you through financial decisions. Credit Sesame offers a user-friendly platform that empowers individuals to understand and improve their credit profiles with ease. Developed by Credit Sesame Inc., this app focuses on providing comprehensive credit insights, score monitoring, and personalized financial advice—all conveniently on your mobile device.

Key Features That Make a Difference

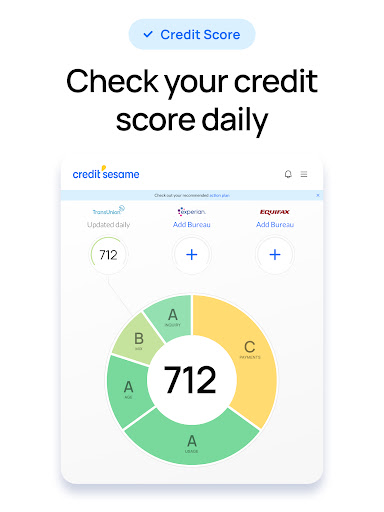

1. Real-Time Credit Score Monitoring and Insights

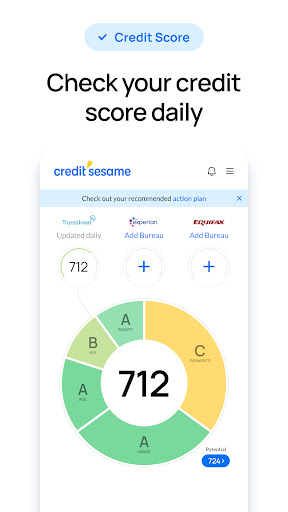

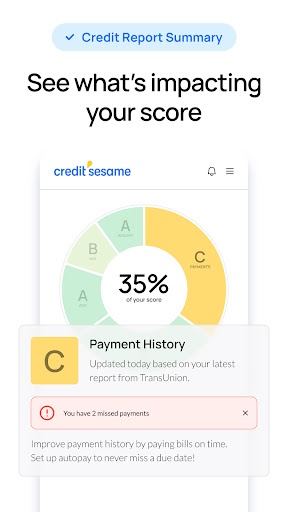

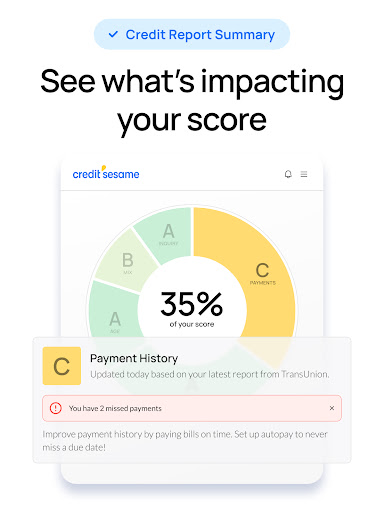

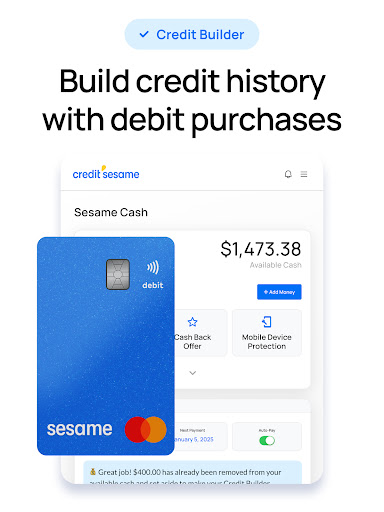

Imagine having a financial dashboard that updates in real-time, giving you a clear picture of your credit health at any moment. Credit Sesame excels here by offering free access to your credit score, along with detailed explanations of what factors are influencing it. The app pulls data from major credit bureaus, ensuring that users receive accurate and timely updates. This continuous monitoring acts as a safety net, catching any sudden score changes that might signal identity theft or errors, similar to a vigilant guardian watching over your financial wellbeing.

2. Personalized Recommendations to Grow Your Score

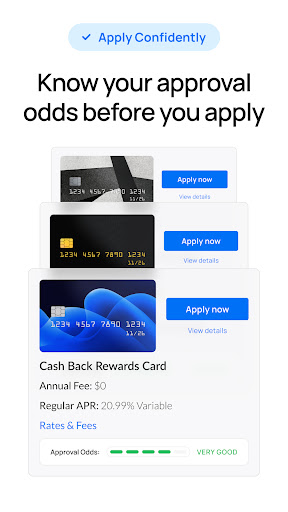

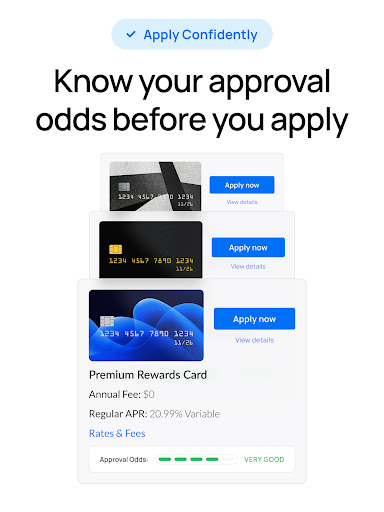

What makes Credit Sesame truly stand out is its tailored approach. After analyzing your credit report, the app provides specific, actionable advice—whether it's paying down high balances, disputing inaccuracies, or suggesting suitable credit products. This personalized coaching transforms complex credit concepts into straightforward steps, making the journey toward a better score feel like a guided adventure rather than an intimidating maze. It's like having a financial coach whispering helpful tips into your ear as you navigate your credit landscape.

3. Credit and Identity Security Features

Security is a cornerstone of trust, especially when managing sensitive financial data. Credit Sesame offers robust security measures, including data encryption and fraud alerts, to ensure that your information remains safe. Additionally, the app monitors your credit report for suspicious activity, acting as a vigilant security guard. This proactive stance is particularly valuable in today's digital environment where identity theft risks are ever-present, setting Credit Sesame apart from some of its peers by prioritizing user safety as a key feature.

User Experience: Interface, Usability, and Learning Curve

From first launch, Credit Sesame presents a clean, intuitive interface resembling a well-organized financial dashboard. Bright visuals and straightforward navigation make it easy for users—whether finance novices or experienced individuals—to access key features without feeling overwhelmed. The app operates smoothly, with rapid data refreshes that minimize waiting times, akin to a well-oiled engine running quietly but powerfully. The learning curve is gentle; helpful tooltips and comprehensive FAQs guide new users through initial setup and understanding of credit metrics, turning what could be an intimidating topic into an accessible, even engaging, experience. This thoughtful design ensures users stay motivated to check in regularly and learn more about their credit.

What Sets Credit Sesame Apart?

While many financial apps focus solely on tracking scores or offering generic suggestions, Credit Sesame's unique strength lies in its integrated approach—combining real-time monitoring with personalized advice and robust security measures. Its ability to provide actionable insights tailored specifically to each user's credit profile helps to demystify the often complex world of credit scoring. Moreover, its emphasis on security, offering fraud monitoring and data encryption, adds an extra layer of reassurance that many competitors lack. This holistic approach makes Credit Sesame feel less like an app and more like a trusted financial partner helping you grow your financial health systematically.

Final Recommendations and Usage Tips

Considering its comprehensive features and user-centric design, I would recommend Credit Sesame for anyone eager to take control of their credit. Whether you're just starting to build credit or aiming to improve an already decent score, the app offers valuable tools to support your goals. For best results, set up notifications to stay aware of score changes and check the personalized advice regularly. Also, integrating the app's insights into your broader financial habits—like paying bills on time and managing debts—will amplify its benefits.

In conclusion, Credit Sesame stands out as a trustworthy, insightful, and user-friendly tool that transforms the often-daunting world of credit management into a manageable and even motivating journey. Its standout features—real-time score updates coupled with customized growth strategies—make it a must-have app for anyone committed to financial wellness. For those seeking a safe, informative, and empowering credit app, Credit Sesame is certainly worth trying out.

Pros

Comprehensive Credit Monitoring

Provides a detailed view of your credit score and factors affecting it, helping users understand their financial health.

Free Credit Score Updates

Offers real-time updates without hidden fees, enabling continuous tracking without subscription costs.

Personalized Tips for Improvement

Includes tailored advice on how to boost your credit score, making it actionable for users.

Loan and Credit Card Offers

Recommends financial products suited to your credit profile, streamlining the application process.

User-Friendly Interface

Features an intuitive design that makes credit management accessible for all users.

Cons

Limited Credit Report Details (impact: Medium)

Does not display the full credit report like some competitors, which may limit in-depth analysis.

Data Update Delays (impact: Low)

Credit scores might not refresh instantly after certain financial activities, leading to outdated information.

Inconsistent Credit Score Models (impact: Low)

Uses different scoring models which might cause discrepancies compared to other credit bureaus.

Limited Credit Monitoring for Non-US Users (impact: Low)

Primarily focuses on US credit data; international users may experience limited features.

Additional Features Require Paid Plans (impact: Medium)

Some advanced monitoring tools are only available through paid subscriptions, which could be a barrier.

Credit Sesame: Grow your score

Version 7.24.1 Updated 2026-02-12