Concora Credit

Concora Credit App Info

-

App Name

Concora Credit

-

Price

Free

-

Developer

Concora Credit

-

Category

Finance -

Updated

2026-02-17

-

Version

3.0.9

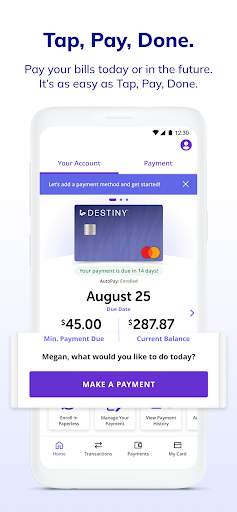

Concora Credit: Your Trusted Companion for Seamless Financial Management

Concora Credit is a thoughtfully designed financial app that aims to simplify personal banking and credit management. Developed by a dedicated team passionate about empowering users with secure and intuitive financial tools, it stands out in the crowded fintech space by blending comprehensive features with a user-friendly experience. Whether you're tracking expenses, managing credit scores, or making transactions, Concora Credit positions itself as your reliable and efficient financial sidekick.

Core Features That Make a Difference

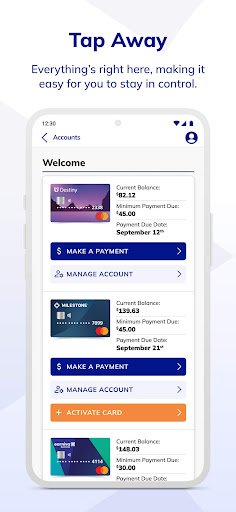

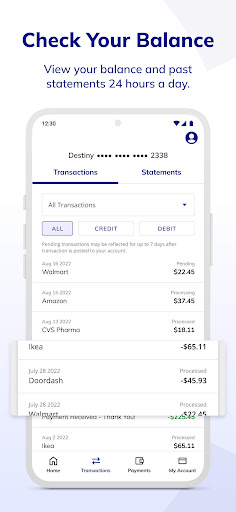

1. Unified Dashboard with Real-Time Insights

Imagine having a cockpit view of all your financial activities at a glance—that's exactly what Concora Credit offers. Its sleek dashboard aggregates your bank accounts, credit cards, and loans, providing real-time updates on balances, upcoming payments, and expenditure patterns. This holistic overview means no more juggling multiple apps or accounts; everything you need is consolidated in one intuitive interface, helping you make smarter financial decisions day by day.

2. Enhanced Security with Account and Fund Safeguarding

Security is the cornerstone of any financial app, and Concora Credit takes this seriously. It employs bank-level encryption, multi-factor authentication, and biometric login, ensuring your sensitive information remains protected. What sets it apart is its proactive fraud detection system that monitors account activities for suspicious transactions, alerting users instantly. This layered approach gives users peace of mind, knowing their funds and personal data are in safe hands—crucial for those wary of digital financial risks.

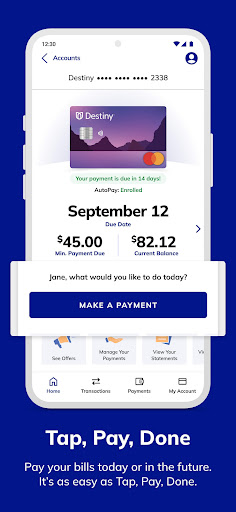

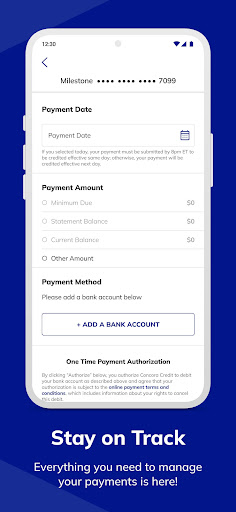

3. Smarter Transaction Experience with Personalized Recommendations

Transacting in Concora Credit feels as smooth as gliding on ice; it's streamlined and remarkably intuitive. Beyond basic transfer options, the app offers personalized insights—such as optimal times to pay bills to avoid fees or suggestions for better saving plans based on your spending habits. Its AI-driven algorithms adapt to your financial behaviors, making every transaction smarter. This feature transforms routine payments into opportunities for savings and financial growth, standing out among competitors that mainly offer transactional functions without personalization.

User Experience: Smooth Sailing or Rough Waters?

From the moment you open Concora Credit, it's like stepping into a well-designed financial cockpit. The interface is clean, with a color palette that's calming yet professional—think of a sleek, modern cockpit with intuitive controls. Navigation is seamless; toggling between accounts, viewing detailed transaction histories, or adjusting settings feels effortless, thanks to thoughtful design choices. The learning curve is gentle—users familiar with basic banking apps will find it easy to get started, while newcomers will appreciate guided tutorials that introduce core features gradually.

Transaction processing is remarkably fluid. Transfers initiate swiftly, with confirmation prompts that reassure users their actions are deliberate. The app's responsiveness ensures that even during peak times, operations remain smooth, reducing frustration often associated with slower financial apps.

Compared to other finance apps, Concora Credit's emphasis on security and personalized transaction advice elevates the user experience. While many competitors focus solely on fund management, this app integrates security and tailored insights into a cohesive whole, making everyday financial interactions safer and smarter.

What Makes Concora Credit Stand Out?

The standout feature of Concora Credit lies in its dual commitment to security and personalized transaction insights. Its advanced fraud detection and real-time monitoring build a fortress around your funds, a feature that instills confidence in users wary of digital risks. Simultaneously, its AI-driven personalized recommendations turn mundane transactions into opportunities for financial optimization, which is still somewhat rare among similar apps.

Recommendation and Usage Tips

Overall, I would recommend Concora Credit to anyone seeking a reliable, easy-to-use, and secure financial management tool. It's especially suitable for users who value privacy and proactive financial advice, as well as those who want an all-in-one platform to track and manage their finances effortlessly.

For best results, start by linking all your bank accounts and credit cards to get a complete financial snapshot. Explore the personalized insights after a week to identify spending patterns and savings opportunities. Regularly enable transaction alerts and security notifications—these are your safety nets for peace of mind. As you grow more comfortable with the platform, you'll find its features can genuinely help you build healthier financial habits without feeling overwhelmed.

In conclusion, Concora Credit offers a thoughtfully curated experience that balances security, ease of use, and intelligent features, making it a worthy choice for those wanting a smarter way to handle their personal finances. Its unique focus on combining robust security with personalized insights truly sets it apart and deserves a solid spot on your fintech app shortlist.

Pros

User-Friendly Interface

Concora Credit offers an intuitive layout that makes navigation easy for both beginners and experienced users.

Real-Time Credit Monitoring

The app provides instant updates on credit scores and reports, enabling timely financial decisions.

Comprehensive Credit Analysis

Includes detailed insights and personalized suggestions to improve credit health.

Secure Data Protection

Employs advanced encryption methods to safeguard user information.

Additional Financial Tools

Offers budgeting features and debt management tips integrated within the app.

Cons

Limited Free Features (impact: Medium)

Some advanced analysis tools are only accessible through a paid subscription, which might be a barrier for casual users.

Occasional Data Sync Delays (impact: Low)

Real-time updates can sometimes experience short delays due to server loads; users can try reloading or reinstalling the app.

Limited Support for Certain Credit Agencies (impact: Medium)

Currently, the app mainly integrates with major credit bureaus, which may exclude some regional agencies; official updates are expected to broaden support.

Learning Curve for Advanced Features (impact: Low)

New users may need time to fully understand all available tools; tutorials within the app can help ease this process.

Battery Consumption (impact: Low)

The app uses significant background data which might drain device power faster; users are advised to monitor usage or disable certain features when needed.

Concora Credit

Version 3.0.9 Updated 2026-02-17