Classic Netspend

Classic Netspend App Info

-

App Name

Classic Netspend

-

Price

Free

-

Developer

NetSpend

-

Category

Finance -

Updated

2025-12-08

-

Version

7.0.4

Unlocking Financial Simplicity: An In-Depth Look at Classic Netspend

If you're searching for a straightforward, user-friendly prepaid card management app, Classic Netspend offers a compelling option that balances functional depth with ease of use. Developed by Netspend Corporation, this app promises to streamline your everyday financial transactions, making managing your prepaid card more accessible than ever before.

Who's Behind the Curtain?

Developed by the well-established Netspend Corporation, a leader in prepaid card services, the Classic Netspend app benefits from extensive industry experience and a focus on customer-centric design. Their goal is to simplify financial management for everyday users, especially those seeking an alternative to traditional banking options.

Key Features That Make a Difference

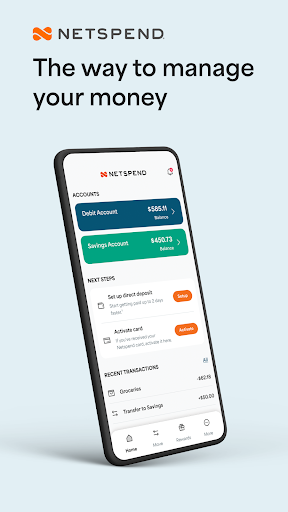

- Real-Time Balance Tracking: Instantly view your current card balance and recent transactions, keeping you in control without any guesswork.

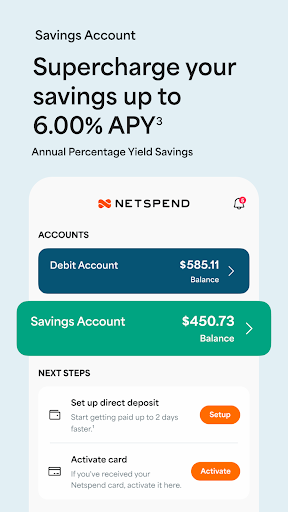

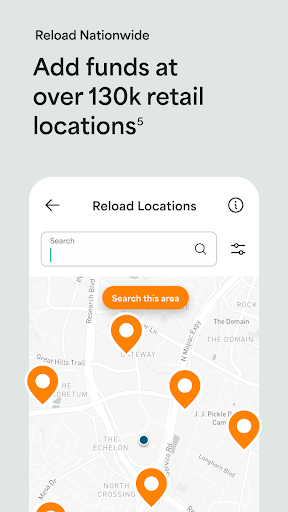

- Easy Funds Reload & Transfer: Load money onto your prepaid card swiftly via linked bank accounts or transfer funds between accounts seamlessly.

- Robust Security Measures: Features like multi-layered authentication and Secure PIN management safeguard your funds and personal data.

- Instant Transaction Notifications: Receive alerts for every spend or deposit, so you're always aware of your financial activity.

Vibrant and Intuitive Interface

Imagine navigating a well-lit, organized workspace where everything appears exactly where you need it—this sums up the user experience on Classic Netspend. The app's design employs a clean layout with intuitive icons and straightforward menus, making it as easy as flipping through a well-structured notebook. Whether you're a tech novice or a seasoned smartphone user, the learning curve is gentle. New users can get started within minutes, thanks to clear instructions and guided onboarding. The smooth fluidity in animations and transitions contributes to a satisfying experience, akin to gliding effortlessly on a well-paved road.

Core Functionalities Explored

Managing Funds with Confidence

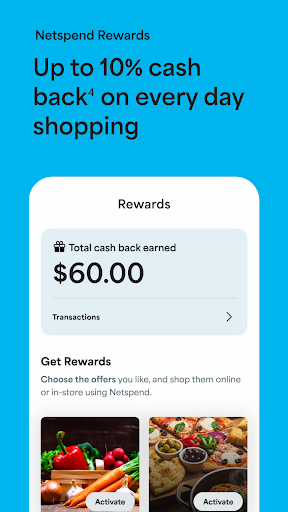

The standout feature of Classic Netspend is its real-time balance tracking coupled with instant notification alerts. This duo turns your phone into a command center for your finances—imagine having a financial guardian angel watching over your funds 24/7. Loading money is a breeze; a few taps connect you to your bank account or convenient reload stations, turning a chore into a simple task. Moreover, the ability to transfer funds between your own accounts or authorized contacts adds flexibility, turning your device into a mini-biscalculator for financial movement.

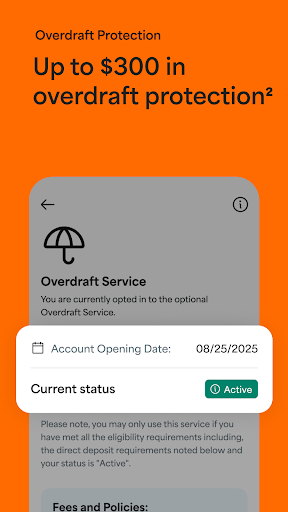

Enhanced Security for Peace of Mind

Beyond convenience, security is paramount. Classic Netspend excels here by integrating multi-factor authentication, secure PIN access, and encrypted data transmission. These features work together to thwart unauthorized access, much like a digital lockbox that only you can open. The app also provides options for setting transaction limits and fraud alerts, giving users extra layers of control. Compared to other finance apps that may overlook security nuances, Netspend's dedicated approach ensures users feel safe in their digital financial environment.

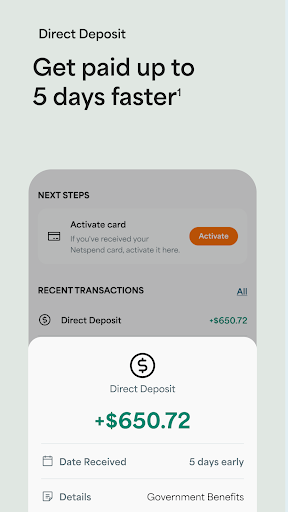

Customer-Centric Transaction Experience

Every transaction feels seamless, akin to sliding down a well-oiled ramp. The transaction history is detailed yet easy to parse, helping you track expenses effortlessly. Alerts keep you updated in real-time, so you're never caught off guard, whether it's a small coffee purchase or a significant transfer. This consistent, transparent feedback builds trust and makes managing your prepaid funds less stressful and more transparent than many counterparts, which sometimes bury details in complex menus.

Final Recommendations: Is It Worth a Try?

Overall, Classic Netspend strikes a commendable balance between simplicity and robustness. Its flagship features, especially the real-time balance updates and layered security, set it apart in the crowded prepaid management app space. If you're someone who values clarity, assurance, and straightforward tools to handle everyday financial transactions, this app is worth considering. It's particularly suitable for users who prefer a no-fuss, transparent experience without sacrificing security. However, for those seeking advanced investing tools or extensive budgeting features, you might find other apps more comprehensive.

In summary, think of Classic Netspend as your reliable financial assistant—easy to operate, a trusted partner for everyday fund management, and a secure platform you can count on. Whether you're reloading funds for daily expenses or just keeping track of your prepaid card activity, this app offers an elegant, no-surprises approach to financial management—friendly, professional, and above all, dependable.

Pros

User-friendly interface

The app offers an intuitive layout that makes managing cards and transactions straightforward for users.

Robust security features

Classic Netspend employs encryption and fraud detection measures to protect user data and finances.

Wide availability

The app supports various card types and is accessible across multiple devices and platforms.

Real-time transaction updates

Users receive instant notifications for transactions, helping them stay aware of their account activity.

Good customer support

The app provides multiple contact options and helpful FAQ sections for troubleshooting issues.

Cons

Occasional app crashes (impact: medium)

Some users experience crashes during login or transaction processing, which can hinder usage.

Limited budgeting tools (impact: low)

The app lacks advanced budgeting features, but users can track expenses manually or use third-party apps as a workaround.

Slow customer support response times (impact: medium)

Support queries may take longer to resolve; contacting via secure messaging or phone can speed things up.

Occasional delays in transaction updates (impact: low)

Some notifications may be delayed; ensuring app permissions are correctly set can mitigate this issue.

Limited features for international users (impact: medium)

International transactions are restricted or incur higher fees; users can check official updates for upcoming features.

Classic Netspend

Version 7.0.4 Updated 2025-12-08