Chime – Mobile Banking

Chime – Mobile Banking App Info

-

App Name

Chime – Mobile Banking

-

Price

Free

-

Developer

Chime

-

Category

Finance -

Updated

2025-12-16

-

Version

5.305.0

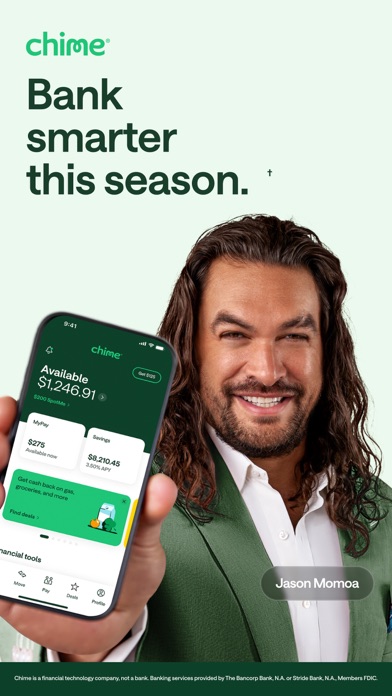

Chime – Mobile Banking: A Fresh Approach to Digital Banking

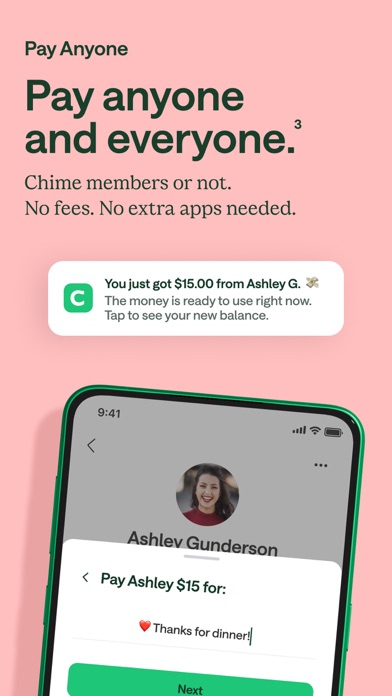

Chime emerges as a modern, user-centric mobile banking app designed to simplify financial management while emphasizing security and seamless transaction experiences. Developed by Chime Financial, Inc., it aims to provide an alternative banking experience without traditional fees or complex procedures.

Key Highlights and Core Features

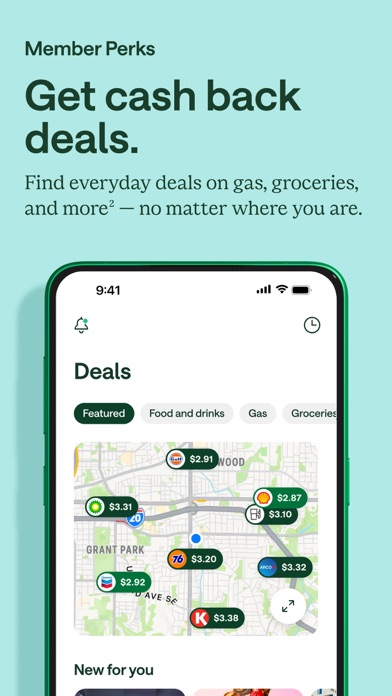

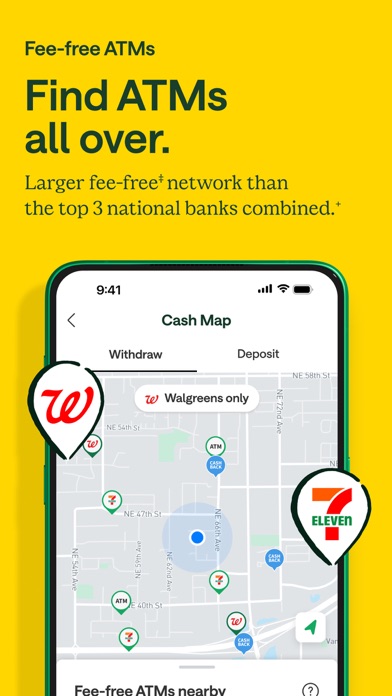

With its sleek interface and innovative functions, Chime stands out in the crowded fintech space. Its standout features include:

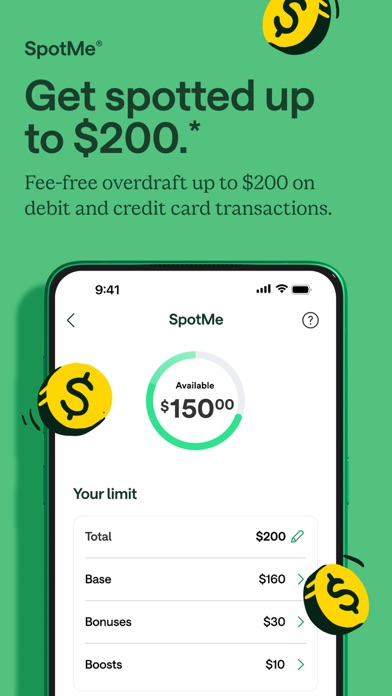

- No-fee Banking: No monthly maintenance charges, overdraft fees, or minimum balance requirements, making banking more accessible.

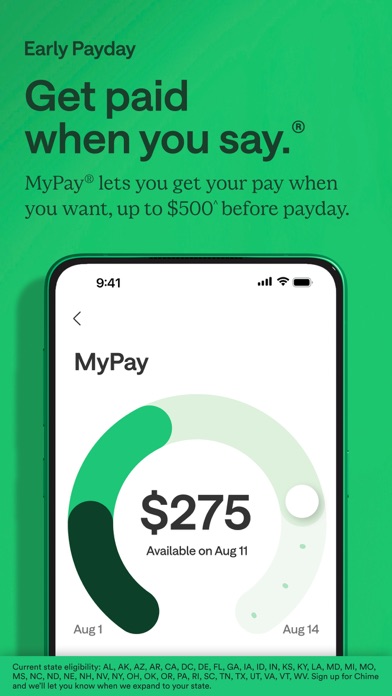

- Early Direct Deposit: Customers can receive their paychecks up to two days earlier, providing greater financial flexibility.

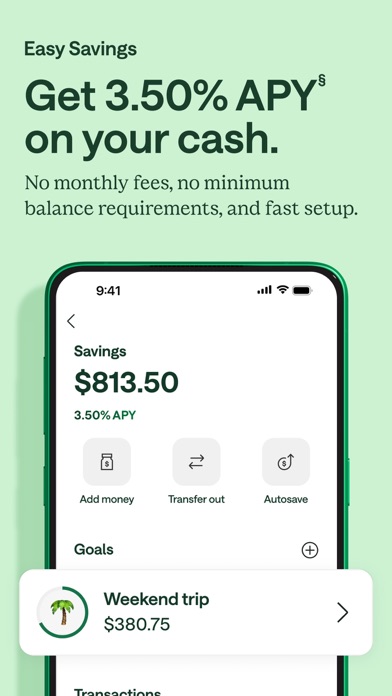

- Automatic Savings: A unique round-up feature that automatically transfers spare change into a dedicated savings account, fostering better savings habits.

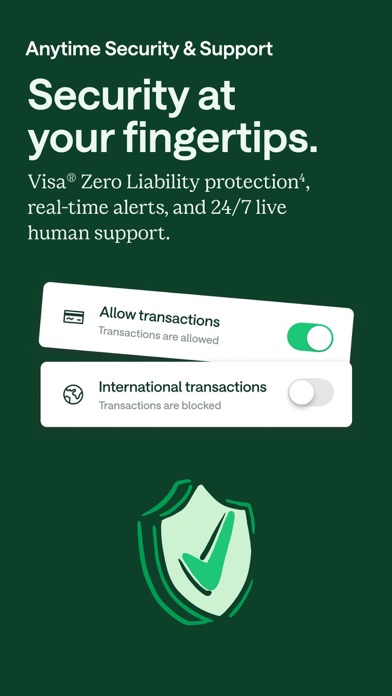

- Secure and Transparent: Emphasizes account and fund security with real-time transaction alerts and strict privacy measures.

Digging Deeper: The User Experience and Core Functionalities

Intuitive Interface and Fluid Navigation

From the moment you open Chime, you're welcomed by a clean, friendly dashboard that feels more like a familiar app than a traditional bank portal. The design uses calming colors and well-organized sections, making financial tasks feel less daunting. The app's layout is straightforward, reducing the learning curve for new users, and operations such as checking balances, transferring money, or scheduling payments are executed with just a few taps. The smooth animations and responsive interface demonstrate thoughtful engineering aimed at providing an effortless experience akin to flipping through a well-designed digital magazine.

Core Functionality: Financial Management Made Easy

The automatic savings feature is arguably the app's most charismatic component. Imagine your spare change gently working for you in the background—rounding up your everyday purchases to the nearest dollar and transferring the difference into a separate savings account. This cleverly designed micro-saving mechanism encourages users to build savings effortlessly, especially appealing to younger demographics unfamiliar with managing large sums.

Next, the early direct deposit feature acts like a financial superhero, delivering your paycheck up to two days early. This function is particularly delightful for those living paycheck-to-paycheck, providing a sense of financial breathing room and reducing reliance on costly payday loans or overdraft fees that plague traditional banking services.

Finally, the transaction experience is streamlined with real-time alerts and easy-to-understand summaries. Whether you're making a transfer, paying a bill, or viewing your spending habits, the process remains transparent and reassuring—unlike some of the more opaque experiences offered by other financial apps.

Security and Distinctiveness: What Sets Chime Apart?

Security is the backbone of any banking app, and Chime prioritizes this with multiple layers of protection. Its real-time transaction alerts keep users informed of every movement of funds, making unauthorized activity quickly detectable. Furthermore, the absence of traditional account numbers and reliance on secured routing numbers enhances fund safety — akin to having a digital fortress guarding your assets.

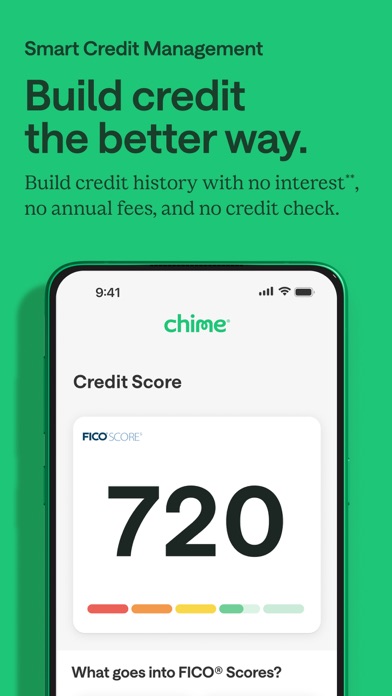

Differentiating itself from many traditional or even digital-only banks, Chime's focus on automatic savings and early paycheck access puts a spotlight on user empowerment. Many financial apps simply facilitate transactions; Chime actively encourages good financial habits with innovative features like round-ups, making saving feel natural rather than burdensome. This approach is particularly appealing to young adults and those new to banking, seeking modern solutions with a personal touch.

Recommendation and Usage Tips

I would confidently recommend Chime if you're looking for a straightforward, no-fuss mobile banking app with some clever features that motivate better financial habits. Its emphasis on security, ease of use, and commitment to eliminating common banking fees make it a solid choice for both beginners and seasoned users who desire a streamlined experience.

For best results, leverage the automatic savings feature to build an emergency fund gradually or to save up for specific goals. Also, opt to activate transaction alerts and regularly monitor your account activity—these small habits complement Chime's security measures to keep your money safe. While it may not yet replace traditional banking for complex needs, Chime is an excellent supplement for everyday financial management, especially for those seeking transparency, simplicity, and proactive savings tools.

Pros

User-friendly interface

The app offers an intuitive and clean layout that makes navigation simple for users of all ages.

No monthly fees

Chime provides banking services without traditional maintenance charges, saving users money.

Early direct deposit feature

Users can receive paychecks up to two days earlier with direct deposit, enhancing financial flexibility.

Automatic savings options

Chime allows users to round up purchases and automatically transfer spare change to savings.

Real-time transaction alerts

Users get immediate notifications for transactions, increasing security and awareness.

Cons

Limited physical banking facilities (impact: low)

Chime is primarily a digital service, which might be inconvenient for users needing in-person banking services.

No check-writing capability (impact: medium)

Currently, users cannot write checks directly from the app, but this feature may be added in future updates.

Limited banking features compared to traditional banks (impact: medium)

Some services like loans or investment options are not available yet, but Chime is focusing on basic banking needs.

Potential delays in customer support (impact: low)

Customer support response times can vary; official improvements are expected to streamline assistance.

Not FDIC insured directly, but funds are protected through partner banks (impact: low)

Money is held at FDIC-insured partner banks, but some users might prefer a traditional bank; this is expected to remain stable due to partnerships.

Chime – Mobile Banking

Version 5.305.0 Updated 2025-12-16