Cash App

Cash App App Info

-

App Name

Cash App

-

Price

Free

-

Developer

Block, Inc.

-

Category

Finance -

Updated

2025-12-15

-

Version

5.30

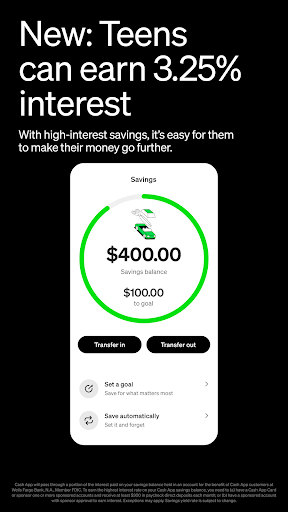

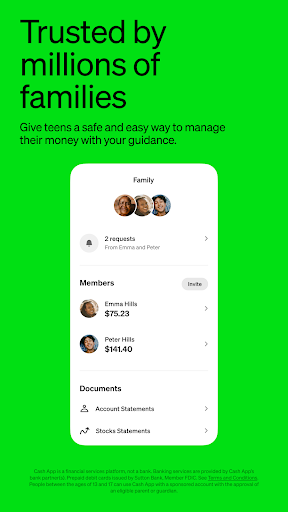

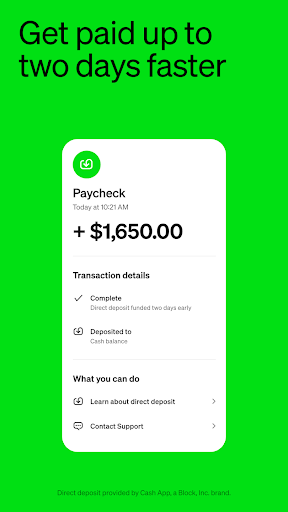

Cash App: Simplifying Your Financial Journey

Cash App stands out as a sleek, user-friendly platform designed to make digital money management accessible and secure for everyday users. Developed by Block, Inc. (formerly Square), this app combines innovative features with a straightforward interface, aiming to bridge the gap between traditional banking and modern financial needs. Whether you're splitting bills with friends, investing in stocks, or sending money abroad, Cash App positions itself as a versatile tool tailored for everyday convenience. Its core strengths include a seamless transaction experience, strong security measures, and convenient investment options, all aimed at a broad spectrum of users—from busy students to small business owners.

Intuitive Design Meets Effortless Functionality

Using Cash App feels like having a digital wallet sculpted to fit snugly into your palm—simple, sleek, and ready for action. The interface is minimalistic but thoughtfully organized, making navigation feel almost instinctive. From the very first tap, users are greeted with a clean home screen that elegantly displays their balances and recent transactions. The app's smooth animations and intuitive flow facilitate a learning curve that's practically non-existent, even for newcomers to digital finance. Transactions are executed swiftly, with real-time updates that keep you perfectly in the know without any frustrating lag.

Core Features: Powering Your Financial Flexibility

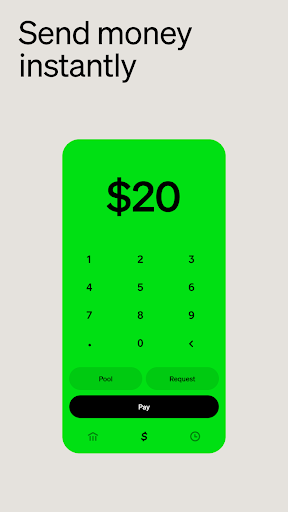

Peer-to-Peer Payments: Cash App's bread and butter lies in its ability to facilitate instant money transfers between friends and contacts. Whether you're splitting dinner, sharing rent, or giving a gift, sending and receiving money is as simple as entering a contact or scanning a QR code. The app supports 2FA verification, ensuring each transfer is protected, echoing the security measures that give users peace of mind in everyday transactions.

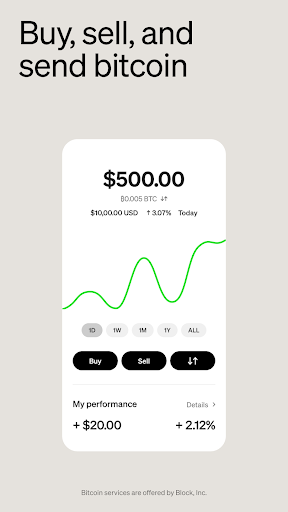

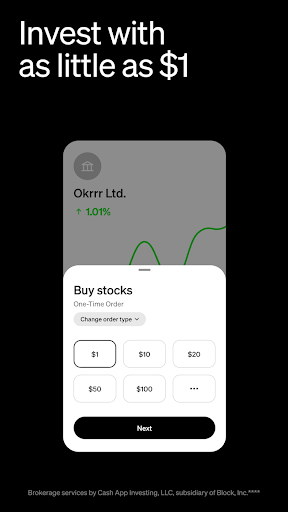

Investments Made Easy: Unlike many traditional finance apps, Cash App opens doors to investing directly from your phone. Users can buy stocks with as little as $1 and even venture into Bitcoin trading. The experience is streamlined, with clear charts, real-time quotes, and minimal jargon, making investing approachable rather than intimidating. The app even offers fractional shares, allowing you to dip your toes into high-value stocks without breaking the bank.

Cash Card & Boosts: The in-app Cash Card is a customizable debit card linked right to your Cash App balance. It functions seamlessly for in-store and online purchases. What sets it apart are the Boosts—special discounts at participating merchants when you use your Cash Card, turning everyday purchases into opportunities for savings. The customization options and instant approval process make this a particularly attractive feature for frequent shoppers.

Security and User Experience: Trust and Ease Hand in Hand

Cash App prioritizes security at every step, deploying encryption and multifactor authentication to safeguard user data and funds. Its account and fund security are on par with, if not superior to, many traditional banking processes, offering features like withdrawal limits and fraud monitoring. The transaction experience is just as polished—fund transfers and investments execute in moments, with transparent status updates that eliminate uncertainty. The app's design fosters a relaxed, friendly environment—think of it as your digital stablemate that's always ready to lend a helping hand, not a confusing maze of options.

Why Choose Cash App? A Clear Recommendation

In the crowded landscape of finance apps, Cash App's standout features—particularly its integrated investment platform and the versatile Cash Card—offer tangible, user-centric advantages. Its focus on security complements its ease of use, making it suitable for users who want quick, reliable, and safe financial transactions without the fuss of traditional banking. For anyone seeking an all-in-one financial companion that balances simplicity, innovation, and security, Cash App warrants a strong recommendation.

Whether you're just starting to explore digital payments or looking for an efficient way to manage your investments and expenses, Cash App provides a balanced, trustworthy platform worth considering. Its unique ability to combine everyday payment functions with investment opportunities and savings rewards makes it more than just a money app—it's a practical personal finance tool.

Pros

User-friendly interface

Cash App offers a simple, intuitive layout that makes financial transactions quick and easy for all users.

Fast transfer speeds

Money transfers are typically processed instantly or within minutes, enhancing user convenience.

Variety of features

Includes options like Bitcoin trading, stock investing, and direct deposits, providing diverse financial tools.

Secure transactions

Uses advanced security protocols such as encryption and multi-factor authentication to protect user data.

No account maintenance fees

Cash App charges no monthly fees for basic use, making it cost-effective for regular users.

Cons

Limited customer support options (impact: medium)

Support primarily relies on in-app chat and email, which can be slow, though official upgrades are announced.

Withdrawal limits for new users (impact: low)

Initial withdrawal limits can be restrictive, but increasing limits typically require identity verification.

Occasional app crashes or bugs (impact: medium)

Some users experience crashes or glitches, which can be temporarily mitigated by app updates or reinstalling.

Customer verification process (impact: low)

Verification can be lengthy, but it is necessary for higher transaction limits and improved security.

Limited availability of certain features in specific regions (impact: low)

Features like Bitcoin trading are not available everywhere; official roadmap indicates regional expansion plans.

Cash App

Version 5.30 Updated 2025-12-15