Capital One Mobile

Capital One Mobile App Info

-

App Name

Capital One Mobile

-

Price

Free

-

Developer

Capital One Services, LLC

-

Category

Finance -

Updated

2025-12-15

-

Version

6.36.2

A Comprehensive Look at Capital One Mobile: Your Personal Banking Companion

In a digital era where convenience and security are paramount, Capital One Mobile stands out as a robust financial app designed to bring the bank's services directly to your fingertips with seamless ease.

Who's Behind the App & What Makes It Shine

Developed by Capital One Financial Corporation, a well-established leader in the banking and financial services industry, the app aims to provide users with a comprehensive, secure, and user-friendly banking experience. Its core strengths include intuitive account management, secure transactions, and innovative financial tools that cater to both casual users and busy professionals. The app is especially suited for existing Capital One customers, young professionals, tech-savvy users, or anyone seeking a reliable, all-in-one financial platform.

Need a Digital Banking Sidekick? Here's Why You'll Love It

Imagine having your financial errands navigated as smoothly as a well-oiled machine—Capital One Mobile strives for just that. It's like carrying a mini branch in your pocket, ready to assist in managing your money whenever you need, whether you're paying bills, viewing transactions, or monitoring your credit score. Its blend of security, ease of use, and innovative features makes it more than just a typical banking app; it's your digital financial partner.

Explore the Core Features that Power the App

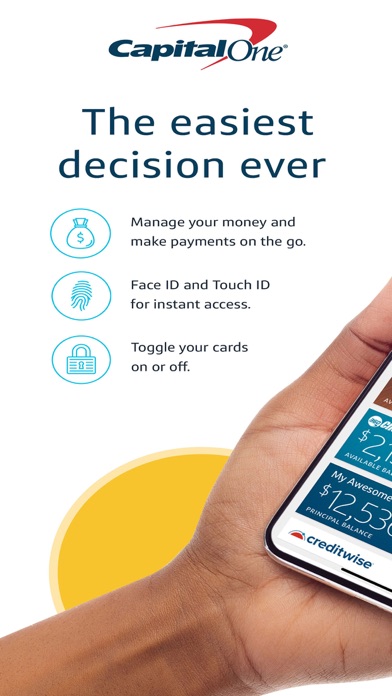

1. Effortless Account Management & Payment Options

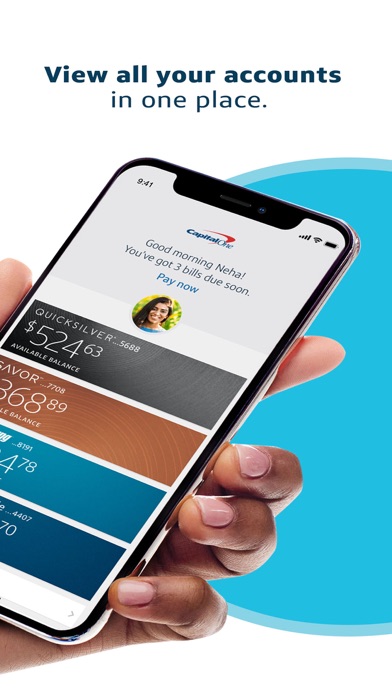

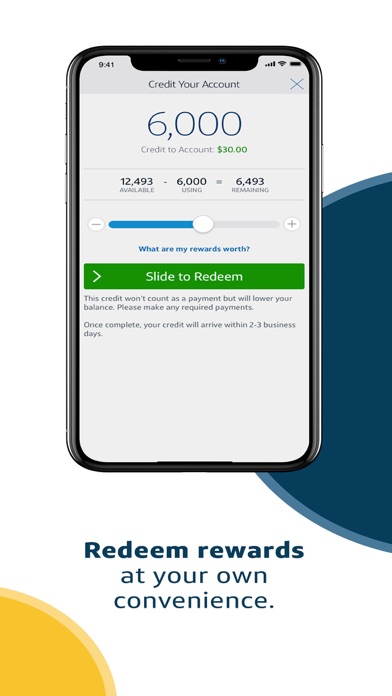

Navigate through multiple accounts with simply a few taps—checking balances, transferring funds, or paying bills. The interface presents a clear overview of your finances with visual cues and quick access icons, removing the typical maze-like complexity of banking apps. The app also offers instant payment scheduling and recurring payments, making routine transactions feel as natural as sending a quick message. Whether you're on the go or relaxing at home, managing your accounts feels intuitive and time-efficient.

2. Advanced Security & Transaction Safeguards

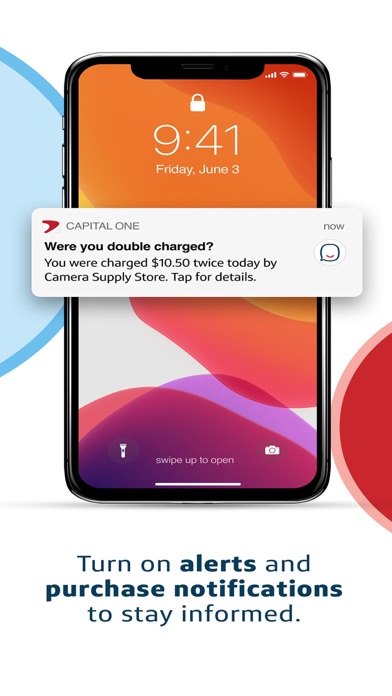

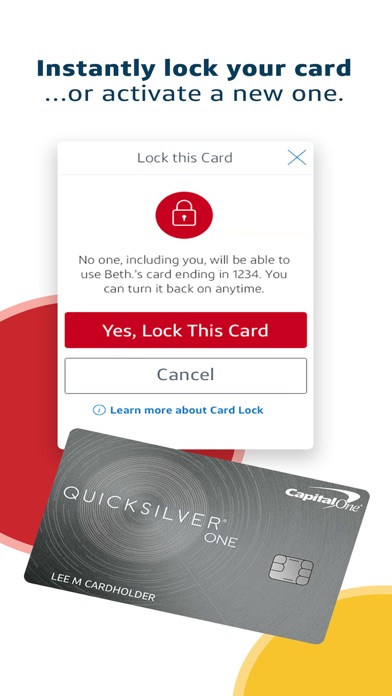

Security is the backbone of any financial application, and Capital One Mobile doesn't disappoint. It employs multi-layered security features such as biometric login (fingerprint or facial recognition), real-time transaction alerts, and automatic login logout, to ensure your financial data remains private. One standout feature is the "Freeze Card" option—you can instantly lock or unlock your credit or debit card directly within the app if you suspect any unauthorized activity, giving you peace of mind without the need for customer service calls.

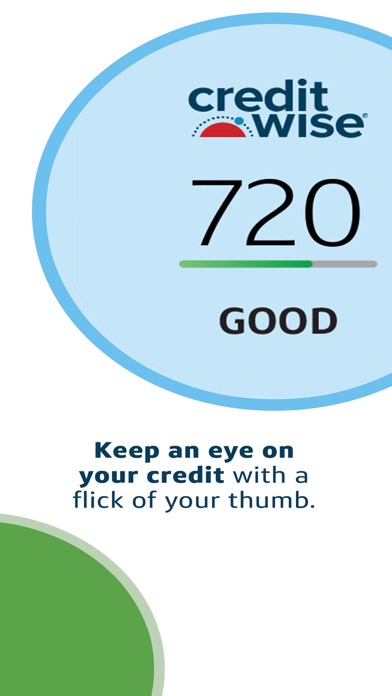

3. Personalized Financial Insights & Credit Monitoring

The app goes beyond basic banking services to offer curated financial insights based on your transaction history. You can view your credit score, get tips to improve it, and receive alerts about important changes or opportunities—like ways to lower your interest rates or save more effectively. This strategic addition turns the app into a financial coach that helps you make smarter money decisions daily.

User Experience & Unique Selling Points

The interface design of Capital One Mobile is sleek yet straightforward, with a color palette and icons that feel welcoming and modern—sort of like walking into a cozy, well-organized office. Navigation flows smoothly without lag, thanks to optimized backend processing. New users will find the learning curve gentle, with guided tutorials and logical menu structures easing them into the full suite of features.

Compared to other finance apps, Capital One Mobile's standout features are its focus on security—particularly the ability to instantly freeze/unfreeze cards—and its integrated approach to credit management. While many banking apps offer transaction history and bill pay, few combine these with proactive credit insights and security controls in a unified, user-friendly interface. This holistic approach makes it especially valuable for users who prefer a comprehensive overview of their financial health, not just basic bank operations.

Final Verdict: Is It Worth Your Time?

If you're already a Capital One customer or looking for a banking app that balances security, usability, and insightful features, this app merits serious consideration. Its core strengths lie in giving users quick control over their accounts and credit health while maintaining high-security standards. For those seeking a straightforward, dependable, and feature-rich mobile banking experience, Capital One Mobile comes highly recommended.

Overall, it's a reliable financial sidekick—smartly designed, secure, and built to keep you connected and protected in today's fast-paced digital finance landscape. Whether you want to keep an eye on your spending or manage your credit proactively, this app can become an indispensable part of your financial toolkit.

Pros

User-Friendly Interface

The app features a clean and intuitive design, making it easy for users to navigate through their accounts.

Robust Security Features

Capital One Mobile employs strong encryption and biometric login options to protect user data.

Real-Time Account Monitoring

Users can instantly view transaction updates and account balances without delay.

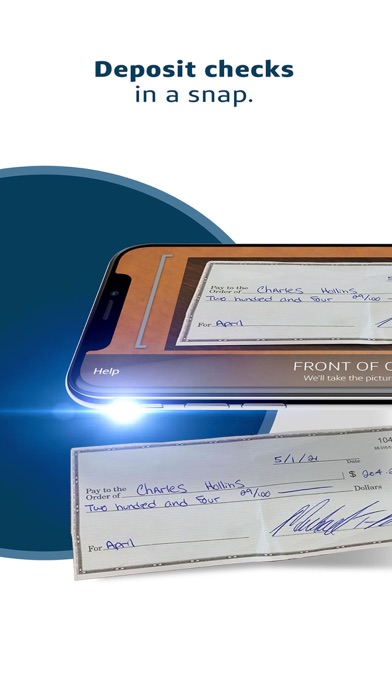

Mobile Deposit Functionality

The app allows for quick check deposits through photo capture, saving time.

Personalized Budgeting Tools

Integrated financial management features help users track spending habits effectively.

Cons

Occasional App Crashes (impact: medium)

Some users experience crashes during login or transaction processing, which can be temporarily resolved by reinstalling the app or updating to the latest version.

Limited Support for Older Devices (impact: low)

The app may not perform optimally on outdated smartphones, potentially requiring device upgrades for smooth operation.

Delayed Transaction Updates (impact: medium)

Transaction history may sometimes lag behind real-time, but future updates are expected to improve synchronization.

Fewer Account Management Features for Business Users (impact: low)

The current version offers limited tools for managing business accounts compared to personal accounts.

Push Notification Bugs (impact: medium)

Some users report receiving delayed or missing alerts; official fixes are anticipated in upcoming updates.

Capital One Mobile

Version 6.36.2 Updated 2025-12-15