Brigit: Cash Advance & Credit

Brigit: Cash Advance & Credit App Info

-

App Name

Brigit: Cash Advance & Credit

-

Price

Free

-

Developer

Brigit

-

Category

Finance -

Updated

2026-02-19

-

Version

1080.0

Brigit: Cash Advance & Credit — Your Friendly Financial Assistant

Brigit is a user-centric app designed to bridge the gap between paychecks, offering small cash advances and credit-building tools to empower users with better financial flexibility and literacy.

Who's Behind Brigit?

Developed by the innovative team at Brigit, Inc., this application is built with a mission to make managing cash flow and establishing credit accessible and straightforward for everyday consumers. Their focus is on delivering a safe, transparent, and helpful financial experience, especially in an era where traditional banking often feels impersonal and complex.

Key Features That Make Brigit Stand Out

- Instant Cash Advances: Get up to $250 ahead of your paycheck with minimal hassle, helping you tackle unexpected expenses without resorting to high-interest payday loans.

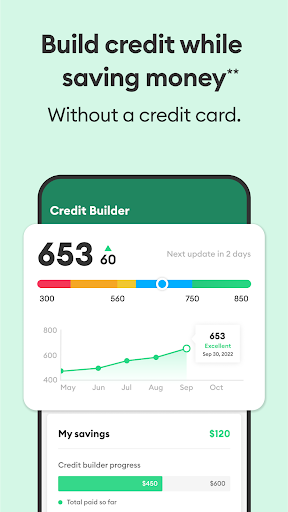

- Credit Score Monitoring and Improvement: Track your credit score over time and receive personalized tips to boost your creditworthiness, demystifying the world of credit reports.

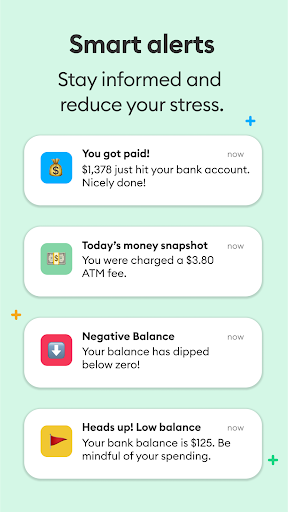

- Financial Health Insights: Receive tailored guidance based on your spending habits, allowing better control over your finances.

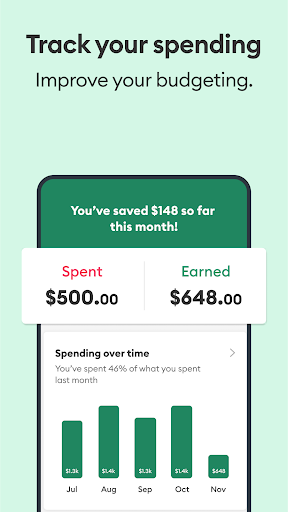

- Automated Savings & Budgeting Tools: Help users cultivate savings habits naturally within the app environment.

Delving into the Brigit Experience

Taking a closer look, Brigit isn't just another cash advance app—it's a companion dedicated to fostering financial resilience. Its friendly interface and thoughtful features make navigating personal finance feel less like a chore and more like a journey toward empowerment.

User Interface & Ease of Use

The first thing you'll notice is how clean and approachable the design is. Bright, friendly colors and intuitive icons make the app feel less intimidating for newcomers. Onboarding feels like chatting with a knowledgeable friend, guiding you effortless through key features. The layout streamlines essential tasks—checking your balance, requesting an advance, or reviewing your credit score—without any clutter. Operation within Brigit is notably smooth; transitions are quick, and responses almost instant, creating a seamless experience that encourages regular engagement. For someone unversed in financial apps, the learning curve is gentle, with helpful prompts gently guiding your steps along the way.

Major Functional Highlights

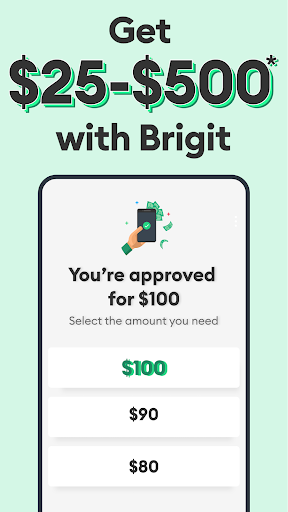

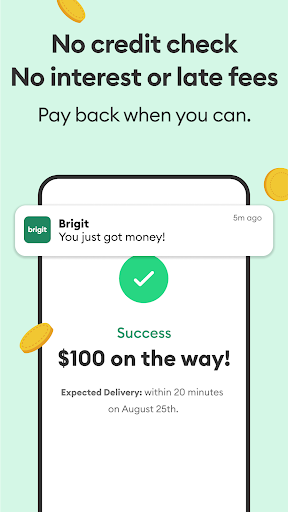

Among its core offerings, Brigit's cash advance feature is undoubtedly the star. Unlike payday lenders or predatory alternatives, Brigit's advance process is transparent: you choose the amount you need, and the app determines your eligibility based on your account activity and repayment history. The approval is swift, often within minutes, giving users peace of mind during urgent moments.

The second standout is its credit score monitoring system. It pulls your credit data securely from major bureaus and presents it in an easy-to-understand dashboard. What sets it apart is the personalized action plan that comes along—simple steps you can take to improve your score, like paying down specific debts or increasing your credit utilization carefully. This educational component transforms what could be an opaque statistic into a tangible pathway toward financial health.

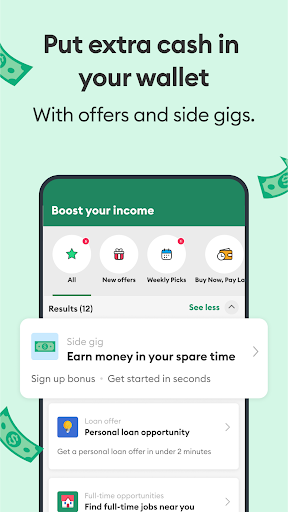

Lastly, the financial insights and budgeting tools act like a friendly financial coach. Analyzing your transaction patterns, Brigit offers advice on reducing unnecessary expenses and boosting savings. It isn't about strict restrictions; instead, it promotes smarter decision-making that feels natural and achievable.

Unique Selling Points Compared to Similar Apps

One of Brigit's most remarkable aspects is its focus on security and trust. Unlike many competitors, it employs robust encryption and regular security audits, ensuring your transaction data and personal information remain protected. Furthermore, the app emphasizes positive transaction experiences—no sneaky fees or hidden charges. Thanks to its fair and transparent approach, users can feel confident that they're fostering their financial well-being without fear of exploitation.

Another differentiator is the seamless integration between cash advances and credit-building. Many apps either focus on one or the other, but Brigit combines these features into a cohesive ecosystem. This synergy means it not only helps you navigate immediate cash needs but also lays a foundation for improved credit scores—creating a virtuous cycle of financial health.

Should You Give It a Try? My Recommendations

If you're someone who sometimes faces short-term cash shortages, or if you're eager to understand and improve your credit profile without jumping through hoops, Brigit is a compelling choice. Its user-friendly design, combined with thoughtful, secure features, makes it suitable for beginners and seasoned financial explorers alike.

However, it's important to use its cash advance feature responsibly. While convenient, advances should complement broader financial planning rather than replace savings efforts. Consider Brigit as a helping hand rather than a long-term solution.

Overall, I recommend Brigit to individuals seeking a transparent, friendly, and trustworthy tool to manage immediate financial needs and enhance their credit journey. It's like having a patient, knowledgeable friend in your pocket—ready to support you whenever life throws a curveball.

Pros

User-Friendly Interface

The app features an intuitive layout that makes navigating and applying for cash advances straightforward for users.

Fast Approval Process

Cash advance requests are often approved within minutes, providing quick access to funds in emergencies.

Transparent Fees

Clear information about fees and repayment terms helps users understand costs upfront, reducing surprises.

Accessible Credit Limits

Offers flexible credit limits tailored to individual financial situations, making it suitable for various users.

Educational Resources

Includes helpful financial tips and tools to assist users in managing their cash flow responsibly.

Cons

Limited Loan Amounts (impact: Medium)

The maximum advance amount may be insufficient for larger financial needs, which can be inconvenient for some users.

Potential High Fees (impact: High)

Fees can be relatively high compared to traditional loans, especially if repayment is delayed; users should review terms carefully.

No Credit Building (impact: Low)

Using the app does not contribute to credit score improvement since it does not report to credit bureaus.

Limited Availability in Some Regions (impact: Medium)

The app's services may not be available in all states or countries, restricting access for some potential users.

Risk of Dependence (impact: Low)

Frequent use of cash advances can lead to financial dependency; setting usage limits and seeking financial advice is recommended.

Brigit: Cash Advance & Credit

Version 1080.0 Updated 2026-02-19