Bright Money - AI Debt Manager

Bright Money - AI Debt Manager App Info

-

App Name

Bright Money - AI Debt Manager

-

Price

Free

-

Developer

Bright Money

-

Category

Finance -

Updated

2025-12-03

-

Version

1.58.3

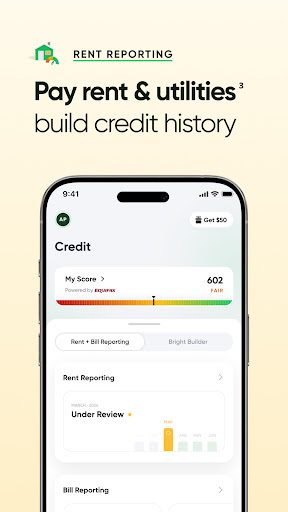

Bright Money - AI Debt Manager: Redefining how you handle your finances

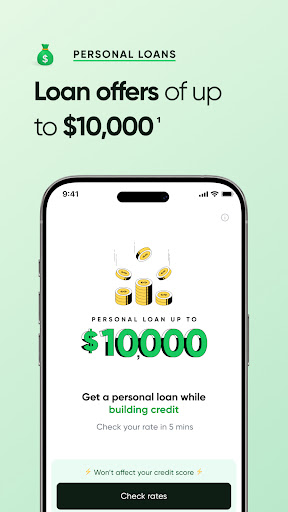

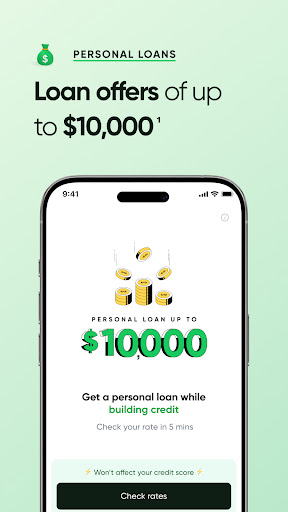

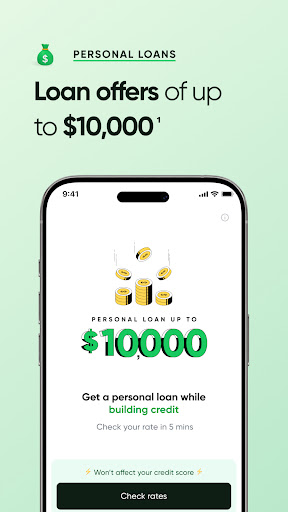

Bright Money's AI Debt Manager is a thoughtfully designed financial tool that aims to simplify debt management and accelerate your journey toward financial freedom using sophisticated AI-driven insights. Developed by a team of fintech innovators, it combines advanced algorithms with user-centric features to transform complex debt repayment strategies into approachable, manageable plans. Whether you're struggling with credit card debt, student loans, or multiple outstanding balances, this app promises to be a reliable companion in your financial journey.

Key Features That Make Bright Money Stand Out

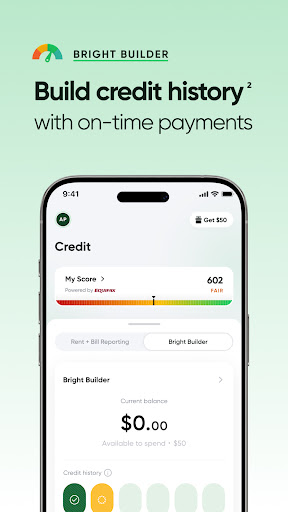

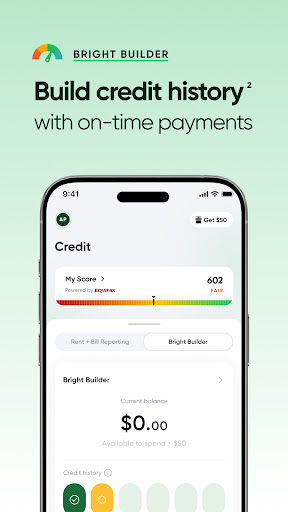

First, its personalized debt payoff plans leverage artificial intelligence to craft tailored repayment strategies, considering variables like interest rates, income, and expenditure habits. Second, the app integrates seamlessly with your bank accounts to automatically track your debts and payments, reducing manual input and errors. Third, Bright Money offers behavioral nudges and educational content to encourage smarter financial decisions, making it more than just an expense tracker. Lastly, its emphasis on security and privacy ensures your sensitive financial data remains protected, setting it apart in the crowded finance app market.

Engaging, Intuitive Interface with Patient Guidance

From the moment you open Bright Money, it feels like stepping into an organized, friendly financial coach's office. The interface balances simplicity with functionality—bright, clean layouts with intuitive navigation that guides you effortlessly through your financial landscape. The onboarding process is smooth, with clear prompts that help new users understand their debt profiles and what to expect. The app employs visual aids like progress bars, pie charts, and clear summaries to make complex data digestible, turning what could be overwhelming numbers into motivational milestones. The learning curve is gentle; most users will find themselves mastering core functions within minutes, feeling confident rather than frustrated.

Core Functionality: From Strategy to Action

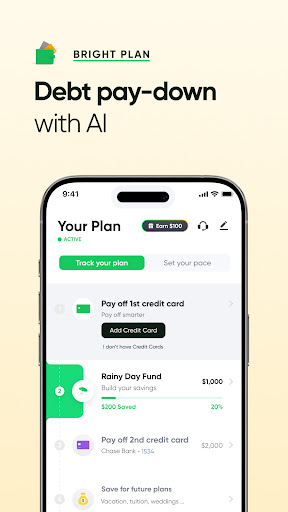

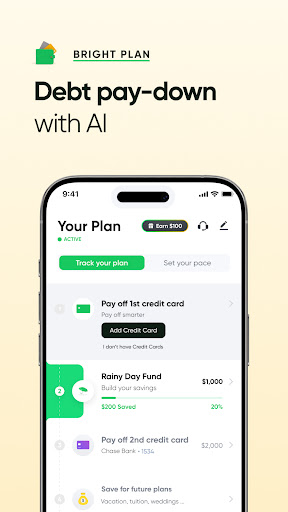

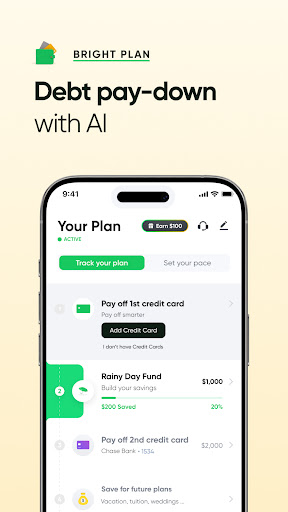

1. Personalized Debt Repayment Plans

At the heart of Bright Money lies its AI-powered algorithm that analyzes your debts and financial behavior to generate customized repayment strategies. Unlike one-size-fits-all solutions, this feature considers your income, expenses, interest rates, and even your behavioral tendencies to recommend the optimal payoff order—be it avalanche, snowball, or hybrid methods. This intelligent approach not only accelerates debt reduction but also aligns with your comfort and financial goals. Imagine having a seasoned financial advisor crafting a roadmap tailored precisely to your circumstances—this is what Bright Money delivers, intelligently and unobtrusively.

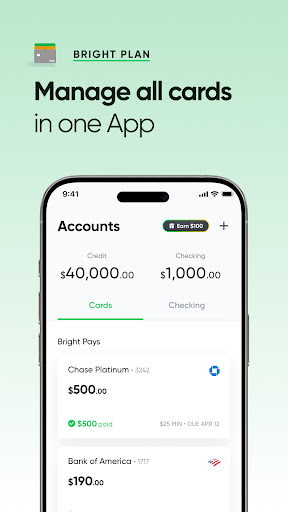

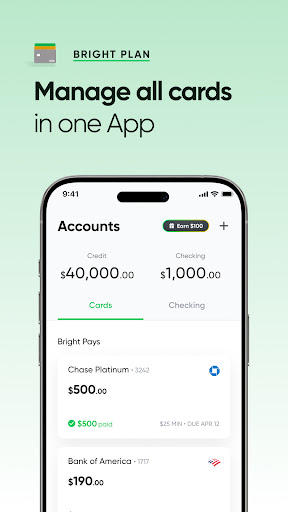

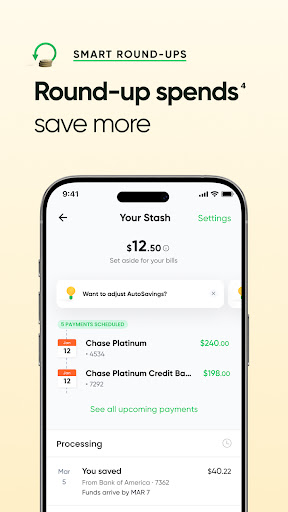

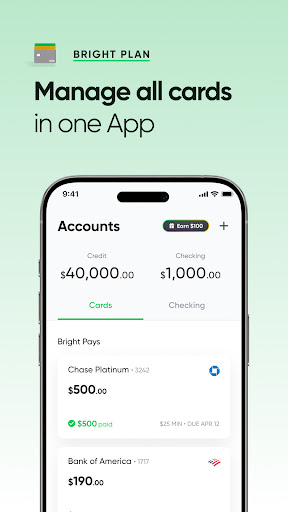

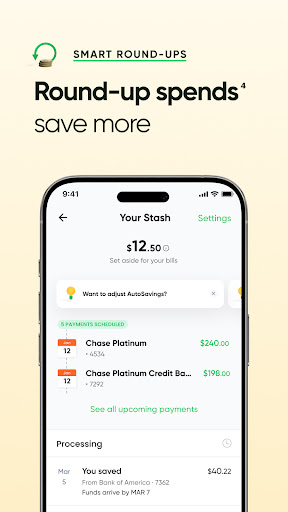

2. Autonomous Tracking and Payment Management

Say goodbye to manual updates and forgotten payments. Bright Money connects securely with your bank accounts, automatically importing your debts and payment histories. This seamless integration ensures your dashboard reflects real-time progress, giving you a clear picture of how close you are to debt freedom. The automation reduces errors and simplifies your routine, making debt management feel less like a chore and more like a natural part of your day-to-day financial health check. Plus, with alerts and reminders, it nudges you gently to stay on track without nagging.

3. Behavioral Nudges and Educational Content

Debt repayment isn't just about numbers—it's also about habits and mindset. Bright Money incorporates behavioral science principles by sending motivational messages and providing educational snippets tailored to your progress. Whether it's celebrating milestones or suggesting small changes to reduce expenses, these features help foster a healthier financial mindset. It's akin to having a friend who keeps you motivated while gently guiding you toward smarter choices, making the often-daunting task of debt reduction more approachable and sustainable.

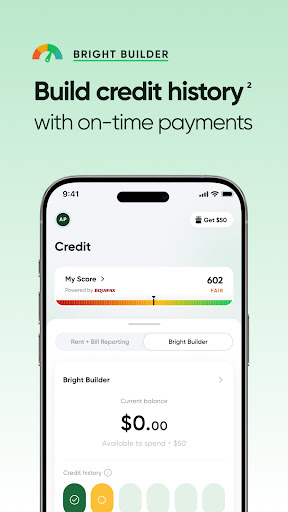

Security and Unique Selling Points

While many financial apps emphasize flashy features, Bright Money emphasizes what truly matters—your data security and differentiated user experience. Its architecture employs bank-level encryption and rigorous privacy standards, ensuring sensitive information like account details and transactions remain confidential. Compared to other financial apps that might focus solely on transaction logging, Bright Money's AI-driven customization and behavioral insights set it apart. Its ability to dynamically adapt repayment strategies based on your actual behavior and circumstances offers a tailored experience rarely found elsewhere. This level of personalization transforms debt management from a mechanical task into a strategic partnership—more akin to having an understanding financial coach by your side.

Final Recommendation and Usage Tips

Overall, I find Bright Money to be a well-crafted, thoughtful application for anyone serious about tackling debt without feeling overwhelmed. Its core strength lies in blending personalized, intelligent strategies with a user-friendly interface that demystifies complex financial concepts. If you're looking for an app that not only helps you plan but actively guides and motivates you toward financial discipline, this is a commendable choice. For optimal results, I recommend setting aside time to review your financial profile thoroughly during setup, allowing the AI to customize your plan effectively. Regularly engaging with the app's educational content and behavioral nudges will help you sustain momentum and make debt repayment more manageable. While no app can replace good old discipline, Bright Money comes close to being a digital financial partner you can trust—smart, secure, and genuinely helpful.

Pros

AI-driven debt optimization

Bright Money uses advanced AI algorithms to tailor debt repayment strategies, maximizing efficiency.

User-friendly interface

The app features an intuitive design that simplifies complex financial planning for users of all levels.

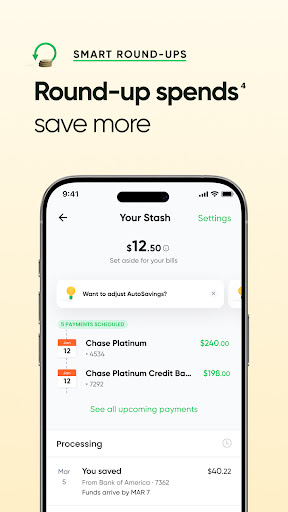

Automatic payment scheduling

Automatically arranges payments to prioritize high-interest debts, saving users time and effort.

Progress tracking and insights

Provides clear visualizations of debt reduction progress and personalized financial insights.

Educational resources

Offers helpful tips and articles to improve users' financial literacy during their debt management journey.

Cons

Limited free features (impact: medium)

Most advanced features are behind a subscription paywall, which may deter some users.

Requires steady internet connection (impact: low)

The app's real-time updates depend on a reliable internet connection; offline mode isn't available.

Data privacy concerns (impact: medium)

Some users might worry about sharing sensitive financial data; improvements in transparency are expected.

Limited debt account integrations (impact: low)

Supports only certain major banks and credit card companies, which may limit comprehensive tracking.

Learning curve for new users (impact: low)

First-time users might need some time to fully understand and utilize AI-driven features effectively.

Bright Money - AI Debt Manager

Version 1.58.3 Updated 2025-12-03