BMO Digital Banking

BMO Digital Banking App Info

-

App Name

BMO Digital Banking

-

Price

Free

-

Developer

BMO Bank National Association

-

Category

Finance -

Updated

2026-01-29

-

Version

26.1.90

Introduction: A Fresh Breeze in Digital Banking

If you're tired of the usual clunky banking apps that feel more like chores than tools, BMO Digital Banking steps onto the scene like a breath of fresh air. Designed with user-centricity in mind, it aims to transform how you manage your finances—making everyday banking not just easier but genuinely intuitive. Developed by BMO Financial Group, a trusted name in banking with decades of experience, this application promises a sleek experience crafted for the modern user.

Core Features That Shine Bright

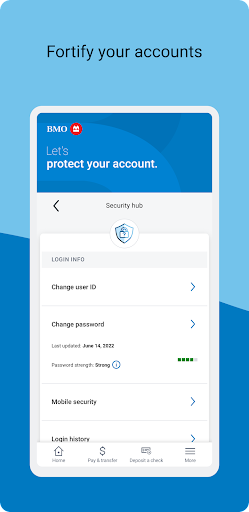

Advanced Security Measures for Peace of Mind

Security is no longer an afterthought but a fundamental pillar of BMO Digital Banking. From biometric login options—think facial recognition and fingerprint scans—to real-time transaction alerts, the app prioritizes safeguarding your assets. Unique to this app is its use of AI-driven fraud detection that proactively identifies suspicious activity, providing users with prompt notifications and easy dispute options. This layered approach ensures your financial data remains tightly shielded without sacrificing convenience.

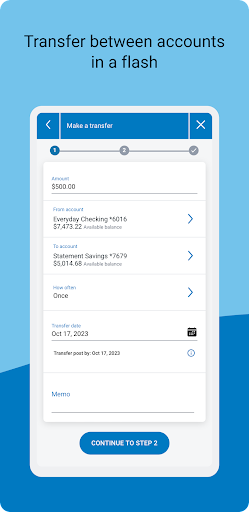

Streamlined Transaction Experience

Transferring money, paying bills, or splitting expenses is as smooth as sliding on ice. The app's interface guides you seamlessly through these processes with minimal effort. For example, a few taps allow for scheduled payments, recurring transfers, or quick send options—just like sending a friend a quick message. Its integration with contacts and the ability to save payees make frequent transactions even more effortless. The app's performance remains swift, with no noticeable lag, thus creating a transaction experience akin to a well-orchestrated dance—each movement precise and fluid.

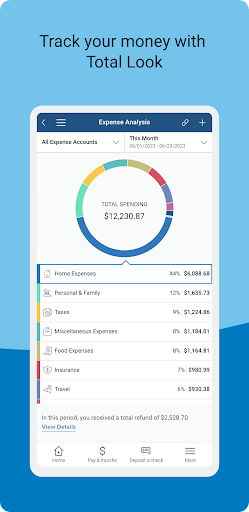

Intelligent Budgeting and Insights

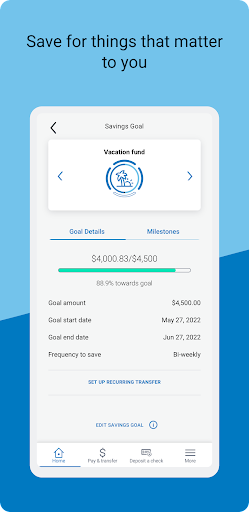

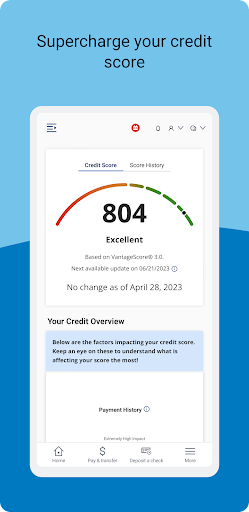

Managing money is often stressful, but BMO Digital Banking aims to change that perception. Its intelligent budgeting tools automatically categorize your spending and provide monthly insights—like having a financial advisor in your pocket. The app also uses predictive analytics to suggest savings opportunities unique to your habits. Imagine having a friendly financial coach reminding you when you're overspending on dining out or highlighting potential investment opportunities tailored for your goals. This feature truly elevates the app from mere transaction handler to an engaging financial mentor.

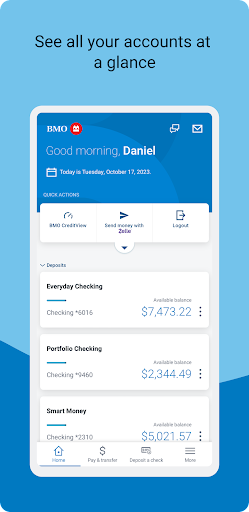

User Experience: Design, Navigation, and Ease of Use

From the moment you open BMO Digital Banking, it feels like stepping into a thoughtfully organized workspace. The clean, modern interface employs a calming color palette and intuitive icons, making navigation feel natural—almost second nature. The layout allows you to find the tools you need without digging through layers, which is perfect for quick transactions or detailed account reviews. Responsiveness is impressive; interactions feel snappy, with no noticeable delays, echoing the smoothness of a well-oiled machine.

For new users, the onboarding process is straightforward, with guided tutorials that help you set up features like biometric authentication and budgeting tools. Seasoned users will appreciate the customization options—moving key features to the home screen or toggling notifications. Overall, it balances sophistication with simplicity, providing a learning curve that is gentle yet rewarding.

What Sets BMO Digital Banking Apart

While many banking apps emphasize security or ease of use, BMO Digital Banking combines these with an extra layer of innovation—particularly through its use of AI for fraud detection and personalized financial insights. Unlike competitors that may treat security as an afterthought, this app's proactive, intelligent security features provide a notable sense of reassurance. Similarly, its transaction experience stands out thanks to user-friendly scheduling and seamless contact integration, making routine banking feel less like a task and more like a fluid conversation.

Recommendation and Usage Advice

Overall, BMO Digital Banking is a solid choice for users looking for a secure, intuitive, and feature-rich banking application. It's particularly well-suited for those who value proactive security and personalized financial guidance. For users who prioritize straightforward transaction management and want a tool that feels like a helpful financial partner, this app delivers reliably.

New users should spend some time exploring its budgeting and insights features—they may discover valuable opportunities to optimize their finances. Existing BMO customers will probably find it an indispensable companion for their daily banking needs, especially thanks to its smooth interface and intelligent features. Overall, I'd recommend giving it a try—think of it as adding a trusted assistant to your financial toolkit, always ready to help manage your money with a friendly nudge.

Pros

User-friendly interface

The app features a clean and intuitive layout, making navigation simple for all users.

Comprehensive banking services

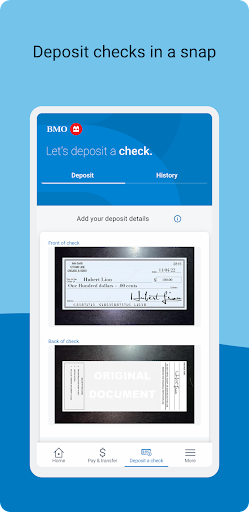

Provides a wide range of functions including transfers, bill payments, and account management within one platform.

Strong security measures

Utilizes advanced encryption and biometric authentication to protect user data.

Real-time transaction updates

Allows users to monitor their accounts instantly, aiding quick decision-making.

Personal finance tools

Offers budgeting and saving features to help users manage their finances effectively.

Cons

Limited customer support channels (impact: medium)

Customer support is primarily via in-app chat, which may not suit urgent inquiries.

Occasional app crashes during high traffic periods (impact: medium)

Some users report app freezing during peak hours, but updates are expected to improve stability.

Features could be expanded for business accounts (impact: low)

Currently more tailored to personal banking, with limited options for small businesses.

Minor glitches in transaction history display (impact: low)

Sometimes transactions display with a slight delay or formatting issues; official updates should address this.

Limited international transaction support initially (impact: low)

International transfers are restricted to certain currencies but are planned to expand soon.

BMO Digital Banking

Version 26.1.90 Updated 2026-01-29