Barclays US

Barclays US App Info

-

App Name

Barclays US

-

Price

Free

-

Developer

Barclays US

-

Category

Finance -

Updated

2025-10-24

-

Version

8.5.7

Introduction: A Fresh Take on Digital Banking with Barclays US

Barclays US presents itself as a modern, user-centric financial app designed to streamline banking and investment management for everyday users. Developed by the renowned Barclays team, this app aims to redefine how Americans access their accounts, invest securely, and monitor their financial health—all within a sleek, intuitive platform. Its standout features include robust security protocols, seamless transaction experiences, and personalized financial insights tailored to individual needs. Whether you're a seasoned investor or just starting to navigate the world of personal finance, Barclays US aspires to be your trusted digital companion in achieving financial well-being.

Clean Design and Intuitive Navigation: User Experience at Its Core

From the moment you open the Barclays US app, you're greeted with a clean, visually appealing interface that feels more like exploring a well-organized digital dashboard than fiddling with a typical banking app. The layout employs soft color palettes and clear icons, making navigation straightforward even for tech novices. Transitioning between features is smooth thanks to fluid animations and logical menu flows—think of it as gliding effortlessly through a well-paved financial highway.

Operation-wise, the app boasts impressive responsiveness. Actions like fund transfers, checking balances, or viewing detailed statements are performed swiftly, with negligible lag. The learning curve is gentle; users can easily adapt to the app's flow within minutes, thanks to clear labels and contextual prompts. This user experience focus makes managing finances less like a chore and more like engaging in a pleasant, productive routine.

Core Functionality Spotlight: Security, Transactions, and Insights

Unmatched Account and Fund Security

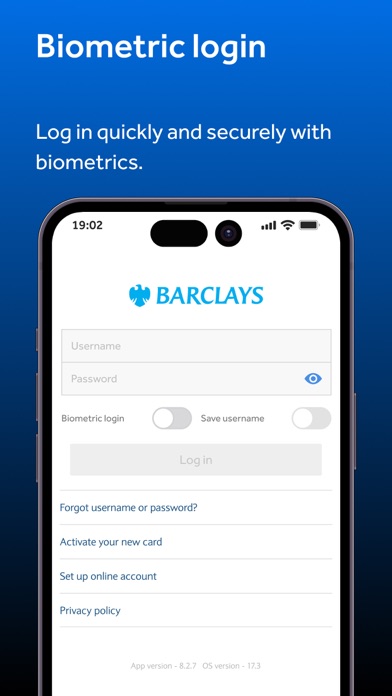

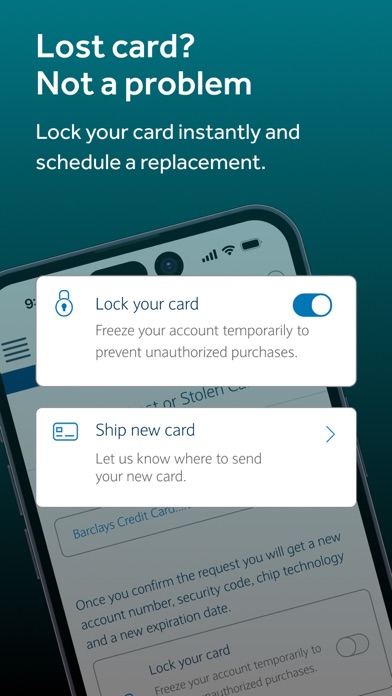

Security is often the deal-breaker in financial apps, and Barclays US rises to the occasion with industry-leading safeguards. Features like biometric authentication—fingerprint or facial recognition—ensure only you can access your account. The app also employs end-to-end encryption, multi-factor authentication, and real-time fraud monitoring to shield your funds from unauthorized access. This layered security approach confidently relaxes users, knowing their assets are protected with the same meticulous care Barclays extends to its global banking operations.

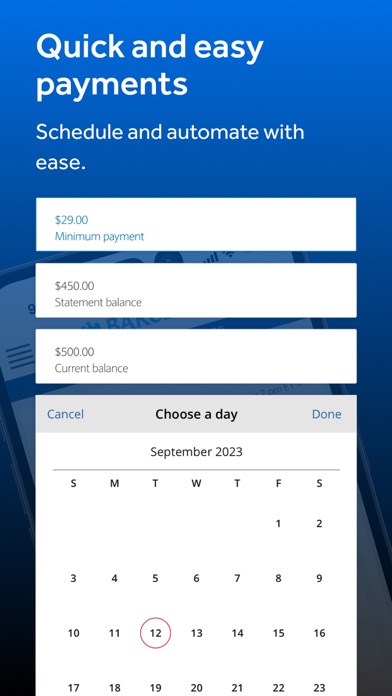

Effortless Transaction Experience

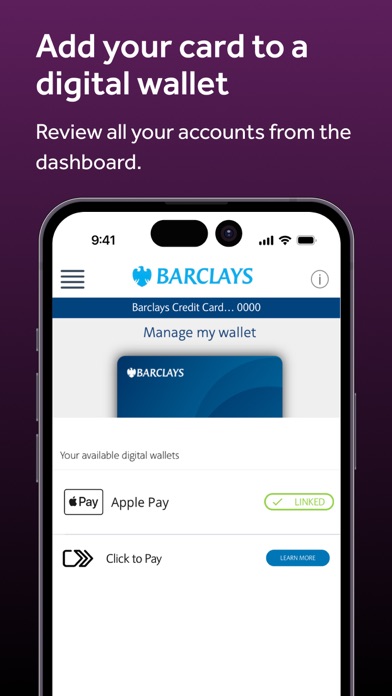

Making transfers feels akin to passing a message to a trusted friend—quick, reliable, and straightforward. The app supports instant peer-to-peer payments, scheduled transfers, and bill payments, all from a unified interface. Unique to Barclays US is a smart transaction recognition system that pre-fills frequent payees and suggests optimal transfer methods based on your history. This reduces manual input errors and speeds up routine transactions, making banking feel as effortless as chatting with a knowledgeable friend.

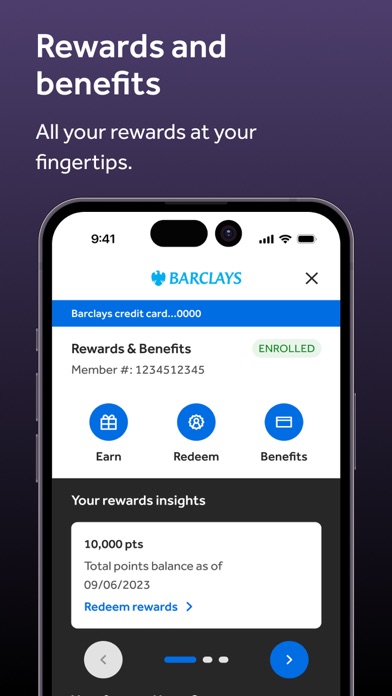

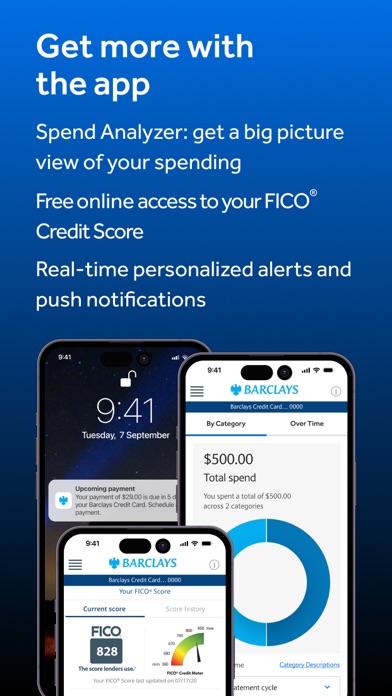

Personalized Financial Insights and Investment Tools

Beyond simple account management, Barclays US provides tailored financial insights—spending analytics, savings goals, and investment performance metrics—that help users make informed decisions. Its investment dashboard highlights opportunities matched to your risk profile and goals, with straightforward visualizations demystifying complex data. This personalized guidance is akin to having a financial advisor in your pocket, making your journey from saving to investing both accessible and educational.

What Sets Barclays US Apart: Security & Transaction Excellence

While many finance apps claim to provide top-notch security and smooth transaction experiences, Barclays US makes these core features truly shine through their integration. The app's comprehensive security infrastructure not only prevents breaches but also offers real-time alerts in case of suspicious activity—turning security from a background feature into an active defense. Meanwhile, the transaction system's ability to learn your habits and suggest pre-filled inputs reduces manual effort and minimizes human error, transforming routine banking into a frictionless task. These aspects differentiate Barclays US as a practical, secure, and user-focused platform that prioritizes your peace of mind and convenience.

Final Verdict and Recommendations

If you're seeking a banking app that balances security with user-friendly features, Barclays US is a commendable choice. Its most noteworthy feature—the integration of top-tier security protocols alongside a smart, streamlined transaction experience—makes it stand out in a crowded marketplace. The app is particularly suitable for users who value safety but don't want to sacrifice ease of use or intuitive design. Newcomers to digital banking will find the learning curve gentle, while experienced investors will appreciate its personalized insights and investment tools.

Overall, I recommend Barclays US for those looking for a reliable, secure, and thoughtfully designed banking app that puts their needs at the forefront. Whether managing daily expenses or planning future investments, this app proves to be a trustworthy digital companion—like having a personal banker at your fingertips, ready to assist seamlessly whenever you need.

Pros

User-Friendly Interface

The app offers an intuitive layout that makes managing accounts straightforward for users.

Robust Security Features

Advanced encryption and biometric login enhance user security and privacy.

Real-Time Transaction Updates

Users receive instant notifications and updates for all account activities.

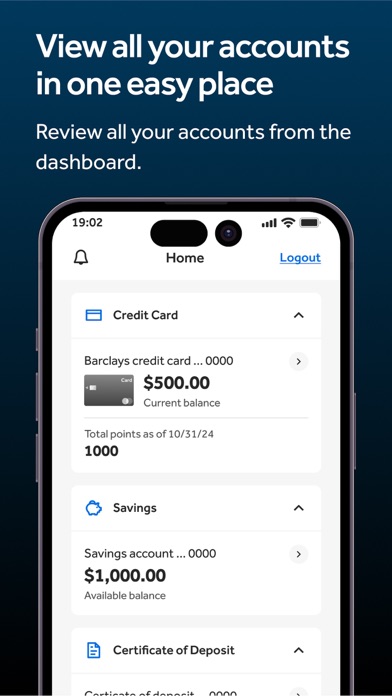

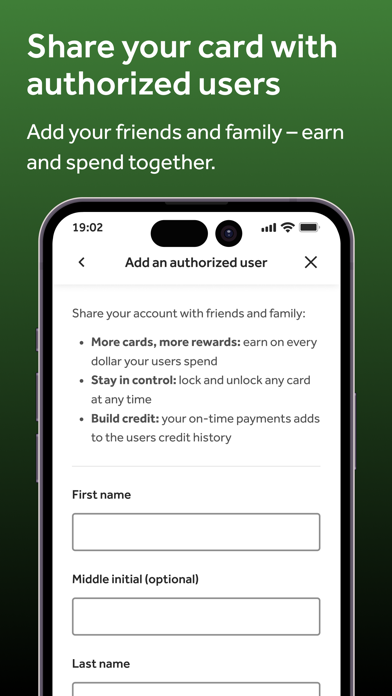

Comprehensive Account Management

Supports multiple account types and services, providing a centralized platform.

Reliable Performance

The app generally runs smoothly with minimal loading times and downtime.

Cons

Limited International Support (impact: medium)

The app primarily caters to US users, which may cause issues for users traveling abroad or with international accounts.

Occasional App Crashes (impact: low)

Some users experience crashes during deposits or transfer processes, but reinstalling or updating often resolves this.

Inconsistent Customer Service Access (impact: low)

Support chat availability may be limited during peak hours; upcoming app updates aim to improve responsiveness.

Limited Budgeting Tools (impact: medium)

More advanced budgeting features are not yet integrated, but Barclays is reportedly developing this for future updates.

Slow Processing of Certain Transactions (impact: low)

Large transfers can occasionally take longer to process; users can monitor statuses via notifications as a temporary workaround.

Barclays US

Version 8.5.7 Updated 2025-10-24