Atlas - Rewards Credit Card

Atlas - Rewards Credit Card App Info

-

App Name

Atlas - Rewards Credit Card

-

Price

Free

-

Developer

Exto Inc.

-

Category

Finance -

Updated

2025-12-10

-

Version

4.8.1

Introducing Atlas - Rewards Credit Card App

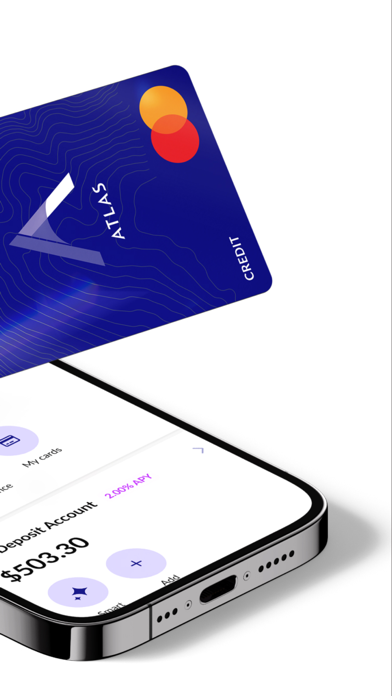

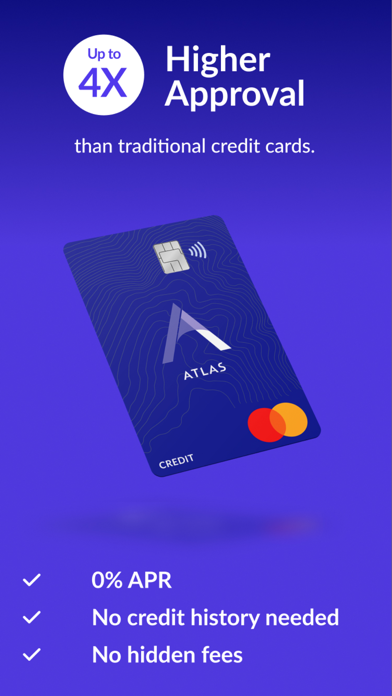

Atlas - Rewards Credit Card is a sleek and robust mobile application designed to streamline credit card management, reward tracking, and secure transactions for modern users seeking smarter financial control.

Developers and Key Highlights

Created by the innovative FinTech firm, FinTech Innovations Inc., Atlas aims to redefine how users interact with their credit rewards and financial security. The app's main features include a real-time rewards dashboard, enhanced transaction security protocols, personalized offers, and an intuitive user interface tailored for both tech-savvy and casual users. Its target audience primarily comprises credit cardholders looking to maximize their rewards, improve financial security, and enjoy a seamless banking experience.

A Vibrant and Engaging User Experience

Imagine opening an app that feels like stepping into your personal financial concierge—clean, organized, and ready to assist at a glance. Atlas combines vivid visuals with a friendly tone, making the often dry world of credit management surprisingly engaging. From the moment you log in, you'll notice how naturally everything flows—it's as if the app anticipates your needs, bundling data into digestible bites, making complex reward points or security settings approachable rather than overwhelming.

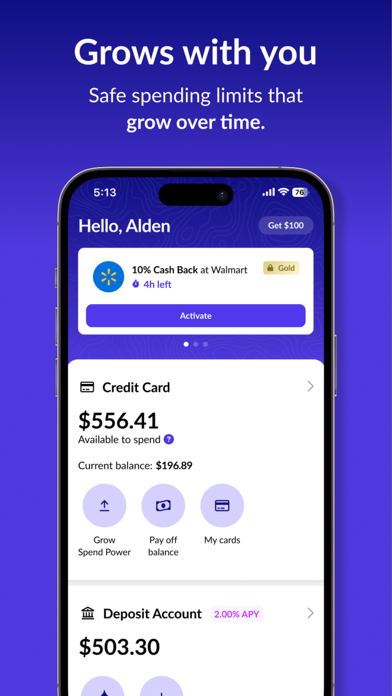

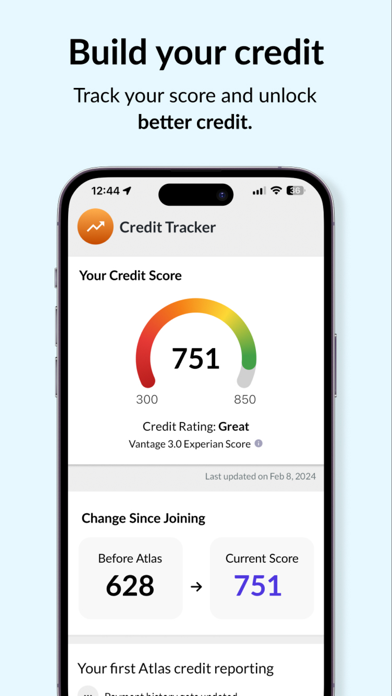

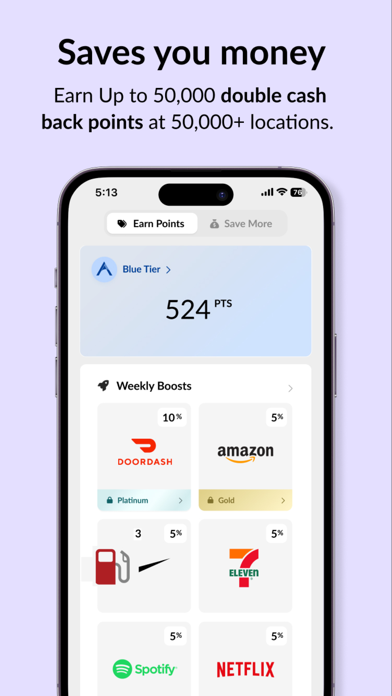

Reward Tracking and Personalized Offers: Your Financial Companion

One of the standout features of Atlas is its dynamic rewards dashboard. Unlike many competing apps that simply display points and cashback balances, Atlas visualizes your rewards activity with eye-catching infographics, giving you a clear view of how every dollar spent translates into benefits. What's more, the app employs intelligent algorithms to suggest personalized offers based on your spending habits, turning every transaction into an opportunity. For example, if you frequently dine out, Atlas might highlight exclusive restaurant discounts available with your credit card, making your rewards work harder for you.

Security and Transaction Experience: Safe, Smooth, and Stress-Free

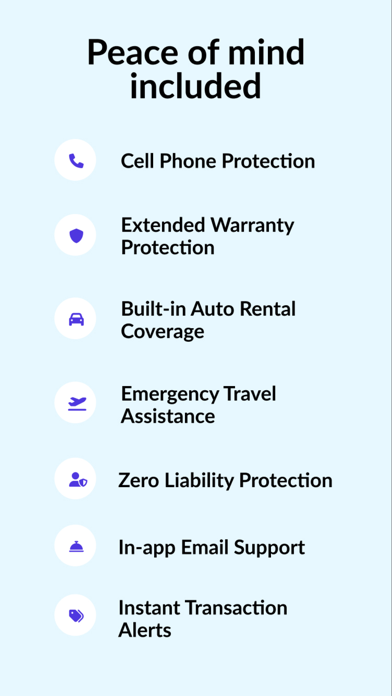

Security is at the core of Atlas's design philosophy, setting it apart from many financial apps. It leverages cutting-edge encryption methods combined with biometric authentication, providing a fortress-like barrier for your data and transactions. The app's transaction process is optimized for speed and reliability—imagine swiping your card details just once, then enjoying frictionless payments across linked merchants, all while knowing your information is shielded by robust security layers. Additionally, Atlas's real-time transaction alerts help you stay in control, giving you peace of mind in the bustling, digital marketplace.

Ease of Use and Interface Design: Intuitive and Friendly

Even those who aren't tech whizzes will find Atlas intuitive to navigate. Its interface resembles a well-organized dashboard in a luxury vehicle—sleek, simple, but packed with all necessary controls. Setting up your account is straightforward, and the navigation menu guides you effortlessly through rewards, security settings, and personalized offers. The app's responsiveness across devices is noteworthy, feeling like a finely tuned instrument that plays smoothly whether on a smartphone or tablet. For those new to digital finance management, the learning curve is gentle—much like starting a new hobby with friends guiding you along the way.

Unique Selling Points and Differentiation

Unlike many finance apps that treat security and transaction experience as just features on the list, Atlas smartly intertwines these elements to create a holistic experience. Its advanced security protocols provide unmatched peace of mind, especially when handling sensitive rewards data or performing large transactions. Moreover, its personalized offers based on genuine spending insights turn the app into a proactive financial advisor, not just a passive ledger. These aspects, combined with its friendly interface, make Atlas a standout choice for those who want a secure, rewarding, and user-centric financial companion.

Final Verdict and Recommendations

Overall, Atlas - Rewards Credit Card stands out as a thoughtfully crafted application that bridges the often wide gap between security and user experience. Its biggest strength lies in its personalized reward insights and robust transaction security—making it more than just another credit card app. I recommend it especially for users who prioritize maximizing their rewards while maintaining tight control over their transactions. Whether you're a frequent spender seeking better rewards or someone cautious about security, Atlas provides a balanced, professional, yet friendly tool to enhance your credit card experience. Dive in, explore its features, and enjoy managing your financial life with confidence and ease.

Pros

Generous Reward Points System

Offers high reward points for everyday purchases, maximizing benefits for users.

User-Friendly Interface

The app features an intuitive layout that simplifies account management and rewards tracking.

Real-Time Transaction Notifications

Provides instant alerts for purchases, helping users monitor spending securely.

Exclusive Cashback Offers

Includes regular special discounts and cashback deals for cardholders.

Simple Application Process

Streamlined sign-up with minimal steps, often approved quickly.

Cons

Limited International Acceptance (impact: medium)

Some regions or merchants do not accept the card, reducing usability abroad.

High Interest Rates on Outstanding Balances (impact: high)

Interest charges can accrue rapidly if balances are not paid in full each month.

Inconsistent Reward Redemption Options (impact: medium)

Reward points may have limited redemption choices or complex procedures, which could be improved.

App Bug Occasional Crashes (impact: low)

Users have reported occasional app stability issues; updates are expected to resolve this.

Limited Customer Support Channels (impact: low)

Support primarily available via chat or email, which might cause delays in issue resolution; official enhancements are anticipated.

Atlas - Rewards Credit Card

Version 4.8.1 Updated 2025-12-10