Ally: Bank, Auto & Invest

Ally: Bank, Auto & Invest App Info

-

App Name

Ally: Bank, Auto & Invest

-

Price

Free

-

Developer

Ally Financial

-

Category

Finance -

Updated

2026-02-11

-

Version

26.1.1

Ally: Bank, Auto & Invest — A Comprehensive Financial Companion

Ally: Bank, Auto & Invest is a versatile financial app designed to streamline banking, auto financing, and investment management into a single user-friendly platform. Developed by Ally Financial, it seeks to empower users to make smarter financial decisions with ease and confidence.

Core Features That Stand Out

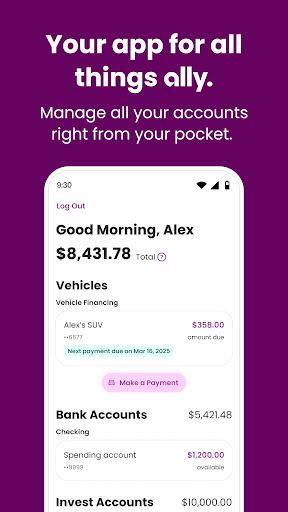

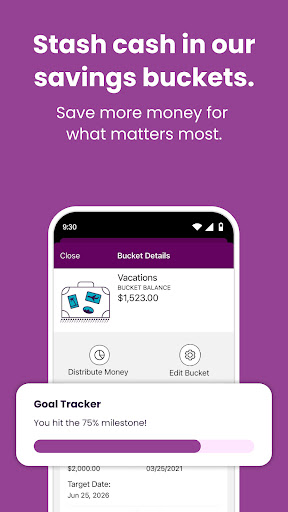

1. Unified Financial Dashboard: Seamlessly integrates banking, auto loans, and investments, offering a holistic view of your financial health.

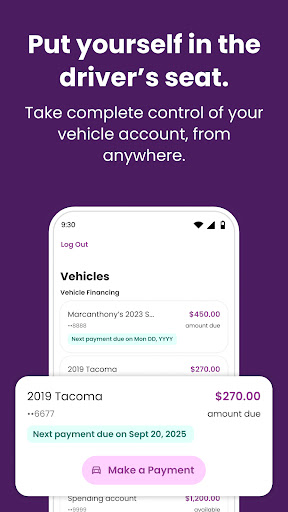

2. Intuitive Auto Financing Tools: Provides personalized vehicle loan options, lease calculators, and quick pre-approvals, making car buying less stressful.

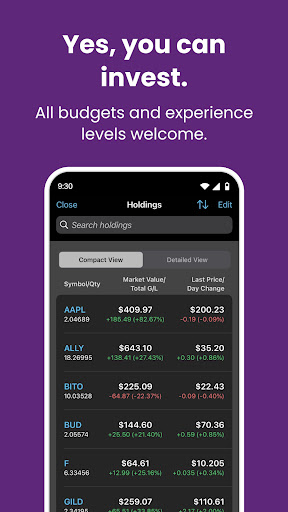

3. Robust Investment Platform: Offers commission-free trading, easy account setup, and tailored investment insights to help you grow your wealth.

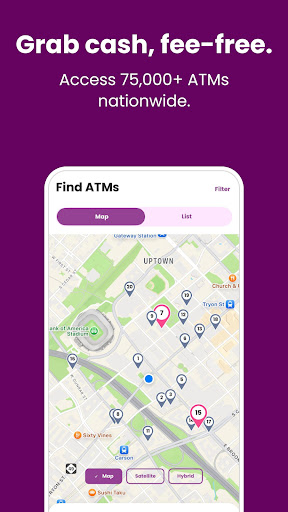

4. Enhanced Security and Transaction Experience: Implements advanced security measures and smooth transaction flows that prioritize user safety and convenience.

A Fresh Take on Financial Management

Imagine logging into your financial universe—one where your banking, auto financing, and investment goals aren't scattered across multiple apps but are harmoniously orchestrated in a single, sleek interface. Ally's app feels like chatting with a knowledgeable friend who understands your financial dreams and helps chart a clear path forward. Its design is clean yet lively, making complex financial data feel less intimidating and more empowering.

Dashboard and User Interface: Your Financial Control Room

Upon launching the app, you're greeted with a colorful, well-organized dashboard that acts like the control panel of a modern spacecraft—critically intuitive and beautiful to behold. Navigating between banking, auto, and investments is just a tap or swipe away. The interface design emphasizes clarity, with easy-to-read labels and logical grouping of information, ensuring that whether you're checking your account balance or reviewing auto loan options, the experience feels natural and straightforward.

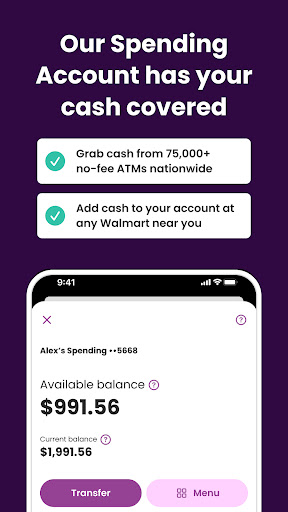

Smooth Operations and Learning Curve

For first-time users, Ally's app offers an inviting environment that requires minimal onboarding—think of it as stepping into a welcoming lounge rather than a labyrinth of tabs. Action sequences like transferring funds, applying for auto loans, or executing trades are executed with minimal friction, thanks to streamlined workflows and well-designed prompts. The app strikes a fine balance between offering enough guidance for beginners and powerful features for seasoned users, making it accessible yet capable.

What Sets Ally Apart: Security and Transaction Experience

Compared to many finance apps, Ally's emphasis on account and fund security is particularly noteworthy. Utilizing advanced encryption, multi-factor authentication, and real-time alerts, it creates a fortress around your financial data without impeding ease of access. Additionally, its transaction process shines as a highlight—quick, transparent, and reliable, with live updates and confirmation notifications that keep you informed at each step. It's akin to having a trusted courier who ensures your valuables are delivered safely and promptly.

Is This App for You? Recommendations and Usage Tips

If you're someone who values having a consolidated view of your finances and needs reliable auto and investment tools in one place, Ally: Bank, Auto & Invest can be a valuable addition to your digital toolkit. It's particularly well-suited for users seeking a user-friendly interface coupled with robust security measures, and those who prefer managing all aspects of their financial journey digitally with confidence.

For best results, I recommend exploring the investment features gradually, especially if you're new to trading. Also, take advantage of the auto loan calculators and pre-approval functions if you're considering a vehicle purchase—these tools can save you time and help you negotiate better terms. Overall, this app earns a solid recommendation for anyone looking to maintain control and clarity over their financial assets with an app that feels more like a trusted partner than just another tool.

Pros

User-Friendly Interface

The app provides an intuitive and easy-to-navigate design, making banking, auto, and investment tasks straightforward for users.

Comprehensive Financial Services

Offers a wide range of features such as banking, auto loans, and investment options within a single platform.

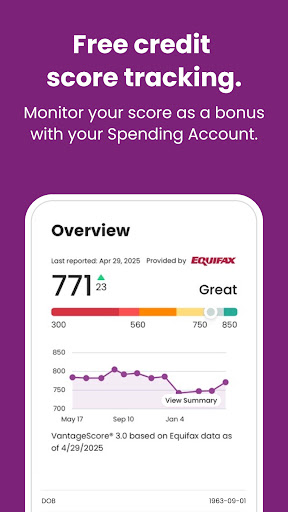

Real-Time Account Monitoring

Allows users to track transactions and account balances instantly, enhancing financial management.

Secure Data Encryption

Utilizes advanced encryption to protect user data and financial information effectively.

Personalized Investment Recommendations

Provides tailored investment advice based on user profiles and risk tolerance.

Cons

Limited Investment Options (impact: medium)

Currently, the app offers a narrower selection of investment products compared to specialized platforms, which may limit user choices.

Slow Customer Support Response (impact: medium)

Customer service response times can be delayed, which might inconvenience users with urgent issues, but official updates are expected to improve response speed.

Occasional App Stability Issues (impact: low)

Some users report crashes or glitches during high-traffic periods; updates are planned to enhance stability.

Minor Navigation Confusion (impact: low)

New users might find the navigation menus slightly complex initially; tutorial features are being expanded to simplify onboarding.

Limited International Availability (impact: medium)

Currently focused on certain regions, which might restrict access for users outside supported areas; expansion plans are underway.

Ally: Bank, Auto & Invest

Version 26.1.1 Updated 2026-02-11