Albert: Budgeting and Banking

Albert: Budgeting and Banking App Info

-

App Name

Albert: Budgeting and Banking

-

Price

Free

-

Developer

Albert - Budgeting & Banking

-

Category

Finance -

Updated

2025-12-12

-

Version

10.0.23

Albert: Budgeting and Banking — A Practical Companion for Financial Management

Albert is a thoughtfully designed app that merges budget planning, expense tracking, and banking management into one seamless platform, aiming to simplify financial lives without overwhelming users with complexity.

Meet the Minds Behind Albert

Developed by Albert Corporation, a team dedicated to redefining personal finance apps, this platform reflects their commitment to user-friendly interfaces paired with robust security measures. Their goal is to empower users to take control of their finances without feeling like they're navigating a labyrinth.

Key Features That Stand Out

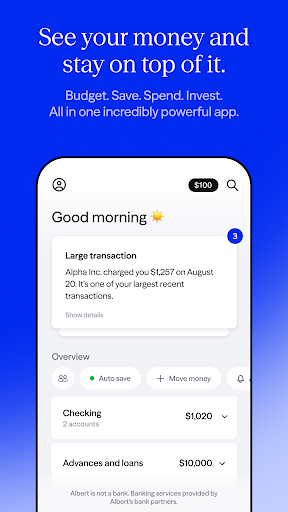

- Holistic Financial Snapshot: Combines bank accounts, credit cards, and investments into one dashboard, offering a 360-degree view of your financial life.

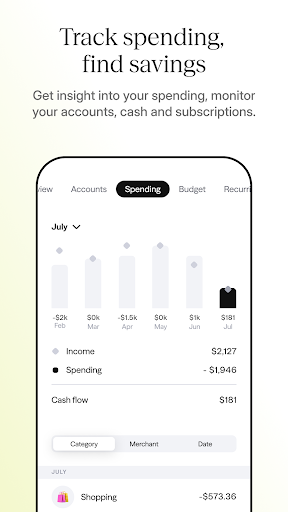

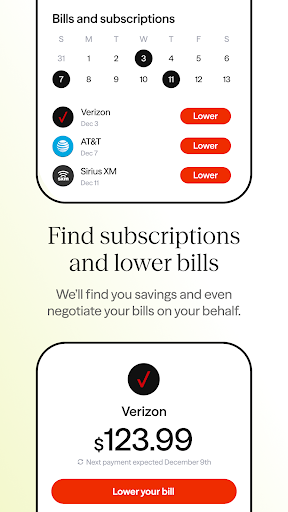

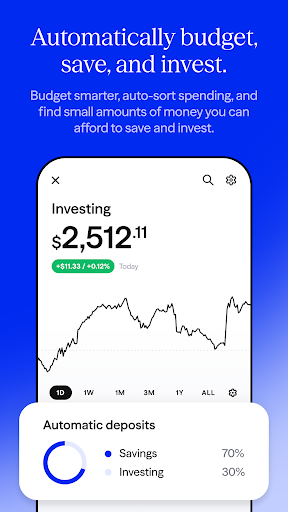

- Smart Budgeting & Expense Insights: Uses automatic categorization and intelligent suggestions to keep your spending on track, helping you meet your savings goals more effortlessly.

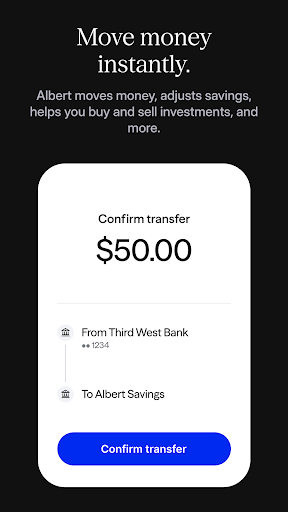

- Secure Banking Integration: Facilitates direct deposit management and real-time transaction updates, built with security protocols that prioritize user data safety.

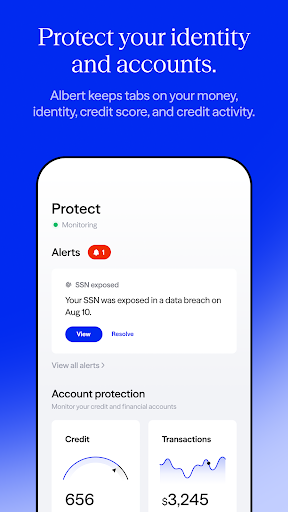

- Personalized Alerts & Recommendations: Offers tailored notifications to avoid overdrafts or suggest better financial moves based on your habits.

Engaging the User: A Deep Dive

Imagine opening a financial app as if stepping into a well-organized but inviting office—everything at your fingertips, yet designed so intuitively that you feel greeted by familiarity rather than confusion. That's the experience Albert strives to deliver. Its interface exudes clean simplicity with a gentle color palette that's easy on the eyes, making even complex financial data look approachable.

Core Functionality: Your Financial Control Center

The heart of Albert lies in its ability to unify your financial accounts. Imagine your bank accounts, credit cards, and investments sitting in an interconnected web—real-time updates refresh seamlessly, providing instantaneous insight into your net worth. This holistic view ensures you're never in the dark about your financial position, much like having a status board visible from your desk, keeping you aware of every financial shift as it happens.

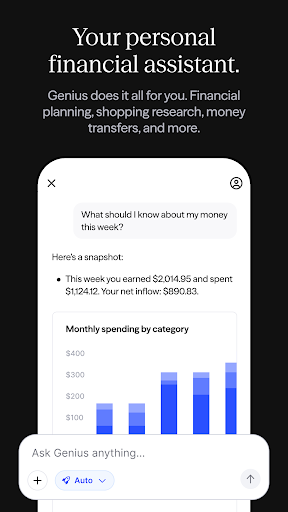

The budgeting feature is another highlight: it doesn't just set arbitrary limits but learns from your habits. By analyzing spending patterns, it offers personalized advice, nudging you toward savings without feeling overbearing. Think of it as a friendly financial coach who subtly reminds you when you're veering off track, but always with a positive tone.

User Experience: Intuitive, Secure, and Friendly

Albert's user interface combines clarity with elegance, turning potentially daunting data into digestible visuals—pie charts, line graphs, and activity summaries make financial health easy to understand at a glance. Navigation feels smooth, like gliding through a well-paved road, with no lag or confusing steps. The app's learning curve is gentle; even users new to financial apps find themselves navigating effortlessly within minutes.

Security is woven into the fabric of Albert's operations. Unlike other financial apps that might treat security as an afterthought, Albert employs bank-level encryption, multi-factor authentication, and continuous monitoring to safeguard your data. This emphasizes the app's commitment to trustworthiness—an essential aspect when your financial life is intertwined with a digital platform.

What Sets Albert Apart? The Unique Strengths

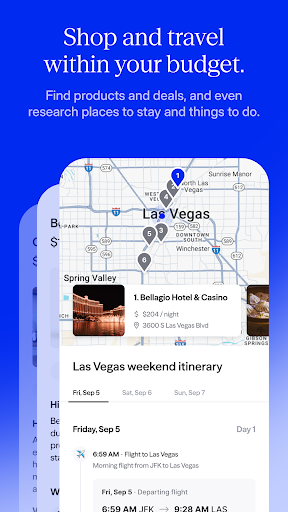

While many financial apps focus solely on either budgeting or banking, Albert excels by integrating both with a holistic perspective. Its notable feature is its intelligent, adaptive recommendations based on your real-time transactions and spending trends, akin to having a silent financial advisor sitting beside you. The app's ability to securely link multiple accounts and display them cohesively not only increases transparency but also reduces the need to juggle multiple platforms, saving time and mental energy. Furthermore, the emphasis on security and data privacy is a major differentiator—it reassures users that their financial details are guarded with rigorous protocols, a critical consideration in today's era of digital vulnerabilities.

Final Thoughts: Who Should Give Albert a Try?

For those who seek an approachable yet comprehensive financial app, Albert offers a balanced blend of features that cater to both the casual user and the more detail-oriented saver or investor. Its standout capabilities—especially the integrated overview and real-time transaction insights—make it a particularly strong choice for users aiming to streamline their financial lives without sacrificing security or usability.

While it might not replace advanced investment tools for seasoned traders, for everyday budgeting, expense tracking, and banking management, Albert is a reliable companion. I'd recommend it to anyone looking for a friendly, secure, and insightful financial app that feels like having a helpful financial assistant in your pocket. Whether you're just starting out or managing a complex financial portfolio, Albert's thoughtful design and core strengths can help you stay on top of your financial journey with confidence.

Pros

User-friendly interface

Intuitive navigation makes managing budgets straightforward for new users.

Robust budgeting tools

Features like expense categorization and goal setting help users track their finances effectively.

Secure data encryption

Employs advanced security measures to protect sensitive banking information.

Automatic transaction sync

Automatically updates transactions from linked bank accounts, saving time and reducing errors.

Customizable notifications

Allows users to set alerts for bill payments and budget limits for better financial control.

Cons

Limited bank integration (impact: medium)

Currently supports only select banks, which may inconvenience users with other banking providers.

Basic reporting features (impact: low)

Lacks in-depth analytics or export options for detailed financial analysis; future updates may include these tools.

Occasional sync delays (impact: medium)

Some users experience delays in transaction updates, but restarting the app often resolves this issue.

Limited customer support options (impact: low)

Support is mainly via email, with live chat or phone support planned for future releases.

Free version offers restricted features (impact: low)

Premium features require a subscription, but a free trial option helps users evaluate functionalities first.

Albert: Budgeting and Banking

Version 10.0.23 Updated 2025-12-12