Afterpay: Pay over time

Afterpay: Pay over time App Info

-

App Name

Afterpay: Pay over time

-

Price

Free

-

Developer

Afterpay

-

Category

Shopping -

Updated

2026-02-17

-

Version

1.130.0

Afterpay: Pay over time — Your flexible shopping companion

In a digital age where convenience and transparency reign supreme, Afterpay stands out as a user-friendly platform that transforms how consumers manage their purchases by offering the flexibility to pay over time without accruing interest. Developed by a dedicated team focused on creating seamless financial solutions, this app caters to those who enjoy shopping but prefer spreading out expenses to better fit their budget. Its core features highlight straightforward installment plans, clear payment schedules, and a user-centric design—all aimed at making responsible shopping easier and more transparent for a broad demographic ranging from everyday shoppers to budget-conscious consumers seeking smarter payment options.

A lively entrance into flexible shopping: what makes Afterpay tick?

Imagine strolling through your favorite shopping district — your cart is full of tempting goods, but your wallet whispers caution. Enter Afterpay: a straightforward digital solution that invites you to indulge now and pay later, turning what might be a financial juggling act into an effortless dance. Its intuitive interface and thoughtful features make it an appealing choice for those seeking transparent, interest-free installment plans. Whether you're purchasing clothing, electronics, or home goods, Afterpay transforms routine shopping into a controlled, budget-friendly experience.

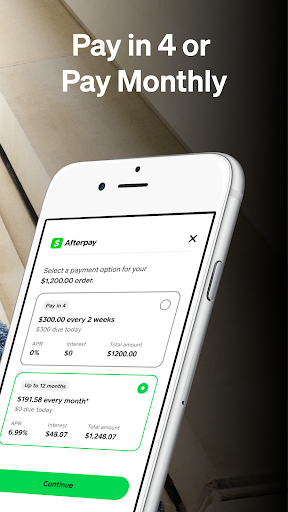

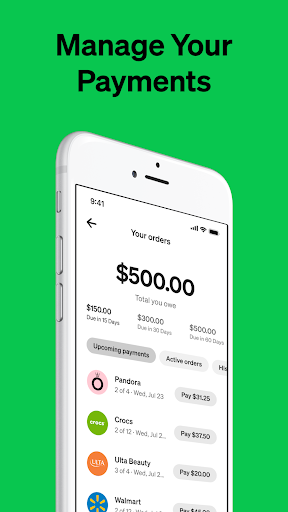

Seamless Installment Flexibility — Making Payments Fit Your Life

At the heart of Afterpay is its flagship feature: buy now, pay later with interest-free installments. Users can split their total purchase into four equal payments, due every two weeks, effectively making larger expenses more manageable. This feature is particularly advantageous during high-volume shopping seasons or for big-ticket items, as it alleviates the upfront financial burden. Setting up payments is as simple as a few taps, and the app provides clear schedules, reminders, and the ability to fully settle early without any penalties, giving shoppers command over their financial commitments.

Transparent Pricing and Smart Budget Management

Unlike many competitors tangled in confusing fee structures or hidden charges, Afterpay prides itself on offering transparent, straightforward pricing—no interest, no hidden fees if payments are made on time. The app displays a clear breakdown of upcoming payments and total costs at checkout, which fosters trust and helps users plan their budgets effectively. Additionally, the rewards dashboard and payment history encourage good financial habits, turning each shopping spree into an opportunity for smarter money management. This transparency distinguishes Afterpay from platforms with opaque fee policies, carving out a niche for responsible, informed consumers.

Design and User Experience — Shopping Made Friendly

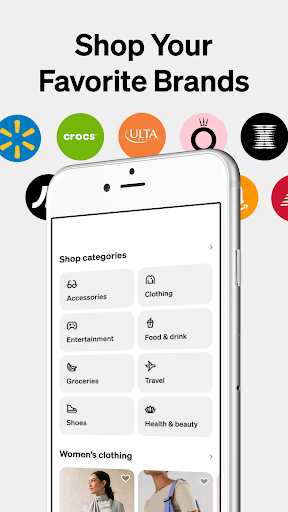

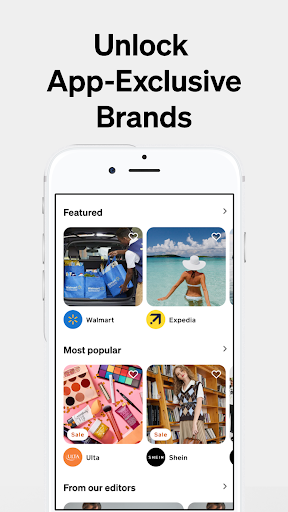

The app adopts a sleek, modern interface: vibrant visuals, intuitive navigation, and responsive interactions create an inviting atmosphere akin to browsing a well-organized boutique. The onboarding process is smooth, with helpful prompts guiding new users through setup and use. Once inside, browsing products and sections feels natural, with categorized listings tailored to your shopping habits. The app's operation flows seamlessly, with quick loading times and minimal lag, ensuring that users spend less time fiddling with the interface and more enjoying their shopping experience. The learning curve is gentle, making it accessible even for tech novices and those unfamiliar with buy-now-pay-later platforms.

What sets Afterpay apart from other shopping apps?

While many of its competitors offer similar "interest-free" payment options, Afterpay's distinct advantage lies in its emphasis on pricing transparency and flexible payment schedules. Unlike some platforms that bury fees in fine print or encourage endless borrowing, Afterpay maintains a clear and predictable structure. Its categorization of products and merchants is well-organized, allowing users to explore a wide variety of goods—from fashion to electronics—while ensuring that payments are simple to track across different categories. Additionally, its focus on responsible credit use, with features such as spending caps and soft credit checks, makes it a more conscientious choice for users cautious about overextending themselves. For consumers seeking a straightforward, trustworthy way to shop smarter, Afterpay offers unique peace of mind and control.

Should you give it a shot? My candid recommendation

If you're someone who loves the thrill of shopping but dislikes the stress of paying everything upfront, Afterpay is worth trying—particularly if you prioritize transparency and ease of use. Its most compelling feature is the ability to split payments interest-free while maintaining full control over your budget. However, I recommend using it responsibly: set reminders for your due dates, avoid impulse buys beyond your means, and treat it as a budgeting tool rather than a free credit line. For seasoned shoppers who want clarity and simplicity, Afterpay is a reliable, friendly companion that makes spending smarter without sacrificing the joy of shopping. Overall, I rate it highly for its user-centric approach and thoughtful design, making it a helpful addition to the digital wallet for modern consumers.

Pros

Flexible payment options

Users can split purchases into four interest-free installments, making high-cost items more affordable.

Instant approval process

The app provides quick approvals, allowing users to shop seamlessly without lengthy checks.

Wide partner store network

Afterpay is accepted by numerous popular retailers, increasing shopping convenience.

No interest if paid on time

As long as users meet payment deadlines, they avoid additional finance charges.

Budget management tools

The app offers reminders and spending tracking features to help users stay on top of payments.

Cons

Late payment fees (impact: high)

Missing a payment results in fees which can add up quickly, potentially impacting credit scores.

Limited repayment flexibility (impact: medium)

The fixed four-installment plan may not suit all users' financial situations; official plans to introduce more options are expected.

Potential for overspending (impact: medium)

Easy access to buy now, pay later may encourage impulsive purchases; users should set personal limits.

Impact on credit score (impact: high)

Late payments can be reported to credit bureaus, affecting future credit opportunities; users need to manage payments carefully.

Limited international availability (impact: low)

Currently primarily available in certain countries, restricting access for some users; expansion is planned but not yet confirmed.

Afterpay: Pay over time

Version 1.130.0 Updated 2026-02-17