Affirm: Buy now, pay over time

Affirm: Buy now, pay over time App Info

-

App Name

Affirm: Buy now, pay over time

-

Price

Free

-

Developer

Affirm, Inc

-

Category

Shopping -

Updated

2026-02-25

-

Version

3.402.1

Introducing Affirm: A Seamless Buy Now, Pay Over Time Solution

Affirm is a pioneering financial app designed to empower consumers with flexible payment options, making big-ticket purchases feel more manageable and transparent. Developed by Affirm, Inc., it functions as a modern alternative to traditional credit, bringing clarity and convenience to online shopping.

Core Features That Make Affirm Stand Out

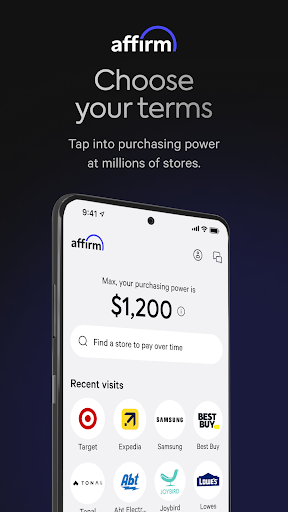

Flexible Financing Made Simple

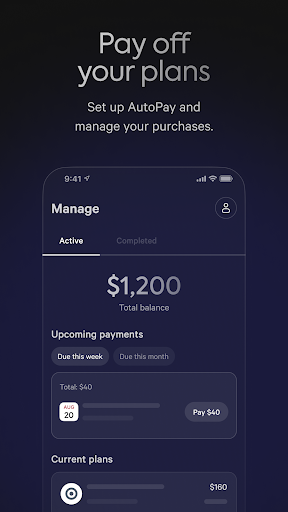

At its heart, Affirm allows users to split purchases into manageable, transparent installment plans with clear interest rates and repayment schedules. Unlike traditional credit cards, Affirm emphasizes upfront pricing without hidden fees, making it easier for consumers to plan their budgets. Whether you're buying electronics, furniture, or travel packages, Affirm offers tailored payment plans that typically range from a few weeks to several months, helping users avoid the surprise of sudden lump sums.

Intuitive User Experience & Seamless Integration

The app boasts a sleek, user-friendly interface that resembles a well-organized digital wallet. Navigating through product options or applying for financing is straightforward, thanks to clear prompts and minimal learning curve. The app effortlessly integrates with partner shopping sites, allowing users to select Affirm at checkout without disrupting their shopping flow. Its operation is generally smooth, with quick approvals and real-time updates on installment schedules, making the entire process feel like chatting with a helpful friend rather than dealing with a stiff bureaucracy.

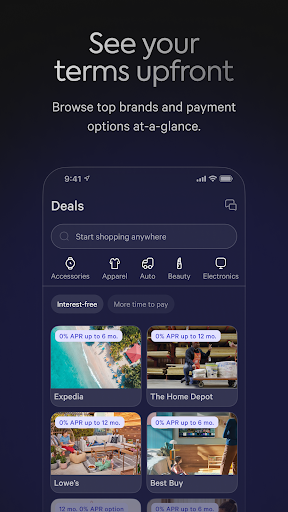

Transparent Pricing & Competitive Rates

One of Affirm's standout features is its commitment to transparency. Unlike many traditional lenders, Affirm displays all costs upfront, including interest rates—sometimes as low as 0% for promotions—and any applicable fees. The platform regularly offers promotional 0% APR options, making it highly competitive against credit cards with high-interest rates. For larger purchases, Affirm's flexible terms can be a game-changer, offering greater affordability without sacrificing clarity or fairness.

Design, Usability, and the Shopping Experience

Imagine entering a stylish, well-lit store where every item is labeled with all its costs and financing options right beside it—that's what Affirm's interface feels like. The app's color palette is calming, primarily featuring soft blues and whites, which foster a sense of trust and clarity. The navigation is intuitive; tabs for ‘Orders,' ‘Payment Plans,' and ‘Promotions' are logically placed, allowing both new and experienced users to find what they need quickly.

Operation speed is impressive—approvals for financing are often instantaneous if the user has completed their profile, and updates on payment schedules are pushed through notifications without delay. The learning curve is minimal: understanding how much you will pay each month, when, and at what cost is straightforward, inviting users to experiment with different payment arrangements before making a purchase decision.

Navigating through the app is akin to browsing a well-curated catalog—smooth scrolling, minimal loading times, and clear calls to action create a frictionless experience. This high level of polish sets Affirm apart in the crowded landscape of shopping and finance apps.

Uniqueness in the Market: Product Range & Pricing Clarity

What truly distinguishes Affirm from other Buy Now, Pay Later (BNPL) apps or traditional credit options is its focus on product variety and categorization, coupled with its commitment to transparent pricing. Unlike competitors that may limit their offerings to specific categories or hide fees in fine print, Affirm provides a broad marketplace spanning electronics, apparel, travel, and more, with long-term financing options clearly visible and customizable.

Its pricing transparency is another marquee feature. Users see exactly what they'll pay with no hidden surprises—a key factor in gaining trust and fostering loyalty. For instance, promotional periods with 0% interest make it an attractive choice for budget-conscious consumers, and even regular rates are displayed transparently alongside the purchase options. This contrasts favorably with some apps that mask actual costs or add on hidden fees after approval.

Final Verdict & Usage Recommendations

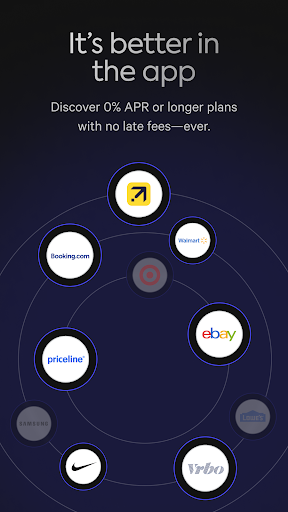

Overall, Affirm is a solid, user-centric platform that balances flexibility with transparency. Its most compelling features—flexible installment plans and upfront pricing—make it a practical tool for those looking to manage larger purchases without the stress of hidden costs or rigid credit lines. If you're someone who values clarity and prefers choosing how to split your payments, Affirm could be a reliable companion in your shopping journey.

However, for casual shoppers or those prone to overspending, it's essential to remain disciplined and ensure these flexible options don't lead to unintended debt accumulation. The app's straightforward design and transparent fee structure make it an excellent choice for financially responsible consumers seeking manageable payment plans.

In conclusion, I recommend giving Affirm a try if you want a transparent, seamless financing experience integrated with your favorite shopping platforms. It's particularly suited for users comfortable with digital financial tools who want to maintain control over their spending while enjoying the convenience of flexible payments.

Pros

Flexible payment options

Affirm allows users to split purchases into manageable payments over time, helping with cash flow management.

No hidden fees

The app clearly states its interest rates and fees upfront, promoting transparency.

Ease of use

A user-friendly interface simplifies the process of setting up an account and making payments.

Wide acceptance

Many major retailers partner with Affirm, expanding shopping choices for users.

Credit building opportunities

Responsible use of Affirm can help improve one's credit score over time.

Cons

Interest charges on some plans (impact: Medium)

Certain installment options include interest, which can increase the total repayment amount.

Limited availability for small purchases (impact: Low)

Affirm may not be available for very low-cost items, requiring alternative payment methods.

Potential for late fees (impact: Medium)

Missed payments could incur late fees, though they are generally transparent and disclosed beforehand.

Credit check may affect credit score (impact: Low)

A soft or hard credit inquiry is performed during application, which might impact credit temporarily.

Limited customer support hours (impact: Low)

Support services may be limited outside normal hours, potentially delaying resolution of issues.

Affirm: Buy now, pay over time

Version 3.402.1 Updated 2026-02-25